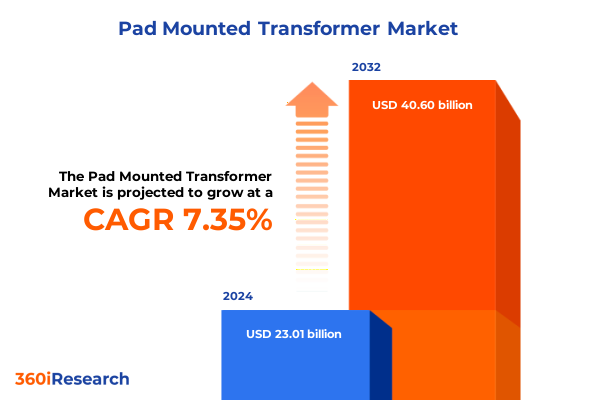

The Pad Mounted Transformer Market size was estimated at USD 24.74 billion in 2025 and expected to reach USD 26.64 billion in 2026, at a CAGR of 7.33% to reach USD 40.60 billion by 2032.

Setting the Stage for a Comprehensive Exploration of Innovations and Dynamics in the Pad Mounted Transformer Landscape for Modern Energy Distribution

Pad mounted transformers serve as pivotal components in modern electrical distribution networks, providing safe, reliable voltage regulation for residential, commercial, and utility applications. These enclosed units streamline power delivery by integrating high-voltage primary coils with accessible low-voltage secondary connections, ensuring that electricity reaches end users securely and efficiently. As infrastructure demands intensify, these transformers play an increasingly critical role in maintaining grid stability and reducing downtime.

In recent years, rapid urbanization and the proliferation of distributed energy resources have amplified the need for resilient transformer solutions. Growing emphasis on renewable energy integration requires distribution assets capable of accommodating variable generation profiles, while stringent safety regulations mandate compact and tamper-resistant designs. Consequently, transformer manufacturers and network operators alike are prioritizing equipment that not only withstands evolving technical requirements but also aligns with environmental and regulatory standards.

Furthermore, the push toward smart grid implementation has elevated expectations for real-time monitoring and predictive maintenance capabilities. By embedding sensors and leveraging data analytics, stakeholders can proactively identify potential failures, optimize load balancing, and extend asset lifespans. These advancements underscore a broader shift toward digitization across the power sector and highlight the transformative potential of next-generation pad mounted transformers.

Building on this context, the ensuing executive summary delves into the technological shifts shaping the market, examines the impact of recent tariff changes, uncovers key segmentation and regional insights, profiles leading companies, and offers actionable recommendations. This structured analysis aims to equip decision-makers with the knowledge needed to navigate a dynamic landscape and capitalize on emerging opportunities.

Uncovering the Key Transformations Redefining the Pad Mounted Transformer Market in Response to Technological and Environmental Imperatives

The pad mounted transformer market is undergoing fundamental transformation driven by digital technologies and evolving operational paradigms. Integrating advanced sensors into transformer enclosures now enables continuous condition monitoring, which in turn supports predictive analytics that elevate asset reliability. Consequently, network operators can transition from reactive maintenance schedules to proactive strategies that reduce unplanned outages and extend equipment lifecycles.

Simultaneously, material innovations are reshaping thermal management and insulation performance. Environmentally friendly alternatives to traditional mineral oils, such as biodegradable ester fluids, deliver enhanced fire safety and reduced environmental risk. Moreover, developments in epoxy resin blends and synthetic insulation materials are enabling more compact designs that optimize footprint without compromising dielectric strength.

In parallel, the convergence of automation and controls has ushered in new capabilities for dynamic load management. Intelligent switches and remote tap changers allow real-time voltage regulation in response to fluctuating demand, facilitating smoother integration of intermittent renewable sources. These smart grid functionalities are rapidly becoming standard expectations among utilities focused on enhancing grid resilience and accommodating distributed generation.

Looking ahead, regulatory drivers emphasizing carbon reduction and energy efficiency will continue to influence transformer design parameters. Manufacturers that can deliver low-loss core materials, improved cooling methods, and integrated diagnostic tools will capture growing interest from utilities and commercial end users seeking both operational savings and environmental compliance.

Assessing the Ripple Effects of Newly Instituted United States Tariffs on Pad Mounted Transformer Supply Chains and Operational Dynamics in 2025

In 2025, newly imposed United States tariffs on imported transformer components have created notable shifts across supply chains and cost structures. Importers are navigating increased duties on steel, copper, and specialized insulation materials, which has led many to reevaluate sourcing strategies. As duties drive up landed costs, manufacturers are exploring alternative procurement options, including domestic suppliers and regional trade agreements, to mitigate financial impact.

These monetary barriers have also prompted adjustments in inventory management. To buffer against ongoing tariff volatility, companies are increasing safety stocks of critical parts, even as they seek to shorten lead times through closer collaboration with tier-one vendors. Consequently, logistics networks are becoming more robust yet agile, with an emphasis on transparency and risk sharing across the supply chain.

Additionally, manufacturers are passing a portion of the tariff burden to end users through tiered pricing models, while investing in cost-containment measures such as lean manufacturing and process automation. This dual approach aims to preserve margin health without stifling demand growth. At the same time, some smaller fabricators are pivoting to retrofit and replacement services, capitalizing on the attraction of refurbishing existing assets rather than procuring new units with higher import costs.

Looking forward, the interplay between tariff policies and domestic production incentives may reshape the landscape further. Should incentives for onshore manufacturing strengthen, there is potential for expanded local capacity, even as global partnerships adjust to navigate a patchwork of trade regulations. Stakeholders who maintain flexible sourcing frameworks and foster strategic alliances will be best positioned to adapt as policies continue to evolve.

Deriving Critical Insights from Multifaceted Segmentation Dimensions to Illuminate Market Drivers and End User Requirements for Pad Mounted Transformers

Analysis of the market through the lens of end-user segmentation reveals divergent growth drivers. Commercial deployments, spanning hospitality, office, and retail applications, are increasingly shaped by demand for compact, low-maintenance transformers that support 24/7 operations. Industrial segments such as manufacturing, mining, and oil & gas, by contrast, prioritize high-reliability insulation systems and robust surge protection to safeguard sensitive processes. In residential contexts, both single-family and multi-family installations value safety-certified enclosures and noise-reduction features that blend seamlessly into urban neighborhoods. Utilities, whether electric or water, require large-scale pad mounted transformers designed for rapid deployment during network expansions and emergency restoration efforts.

When considering insulation type, the choice between dry-type and oil-immersed designs is dictated by site constraints and performance requirements. Dry-type transformers are gaining traction in indoor and congested installations due to their fire-safe operation and minimal maintenance needs. Alternatively, oil-immersed transformers continue to serve as cost-effective solutions for outdoor installations demanding high thermal dissipation, especially where extended overload capabilities and compact footprints are paramount.

Power rating segmentation further refines design and performance expectations. Low-voltage units under 250 kVA are common in smaller commercial and residential projects, offering plug-and-play convenience and simplified wiring. Medium-voltage units ranging from 250 kVA to 1,000 kVA balance capacity and flexibility, making them suited for small industrial campuses and localized distribution networks. High-voltage transformers above 1,000 kVA serve as backbone assets for utilities and large-scale industrial sites, where high load densities and long-distance distribution govern technical specifications.

Voltage level considerations influence core dimensions and safety clearances. Low-voltage transformers under 15 kV, subdivided into those under 5 kV or in the 5–15 kV range, cater to neighborhood distribution grids and residential subdivisions. Medium-voltage variants, spanning 15 kV to 35 kV, often deploy in municipal networks for broad urban coverage or serve as step-down assets for manufacturing facilities. High-voltage units above 35 kV, further segmented into 35–66 kV and those exceeding 66 kV, primarily support transmission interties and large-scale renewable interconnections.

This comprehensive research report categorizes the Pad Mounted Transformer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- End User

- Insulation Type

- Power Rating

- Installation Type

- Cooling Method

Analyzing Regional Variations to Uncover Strategic Opportunities and Infrastructure Developments Driving Pad Mounted Transformer Demand Worldwide

In the Americas, infrastructure modernization is advancing at a rapid pace, fueled by federal funding initiatives and state-level grid resilience programs. These efforts emphasize the replacement of aging substation assets and the rollout of smart grid technologies, which in turn bolsters adoption of pad mounted transformers with integrated diagnostics. Urban centers, particularly in North America, are embracing electric vehicle charging networks that demand reliable low-voltage distribution, while rural electrification programs in South America place a premium on cost-effective, easily deployable units capable of withstanding harsh environmental conditions.

Across Europe, the Middle East & Africa, regulatory frameworks centered on emissions reduction and energy efficiency are driving significant upgrades to distribution infrastructure. In mature markets, utilities are retrofitting legacy installations to comply with stringent loss-reduction targets, leading to increased demand for pad mounted transformers employing low-loss core materials. Emerging economies in the Middle East and Africa are concurrently expanding grid reach to underserved communities, elevating the importance of compact, modular transformer solutions that can be installed quickly and maintained with limited local resources.

Asia-Pacific presents a diverse tapestry of growth dynamics, with megacities in China and India pursuing grid enhancements to integrate surging renewable capacity. State mandates for carbon neutrality are accelerating the replacement of oil-filled units with eco-friendly alternatives. Meanwhile, Australia and Southeast Asian markets prioritize resilience against climate-related events, creating demand for transformers with superior ingress protection and advanced cooling methods. This regional mosaic underscores the need for product portfolios that balance global engineering standards with localized feature sets and after-sales support networks.

This comprehensive research report examines key regions that drive the evolution of the Pad Mounted Transformer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Manufacturers and Innovators Shaping the Competitive Dynamics of the Pad Mounted Transformer Industry Ecosystem

Leading global manufacturers are intensifying efforts to differentiate through comprehensive service offerings that extend beyond core transformer sales. Companies are establishing centralized monitoring platforms that aggregate sensor data for multiple installations, enabling cross-portfolio analytics and benchmarking. This service model not only enhances customer loyalty but also generates recurring revenue streams tied to software subscriptions and performance guarantees.

Strategic partnerships are emerging as a central feature of competitive playbooks. Technology firms specializing in Internet of Things and artificial intelligence are collaborating with transformer OEMs to deliver turnkey smart grid solutions. These alliances facilitate rapid integration of digital control modules and predictive maintenance algorithms, streamlining the deployment process and reducing customer implementation risks.

Research and development investments remain a key differentiator among top players. By channeling resources into advanced core metallurgy and novel coolant formulations, leading firms are achieving measurable reductions in core losses and temperature rise. Such technical breakthroughs are highlighted in product literature and marketing campaigns, positioning these companies as innovators able to meet demanding operational specifications.

In addition, targeted acquisitions of regional fabricators and service providers are solidifying market reach and after-sales support capabilities. Through these transactions, manufacturers gain established local footprints and skilled labor forces, which enhance their ability to deliver rapid response services and align product configurations with regional standards and utility regulations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pad Mounted Transformer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- CG Power and Industrial Solutions Ltd.

- Dalian Transformer Group Co., Ltd.

- Eaton Corporation plc

- EFACEC Power Solutions SGPS S.A.

- Elantas GmbH

- Fuji Electric Co., Ltd.

- General Electric Company

- Hyosung Corporation

- Kirloskar Electric Company Limited

- Mitsubishi Electric Corporation

- Ortea Next S.p.A.

- Schneider Electric SE

- SGB-SMIT Group

- Siemens AG

- Tebian Electric Apparatus Stock Co., Ltd.

- Toshiba Corporation

- WEG S.A.

- Wilson Transformer Company

Actionable Strategic Recommendations to Guide Industry Leaders Through Emerging Challenges and Unlock Value in the Pad Mounted Transformer Market

Industry leaders should prioritize the integration of digital monitoring and analytics into their transformer portfolios, enabling value-added service models that complement hardware sales. By emphasizing ongoing performance insights and predictive maintenance contracts, organizations can establish differentiated revenue streams and foster long-term client relationships.

Investing in flexible manufacturing and modular design practices will underpin supply chain resilience amid fluctuating tariff regimes and material shortages. Adopting lean production techniques and localized assembly hubs can shorten lead times and reduce exposure to international trade tensions while preserving cost competitiveness.

Collaborating proactively with standards bodies and regulatory agencies will accelerate the approval of innovative insulation materials and transformer designs. Engaging in joint research consortia and field trials can validate new technologies under real-world conditions, smoothing the path to market acceptance and ensuring compliance with evolving safety guidelines.

Finally, aligning product development roadmaps with end-user segments and regional priorities ensures offerings resonate with target customers. Tailoring transformer features-such as enclosure ratings, cooling methods, and voltage configurations-to specific market needs will boost adoption rates and reinforce leadership positions within key geographic corridors.

Detailing the Rigorous Research Methodology Underpinning In-Depth Analysis of Technological Trends and Market Structures for Pad Mounted Transformers

This report’s findings are grounded in a systematic research approach that began with extensive secondary research, including a review of technical papers, trade publications, and regulatory filings. These sources provided foundational insight into industry standards, material properties, and emerging technology benchmarks.

Primary research followed, featuring in-depth interviews with senior executives from utilities, manufacturers, and engineering consultancies. Discussions focused on strategic priorities, operational challenges, and expectations for future grid evolution, offering a nuanced understanding of the factors driving demand for pad mounted transformers.

Quantitative data collection involved detailed surveys administered to equipment specifiers and end-users in multiple regions. Responses were analyzed to identify preferences related to insulation types, power ratings, and configuration options. This dataset was then triangulated against plant capacity figures and shipment records to ensure consistency and robustness.

To validate findings, the research team conducted iterative reviews with external experts, including electrical engineers and policy analysts. Feedback loops ensured that conclusions accurately reflect on-the-ground realities and account for the latest regulatory developments. The methodology’s rigor supports the report’s reliability and the credibility of its strategic insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pad Mounted Transformer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pad Mounted Transformer Market, by End User

- Pad Mounted Transformer Market, by Insulation Type

- Pad Mounted Transformer Market, by Power Rating

- Pad Mounted Transformer Market, by Installation Type

- Pad Mounted Transformer Market, by Cooling Method

- Pad Mounted Transformer Market, by Region

- Pad Mounted Transformer Market, by Group

- Pad Mounted Transformer Market, by Country

- United States Pad Mounted Transformer Market

- China Pad Mounted Transformer Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Insights Highlighting Key Learnings and the Strategic Imperatives for Continued Advancement in Pad Mounted Transformer Technologies

The pad mounted transformer landscape is defined by rapid technological advancement, shifting regulatory requirements, and the increasing imperatives of supply chain agility. Taken together, these factors underscore the importance of holistic strategies that integrate digital innovation, sustainable materials, and adaptive sourcing frameworks.

Segmentation analysis reveals that a one-size-fits-all approach is no longer viable. Instead, tailored solutions that align with specific end-user applications, insulation preferences, power capacities, and installation scenarios will capture the greatest value. Regional nuances further reinforce the need for localized product configurations and support structures.

Tariff developments in 2025 have highlighted the fragility of globalized supply chains and reinforced the advantage of diversified procurement strategies. Organizations that proactively respond through nearshoring, lean inventory practices, and strategic partnerships will retain competitive positioning in an environment of policy unpredictability.

Moving forward, success will hinge on the ability to balance innovation with operational rigor. By embracing digitalization, fostering cross-industry collaborations, and maintaining a clear focus on customer requirements, manufacturers and network operators can ensure continued reliability, efficiency, and growth in the pad mounted transformer domain.

Prompt Next Steps to Connect with Associate Director Sales & Marketing for Exclusive Insights and to Secure the Comprehensive Pad Mounted Transformer Market Report

I invite you to connect directly with Ketan Rohom, the Associate Director of Sales & Marketing, to explore how this comprehensive report can inform your strategic roadmap and drive competitive advantage. Engaging with this expert resource ensures you receive tailored insights and the opportunity to address specific operational challenges with evidence-backed guidance.

Take the next step by scheduling a personalized consultation to discuss report highlights, clarify any questions, and secure immediate access to in-depth analysis and strategic recommendations. Empower your team with actionable intelligence and ensure your organization stays ahead of industry trends by obtaining your copy today

- How big is the Pad Mounted Transformer Market?

- What is the Pad Mounted Transformer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?