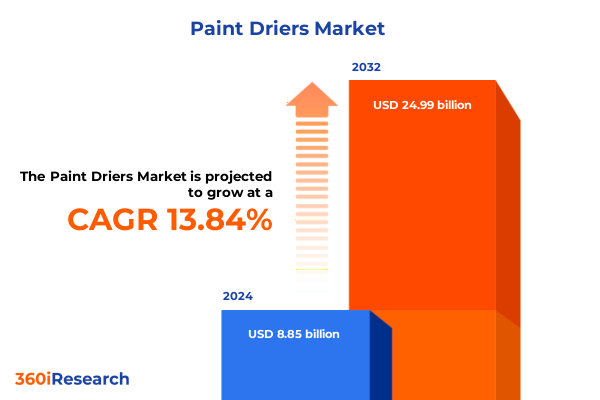

The Paint Driers Market size was estimated at USD 10.00 billion in 2025 and expected to reach USD 11.29 billion in 2026, at a CAGR of 13.97% to reach USD 24.99 billion by 2032.

Exploring the Growing Dynamics and Innovations Shaping the Future of Industrial Paint Drying Technologies Worldwide with Efficiency and Sustainability Trends

The introduction offers a panoramic snapshot of the paint dryer market by underscoring the essential role these systems play in modern manufacturing environments. Rapid drying cycles underpin operational throughput across sectors, from automotive refinish shops to large-scale industrial coating lines. In tandem with quality expectations, the drive to reduce energy consumption and minimize environmental impact has propelled manufacturers to integrate advanced curing technologies into their product portfolios. Strict regulatory requirements for volatile organic compound emissions have further elevated the prominence of efficient, low-emission drying equipment. As regulatory pressures intensify, the ability to deliver consistent, high-quality finishes becomes a critical differentiator that influences customer choice and end-user satisfaction.

Moving beyond compliance, the industry is witnessing a strategic convergence of drying technology with smart automation platforms and data analytics. Manufacturers are increasingly embedding sensors and real-time monitoring interfaces to deliver predictive maintenance capabilities and ensure uniform drying performance. Enhanced user interfaces that guide operators through process parameters help mitigate variability across substrates and coating materials. Looking ahead, the landscape is set to evolve as artificial intelligence and machine learning algorithms are integrated into control systems, enabling adaptive drying profiles that continually optimize for energy efficiency and throughput. This introduction establishes the foundational context for understanding the evolving dynamics, strategic priorities, and technological enablers that shape the future of industrial paint drying solutions.

Unveiling Key Technological and Operational Breakthroughs Reshaping Efficiency and Sustainability in Paint Drying Processes and Industry Best Practices

The paint dryer market is undergoing a fundamental transformation driven by a convergence of technological breakthroughs and evolving end-user expectations. Industry 4.0 principles are steadily being adopted, ushering in digital architectures that link dryer units with enterprise resource planning systems, quality control platforms, and supply chain management tools. Such integrations allow decision-makers to orchestrate production schedules more precisely, minimize downtime, and maintain consistent product quality even under high-volume conditions.

Parallel to digital convergence, curing technologies themselves are advancing at an unprecedented pace. Ultraviolet curing has become more versatile through the adoption of light-emitting diode sources that offer longer service life, lower power consumption, and tunable spectral properties. The realm of infrared systems has also seen innovations, with wavelength-selective emitters improving energy transfer efficiency by matching the absorption characteristics of specific coatings. High-power microwave solutions are being explored for rapid bulk heating applications, whereas short-wave infrared units allow for surface-level curing without over-penetration into sensitive substrates. These technological strides are complemented by growing interest in hybrid systems that marry multiple energy sources to balance cure speed, energy usage, and finish integrity.

Sustainability mandates and volatile energy prices have further accelerated the shift toward more efficient drying methods. By reducing peak power demand and optimizing heat distribution, advanced systems can slash operational costs while maintaining throughput. Moreover, data-driven process control stands to deliver new levels of precision, empowering production managers to fine-tune drying parameters based on real-time feedback loops. This transformative wave of digital intelligence and energy-efficient technology sets the stage for a new era of productivity and environmental stewardship in paint drying operations.

Assessing the Consequences of 2025 United States Tariffs on Supply Chains, Pricing Dynamics and Strategic Responses in the Paint Dryer Industry

The implementation of new United States tariff measures in 2025 has exerted a profound impact on the global paint dryer supply chain. Increased duties on imported components, particularly those sourced from leading equipment exporters, have triggered cost pressures that ripple through the value chain. Manufacturers reliant on specialized infrared emitters and advanced ultraviolet lamps have responded by reassessing their vendor portfolios, seeking both alternative sources and opportunities to localize key component production. As a result, some original equipment manufacturers have expedited plans to establish domestic assembly facilities, aiming to mitigate the uncertainty associated with fluctuating duty structures.

Pass-through effects have been felt most acutely by users in cost-sensitive segments such as wood finishing and general industrial maintenance, where margins are narrow and equipment replacement cycles are tightly planned. Automotive OEM and refinish providers, equipped with long-term service agreements, have generally been able to negotiate stable pricing arrangements, but have nonetheless adjusted capital allocation strategies to account for longer lead times and potential future tariff escalations. Regulatory responses in trading partner countries have introduced another layer of complexity, with reciprocal duties on U.S. exports prompting some paint dryer developers to diversify their export destinations.

In navigating this landscape, industry stakeholders have adopted adaptive procurement strategies that combine increased inventory buffers with strategic partnerships for shared risk. Collaborative initiatives between coating formulators, equipment vendors, and end users have emerged, focusing on joint development of modular systems that can be reconfigured to accommodate localized component availability. Ultimately, the cumulative impact of the 2025 tariff environment underscores the need for supply chain agility, proactive scenario planning, and cross-border collaboration to safeguard market continuity and cost competitiveness.

In-Depth Analysis of Paint Dryer Market Segmentation Revealing How Technology, Application, Coating Types and End Use Industries Drive Industry Dynamics

An in-depth examination of market segmentation reveals the nuanced forces shaping demand for paint drying equipment across multiple dimensions. Technological differentiation plays a pivotal role, as infrared systems are subdivided into long-wave formulations optimized for thick-film thermal curing, medium-wave architectures suited for general industrial applications, and short-wave variants designed for surface-level rapid drying. Parallel advancements in LED technology are categorized into high-power installations that achieve swift photoinitiator activation and mid-power configurations balancing energy savings with moderate cure velocities. Similarly, microwave solutions are bifurcated into high-power units for bulk heating and low-power setups tailored to precision drying tasks, while ultraviolet curing spans UVA, UVB and UVC spectra to accommodate a wide array of coating chemistries.

Beyond technology, application sectors such as automotive OEM, automotive refinish, industrial equipment, packaging and wood finishing exhibit distinct operating requirements. Automated painting lines in automotive assembly plants demand high-capacity, continuous-cast drying tunnels, whereas refinish operations emphasize compact ovens capable of intermittent use. Industrial equipment producers and packaging specialists both seek systems that minimize floor space while ensuring robust throughput, and wood finishing in cabinetry and furniture manufacturing often requires specialized airflow patterns to protect delicate substrates.

Coating type further refines buyer preferences, with powder systems prized for their solvent-free operation, solvent-based coatings valued for their adhesion versatility, and waterborne formulations lauded for low VOC content and regulatory compliance. Finally, end use industries including automotive, electronics, metal fabrication and wood products each impose unique quality standards, throughput targets and facility constraints. By understanding how drying requirements align with these segmentation layers, equipment providers can tailor solutions that deliver optimized performance, regulatory adherence and cost-effectiveness.

This comprehensive research report categorizes the Paint Driers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Coating Type

- Application

- End Use Industry

Comparative Examination of Regional Opportunities Challenges and Growth Catalysts Across Americas Europe Middle East & Africa and Asia-Pacific Paint Drying Markets

Regional markets for paint drying solutions differ significantly in both growth drivers and operational challenges, necessitating localized strategies that align with unique customer needs and policy frameworks. In the Americas, the emphasis on automotive refinishing and industrial coatings in the United States and Canada is buoyed by stringent environmental regulations that prioritize rapid, low-emission drying technologies. Latin American markets, while more cost-sensitive, are experiencing steady modernization efforts as manufacturers upgrade aging paint lines to comply with cross-border trade agreements and sustainability mandates.

Europe, Middle East & Africa present a mosaic of requirements shaped by diverse economic landscapes. Western European nations emphasize renewable energy integration and circular economy principles, fostering high uptake of LED and infrared hybrid systems that optimize energy consumption. Meanwhile, the Middle East’s growing industrial infrastructure investment drives demand for high-throughput microwave and ultraviolet solutions tailored to petrochemical and heavy equipment sectors. In Africa, nascent automotive assembly plants and woodworking industries are beginning to adopt modular, scalable drying units that balance initial capital expenditure with future expansion potential.

Asia-Pacific remains a hotbed of innovation and volume, with rapid industrialization fueling demand for versatile curing platforms. Japan’s electronics manufacturing hubs continue to push the envelope on high-precision, low-temperature drying for delicate components, while China and India see rising adoption of automated, conveyorized drying tunnels in automotive and white goods production. Southeast Asian markets, characterized by mixed regulatory clarity, are increasingly partnering with technology licensors to implement systems that meet forthcoming environmental standards. Across all regions, government incentives for energy efficiency and emissions reduction serve as critical levers driving localized equipment upgrades and new installations.

This comprehensive research report examines key regions that drive the evolution of the Paint Driers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Strategic Initiatives and Competitive Positioning That Are Shaping the Global Paint Dryer Market Landscape

Leading companies in the paint dryer landscape are actively pursuing strategies that encompass both technological innovation and service expansion. Established equipment manufacturers are investing heavily in R&D to introduce next-generation curing systems featuring digital twins, advanced process controls and integrated analytics platforms. Strategic partnerships with coating formulators enable these players to co-develop turnkey solutions that guarantee performance across specific substrate-coating combinations, thereby deepening customer relationships and enhancing differentiation.

Simultaneously, nimble technology providers are carving out niches by specializing in modular, retrofit-friendly units that can be seamlessly integrated into existing paint lines without halting production. These firms are leveraging cloud-based monitoring services that allow remote diagnostics, firmware updates and performance benchmarking across multiple sites. By adopting a subscription-based model for analytics and preventive maintenance, they are creating recurring revenue streams while offering end users predictable operational costs.

Mergers and acquisitions have also reshaped the competitive landscape, as global conglomerates absorb regional specialists to broaden geographic reach and fill portfolio gaps. Alliances with automation integrators, electrical OEMs and renewable energy suppliers are becoming more common, reflecting the interconnected nature of modern production ecosystems. In this evolving market, success hinges on the ability to blend hardware excellence, software capabilities and service offerings into cohesive packages that address the full spectrum of customer pain points.

This comprehensive research report delivers an in-depth overview of the principal market players in the Paint Driers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGGARWAL CHEMICALS

- AKPA KİMYA

- Allnex GMBH

- Arihant Metallica

- Arkema Group

- Aryavart Chemicals Pvt. Ltd.

- Catalent, Inc.

- Chaman Chemical Industries

- Comar Chemicals AG

- Cromax Germany

- DIC Corporation

- Dura Chemicals, Inc.

- DURA Chemicals, Inc.

- Eastman Chemical Company

- EGE KIMYA

- Goldstab Organics Pvt. Ltd.

- LANGRIDGE

- Maldeep Catalysts Pvt. Ltd.

- Matrixuniversal

- Milliken & Company

- Optichem

- Organometal

- Patcham

- PPG Industries, Inc.

- Prakash Chemicals International Pvt. Ltd.,

- RPM International Inc.

- Rustins Limited

- Sherwin-Williams Company

- SpecialChem S.A.

- Sunnyside Corporation

- The Dow Chemical Company

- Venator Materials PLC

Strategic Recommendations for Industry Leaders to Leverage Emerging Technologies Optimize Operations and Navigate Market Disruptions Successfully

Industry leaders need to prioritize investment in next-generation curing technologies that align with global sustainability objectives and customer expectations for rapid throughput. To achieve this, organizations should establish dedicated innovation hubs where cross-functional teams can collaborate on integrating AI-driven control systems with thermal and photonic drying modules. Such centers will accelerate prototyping cycles and facilitate real-world validation in partnership with key end users.

Given the unpredictability of international trade policies, companies are advised to diversify their supply chains by qualifying multiple component sources across different regions. Dual-sourcing arrangements and strategic alliances with domestic manufacturers can mitigate exposure to duty changes and logistical disruptions. In parallel, adopting modular equipment architectures that allow for field-level component swaps will enable swift adaptation to changing part availabilities.

Furthermore, firms should expand service portfolios to include outcome-based contracts tied to energy savings, throughput guarantees and emissions performance. By leveraging remote monitoring and predictive maintenance, service teams can deliver continuous value, strengthen customer loyalty and unlock new revenue opportunities. Finally, establishing a continuous market intelligence framework-drawing on primary interviews, operational data and environmental policy analyses-will ensure that strategic decisions remain aligned with emergent trends and regulatory developments.

Detailed Overview of Research Methodology Data Sources and Analytical Techniques Employed to Ensure Robustness and Reliability of Market Insights

This research effort is grounded in a rigorous methodological framework designed to deliver reliable, actionable insights. Data collection began with in-depth interviews and surveys involving senior executives, operations managers and technical specialists from end-use industries, equipment manufacturers and coating formulators. These primary interactions were complemented by a systematic review of technical papers, patent filings and regulatory documents to validate emerging technology trends and policy shifts.

Quantitative data points were triangulated through analysis of import-export records, manufacturing output statistics and energy consumption reports. Supply chain mapping exercises provided visibility into critical nodes for component sourcing and identified potential bottlenecks under varying tariff scenarios. Rigorous cross-verification processes ensured consistency between vendor disclosures and end-user feedback.

Analytical techniques included SWOT assessments at segment and regional levels, scenario modeling for tariff impacts, and cluster analysis to uncover and validate key customer personas. Quality assurance protocols were applied at every stage, with findings subjected to peer review by an independent panel of industry experts. This multifaceted approach ensures that conclusions and recommendations rest on a foundation of robust evidence, diverse perspectives and a clear understanding of operational realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Paint Driers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Paint Driers Market, by Technology

- Paint Driers Market, by Coating Type

- Paint Driers Market, by Application

- Paint Driers Market, by End Use Industry

- Paint Driers Market, by Region

- Paint Driers Market, by Group

- Paint Driers Market, by Country

- United States Paint Driers Market

- China Paint Driers Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Comprehensive Synthesis of Key Findings Identifying Critical Trends Opportunities and Strategic Imperatives in the Evolving Paint Dryer Sector

This comprehensive examination of the paint dryer sector illuminates a series of interlocking trends and imperatives. Technological innovation, driven by energy efficiency and digital integration, is redefining expectations for equipment performance and lifecycle management. The 2025 tariff landscape has underscored the necessity of supply chain agility and strategic sourcing to maintain cost competitiveness and market continuity. Segmentation analysis has highlighted distinct requirements across technology types, application sectors, coating chemistries and end-use industries, revealing pathways for targeted solution development.

Regional diversity in regulatory dynamics, industrial investment patterns and end-user priorities calls for tailored market entry strategies and collaborative innovation partnerships. Competitive profiling illustrates the growing prevalence of ecosystem plays where hardware, software and service offerings converge. Actionable recommendations advise industry stakeholders to embrace flexible equipment architectures, strengthen data-driven maintenance models and cultivate dual-sourcing networks to mitigate geopolitical risks.

By synthesizing these elements, this report provides a cohesive roadmap for companies seeking to gain a strategic edge. Decision-makers are charged with balancing innovation imperatives against operational resilience, ensuring that future investments not only drive performance but also anticipate evolving market and regulatory demands.

Connect with Ketan Rohom for Personalized Guidance Strategic Briefings and Exclusive Access to the Comprehensive Paint Dryer Market Research Report

I invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure a tailored consultation that aligns with your strategic objectives and operational requirements. By engaging directly, you will gain access to exclusive data-driven briefings and in-depth analyses designed to support informed decision-making in an increasingly competitive environment. Leverage Ketan’s expertise to explore customized solutions, discuss specialized application scenarios, and unlock early insights into upcoming technological roadmaps. This partnership will equip your organization with the confidence to navigate market complexities, anticipate regulatory shifts, and capitalize on emerging opportunities in the paint dryer sector. Take the next step toward a competitive advantage by requesting a comprehensive report that empowers your team with actionable intelligence and precise guidance.

- How big is the Paint Driers Market?

- What is the Paint Driers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?