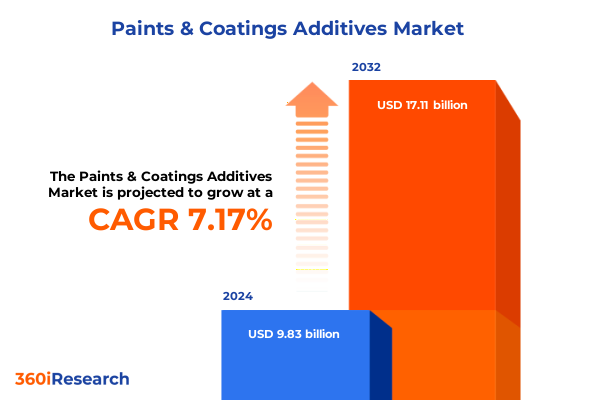

The Paints & Coatings Additives Market size was estimated at USD 10.55 billion in 2025 and expected to reach USD 11.35 billion in 2026, at a CAGR of 7.15% to reach USD 17.11 billion by 2032.

Exploring the Core Dynamics and Critical Advancements That Are Propelling the Evolution of the Paints and Coatings Additives Industry Today

The paints and coatings additives sector stands as a pivotal enabler of performance enhancement, durability, and aesthetic quality across a myriad of end-use applications. At its core, this industry segment delivers specialized chemical solutions that address critical challenges such as corrosion protection, viscosity control, film formation, and environmental compliance. From architectural coatings on high-rise facades to precision automotive finishes, the additive portfolio underpins the desired rheological behavior, long-term stability, and protective attributes required by formulators and end users alike.

Against a backdrop of increasing regulatory scrutiny and evolving customer expectations, additives have transcended their traditional roles. Innovations in waterborne technologies, bio-based chemistries, and multifunctional additive blends are redefining how paints and coatings respond to environmental stressors and sustainability mandates. Concurrently, digitization and advanced analytics are empowering formulators with real-time performance diagnostics, accelerating product development cycles, and optimizing production yields. As a result, the additives market is experiencing a convergence of cutting-edge research, cross-disciplinary collaboration, and strategic investments aimed at unlocking new value propositions.

In essence, the current landscape for paints and coatings additives reflects a dynamic interplay between technological breakthroughs and market imperatives. Entering this landscape with a clear understanding of emerging trends, regulatory drivers, and application-specific demands is therefore indispensable for stakeholders seeking to capitalize on growth opportunities and maintain competitive differentiation.

Navigating the Groundbreaking Technological, Sustainability and Regulatory Transformations Reshaping the Future of Paints and Coatings Additives

Over the past decade, sustainability imperatives have catalyzed a paradigm shift toward eco-friendly additives, prompting formulators to migrate from solvent-borne to waterborne systems and to embrace bio-derived raw materials. This transition has been reinforced by stringent emissions regulations across key markets, compelling additive suppliers to innovate low-volatile organic compound (VOC) solutions and next-generation coupling agents that deliver performance parity while adhering to tighter environmental norms.

Simultaneously, digital transformation has begun to permeate every facet of additive development and application. Leveraging machine learning–driven formulation platforms and real-time process monitoring, manufacturers are refining additive chemistries more rapidly, reducing trial-and-error cycles, and enhancing batch-to-batch consistency. These technologies have introduced unprecedented transparency into the supply chain, enabling precise traceability of critical raw materials and expediting compliance with global regulatory standards.

Furthermore, the convergence of nanotechnology and functional coatings has unlocked new realms of performance, as nano-scale rheology modifiers and UV stabilizers imbue paints with self-healing, anti-microbial, and advanced weathering resistance characteristics. This multidisciplinary approach has lowered the barriers to market entry for novel additive platforms, while reshaping competitive dynamics and fostering strategic partnerships between chemical innovators and formulation engineers.

Taken together, these transformative shifts underscore the importance of agility and foresight in navigating the rapidly evolving additives landscape, where regulatory constraints, sustainability objectives, and technological advancements intersect to redefine industry benchmarks.

Assessing the Broad Ranging Consequences of 2025 United States Tariff Measures on Sourcing, Pricing and Innovation Strategies in Additives

The imposition of revised United States tariffs in 2025 has exerted considerable influence on the additives supply chain, particularly for key intermediates sourced from major overseas producers. As duties on certain resin precursors and specialty surfactants climbed, formulators confronted escalated raw material costs, prompting a reevaluation of sourcing strategies and an emphasis on supplier diversification. In consequence, some manufacturers have accelerated investments in domestic capacity expansion, seeking to insulate production lines from import-related price volatility.

Beyond immediate cost pressures, the tariffs have stimulated a wider reconsideration of collaborative R&D models. By fostering joint ventures with regional chemical producers, leading additive suppliers have sought to localize critical processes, thereby mitigating exposure to geopolitical risks. This trend has not only streamlined supply chain logistics but also facilitated closer alignment with U.S. environmental and safety regulations, expediting product registrations and market entry timelines.

In parallel, downstream players in automotive OEM and industrial machinery applications have recalibrated their additive formulations to accommodate alternative resin grades and in-country chemistries. This shift has underscored the strategic importance of agile formulation platforms capable of accommodating supply variability without compromising performance benchmarks. As a result, cross-functional teams of procurement specialists, formulators, and regulatory experts are collaborating more intensely to ensure continuity of supply and adherence to evolving trade policies.

Overall, the cumulative impact of the 2025 tariff measures has reverberated throughout the paints and coatings additives ecosystem, driving regionalization of production, accelerating supply chain innovation, and reinforcing the resilience of domestic manufacturing networks.

Deriving Impactful Insights from Resin Form Additive Application and End Use Segmentation to Inform Strategic Decisions in Additives

A granular examination of the market through resin type segmentation reveals that acrylic and epoxy-based additive platforms continue to command significant attention for their versatility across decorative and industrial coatings. The emergence of polyester and polyurethane chemistries caters to specialized corrosion- and abrasion-resistant applications, while alkyd and vinyl resins retain their foothold in cost-sensitive architectural finishes. By contrast, niche opportunities in high-performance coatings are driving targeted innovation in hybrid resin systems that blend the best attributes of multiple chemistries.

When considering additive form, liquid-based offerings, encompassing both solvent-borne and waterborne variants, account for the preponderance of new product introductions, reflecting formulators’ preference for ease of integration and processing flexibility. Nonetheless, paste additives have carved out distinct advantages in high-solid formulations, enabling pigment wetting and consistent rheological control, while powder forms, particularly epoxy and polyester powders, are gaining traction in electrostatic spray and coil coating applications due to their minimal waste profiles and improved film properties.

From the additive type perspective, multifunctional chemistries such as combined flow and leveling agents with embedded UV stabilizers have emerged as a growth vector, simplifying formulation complexity and reducing total additive loadings. Specialized biocides, both in-can and dry-film variants, alongside advanced polar dispersants, continue to safeguard product stability and pigment dispersion, whereas the latest associative and non-associative thickeners are fine-tuning viscosity management for precision application processes across automotive and coil coil markets.

Turning to application-specific segmentation, architectural coatings are further differentiated into exterior and interior technologies that respond to climatic durability and indoor air quality requirements. Similarly, automotive OEM coatings leverage distinct additives for commercial vehicle and passenger vehicle lines, optimizing chemical performance for regulatory compliance, process efficiency, and aesthetic standards. Equally, the marine, industrial machinery and industrial OEM sectors are demanding tailored additive suites to withstand harsh operating environments and meet stringent performance criteria.

Finally, analyzing end-use industry segmentation underscores that automotive OEM and refinish sectors are continually pushing the envelope on faster cure rates and scratch resistance. Construction coatings, segmented into non-residential and residential builds, favor additives that enhance substrate adhesion and fade resistance. The wood and marine end users demand biocide-infused and highly cross-linkable systems to combat biological attack and corrosive conditions, while industrial equipment applications require precision rheology modifiers that ensure consistent coverage and minimal overspray.

This comprehensive research report categorizes the Paints & Coatings Additives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Form

- Additive Type

- Application

- End-Use Industry

Comparative Analysis of Regional Market Dynamics Across Americas Europe Middle East Africa and Asia Pacific in the Additives Domain

Regional dynamics in the Americas are shaped by robust activity in North American automotive OEM and industrial machinery coatings, where additive developers are prioritizing low-VOC and high-performance solutions to satisfy federal and state-level environmental mandates. Similarly, Latin American markets are displaying renewed interest in powder-based additives, driven by government incentives for energy-efficient coating processes and the expanding manufacturing base in automotive and construction sectors.

Across the Europe, Middle East and Africa region, regulatory rigor-particularly within the European Union-has accelerated the adoption of waterborne and bio-based additive platforms. The need to comply with REACH and other regional chemical directives has fostered innovation in non-silicone defoamers and polymeric dispersants that reduce ecological impact. In parallel, rapid urbanization in the Middle East and North Africa has stimulated demand for UV-stable exterior architectural coatings, encouraging suppliers to tailor their additive chemistry to local climatic conditions.

In the Asia-Pacific region, the convergence of infrastructure growth and rising disposable incomes has fueled expansion in both architectural and automotive refinish applications. China’s continued investment in electric vehicle manufacturing has created a surge in demand for specialty additives that enable fast curing and durable finishes. Meanwhile, India’s growing consumer goods sector is driving uptake of rheology modifiers and flow agents that facilitate efficient high-speed production in coil and industrial OEM plants.

Collectively, these regional variations underscore the necessity for additive suppliers to adopt a nuanced market entry strategy, blending product portfolios with localized regulatory expertise and targeted application testing. This approach ensures that formulations are optimized for performance in diverse environmental and operational conditions across the globe.

This comprehensive research report examines key regions that drive the evolution of the Paints & Coatings Additives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the Strategic Initiatives and Competitive Posturing of Leading Industry Players in the Paints and Coatings Additives Sector

Major chemical corporations are leveraging their expansive R&D networks to introduce next-generation additives that align with stringent sustainability and performance criteria. Firms with integrated global supply chains are accelerating the commercialization of waterborne rheology modifiers and multifunctional dispersants that deliver lower environmental impact and enhanced process efficiency. In response to evolving customer demands, leading players are also forging strategic alliances with specialty polymer manufacturers to co-develop hybrid additive systems that offer synergistic property enhancements.

Meanwhile, mid-sized and niche innovators are capitalizing on agility by focusing on rapid product launches tailored to emerging application segments, such as high-solid automotive refinish coatings and maritime antifouling formulations. By maintaining lean development pipelines, these companies can swiftly integrate breakthrough raw materials into additive portfolios, securing first-mover advantage in select markets.

Additionally, cross-sector collaboration between additive suppliers and OEM equipment manufacturers has intensified, particularly in high-volume coil coating and industrial machinery applications. Through co-innovation programs, additive developers are embedding real-time monitoring sensors into production lines, enabling formulators to adjust additive dosing dynamically and optimize throughput without sacrificing film quality.

Consolidation trends are also evident, as merger and acquisition activities enable firms to augment their geographic footprint, strengthen raw material sourcing, and broaden technology platforms. This wave of strategic transactions is reshaping competitive hierarchies, compelling industry participants to continuously reassess their value propositions and partnership strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Paints & Coatings Additives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AGC Inc

- Akzo Nobel N.V.

- ALLNEX NETHERLANDS B.V.

- ALTANA AG

- Arkema S.A.

- Ashland Inc

- Axalta Coating Systems Ltd.

- BASF SE

- BYK-Chemie GmbH

- Cabot Corporation

- Clariant AG

- DAIKIN INDUSTRIES Ltd

- DIC Corporation

- Dow Inc

- Eastman Chemical Company

- ELEMENTIS PLC

- Evonik Industries AG

- Kusumoto Chemicals Ltd

- Momentive Performance Materials Inc.

- MÜNZING Corporation

- Nouryon

- Shamrock Technologies

- Solvay S.A.

- The Lubrizol Corporation

Actionable Strategies for Industry Leaders to Capitalize on Emerging Opportunities and Overcome Challenges in the Additives Market

To thrive amid geopolitical uncertainties and evolving regulations, industry leaders should prioritize the expansion of localized production hubs that can mitigate tariff-induced cost pressures and ensure uninterrupted supply continuity. By investing in modular manufacturing units tailored for waterborne and powder additive fabrication, companies can rapidly reallocate capacity in response to regional demand shifts and trade policy fluctuations.

Simultaneously, formulating a robust sustainability roadmap is paramount. Organizations must integrate life cycle analysis tools into product development workflows to identify opportunities for raw material substitution with bio-based or recycled feedstocks. Aligning additive portfolios with the most stringent environmental standards will not only preempt future regulatory constraints but also resonate with end customers increasingly focused on green building certifications and eco-labels.

Building on this foundation, leaders should cultivate cross-functional innovation platforms that bring together chemists, data scientists, and application engineers to co-create digital formulation tools. These interactive platforms can empower R&D teams to simulate performance scenarios, optimize additive concentrations, and accelerate time to market, thereby strengthening competitive differentiation.

Finally, fostering deeper customer partnerships through tailored technical service programs can drive loyalty and accelerate adoption of advanced additive chemistries. By offering on-site trials, joint development agreements, and predictive maintenance analytics, suppliers can demonstrate tangible value, position themselves as indispensable collaborators, and unlock long-term growth opportunities.

Comprehensive Explanation of the Multimethod Research Approach Underpinning the Robustness of the Additives Market Analysis

The research underpinning this analysis integrates a systematic review of industry publications, patent databases, and regulatory filings to establish a comprehensive secondary research baseline. Key steps included mapping global additive supply chains, tracking regional tariff and compliance developments, and synthesizing technical white papers to identify emerging chemistry trends. Proprietary databases were leveraged to collate historical product launch information and strategic investment announcements.

Complementing secondary research, a robust primary research phase involved in-depth interviews with over fifty stakeholders spanning additive manufacturers, formulators, original equipment manufacturers, and regulatory authorities. These qualitative discussions yielded nuanced perspectives on formulation challenges, supply chain adaptations post-tariff, and future technology priorities. Quantitative surveys administered to coating professionals across key regions further enriched the dataset, enabling comparative analysis of additive performance requirements and procurement preferences.

Data triangulation methods were applied to reconcile insights from secondary data, primary interviews, and survey results. This multidimensional approach ensured the validity and reliability of thematic conclusions, while bespoke analytical frameworks facilitated segmentation-based demand profiling. To bolster methodological rigor, findings underwent peer review by independent industry experts and internal quality assurance audits, ensuring consistency and objectivity in reporting.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Paints & Coatings Additives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Paints & Coatings Additives Market, by Resin Type

- Paints & Coatings Additives Market, by Form

- Paints & Coatings Additives Market, by Additive Type

- Paints & Coatings Additives Market, by Application

- Paints & Coatings Additives Market, by End-Use Industry

- Paints & Coatings Additives Market, by Region

- Paints & Coatings Additives Market, by Group

- Paints & Coatings Additives Market, by Country

- United States Paints & Coatings Additives Market

- China Paints & Coatings Additives Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Synthesizing Key Findings to Provide a Cohesive Perspective on the Current State and Trajectory of the Additives Market

The paints and coatings additives market is at an inflection point, shaped by sustainability mandates, digital innovation, and strategic supply chain restructuring. From the iterative advancements in waterborne and powder additive platforms to the multifaceted impact of 2025 tariffs, industry stakeholders must remain vigilant and adaptable. Segmentation analysis underscores the criticality of resin, form, additive type, application, and end-use nuances in determining product-market fit, while regional insights highlight the diversity of regulatory and commercial landscapes.

Competitive dynamics are evolving as both established chemical giants and agile niche players vie for leadership through differentiated technologies and strategic alliances. As additive suppliers navigate geopolitical headwinds, sustainable product portfolios and localized manufacturing will emerge as key differentiators. Moreover, the acceleration of digital formulation tools and real-time monitoring capabilities signals a shift toward data-driven process optimization and customer-centric innovation.

In conclusion, success in the paints and coatings additives industry will hinge on the ability to balance performance excellence with environmental stewardship, supply chain resilience, and forward-looking R&D. Companies that proactively align their strategies with emerging trends and regulatory requirements will be best positioned to capture new growth opportunities and maintain a competitive edge.

Engage with Our Associate Director Sales and Marketing to Secure the Definitive Paints and Coatings Additives Market Research Report

For more comprehensive insights into market dynamics, in-depth segmentation analysis, and strategic guidance tailored to your business objectives, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He can provide you with a detailed overview of our latest paints and coatings additives market study, outline how the findings apply to your organization, and guide you through the process of acquiring the full research report to empower your decision-making.

- How big is the Paints & Coatings Additives Market?

- What is the Paints & Coatings Additives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?