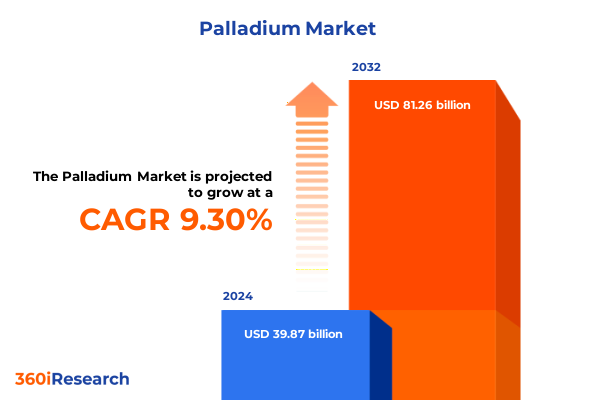

The Palladium Market size was estimated at USD 43.66 billion in 2025 and expected to reach USD 47.82 billion in 2026, at a CAGR of 9.27% to reach USD 81.26 billion by 2032.

Exploring Palladium’s Unique Properties and Critical Role Across Industries in Driving Sustainable Technological Advancements Worldwide

Palladium has emerged as a cornerstone of modern industrial and commercial applications, distinguished by its unique combination of catalytic efficiency, corrosion resistance, and electrical conductivity. First isolated over a century ago, this noble metal has transcended its origins in jewelry and dentistry to become indispensable in sectors ranging from automotive emission control to advanced electronics. Its role in automotive catalytic converters, for instance, underpins global efforts to meet ever-stricter emissions regulations, while its electrical properties drive miniaturization and performance enhancements in consumer and industrial electronics.

Transitioning from niche applications to a foundation of sustainable technologies, palladium’s influence extends to emerging sectors such as green hydrogen production and fuel cells, where it serves as a critical catalyst for hydrogen oxidation. This intersection of traditional and transformative uses positions palladium at the heart of industrial decarbonization strategies and next-generation electronic devices. As such, understanding its broad utility and evolving demand drivers is essential for stakeholders aiming to navigate the complexities of supply chains and capitalize on growth opportunities.

Identifying the Emergence of Cleaner Emission Standards and Ripple Effects Fueling a Paradigm Shift in Palladium Demand and Supply Dynamics

In recent years, rapid shifts in environmental policy and technological innovation have fundamentally altered the palladium landscape. Stricter global emissions standards have catalyzed surging demand for catalytic converters in both developed and emerging markets, compelling automakers to prioritize palladium-based catalysts. Concurrently, geopolitical tensions have prompted supply chain diversification, with purchasers seeking to reduce reliance on traditional sourcing regions by forging alternative partnerships and investing in recycling infrastructure.

At the same time, the proliferation of electric vehicles and renewable energy technologies has introduced new dynamics. Although electric powertrains do not require catalytic converters, upstream investment in green hydrogen and fuel cell systems has generated parallel demand for palladium catalysts. Electrification initiatives in telecommunications and industrial electronics have further amplified the metal’s importance, as manufacturers harness its superior conductivity and durability in ever-smaller device form factors. The convergence of policy-driven emission controls and innovation-led technology adoption has thus propelled palladium from a specialty metal to a strategic industrial commodity.

Understanding How Recent U.S. Tariff Policies Implemented in 2025 Have Reshaped Global Palladium Trade Routes and Market Stability

The introduction of new U.S. tariffs on palladium imports in early 2025 has exerted a multifaceted influence on the global market, reshaping trade flows and price discovery mechanisms. Imposed with the stated aim of bolstering domestic sourcing and safeguarding essential supply chains, these measures have elevated import duties on primary palladium-producing nations. As a consequence, buyers in North America have sought to reevaluate procurement strategies, balancing short-term cost pressures against long-term stability.

This policy shift has triggered downstream adjustments, notably among automakers and chemical suppliers, who must now navigate increased input costs and potential supply bottlenecks. In response, firms have accelerated investments in material substitutions, palladium recycling, and stockpiling, while also exploring spot market opportunities in secondary regions. These adaptations have underscored the metal’s geopolitical sensitivity and highlighted the critical need for agile sourcing and risk mitigation frameworks in an era of heightened trade uncertainty.

Unveiling Comprehensive Insights into Palladium Market Segmentation by Application Form Purity End User Industry and Distribution Channels

A holistic examination of the palladium market reveals insights across multiple dimensions of segmentation that inform strategic decision-making. When viewed through the lens of application, automotive catalytic converters account for the lion’s share of industrial usage, reflecting stringent tailpipe emission standards worldwide. In the chemical industry, palladium’s catalytic prowess facilitates essential reactions in fine chemical synthesis and petrochemical refining. Dentistry continues to rely on palladium alloys for biocompatible restorations, while electronics manufacturers leverage the metal’s conductivity and stability in both consumer and industrial electronics, spanning computers, smartphones, and televisions. Investment demand manifests through investment vehicles such as bars, coins, and exchange-traded funds, with cast bars and minted bars offering varied liquidity profiles. Jewelry remains a traditional segment, valued for palladium’s tarnish-resistant luster and hypoallergenic properties.

Beyond applications, the market’s product form segmentation offers further clarity. Bars and coins dominate investment-oriented flows, whereas granules and powder serve as feedstock for chemical catalysts and manufacturing processes. Rods find niche roles in specialized industrial and laboratory equipment. Purity also plays a pivotal role in value determination, with 99.9 percent and 99.95 percent grades commanding premium status among fabricators and end users. Examining end-user industries underscores the metal’s diverse ecosystem: automotive and chemicals lead industrial consumption, dental practices sustain biomedical applications, electronics drive high-volume deployment, and jewelry caters to luxury consumer markets. Distribution channels range from direct sales agreements with producers to distributor networks, online trading platforms, and traditional retail outlets, each offering distinct advantages in terms of lead time, customization, and service support.

This comprehensive research report categorizes the Palladium market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Purity

- Distribution Channel

- Application

- End User Industry

Analyzing Regional Variations in Palladium Consumption Supply Chain Resilience and Emerging Opportunities Across Americas EMEA and Asia Pacific

Regional perspectives illuminate shifting patterns of consumption, production, and investment in the palladium market. In the Americas, the United States emerges as a pivotal consumer, driven by domestic automotive and electronics sectors. The region’s response to 2025 tariffs has spurred growth in recycling initiatives and secondary sourcing partnerships with Latin American refiners. Canadian production, while modest, benefits from proximity to manufacturing hubs, bolstering supply resilience.

Europe, the Middle East, and Africa present a tapestry of demand profiles shaped by stringent European emissions regulations, burgeoning petrochemical capacity in the Middle East, and evolving industrial landscapes across Africa. European automotive OEMs remain avid consumers of palladium catalysts, while the region’s pharmaceutical and specialty chemicals sectors utilize the metal’s catalytic attributes. In the Middle East, upstream oil and gas investments have indirectly supported palladium demand through expanded refining capacity. North African markets, though nascent, show potential for growth in electronics assembly and precious metal recycling.

Asia-Pacific continues to anchor global palladium consumption, with China and India leading in both manufacturing output and automotive production. Chinese refiners have scaled up capacity to meet domestic demand, while Indian dental and jewelry markets contribute incremental growth. Southeast Asian electronics clusters leverage palladium’s stability in high-performance circuit applications. Japan and South Korea, historically significant users of noble metals, maintain steady demand in semiconductor and automotive segments, underpinning a region-wide imperative to secure reliable palladium supplies.

This comprehensive research report examines key regions that drive the evolution of the Palladium market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Competitive Positioning of Leading Palladium Producers Refiners and Downstream Market Players

Leading players in the palladium ecosystem have adopted distinct strategies to consolidate market positions and capture value. Major miners and refiners have pursued capacity expansions and joint ventures in key jurisdictions, enhancing upstream control over raw material flows. Concurrently, integrated producers with downstream capabilities have leveraged proprietary technologies to optimize recycling and recovery processes, reducing dependence on primary mining.

On the manufacturing front, chemical producers have diversified catalyst portfolios to include palladium alternatives while investing in process intensification techniques that lower overall metal loadings. Dental alloy specialists have introduced advanced formulations that balance biocompatibility with cost-efficiency, addressing both clinical performance and pricing concerns. Electronics component suppliers have innovated plating and deposition methods that minimize palladium usage without sacrificing conductivity, aligning with broader sustainability goals.

Investment product issuers and fabricators have expanded product lines of palladium bars and coins, enhancing liquidity and accessibility for retail and institutional buyers. Meanwhile, jewelry brands have highlighted palladium’s hypoallergenic properties to differentiate collections, tapping into consumer trends favoring low-maintenance precious metals. These cumulative initiatives illustrate a marketplace in which collaboration, technological differentiation, and customer-centric innovation define competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Palladium market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aberdeen International

- African Rainbow Minerals Limited

- Alfa Aesar by Thermo Fisher Scientific Inc.

- Anglo American plc

- Atlatsa Resources Corporation

- BASF SE

- First Quantum Minerals Ltd.

- Glencore plc

- Heraeus Holding GmbH

- Impala Platinum Holdings Limited

- Indian Platinum Pvt.Ltd

- Ivanhoe Mines Ltd.

- Johnson Matthey Group

- Manilal Maganlal & Company

- New Age Metals Inc.

- Norilsk Nickel

- Northam Platinum Holdings Limited

- Otto Chemie Pvt. Ltd.

- Palladium One Mining Inc.

- Platinum Group Metals Ltd

- Sibanye Stillwater Limited

- Southern Palladium Limited

- Umicore N.V.

- Vale S.A.

- Vineeth Precious Catalysts Pvt. Ltd.

Actionable Strategies for Industry Leaders to Navigate Volatility Optimize Supply Chains and Capitalize on Shifting Palladium Market Trends

Industry leaders must adopt a multifaceted approach to navigate current market complexities and secure long-term resilience. Prioritizing supply chain diversification is paramount; forging strategic alliances with non-traditional refining partners and ramping up internal recycling capabilities will mitigate exposure to tariff-induced disruptions. In parallel, proactive engagement with policymakers can help shape regulations that balance trade security with market fluidity.

Research and development investments should focus on catalyst lifecycle optimization, exploring alloy compositions and support materials that reduce overall palladium consumption in automotive and chemical applications. Collaboration between original equipment manufacturers and catalyst suppliers can yield co-developed solutions that align performance targets with cost efficiency. In electronics, scaling advanced deposition and surface engineering techniques will unlock further material savings while maintaining product integrity.

From a commercial standpoint, organizations should refine pricing strategies to accommodate input cost volatility, leveraging flexible contract structures and hedging mechanisms. Enhancing customer service through digital platforms and tailored supply agreements will strengthen relationships and foster trust amid uncertainty. Finally, continual market monitoring-anchored by robust intelligence frameworks-will empower decision-makers to anticipate shifts in demand patterns and tariff landscapes, translating insights into timely strategic pivots.

Detailing a Robust Research Methodology Combining Primary Engagements Secondary Intelligence and Triangulation for Market Insights Validation

Our research methodology combines comprehensive primary data collection with rigorous secondary analysis and triangulation to ensure both breadth and depth of insights. Primary engagements include structured interviews with key executives in mining, refining, manufacturing, and end-user organizations, supplemented by detailed surveys that capture operational priorities, risk perceptions, and investment plans.

Secondary intelligence is drawn from authoritative industry publications, trade association reports, and customs data, enabling contextualization of primary findings within broader market trends. Advanced analytical models support segmentation analyses, while peer benchmarking exercises validate competitive positioning insights. Triangulation across data sources and method cross-checks fortify the reliability of conclusions and mitigate potential biases.

This integrated approach ensures that our insights reflect real-time industry dynamics, offering stakeholders a nuanced understanding of supply chain vulnerabilities, technological inflection points, and emerging growth corridors. By applying rigorous validation protocols at each stage, the methodology secures a high degree of factual accuracy, making the findings both actionable and strategically relevant.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Palladium market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Palladium Market, by Form

- Palladium Market, by Purity

- Palladium Market, by Distribution Channel

- Palladium Market, by Application

- Palladium Market, by End User Industry

- Palladium Market, by Region

- Palladium Market, by Group

- Palladium Market, by Country

- United States Palladium Market

- China Palladium Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Drawing Conclusive Perspectives on the Evolving Palladium Landscape and Implications for Stakeholders Across the Value Chain

As environmental imperatives and technological innovations continue to redefine industrial metals markets, palladium’s strategic importance is poised to endure and evolve. The interplay of fresh regulatory frameworks, such as the 2025 U.S. tariff adjustments, with accelerating demand from automotive, electronics, and green energy applications underscores the metal’s critical role in modern value chains.

Stakeholders across the palladium ecosystem confront a landscape marked by both opportunity and uncertainty. Supply chain diversification efforts, ongoing investment in recycling infrastructure, and technological advancements in catalyst design collectively shape a market that demands agility and foresight. Regional dynamics in the Americas, EMEA, and Asia-Pacific further complicate planning, yet they also provide pathways for growth through collaboration and targeted market entry.

By synthesizing segmentation analyses, company intelligence, and actionable recommendations, this executive summary offers a consolidated perspective on the forces steering palladium markets today. The insights presented herein aim to equip decision-makers with the strategic context needed to anticipate challenges, seize emerging opportunities, and maintain a competitive edge as global industrial transitions accelerate.

Connect with the Associate Director to Unlock Customized Palladium Market Intelligence and Strategic Insights That Drive Competitive Advantage

Don’t let critical market insights slip through the cracks. Reach out today to engage with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, and secure your comprehensive Palladium market research report. Ketan offers personalized guidance on report features, customized data analytics, and strategic workshops designed to accelerate your decision-making. By partnering with him, you gain access to the latest intelligence on supply chain shifts, tariff impacts, and emerging technologies that will shape the Palladium market’s future. Act now to equip your organization with actionable insights and maintain a competitive edge in a rapidly evolving market.

- How big is the Palladium Market?

- What is the Palladium Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?