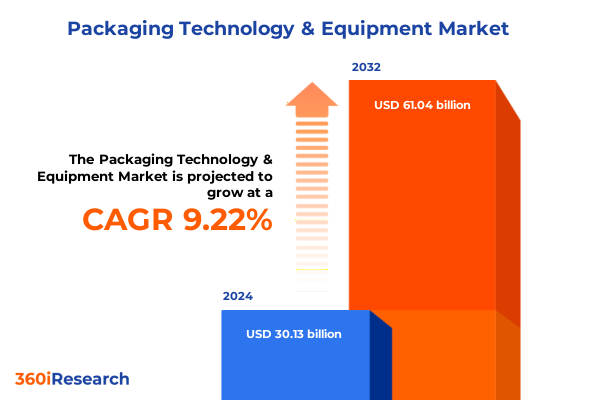

The Packaging Technology & Equipment Market size was estimated at USD 32.37 billion in 2025 and expected to reach USD 34.78 billion in 2026, at a CAGR of 9.48% to reach USD 61.04 billion by 2032.

How Cutting-Edge Packaging Technologies and Equipment Innovations Are Driving Efficiency, Sustainability, and Market Competitiveness Across Industries

The packaging technology sector stands at the forefront of industrial innovation, driven by an imperative to enhance operational efficiency, reduce environmental impact, and meet evolving consumer demands for convenience and safety. In recent years, manufacturers across diverse end-user industries have confronted a convergence of technological breakthroughs-from advanced robotics to Internet of Things integration-that is reshaping traditional equipment paradigms. Against this backdrop, stakeholders must develop a lucid understanding of how emerging machinery capabilities and digital solutions are redefining production workflows and supply chain management.

This executive summary synthesizes critical developments and overarching themes that characterize the modern packaging equipment landscape. It highlights how automation improvements, material diversification, and regulatory shifts are collectively influencing capital investment decisions and competitive positioning. By framing the current environment through the lenses of technological readiness, cost pressures, and sustainability mandates, this introduction sets the stage for a deeper exploration of transformative trends, trade policy impacts, and segmentation dynamics that follow. As you delve into the subsequent sections, you will gain a holistic perspective on the forces driving innovation, the challenges at hand, and the strategic priorities that will shape success in the years ahead.

Rapid Shift Toward Smart Automation, Sustainable Materials, and Digitization Is Redefining Packaging Equipment Landscape with Unprecedented Operational Benefits

Over the past decade, the packaging equipment arena has embarked on a paradigm shift, transitioning from mechanized assembly lines to intelligent, data-driven operations. The advent of real-time monitoring platforms and predictive maintenance algorithms has empowered manufacturers to preempt downtime, optimize throughput, and extend equipment lifecycles. Simultaneously, the integration of machine vision and automated inspection systems has elevated product quality assurance, enabling instantaneous defect detection and reducing reliance on manual checkpoints.

Parallel to technological maturation, sustainability initiatives have galvanized investment in eco-friendly materials handling and resource-efficient machinery. Renewable energy integration, lightweighting solutions, and biodegradable substrate compatibility are rapidly moving from experimental pilots to full-scale adoption. In addition, the rise of flexible production models-underpinned by modular equipment configurations and rapid changeover mechanisms-is enabling agile responses to SKU proliferation and seasonal demand fluctuations. Collectively, these transformative shifts are forging a new landscape where operational resilience, cost optimization, and environmental stewardship coalesce, ultimately delineating the competitive frontiers of the packaging technology domain.

Assessing the Aggregate Consequences of 2025 United States Tariff Adjustments on Global Supply Chains, Cost Structures, and Equipment Procurement Strategies

In 2025, the United States implemented a series of tariff adjustments targeting imported packaging machinery and related components, resulting in a cumulative increase of duties across multiple HS code classifications. The ripple effects of these policy changes have permeated procurement strategies, compelling OEMs and contract packagers to reassess global sourcing networks and supplier diversification. As import levies escalated, total landed costs for critical equipment categories-particularly high-precision filling and sealing systems-experienced upward pressure, prompting some manufacturers to repatriate production or negotiate localized assembly agreements with foreign machinery vendors.

Furthermore, the tariff environment accelerated dialogue around regional trade partnerships, with stakeholders exploring nearshore and free trade zone alternatives to mitigate duty burdens. This strategic realignment has also influenced capital expenditure timing, as organizations grapple with balancing short-term cost increases against long-term operational efficiency gains. Ultimately, the cumulative impact of these tariff measures has underscored the importance of robust risk-management frameworks and the capacity to adapt supply chain architectures in response to an increasingly fluid trade policy landscape.

Uncovering Crucial Segmentation Perspectives Across Equipment Functionality, Material Composition, End Users, Packaging Formats, and Automation Hierarchies

Segmentation analysis reveals that equipment type diversity is central to meeting the multifaceted requirements of end users: from capping and closing modules to sophisticated inspection and quality control platforms. The filling and sealing segment, in particular, exhibits granular innovation across liquid, powder, and granule processing. Within liquid filling, a mix of gravity, piston, pressure, and vacuum technologies serves applications ranging from high-volume beverages to sensitive pharmaceutical formulations. These distinctions inform not only capital allocation but also maintenance regimens and compliance considerations.

Material type further differentiates market engagement strategies. Glass and metal substrates command premium positioning for high-barrier packaging, while paper and board continue to gain traction in sustainable branding initiatives. Plastic remains ubiquitous, yet niche adoption of HDPE, LDPE, PET, PP, and PVC formulations speaks to a nuanced demand for barrier performance, recyclability, and cost efficiency. In parallel, end user industries-spanning automotive, chemicals, food and beverage, healthcare, and personal care-present unique requirements. The food and beverage sector’s bakery, dairy, beverages, and meat and poultry categories drive demand for hygienic sealing and rapid changeover, whereas pharmaceuticals prioritize traceability and sterile processing environments.

Packaging type offers another vantage point: flexible structures like bags, films, and pouches deliver lightweight transportation benefits, whereas rigid formats such as corrugated boxes, glass bottles, and plastic containers emphasize durability and premium appeal. Semi-rigid clamshells and trays fulfill specialized retail presentation needs. Finally, automation level stratifies investments into manual, semi-automatic, and fully automatic lines, reflecting a spectrum of throughput targets and workforce skill requirements. Holistically, these segmentation insights guide equipment developers and end users in tailoring solutions that align with specific operational and commercial imperatives.

This comprehensive research report categorizes the Packaging Technology & Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Material Type

- Packaging Type

- Automation Level

- End User Industry

Delineating Contrasting Regional Dynamics and Growth Drivers Across Americas, Europe Middle East Africa, and Asia Pacific Packaging Equipment Markets

Regional dynamics in the packaging equipment domain vary substantially across the Americas, Europe Middle East & Africa, and Asia Pacific, driven by distinct macroeconomic environments and policy frameworks. In the Americas, nearshoring trends and reshoring incentives have invigorated demand for mid-tier automation as manufacturers bolster domestic capacity and shorten supply chains. Trade agreements within North America foster collaborative innovation clusters, with cross-border OEM partnerships accelerating localized equipment customization.

Across Europe Middle East & Africa, stringent regulatory mandates on material recyclability and carbon emissions are catalyzing investment in sustainable packaging technologies. The European Union’s ecodesign directive and extended producer responsibility schemes have spurred adoption of lightweighting equipment and advanced sorting machinery. Meanwhile, Middle East markets leverage gratuitous energy resources to pilot large-scale automation projects, and African economies focus on modular, scalable solutions to address rapid urbanization and retail expansion.

In Asia Pacific, booming e-commerce ecosystems and population density drive demand for high-speed, high-flexibility lines capable of managing diverse SKUs and packaging formats. Regional hubs in China, Southeast Asia, and India serve as both consumption and manufacturing centers, fostering a competitive landscape where global incumbents and local vendors contend on price, performance, and service responsiveness. Taken together, these regional insights underscore the necessity of geography-specific go-to-market approaches and capacity planning strategies.

This comprehensive research report examines key regions that drive the evolution of the Packaging Technology & Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Positioning and Strategic Initiatives of Leading Packaging Equipment Suppliers Driving Innovation and Market Penetration

A cohort of established equipment manufacturers and emerging technology providers is actively shaping the competitive architecture of the packaging industry. Legacy players leverage decades of engineering expertise to deliver integrated turnkey solutions encompassing filling, sealing, coding, and inspection. Strategic acquisitions of robotics and vision-system specialists have fortified their capacities to offer fully automated lines with seamless data integration.

Concurrently, agile start-ups and specialty firms are capitalizing on niche opportunities-ranging from micro-dosing filling systems for high-value chemicals to blockchain-enabled traceability modules for pharmaceutical compliance. These innovators often partner with research institutions and digital platform providers to co-develop prototypes, accelerating the commercialization of disruptive technologies.

Alliances between equipment vendors and material suppliers are another key trend, fostering synchronized advancements in substrate compatibility and machine performance. Such collaborations ensure that new packaging formats can be seamlessly adopted without extensive machinery retrofits. Ultimately, the competitive landscape is characterized by a dual strategy: incumbents consolidating breadth through M&A and partnerships, and challengers driving depth through specialization and rapid iteration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Packaging Technology & Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor Group GmbH

- Ball Corporation

- Berlin Packaging LLC

- Berry Global Inc.

- Coesia S.p.A.

- Coveris Management GmbH

- Crown Holdings, Inc.

- DS Smith PLC

- GEA Group Aktiengesellschaft

- Graphic Packaging International, LLC

- IMA Group

- International Paper

- Kymanox Corporation

- Lead Packaging Ltd.

- Leading Futuristic LLC

- Liberty Diversified International, Inc.

- Malone Group

- Mondi PLC

- MULTIVAC Sepp Haggenmüller SE & Co. KG

- O-I Glass, Inc.

- OPTIMA packaging group GmbH

- Packaging Corporation of America

- Plastic Packaging Technologies, LLC

- Reynolds Group

- Sealed Air Corporation

- Silgan Holdings Inc.

- Smurfit Kappa Group

- Steripack Group Limited

- Stora Enso Oyj

- Syntegon Technology GmbH

- WestRock Company

Strategic Imperatives and Tactical Recommendations for Industry Leaders to Capitalize on Packaging Technology Advancements and Evolving Market Trends

To capitalize on the convergence of automation, sustainability, and digitalization, industry leaders should prioritize modularity in equipment design, enabling swift adaptation to changing production requirements and regulatory standards. Investing in open-architecture control systems will facilitate seamless integration with enterprise resource planning platforms and third-party IoT solutions, driving end-to-end visibility and performance optimization.

Moreover, fostering cross-functional collaboration between R&D, procurement, and operations teams can accelerate the iterative co-development of customized machinery solutions. Leaders are advised to establish strategic partnerships with material innovators to co-create packaging substrates that reduce weight without compromising barrier properties. Parallelly, developing localized service networks in key regional markets can reduce downtime risks and strengthen customer relationships through responsive maintenance support.

Finally, embedding sustainability metrics into equipment selection criteria-such as energy consumption per cycle and recyclability compatibility-will not only align with environmental targets but also generate long-term cost savings. By pursuing these action-oriented strategies, organizations can enhance resilience, elevate product quality, and secure a competitive edge in an increasingly dynamic market.

Comprehensive Research Methodology Outlining Primary and Secondary Approaches, Data Validation Techniques, and Analytical Frameworks

The findings and insights presented in this report are grounded in a dual-layered research methodology encompassing both primary and secondary data collection. Primary research involved in-depth interviews with industry executives, plant managers, and technology specialists to validate emerging trends and capture nuanced operational perspectives. These qualitative inputs were supplemented by structured surveys targeting decision-makers across key end-user segments to quantify equipment adoption drivers and investment priorities.

Secondary research drew upon a broad spectrum of reputable sources, including peer-reviewed journals, trade associations, regulatory filings, and machinery patent databases. Data triangulation was employed to cross-verify market dynamics, ensuring consistency across disparate information streams. Analytical frameworks such as SWOT and PESTEL were applied to systematically evaluate competitive forces and external environmental factors. In addition, a rigorous validation protocol involving iterative stakeholder reviews was conducted to uphold the accuracy and relevance of the insights.

Limitations of the study primarily relate to the evolving nature of trade policies and the proprietary status of certain technological innovations. To mitigate these factors, the research team engaged with multiple independent experts and incorporated the latest public disclosures up to mid-2025. This comprehensive approach ensures that the report delivers actionable intelligence with a high degree of confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Packaging Technology & Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Packaging Technology & Equipment Market, by Equipment Type

- Packaging Technology & Equipment Market, by Material Type

- Packaging Technology & Equipment Market, by Packaging Type

- Packaging Technology & Equipment Market, by Automation Level

- Packaging Technology & Equipment Market, by End User Industry

- Packaging Technology & Equipment Market, by Region

- Packaging Technology & Equipment Market, by Group

- Packaging Technology & Equipment Market, by Country

- United States Packaging Technology & Equipment Market

- China Packaging Technology & Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesis of Key Industry Insights and Forward-Looking Considerations for Sustained Success in the Packaging Equipment Sector

In synthesizing the critical trends, segmentation insights, and regional nuances of the packaging equipment industry, several overarching conclusions emerge. First, the sustained momentum toward smart automation and digital integration will redefine operational benchmarks, demanding that organizations adopt flexible, data-enabled machinery to remain competitive. Second, the ripple effects of tariff adjustments underscore the strategic importance of supply chain agility and the diversification of sourcing footprints. Third, segmentation analyses reveal that success hinges on aligning equipment capabilities with precise material, end-use, and packaging format requirements.

Furthermore, regional variations necessitate bespoke market entry and service models, with North America focused on nearshoring, EMEA emphasizing sustainability compliance, and Asia Pacific prioritizing high-throughput agility. Finally, the competitive landscape is balancing consolidation by established players with innovation led by specialized entrants, creating a dynamic ecosystem ripe for collaboration and disruption. As industry stakeholders navigate this complex environment, targeted investments in modular technology, strategic partnerships, and robust data architectures will be critical to achieving sustainable growth.

Engage with Ketan Rohom to Acquire Detailed Packaging Equipment Market Intelligence and Unlock Actionable Insights for Strategic Decision Making

To explore the comprehensive insights and in-depth analyses presented in this report and to receive customized guidance on applying these findings to your organizational objectives, please reach out directly to Ketan Rohom. Ketan Rohom, Associate Director of Sales & Marketing, is available to discuss your specific requirements, provide tailored executive summaries, and facilitate access to supporting data sets. Engaging with Ketan will enable your team to accelerate decision-making processes, develop targeted investment strategies, and optimize implementation roadmaps that are anchored in the latest industry intelligence. Don’t miss the opportunity to leverage expert consultation and secure a leading position in the transforming packaging technology landscape by initiating a conversation with Ketan Rohom today.

- How big is the Packaging Technology & Equipment Market?

- What is the Packaging Technology & Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?