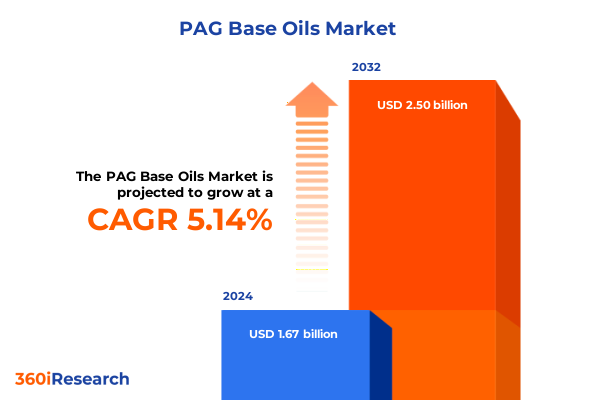

The PAG Base Oils Market size was estimated at USD 1.73 billion in 2025 and expected to reach USD 1.79 billion in 2026, at a CAGR of 5.38% to reach USD 2.50 billion by 2032.

Unveiling the Unique Performance and Applications of Polyalkylene Glycol Base Oils Driving Modern Industrial and Automotive Lubrication Solutions

Polyalkylene glycol base oils represent a versatile class of synthetic lubricants engineered through the controlled polymerization of oxypropylene and oxyethylene monomers to deliver tailored performance characteristics for demanding environments. Developed initially under naval mandates during World War II to address fire hazards in hydraulic fluids, modern formulations leverage advanced polymer chemistry to achieve precise viscosity profiles and functional attributes.

At their core, these fluids offer an exceptional balance of high viscosity index, oxidative stability, and low pour point, ensuring consistent lubrication across extreme thermal ranges. Their inherent polarity fosters robust metal surface films that diminish startup wear, while water-soluble variants facilitate easy equipment cleaning and environmental compliance through biodegradability.

Today, polyalkylene glycol base oils find critical roles across compressor and refrigeration lubricants, hydraulic and gear fluids, metalworking operations, and food-grade machinery applications due to their low volatility and deposit resistance. Their unique compatibility with modern refrigerants and resistance to varnish formation make them indispensable for sectors prioritizing safety, efficiency, and reduced environmental impact.

Exploring the Disruptive Technological and Regulatory Transformations Shaping the Future of Polyalkylene Glycol Base Oils Across Industries

In response to evolving performance demands and sustainability goals, leading manufacturers have aggressively expanded production and innovated next-generation polyalkylene glycol blends. BASF announced a capacity enhancement in recent years to bolster supply for high-performance automotive and industrial sectors, ensuring reliability amid tightening raw material availability. Dow’s introduction of bio-derived PAG variants marks a significant pivot toward renewable feedstocks, aligning product portfolios with corporate net-zero objectives through lifecycle carbon reductions. ExxonMobil’s strategic collaboration with a biotechnology partner further underscores the industry’s shift to lower-emission polyol sources and energy-efficient production methods.

Simultaneously, regulatory frameworks are accelerating the transition to greener lubricants. Stringent European REACH requirements and California’s Safer Consumer Products program have compelled suppliers to secure USDA BioPreferred and OECD biodegradability certifications to maintain market access. Marine operators now prioritize formulations compliant with IMO 2020 sulfur regulations, while emerging ionic-liquid additives offer enhanced thermal resilience without heavy metal constituents, reflecting heightened environmental scrutiny and performance expectations.

On the application front, specialized high-temperature PAG variants have emerged to extend equipment life under oxidative stress, as highlighted by Idemitsu’s thermal-stable portfolio and Clariant’s pharmaceutical-grade PEG derivatives for medical and personal care industries. Concurrent advances in food-grade PAG lubricants certified under FDA guidelines enable safe incidental contact, demonstrating the sector’s commitment to hygiene and operational continuity.

Assessing the Far-Reaching Effects of Recent United States Energy Tariffs on Polyalkylene Glycol Base Oil Trade Flows and Supply Chains in 2025

In early 2025, the United States government moved to impose energy-related tariffs that threatened a ten percent levy on Canadian base oils and finished lubricants, alongside broader industry duties, before delaying implementation in a last-minute policy reversal. This action followed initial threats of twenty-five percent economy-wide tariffs on Canadian and Mexican imports, signaling potential cost shifts across North American lubrication supply chains.

The announcement immediately reverberated through procurement and distribution networks. Canadian exporters faced uncertainty over demand for Group II base stocks, prompting contingency planning to redirect volumes away from U.S. northeast refilling hubs. Meanwhile, forward trades in finished lubricants experienced volatility as buyers weighed short-term risks of supply interruptions against longer-term trade negotiations.

Looking ahead, market participants anticipate a rebalancing of crude and base oil flows. Mexican heavy crude streams may divert to Europe and Asia under a sustained tariff regime, compelling Gulf Coast refiners to explore alternative feedstocks or optimize blending strategies. Should levies persist, U.S. suppliers could pivot toward competitively priced regions such as South America or West Africa to maintain export momentum.

Decoding Market Segmentation of Polyalkylene Glycol Base Oils to Reveal End Use Patterns, Viscosity Grade Preferences and Distribution Channel Dynamics

Market segmentation by end use reveals a complex mosaic of performance requirements and formulation preferences influencing product development and distribution strategies. Within automotive lubricants, engine oils and transmission fluids demand high shear stability and thermal resilience, while greases featuring lithium or polyurea thickeners must deliver load-bearing capacity and water resistance. Industrial lubricant segments classify compressor oils, gear oils, and hydraulic fluids each tailored for duty-specific shear and calibration properties. Metalworking fluids, differentiated into oil-based and water-soluble variants, address machining cleanliness and coolant compatibility needs.

Viscosity grade segmentation further refines market positioning around operational temperature windows and load profiles. Products in the mid-range viscosity tiers serve as versatile multi-temperature solutions, whereas heavy grades support extremes of pressure and thermal stress. Lower viscosity formulations enable rapid flow and efficient heat dissipation in high-speed rotating equipment.

From a product type perspective, diols, polyethers, and triols each confer distinct molecular architectures that balance polarity, chain length, and solubility. Diols often underpin high-viscosity applications, polyethers enable tunable performance across polar and non-polar regimes, and triols supply branching that elevates film strength and shear stability.

Sales channel insights highlight the interplay between direct customer engagement and distributor networks. Direct sales enable bespoke service for large end users with tailored formulation needs, while chemical distributors and lubricant blenders offer localized inventory, technical support, and blended solutions to address regional supply dynamics.

This comprehensive research report categorizes the PAG Base Oils market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Viscosity Grade

- Product Type

- End Use

- Sales Channel

Unraveling Regional Dynamics Impacting Polyalkylene Glycol Base Oils with Strategic Observations from the Americas Europe Middle East Africa and Asia Pacific

In the Americas, a mature downstream infrastructure and deep penetration of synthetic solutions underpin steady demand for PAG-based compressor oils and gear fluids. Leading air compressor OEMs in North America have standardized on polar glycol lubricants for rotary screw units, reflecting decades of proven field performance and OEM approvals. The region’s focus on energy efficiency and emissions reduction continues to drive procurement toward high-performance synthetic base stocks.

Europe, the Middle East, and Africa collectively navigate a stringent regulatory landscape that favors environmentally acceptable lubricants. EU directives on fluorinated gases and industrial emissions compel fleet operators to specify marine-grade PAG lubricants meeting IMO 2020 limits, while REACH-compliant bio-based formulations gain market share in sensitive offshore and food-processing contexts. This convergence of sustainability mandates and performance criteria shapes supplier roadmaps and customer expectations.

Across Asia-Pacific, rapid industrialization and expansion of the automotive and electronics sectors catalyze growing adoption of specialized PAG variants. Policy drivers such as China’s dual-carbon targets and evolving fuel efficiency standards fuel OEM preferences for low-global-warming potential refrigerants paired with compatible polar lubricants. Domestic chemical producers are scaling capacity for high-purity and biodegradable PAG grades to meet regional greenhouse gas reduction commitments.

This comprehensive research report examines key regions that drive the evolution of the PAG Base Oils market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Innovations and Competitive Moves by Leading Players in the Polyalkylene Glycol Base Oils Market Landscape

Major chemical conglomerates are positioning themselves through capacity expansions and targeted innovation programs. BASF has increased polyalkylene glycol production capabilities to serve growing automotive OEM pipelines, while Dow’s launch of renewable-based PAGs underlines its commitment to sustainable performance fluids. ExxonMobil’s collaborative efforts with biotechnology firms to incorporate bio-feedstocks highlight diversified sourcing strategies aimed at reducing carbon intensity in base oil production.

Regional specialists like Idemitsu Kosan and Clariant are developing temperature-resistant and pharmaceutical-grade polymer blends to address niche market requirements. Idemitsu’s high-temperature PAG portfolio delivers enhanced oxidation resistance for industrial machinery, while Clariant’s PEG lines support improved solubility and biodegradability in medical and cosmetic formulations.

New market entrants and distributors are reshaping competitive dynamics through localized blending and technical services. Chemical distributors and lubricant blenders are gaining traction by offering tailored PAG formulations suited to regional equipment standards and regulatory contexts. This fragmentation has intensified competition, compelling established players to enhance service models and invest in digital ordering platforms to retain customer loyalty.

This comprehensive research report delivers an in-depth overview of the principal market players in the PAG Base Oils market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Chevron Corporation

- Clariant AG

- Croda International PLC

- Denso Corporation

- Dow Chemical Company

- Eni Suisse S.A.

- Exxon Mobil Corporation

- FUCHS LUBRIFIANT FRANCE SA

- Hornett Bros & Co Ltd.

- Idemitsu Kosan Co., Ltd.

- ILC SRL

- LIQUI MOLY GmbH

- Matrix Specialty Lubricants BV

- Morris Lubricants

- MOSIL Lubricants Private Limited

- PCC Rokita SA

- PETRONAS Lubricants International Sdn. Bhd.

- Phillips 66 Company

- Shell PLC

- SpecialChem S.A.

- Technical Lubricants International B.V.

- Total Energies SE

- TSI Supercool

- Ultrachem Inc.

Providing Strategic Roadmaps and Proven Recommendations for Industry Leaders to Capitalize on Opportunities in Polyalkylene Glycol Base Oils Sector

Industry leaders should prioritize bio-feedstock integration and circular raw material sourcing to align product portfolios with evolving sustainability mandates. By establishing strategic alliances with biotechnology firms and academic consortia, manufacturers can accelerate the development of lower-emission PAG grades and secure long-term access to renewable monomers.

A robust regulatory intelligence capability will be critical to navigate dynamic environmental standards. Investing in dedicated compliance teams to monitor regional policies such as REACH, F-Gas regulation, and emerging lifecycle toxicity criteria will help anticipate formulation adaptations and preempt supply chain disruptions.

Optimizing product differentiation through advanced additive packages and digital formulation tools can unlock new end-use segments. Leveraging data analytics to tailor viscosity profiles and compatibility parameters for specific OEM approvals will deliver measurable performance gains and foster deeper customer partnerships.

Outlining the Rigorous Research Framework and Methodological Approaches Underpinning the Analysis of Polyalkylene Glycol Base Oils Market Trends

This analysis integrates secondary research from industry journals, regulatory filings, and trade publications to compile a comprehensive view of the polyalkylene glycol base oils landscape. Primary interviews with supply chain executives, OEM representatives, and distributors provided firsthand perspectives on application requirements and performance benchmarks.

Data triangulation across diverse sources ensured accuracy of technological and regulatory insights. Company announcements, patent filings, and environmental agency reports were cross-referenced to validate innovation timelines and compliance implications. Regional demand patterns were mapped using trade flow data and expert interviews to capture nuanced shifts in procurement strategies.

Analytical methodologies included qualitative content analysis to identify emerging thematic drivers, and competitive benchmarking to assess capability gaps among key players. This multi-dimensional research approach underpins the actionable recommendations and strategic narratives presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our PAG Base Oils market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- PAG Base Oils Market, by Viscosity Grade

- PAG Base Oils Market, by Product Type

- PAG Base Oils Market, by End Use

- PAG Base Oils Market, by Sales Channel

- PAG Base Oils Market, by Region

- PAG Base Oils Market, by Group

- PAG Base Oils Market, by Country

- United States PAG Base Oils Market

- China PAG Base Oils Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Summarizing Key Insights and Strategic Conclusions to Empower Stakeholders Engaged in the Evolution of the Polyalkylene Glycol Base Oils Landscape

The polyalkylene glycol base oils sector stands at the intersection of performance innovation and environmental stewardship. Advanced polymer chemistries, bio-sourcing strategies, and regulatory evolutions are collectively reshaping supply dynamics and product roadmaps.

Stakeholders who embrace collaborative development ventures, invest in compliance foresight, and refine segmentation strategies will be best positioned to capture emerging growth from automotive electrification, industrial decarbonization, and specialized end-use applications.

As the market continues to evolve, agility in formulation, distribution, and customer engagement will define industry leadership and unlock new avenues for sustainable value creation.

Connect with Ketan Rohom Associate Director of Sales and Marketing to Access the Definitive Polyalkylene Glycol Base Oils Research Report and Accelerate Strategic Decisions

Ready to take your strategic planning to the next level with unparalleled industry insights and data on polyalkylene glycol base oils? Reach out directly to Ketan Rohom, Associate Director of Sales and Marketing, to secure your comprehensive research report and accelerate informed decision making across your organization today

- How big is the PAG Base Oils Market?

- What is the PAG Base Oils Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?