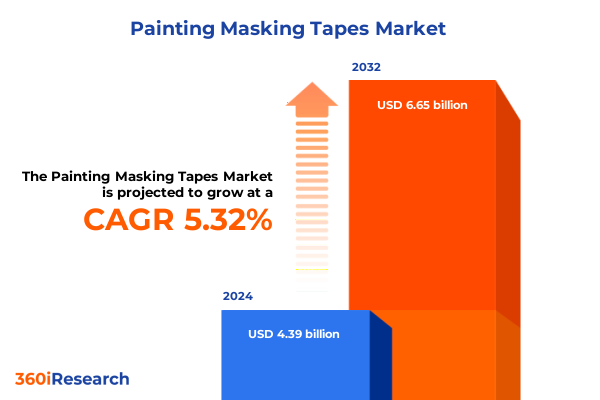

The Painting Masking Tapes Market size was estimated at USD 4.58 billion in 2025 and expected to reach USD 4.78 billion in 2026, at a CAGR of 5.46% to reach USD 6.65 billion by 2032.

Discover How Painting Masking Tapes Serve as an Indispensable Catalyst for Precision Surface Protection and Flawless Finishing Across Automotive Industrial and DIY Applications

Painting masking tapes have evolved from simple paper-based tapes to technologically advanced products that enable precision in surface protection and finishing applications. Initially conceived as a low-cost way to guard surfaces against excess paint, modern masking tapes now support a spectrum of industry requirements, from fine-line automotive painting to large-scale architectural projects. In addition, the rise of specialty materials and adhesive chemistries has expanded the functional horizons of these tapes, making them critical enablers of both manual craftsmanship and automated finishing lines.

Moreover, as finishing standards continue to tighten across sectors such as automotive, aerospace, and construction, the demand for tapes that deliver clean removal without residue has intensified. Consequently, manufacturers have invested in research to formulate adhesives that balance strong adhesion with gentle release, while also optimizing backing materials for dimensional stability. The convergence of these advancements underscores why painting masking tapes now occupy a strategic place in manufacturing and DIY toolkits alike.

Ultimately, this section sets the stage for an in-depth exploration of market transformations, policy influences, segmentation dynamics, regional nuances, and competitive strategies. By framing the discussion around emerging trends and operational imperatives, it prepares decision-makers to navigate the complexities of this evolving landscape.

Explore the Transformative Shifts Reshaping the Painting Masking Tape Landscape Through Innovation Sustainability and Evolving End Use Demands

In recent years, the painting masking tape market has undergone profound shifts driven by material innovation, sustainability priorities, and evolving end-use requirements. Technological breakthroughs in backing films and release liners have augmented tape performance under high-temperature curing processes, thereby enabling wider adoption in industrial coating lines. Concurrently, the development of low-tack and residue-free adhesives reflects a broader industry pivot toward cleaner production practices.

Furthermore, sustainability has emerged as a defining theme, with manufacturers pioneering recyclable backings and solvent-free adhesive systems. This orientation toward environmental responsibility not only aligns with corporate sustainability goals but also addresses regulatory pressures on volatile organic compound (VOC) emissions. As a result, next-generation tapes are now evaluated not solely on adhesion metrics but also on their life-cycle impact.

In addition, end users are demanding greater customization and precision, prompting tape suppliers to integrate digital printing technologies and variable-width slitting capabilities. This shift has significant implications for sectors ranging from bespoke automotive refinishing to large-volume construction projects. Consequently, companies that invest in flexible manufacturing and rapid prototyping will be better positioned to meet dynamic customer specifications.

Assess the Cumulative Impact of 2025 United States Tariffs on Painting Masking Tape Supply Chains Manufacturing Costs and Market Dynamics

The introduction of new import duties on select painting masking tape categories in 2025 has exerted ripples throughout the supply chain, compelling manufacturers and distributors to reassess sourcing strategies and cost structures. Initially, raw material costs surged as key inputs-such as crepe paper and specialty reinforcements-became subject to higher border levies, thereby increasing landed expenses. Consequently, supply-chain planners responded by diversifying supplier portfolios and exploring nearshore production options to mitigate tariff exposure.

Meanwhile, domestic converters have capitalized on the tariff environment by ramping up capacity investments and accelerating automation initiatives. This realignment has not only reduced dependence on imported tape rolls but also created opportunities for localized customization and faster turnaround times. However, these gains have been tempered by elevated manufacturing overheads associated with advanced production equipment.

Subsequently, end-use industries, particularly construction and automotive refinishing, have encountered cost pressures that reverberate through project budgets. To adapt, many service providers are experimenting with hybrid procurement models, blending premium and economy tape grades to balance performance with expense. These adaptive strategies underscore the market’s resilience in the face of regulatory shifts, while also highlighting the importance of agility in tariff-impacted ecosystems.

Gain Deep Insights into Market Segmentation Drivers and Consumer Preferences Underpinning Product Type End Use Adhesive and Distribution Dynamics

A nuanced examination of product type reveals that crepe paper tapes maintain strong traction among DIY enthusiasts and light-duty contractors due to their affordability and conformability, whereas foil tapes are increasingly favored in industrial settings for their thermal resistance and moisture barrier properties. Plastic tapes, known for water-resistance and tensile strength, have gained traction in construction applications, especially in exterior painting and sealing tasks. Meanwhile, washi tapes, prized for their ultra-clean removal and fine-line capabilities, continue to carve out a niche in high-precision detailing work.

Transitioning to end-use patterns, automotive refinish shops demand tapes with superior conformability and adhesive performance to accommodate curved surfaces and multi-coat paint systems. In contrast, the construction sector prioritizes UV-resistant and weatherproof variants that can withstand prolonged outdoor exposure. The vibrant DIY segment often leans toward economy-priced products with sufficient performance for household tasks, while industrial applications require premium tapes engineered for rigorous process conditions.

Adhesive selection plays an equally critical role, as acrylic formulations deliver long-term adhesion with minimal residue, even under fluctuating temperatures, whereas rubber-based adhesives offer cost advantages for short-term masking jobs. Distribution channels further shape purchasing behavior: professional users predominantly rely on offline specialty distributors that provide technical support, whereas smaller enterprises and hobbyists increasingly purchase through online platforms for convenience and bulk-ordering options.

In terms of tape width, the mid-range 18-36 millimeter category captures the largest share of general-purpose usage due to its versatility, while broader tapes above 36 millimeters are preferred for large-surface masking in industrial and construction projects. Narrow rolls up to 18 millimeters are sought by detail-oriented professionals engaged in decorative finishes. Finally, pricing tiers delineate strategic positioning: economy segments serve price-sensitive buyers, premium ranges cater to performance-driven applications, and standard price points balance functionality with cost for mainstream users.

This comprehensive research report categorizes the Painting Masking Tapes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Adhesive Type

- Width

- Price Range

- End Use

- Distribution Channel

Uncover Key Regional Dynamics and Growth Opportunities for Painting Masking Tapes Across the Americas Europe Middle East Africa and Asia Pacific Hubs

Regional dynamics underscore the varied drivers shaping painting masking tape demand. In the Americas, heightened renovation activity and a robust automotive repair landscape stimulate steady tape consumption, while regulatory frameworks in Canada and the United States emphasize low-VOC adhesives, compelling suppliers to innovate accordingly. Moreover, Latin American markets exhibit growing interest in premium tape grades as infrastructure projects accelerate.

Shifting focus to Europe, stringent environmental regulations and an emphasis on sustainable manufacturing have encouraged the adoption of recyclable backings and solvent-free adhesives. Meanwhile, the Middle East’s rapid urbanization fuels demand for high–performance tapes in large-scale construction and oil-and-gas applications. In Africa, nascent industrialization and ongoing infrastructure investments create emerging opportunities, though logistical challenges persist.

Meanwhile, the Asia-Pacific region stands out for its dynamic growth profile. Rapid urban expansion in China and India has sparked significant uptake in construction-grade tapes, whereas manufacturers in Japan and South Korea focus on ultra-high-precision variants for electronics and automotive applications. Additionally, Southeast Asian countries are increasingly integrating local production facilities to serve both regional consumption and export markets, thereby enhancing supply-chain robustness.

This comprehensive research report examines key regions that drive the evolution of the Painting Masking Tapes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyze Strategic Moves Competitive Positioning and Innovation Portfolios of Leading Painting Masking Tape Manufacturers Driving Industry Leadership

Leading manufacturers have pursued distinct strategies to maintain competitive differentiation. One global conglomerate has concentrated on advanced adhesive research, unveiling new solvent-free formulations that meet evolving environmental standards. In contrast, a major European producer has expanded its product portfolio through the acquisition of niche specialty tape companies, thereby enriching its offering of precision detailing solutions.

Another industry stalwart based in Asia has leveraged economies of scale to drive cost efficiencies in crepe paper tape production, while simultaneously investing in digital printing capabilities that enable customized color and branding options for automotive OEMs. Meanwhile, a North American specialist has developed a modular supply-chain model that allows rapid reconfiguration of tape widths and roll lengths, thereby catering to fluctuating order profiles.

Furthermore, strategic partnerships between tape manufacturers and end-user consortia have accelerated the adoption of best practices in tape application and removal, thereby reducing waste and rework rates. Ultimately, these competitive maneuvers reflect a clear trend: companies that integrate product innovation with supply-chain agility are best positioned to navigate volatile input costs and shifting regulatory landscapes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Painting Masking Tapes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Avery Dennison Corporation

- Berry Global Group, Inc.

- Henkel AG & Co. KGaA

- Intertape Polymer Group, Inc.

- Lintec Corporation

- Lohmann GmbH & Co. KG

- Nichiban Co., Ltd.

- Nitto Denko Corporation

- Northern Technologies International Corporation

- tesa SE

Implement Targeted Strategic Recommendations and Operational Enhancements for Industry Leaders to Capitalize on Emerging Trends and Sustain Competitive Advantages

Industry leaders should prioritize investment in sustainable adhesive technologies, focusing on solvent-free and biodegradable formulations to comply with tightening environmental regulations and appeal to eco-conscious customers. Furthermore, enhancing supply-chain visibility through digital tracking systems will enable real-time adaptation to tariff changes and raw material price fluctuations, thereby safeguarding margin performance.

Moreover, companies would benefit from expanding omnichannel distribution strategies that integrate offline specialty partnerships with robust e-commerce capabilities. This dual approach not only caters to professional contractors requiring technical guidance but also taps into the burgeoning online demand from small businesses and DIY enthusiasts. Additionally, cooperative research agreements with end-use sectors, such as automotive and construction consortiums, can accelerate the co-development of application-specific tapes and reinforce customer loyalty.

In parallel, operational excellence initiatives-such as lean manufacturing and predictive maintenance-should be deployed to optimize throughput and reduce downtime. Coupled with data-driven marketing efforts that segment customers by industry and usage patterns, these measures will enable precise targeting of promotions and product launches. By executing these strategies, industry players can convert emerging trends into sustainable competitive advantages.

Understand the Robust Research Methodology Combining Primary Interviews Secondary Data Analysis and Rigorous Validation Protocols Ensuring Data Integrity

This research employed a rigorous methodology combining primary stakeholder interviews with comprehensive secondary data analysis. Initially, experts from key end-use industries, including automotive refinishing leaders and construction project managers, were interviewed to capture firsthand perspectives on application challenges and performance requirements. Subsequently, archival sources-such as industry journals and trade-association reports-were analyzed to validate market trends and regulatory developments.

Furthermore, a multi-stage data triangulation process was implemented, wherein quantitative findings from industry databases were cross-checked against qualitative insights garnered from proprietary case studies. This approach ensured consistency and minimized bias. Quality control protocols, including peer reviews and internal validation workshops, were conducted at each stage to uphold data integrity and analytic rigor.

Finally, proprietary frameworks were applied to synthesize the information into actionable intelligence. These frameworks facilitated the mapping of competitive landscapes and the identification of strategic inflection points. Taken together, this robust research design provides stakeholders with a reliable basis for decision making, grounded in transparent and reproducible methods.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Painting Masking Tapes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Painting Masking Tapes Market, by Product Type

- Painting Masking Tapes Market, by Adhesive Type

- Painting Masking Tapes Market, by Width

- Painting Masking Tapes Market, by Price Range

- Painting Masking Tapes Market, by End Use

- Painting Masking Tapes Market, by Distribution Channel

- Painting Masking Tapes Market, by Region

- Painting Masking Tapes Market, by Group

- Painting Masking Tapes Market, by Country

- United States Painting Masking Tapes Market

- China Painting Masking Tapes Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesize Strategic Takeaways from Comprehensive Painting Masking Tape Analysis to Inform Decision Makers and Guide Long Term Business Strategies

In synthesizing the insights from this comprehensive analysis, several strategic takeaways emerge. First, the convergence of sustainable material development and precision application requirements will continue to redefine product road maps, making innovation a non-negotiable imperative. Second, tariff volatility underscores the need for agile supply-chain configurations that can rapidly shift sourcing without compromising quality or lead times.

Moreover, segmentation analyses reveal that a one-size-fits-all approach is increasingly untenable; instead, manufacturers must tailor product offerings by tape type, adhesive chemistry, and width to serve distinct customer cohorts effectively. Regional developments further highlight that growth trajectories differ markedly, meaning that successful players will deploy localized strategies aligned with regulatory frameworks and infrastructure trends.

Finally, competitive intelligence underscores the importance of strategic alliances and digital capabilities in delivering both product differentiation and operational resilience. Collectively, these findings equip decision-makers with a clear strategic blueprint for navigating the evolving painting masking tape landscape and capturing emerging opportunities.

Engage with Ketan Rohom Associate Director of Sales and Marketing to Secure the Comprehensive Painting Masking Tape Research Report and Unlock Growth Insights

To gain the full suite of in-depth insights, proprietary data compilations, and granular trend analysis, reach out directly to Ketan Rohom, the Associate Director of Sales and Marketing. By securing this comprehensive report, stakeholders will obtain a customized briefing, priority access to raw data tables, and expert commentary tailored to strategic planning needs. Contacting Ketan unlocks a streamlined procurement process and ensures that each executive receives personally guided support in interpreting complex findings. Ultimately, this partnership empowers organizations to translate analytical rigor into actionable initiatives that drive tangible improvements in product development, supply-chain resilience, and go-to-market effectiveness. Take the next decisive step toward outpacing competitors by connecting with Ketan Rohom today.

- How big is the Painting Masking Tapes Market?

- What is the Painting Masking Tapes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?