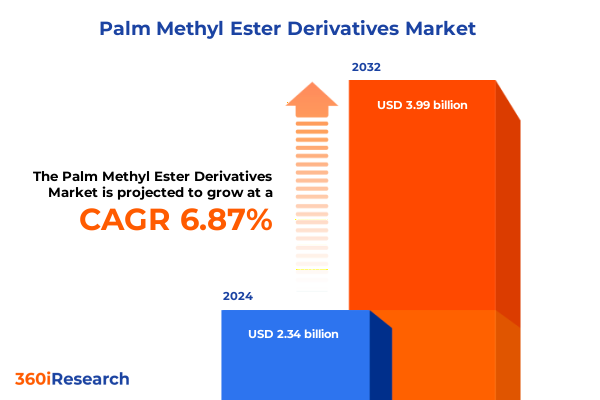

The Palm Methyl Ester Derivatives Market size was estimated at USD 2.50 billion in 2025 and expected to reach USD 2.65 billion in 2026, at a CAGR of 6.89% to reach USD 3.99 billion by 2032.

Unveiling the Strategic Importance of Palm Methyl Ester Derivatives in Modern Applications Driving Sustainable Innovation Across Key Industries

Paragraph 1: Palm methyl ester derivatives are specialized oleochemicals produced via the transesterification of palm oil feedstocks, prized for their biodegradability and versatile functional properties. These compounds underlie a variety of sustainable applications, from solvents and surfactants to energy carriers in biodiesel formulations. Recent advances in both enzymatic and non-catalytic transesterification processes have enhanced product purity while reducing energy consumption, positioning these derivatives as competitive, eco-friendly alternatives to traditional petrochemicals.

Paragraph 2: Over the past decade, global manufacturers have increasingly integrated palm methyl ester derivatives into product lines spanning automotive coatings, industrial lubricants, and personal care formulations. This shift is driven by stringent low-VOC and environmental regulations, as well as consumer demand for natural and sustainable ingredients. Market leaders leverage these derivatives to deliver improved sensory experiences and product stability in home care and cosmetic applications, aligning with international eco-label standards such as COSMOS and ECOCERT.

Paragraph 3: The strategic role of palm methyl ester derivatives extends to the biodiesel sector, where fatty acid methyl esters derived from palm feedstocks are central to meeting national blending mandates in major producing countries. As stakeholders pursue initiatives like RSPO certification to ensure deforestation-free sourcing, these derivatives are emerging as critical components in the transition toward low-carbon fuel alternatives, reflecting the convergence of regulatory policies and sustainability priorities.

Charting the Transformative Shifts Redefining the Palm Methyl Ester Derivatives Landscape Through Technological and Regulatory Advancements

Paragraph 1: The landscape of palm methyl ester derivatives is undergoing seismic shifts driven by regulatory pressures and consumer expectations for eco-friendly solutions. In coatings and paints, formulators are transitioning toward biodegradable solvents to meet stringent VOC reduction mandates, leveraging the low volatility and solvent power of methyl esters. Meanwhile, the surge in green personal care has prompted brands to integrate palm-derived surfactants and emulsifiers that comply with COSMOS and ECOCERT standards, enhancing both product performance and environmental credentials.

Paragraph 2: Technological breakthroughs in transesterification, including enzymatic catalysis, are optimizing production efficiency and reducing energy consumption. These advances enable producers to deliver high-purity derivatives tailored for specialized applications in pharmaceuticals, agrochemicals, and industrial lubricants. Such process innovations, coupled with digital traceability solutions, reinforce commitments to sustainable sourcing and RSPO compliance, addressing ongoing concerns regarding deforestation and biodiversity loss.

Paragraph 3: Concurrently, policy frameworks are reshaping market dynamics. Emerging eco-tariff proposals aim to impose import fees based on the carbon intensity of manufactured products, potentially adding a new layer of cost and complexity for palm derivative exporters. At the same time, collaborative initiatives between major consumer goods companies and feedstock suppliers are forging resilient supply chains, ensuring both product availability and adherence to evolving ESG benchmarks.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Palm Methyl Ester Derivative Trade and Biofuel Feedstock Dynamics

Paragraph 1: In 2025, the United States implemented a series of tariffs targeting renewable fuel feedstocks and palm oil imports that have significantly disrupted global trade flows. The administration’s universal 10 percent surcharge on imports, augmented by targeted levies such as a 32 percent tariff on Indonesian palm oil, has elevated procurement costs for manufacturers of palm methyl ester derivatives. These measures have also cast uncertainty over long-term trade agreements, prompting industry participants to reassess supply chain strategies.

Paragraph 2: One of the most substantial disruptions has been in the biodiesel sector, where tariffs of up to 54 percent on Chinese used cooking oil have curtailed a major feedstock stream for FAME production. Biofuel producers in the U.S. have reported reduced feedstock availability and price volatility, compelling a shift toward domestic alternatives such as soybean oil. This reorientation has implications for derivative manufacturers who rely on consistent methyl ester quality and supply volumes.

Paragraph 3: Tariff differentials have also skewed trade between lineage producers. Malaysian exporters face a 24 percent duty, while negotiations are underway to potentially reduce Indonesian tariffs from 32 percent to 19 percent under forthcoming bilateral agreements. This evolving tariff landscape necessitates agile risk management, as companies weigh the benefits of securing preferential trade terms against the operational challenges of diversifying procurement sources.

Unraveling Key Market Segmentation Insights Revealing Application, Function, Grade and Distribution Dynamics for Palm Methyl Ester Derivatives

Paragraph 1: The market for palm methyl ester derivatives encompasses a wide spectrum of applications, ranging from biodiesel formulations for industrial and vehicular energy to high-performance coatings in both architectural and industrial settings. Industrial lubricants span hydraulic fluids, available in mineral and synthetic bases, and metal working fluids in semisynthetic, soluble, and fully synthetic variants. Each application demands specific purity and performance attributes, driving producers to fine-tune derivative characteristics to match end-use requirements.

Paragraph 2: Functional roles of these derivatives include serving as emollients and emulsifiers in personal care segments, where formulations for hair, skin, and oral care leverage the natural affinity and biocompatibility of fatty acid esters. Surfactants derived from palm methyl esters-encompassing amphoteric, anionic, cationic, and nonionic types-facilitate cleaning, dispersion, and emulsification in both household and industrial products. The selection of cosmetic, pharmaceutical, or technical grade further refines derivative specifications to comply with regulatory and performance thresholds, while direct and distributor channels shape market accessibility and pricing dynamics.

This comprehensive research report categorizes the Palm Methyl Ester Derivatives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Function

- Grade

- Distribution Channel

Key Regional Insights Highlighting Growth Drivers and Sustainability Trends Impacting Palm Methyl Ester Derivative Adoption Globally

Paragraph 1: Regional dynamics reveal distinct growth drivers and regulatory influences across the Americas, EMEA, and Asia-Pacific. In the Americas, incentive programs such as the USDA’s BioPreferred certification support the adoption of bio-based intermediates, while U.S. feedstock diversification strategies respond to tariff-induced supply constraints. Local manufacturers are investing in capacity expansions to mitigate import reliance and stabilize derivative quality for downstream users.

Paragraph 2: Europe, the Middle East, and Africa are characterized by stringent deforestation-free supply chain regulations and eco-label requirements. The EU’s recently enacted due diligence rules compel traceability of palm oil footprints, elevating demand for derivatives sourced from RSPO-certified plantations. In regions such as the Gulf Cooperation Council, growing industrialization and infrastructure projects are driving the uptake of palm-derived coatings and lubricants that meet low-VOC and green building standards.

Paragraph 3: Asia-Pacific remains the largest production hub, propelled by B40 biodiesel mandates in Indonesia and Malaysia’s biodiesel blending increases. Surplus crude palm oil is channeled into derivative production for both domestic consumption and export markets. Rapid industrial growth in China and India is expanding demand for bio-based surfactants and solvents, while local R&D initiatives focus on enzyme-based processes to enhance yield efficiency and product consistency.

This comprehensive research report examines key regions that drive the evolution of the Palm Methyl Ester Derivatives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Key Companies Shaping the Competitive Landscape of Palm Methyl Ester Derivatives Through Innovation, Capacity Expansion and Sustainability

Paragraph 1: The competitive landscape of palm methyl ester derivatives is led by global integrated agribusiness firms that command significant supply chain capabilities. Wilmar International, with its extensive refining and fractionation infrastructure, continues to invest in capacity expansions and downstream R&D for specialty derivatives. KLK Oleo leverages its Malaysia-based production network to supply high-purity laurate and oleate esters to personal care and home care conglomerates, while IOI Oleo capitalizes on vertical integration to optimize feedstock traceability and cost efficiency.

Paragraph 2: Specialty chemical majors such as BASF and Clariant are key collaborators in co-developing tailored surfactant and lubricant solutions, bringing formulation expertise and regulatory support to the value chain. Consumer goods leaders, exemplified by Unilever’s Clean Future initiative, are driving demand for certified sustainable feedstocks, incentivizing derivative suppliers to attain higher standards of eco-certification and carbon footprint transparency.

This comprehensive research report delivers an in-depth overview of the principal market players in the Palm Methyl Ester Derivatives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer Daniels Midland Company

- Bunge Limited

- Cargill, Incorporated

- Emery Oleochemicals

- IOI Corporation Berhad

- Kuala Lumpur Kepong Berhad

- Musim Mas Holdings Pte. Ltd.

- Ruchi Soya Industries Limited

- Sime Darby Plantation Berhad

- Wilmar International Limited

Actionable Recommendations for Industry Leaders to Enhance Competitiveness and Sustainability in the Palm Methyl Ester Derivatives Value Chain

Paragraph 1: Industry leaders should prioritize strategic partnerships across the value chain, aligning with certified sustainable palm oil producers and technology providers to secure reliable feedstock access. Investing in modular processing units capable of enzymatic transesterification can reduce energy consumption and enable rapid scaling in response to demand fluctuations.

Paragraph 2: Companies must proactively monitor evolving tariff regimes and free trade negotiations to optimize procurement strategies, including leveraging preferential trade agreements and exploring alternative feedstocks when warranted. Enhancing digital traceability and lifecycle analysis tools will not only ensure compliance with deforestation-free mandates but also support transparent reporting to stakeholders.

Paragraph 3: To capitalize on emerging end-use opportunities, firms are advised to expand their product portfolios by developing performance-enhancing additive packages for biodiesel, coatings, personal care, and industrial lubricants. R&D collaborations with academic institutions and government research bodies can accelerate the discovery of novel catalytic processes and next-generation derivative chemistries.

Research Methodology Employed to Deliver Comprehensive, Accurate and Insightful Analysis of Palm Methyl Ester Derivative Market Dynamics

Paragraph 1: This report is grounded in a rigorous research framework combining both primary and secondary data sources. Primary inputs include interviews with industry executives, feedstock suppliers, and end-user formulators to validate market drivers, regulatory impacts, and technological developments.

Paragraph 2: Secondary research encompassed analysis of trade journals, company annual reports, government publications, and international regulatory documents. Data triangulation techniques were employed to reconcile disparate sources and ensure statistical accuracy.

Paragraph 3: Our methodology further incorporates quantitative modeling of trade flows, capacity utilization, and sustainability metrics, complemented by expert panel reviews to refine projections and validate strategic insights. This holistic approach ensures a comprehensive and actionable understanding of market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Palm Methyl Ester Derivatives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Palm Methyl Ester Derivatives Market, by Application

- Palm Methyl Ester Derivatives Market, by Function

- Palm Methyl Ester Derivatives Market, by Grade

- Palm Methyl Ester Derivatives Market, by Distribution Channel

- Palm Methyl Ester Derivatives Market, by Region

- Palm Methyl Ester Derivatives Market, by Group

- Palm Methyl Ester Derivatives Market, by Country

- United States Palm Methyl Ester Derivatives Market

- China Palm Methyl Ester Derivatives Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Conclusion Summarizing Strategic Implications and Future Outlook for Palm Methyl Ester Derivatives in Evolving Global Industry Context

Paragraph 1: The palm methyl ester derivatives sector stands at a pivotal juncture, shaped by sustainability imperatives, technological innovation, and shifting trade policies. The convergence of green consumer demand and regulatory mandates underscores the strategic importance of high-purity, certified derivatives across diverse industrial and personal care applications.

Paragraph 2: As tariff landscapes continue to evolve, companies that invest in flexible processing technologies, robust supply chain partnerships, and advanced traceability systems will secure competitive advantages. Collaboration between producers, formulators, and policymakers will be essential to navigate compliance requirements and unlock new market segments.

Paragraph 3: In sum, palm methyl ester derivatives will remain integral to the transition towards bio-based economies, offering scalable, biodegradable solutions that complement both emerging and established industries. Stakeholders who anticipate and adapt to these dynamics will be best positioned to drive sustainable growth and innovation.

Explore the Comprehensive Palm Methyl Ester Derivative Market Research Report Today by Contacting Ketan Rohom Associate Director of Sales & Marketing

Paragraph 1: To gain a comprehensive understanding of the palm methyl ester derivatives market and access detailed data on applications, tariffs, supply chain strategies, and competitive benchmarking, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. He can guide you through the insights and support your organization’s strategic planning.

Paragraph 2: Reach out to Ketan Rohom to discuss bespoke market intelligence offerings, unlock deeper analysis, and secure your copy of the full market research report. Take this opportunity to leverage expert expertise and position your business at the leading edge of the palm methyl ester derivatives landscape.

- How big is the Palm Methyl Ester Derivatives Market?

- What is the Palm Methyl Ester Derivatives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?