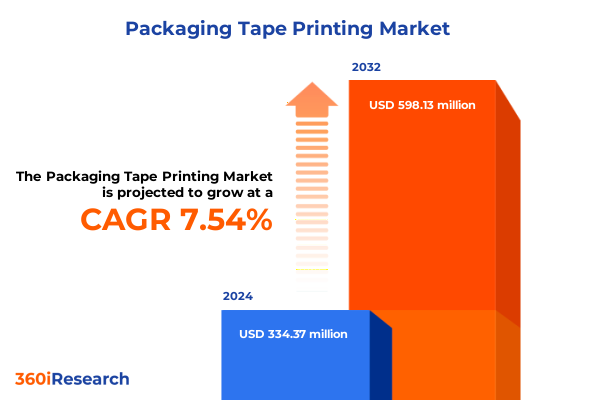

The Packaging Tape Printing Market size was estimated at USD 359.16 million in 2025 and expected to reach USD 381.04 million in 2026, at a CAGR of 7.55% to reach USD 598.13 million by 2032.

Setting the Stage for the Evolution of Custom Printed Packaging Tape in an Era of Digital Innovation and Sustainability Imperatives

Packaging tape printing has swiftly emerged as a pivotal element of modern brand communication and product protection. In an era where digital innovation has disrupted traditional printing avenues, packaging tape serves as both a functional sealant and a high-impact marketing asset. The rise of e-commerce and direct-to-consumer fulfilment has only amplified the importance of customized tape as a tool for brand visibility, enabling companies to embed logos, slogans, and QR codes directly on the outermost layer of their shipments. This strategic fusion of form and function has elevated packaging tape from a mere commodity to a critical touchpoint in the customer experience.

Meanwhile, sustainability imperatives are reshaping material and adhesive choices, spurring the development of biodegradable substrates and eco-friendly inks that align with both regulatory mandates and consumer expectations. The shift away from monolithic commercial print toward dynamic packaging solutions illustrates a broader industry metamorphosis, one in which adaptability and innovation define competitive advantage. As businesses navigate cost pressures, environmental requirements, and brand differentiation challenges, packaging tape printing stands at the convergence of these forces, setting the stage for an expansive evolution that will be explored in subsequent sections.

Unveiling the Technological and Market Transformations Shaping the Future of Packaging Tape Printing Across Global Industries

The landscape of packaging tape printing is being reshaped by several concurrent forces that blur the lines between traditional packaging and advanced printing technologies. Digital printing has emerged as a game-changer, offering unparalleled flexibility for short runs and variable data, enabling brands to test new designs, seasonal promotions, and market-specific messaging without significant setup costs. Beyond digital, advanced nanographic techniques are gaining traction, delivering high-definition prints at high speeds and enabling richer color palettes and more durable finishes, thus meeting the dual need for visual impact and operational efficiency.

Simultaneously, the integration of smart technologies, including RFID and QR code embedding, is expanding the role of packaging tape from passive sealant to active data carrier, enhancing traceability and consumer engagement. Environmental sustainability remains another catalyst for change, with water-based and UV-curable inks enabling low-VOC, recyclable solutions that satisfy stringent regulatory standards while preserving print quality. At the same time, manufacturers are leveraging automation and Industry 4.0-driven analytics to streamline production processes, reduce waste, and adapt rapidly to evolving order profiles. These transformative shifts are collectively forging a new paradigm in which packaging tape printing not only meets functional requirements but also drives differentiated brand experiences and operational resilience.

Assessing the Cumulative Consequences of 2025 United States Trade Measures on Packaging Tape Printing Supply Chains and Cost Structures

The cumulative impact of the 2025 United States tariff regime has reverberated across the packaging tape printing supply chain, introducing new cost considerations and strategic realignments. Early in the year, IEEPA-mandated tariffs targeted key trading partners, imposing additional duties on materials sourced from China, Canada, and Mexico, while Section 232 measures restored duties on steel and aluminum, affecting metal components used in industrial packaging equipment. Shortly thereafter, the administration implemented a baseline tariff on all imported goods, layering reciprocal levies on nations with significant trade imbalances. Although a subsequent May 12 trade accord recalibrated bilateral rates, the interim period saw material costs surge, prompting manufacturers to reassess sourcing strategies.

Faced with escalating prices on film substrates, adhesives, and ancillary components, tape producers and converters accelerated efforts to localize production, diversify supplier bases, and absorb certain cost increases through operational efficiencies. To mitigate border delays and price volatility, some businesses embraced lighter packaging constructions and thinner liners, while others reconfigured inventory buffers to cushion against supply chain disruptions. Across the industry, these cumulative trade measures have underscored the need for supply chain agility, strategic sourcing partnerships, and investment in domestic capabilities to safeguard against future policy shifts.

Revealing Critical Insights Across Materials, Adhesives, Widths, Colors, Applications, and End-Use Industries Driving Packaging Tape Markets

In the dynamic packaging tape printing market, material selection remains foundational. BOPP films continue to dominate thanks to their high clarity, tensile strength, and superior print adhesion, whereas PE tapes offer cost-efficient sealing for general-purpose applications, and PVC variants address niche requirements such as flame retardance and solvent resistance. Equally critical is adhesive technology: acrylic formulations are prized for long-term durability and UV stability; rubber adhesives deliver immediate, aggressive tack for rough or recycled surfaces; and silicone adhesives enable secure bonding under extreme temperatures and chemical exposure, expanding application scenarios across industries.

Width configurations further tailor tape performance, with narrow gauges facilitating precision sealing on small parcels, standard widths serving versatile sealing needs, and extra-wide tapes ensuring robust closure on palletized shipments. Color and printing choices also play a pivotal role: brown and clear tapes remain staples for straightforward sealing, white and printed tapes serve as mobile canvases for branding or compliance messaging, and high-contrast printed designs incorporate barcodes or QR codes for integrated tracking systems. Application demands drive customization as well; bundling tapes secure grouped items, labeling tapes identify contents, palletizing tapes anchor loads for transit, and sealing tapes maintain package integrity through complex logistics. Finally, end-use industries dictate performance specifications: the automotive sector’s focus on high-strength tapes contrasts with e-commerce’s emphasis on branded aesthetics, food and beverage’s need for safe, FDA-compliant materials, healthcare’s requirement for tamper-evident constructions, and manufacturing’s demand for versatile, all-purpose tapes.

This comprehensive research report categorizes the Packaging Tape Printing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Adhesive Type

- Width

- Color

- Application

- End Use Industry

Decoding Regional Dynamics and Growth Drivers Influencing Packaging Tape Printing Demand in the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics illustrate distinct drivers and growth patterns for packaging tape printing. In the Americas, robust e-commerce expansion and stringent sustainability regulations have spurred demand for custom-printed, recyclable tapes that reinforce brand identity while meeting environmental mandates. North American converters increasingly invest in digital and nanographic presses, prioritizing agility for short-run campaigns and variable data applications that resonate with consumers across diverse markets.

Over in Europe, Middle East & Africa, regulatory pressures around single-use plastics and rising consumer advocacy for eco-friendly packaging are catalyzing the adoption of water-based inks and biodegradable tapes. Retailers leverage printed tapes as an extension of in-store branding, integrating QR codes and NFC links to bridge offline and online experiences. Meanwhile, regional collaboration via trade blocs and sustainability alliances is fostering innovation in composite and recyclable substrate technologies.

Asia-Pacific continues to be a powerhouse for both production and consumption, driven by its extensive manufacturing base and surging e-tail sectors. Investment in smart manufacturing-combining IoT, automation, and advanced analytics-is enhancing throughput and lowering unit costs, enabling local producers to serve dynamic domestic markets before scaling capabilities for export. The region’s rapid embrace of digital printing and variable data solutions underscores the role of packaging tape as both a functional necessity and a strategic marketing tool in this high-growth environment.

This comprehensive research report examines key regions that drive the evolution of the Packaging Tape Printing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Industry Leaders and Their Strategic Innovations in Sustainability, Customization, and Technology Within the Packaging Tape Printing Sector

Leading companies in packaging tape printing are charting differentiated courses through a blend of sustainability, customization, and technology investments. 3M has introduced bio-based adhesive formulations and recycled cores in its Scotch® packaging tape series, underscoring the drive toward renewable inputs without compromising performance. Intertape Polymer Group has unveiled proprietary adhesive upgrades designed for high-recycled corrugated substrates, addressing the sealing challenges posed by post-consumer fiber content.

Avery Dennison continues to expand its digital-printable tape solutions, enabling rapid customization and on-demand branding to meet the needs of agile B2B and direct-to-consumer channels. Tesa SE has pushed the envelope in anti-counterfeit and security-enhanced tapes, integrating tamper-evident features and covert inks that deter theft and reassure end users. At the same time, Berry Global is advancing high-strength, tamper-proof tapes tailored for the rigors of global e-commerce, while Shurtape Technologies has launched compostable, pressure-sensitive formulations aligned with circular economy principles. These strategic innovations highlight the sector’s focus on marrying functional excellence with environmental responsibility and brand engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Packaging Tape Printing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Becpak Printed Tapes

- Biopack & Logistics BVBA

- Canon Inc.

- Cenveo Worldwide Limited

- Continental Tape Printers

- DuPont de Nemours, Inc.

- EC Labels LTD.

- Fast Printing Group Pty Ltd

- Kangaroo group, a.s.

- Laro Tape B.V.

- Lixin Adhesive Technology (Shanghai) Co., Ltd.

- MaverickLabel.Com, Inc.

- Phoenix Tape & Supply

- Pixartprinting S.p.A.

- Quad/Graphics, Inc.

- R.R. Donnelley & Sons Company

- Satyam Enterprises

- Shurtape Technologies, LLC

- Siat S.p.A

- Tape Jungle

- The Eco Solution, LLC

- Uline

- Ventamac Packaging

- Windmill Tapes and Labels Ltd

- Xerox Corporation

Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Challenges in Packaging Tape Printing

To thrive amid evolving market forces, industry participants should prioritize several strategic initiatives. First, diversifying material portfolios to include biodegradable and renewable substrates can address regulatory requirements and strengthen customer trust in sustainability claims. Second, investing in digital and smart printing technologies will enable faster turnarounds, more precise variable data capabilities, and seamless integration of QR codes or RFID features for enhanced supply chain visibility and consumer engagement.

Third, companies must fortify supply chain resilience by establishing alternative sourcing channels, localizing critical inputs, and building buffer inventories to hedge against future tariff fluctuations. Collaboration with raw material suppliers on cost-reduction and eco-innovation projects can further mitigate cost pressures stemming from trade measures. Fourth, refining segmentation strategies-by tailoring tape widths, adhesives, and printed content to specific applications and industries-will help maximize value and differentiation. Lastly, expanding digital marketing and e-commerce channels for custom-printed tape offerings can open new revenue streams, especially among SMEs seeking brand elevation through cost-effective packaging solutions. Collectively, these actions will position industry leaders to capitalize on emerging opportunities and navigate an increasingly complex competitive landscape.

Detailing the Robust Multi-Source Research Framework and Analytical Processes Underpinning the Packaging Tape Printing Market Study

This market study combines primary and secondary research methodologies to ensure robust, actionable insights. The primary research phase involved in-depth interviews with supply chain executives, packaging engineers, and brand managers across key industries, providing real-world perspectives on demand drivers, performance requirements, and purchasing criteria. Simultaneously, secondary sources-including industry journals, government tariff announcements, and technology white papers-were analyzed to validate qualitative findings and track regulatory developments.

Quantitative data was triangulated through cross-referencing trade flow statistics, input cost indices, and sustainability certification databases. Detailed reviews of company annual reports, press releases, and patent filings were conducted to map innovation trends and competitive positioning. This multi-source approach-underpinned by rigorous data quality controls and expert panel reviews-ensures the findings reflect both current market realities and forward-looking trajectories, equipping decision-makers with a comprehensive understanding of the packaging tape printing landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Packaging Tape Printing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Packaging Tape Printing Market, by Material

- Packaging Tape Printing Market, by Adhesive Type

- Packaging Tape Printing Market, by Width

- Packaging Tape Printing Market, by Color

- Packaging Tape Printing Market, by Application

- Packaging Tape Printing Market, by End Use Industry

- Packaging Tape Printing Market, by Region

- Packaging Tape Printing Market, by Group

- Packaging Tape Printing Market, by Country

- United States Packaging Tape Printing Market

- China Packaging Tape Printing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Concluding Perspectives on Packaging Tape Printing’s Evolution and Strategic Imperatives for Stakeholders in a Competitive Landscape

As packaging tape printing continues to mature, the convergence of digital technologies, sustainability mandates, and brand engagement imperatives will shape the sector’s trajectory. Companies that adeptly leverage advanced printing platforms and eco-friendly materials will differentiate their offerings and secure leadership positions. Meanwhile, supply chain flexibility and strategic responses to policy shifts-particularly tariffs-will remain critical to safeguarding profitability and operational continuity.

Looking ahead, the integration of smart features within tape substrates, enhanced by data analytics and traceability solutions, will unlock new use cases beyond traditional sealing. By aligning material science, adhesive innovation, and digital printing capabilities, stakeholders can deliver packaging tape solutions that not only protect shipments but also engage end users, reinforce brand narratives, and support circular economy objectives. The insights presented in this executive summary serve as a roadmap for navigating the complexities of a dynamic market, offering strategic guidance for both established players and emerging entrants.

Engage with Ketan Rohom to Secure In-Depth Packaging Tape Printing Insights and Propel Your Strategic Decision-Making Today

Don’t miss out on the opportunity to gain a comprehensive understanding of the packaging tape printing landscape and translate insights into strategic advantage. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the full market research report and begin refining your go-to-market strategies with confidence.

- How big is the Packaging Tape Printing Market?

- What is the Packaging Tape Printing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?