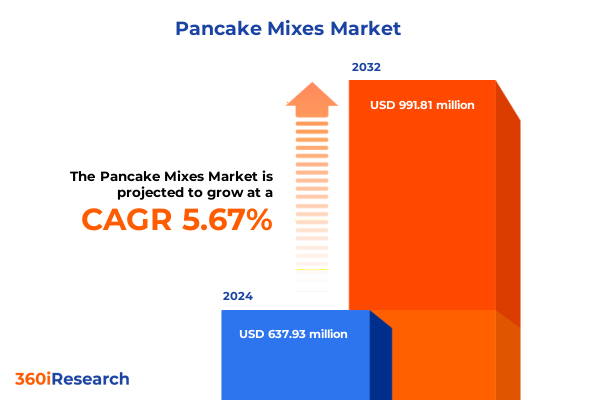

The Pancake Mixes Market size was estimated at USD 672.25 million in 2025 and expected to reach USD 708.82 million in 2026, at a CAGR of 5.71% to reach USD 991.81 million by 2032.

Opening the Griddle on Pancake Mix Market: Unveiling the Tantalizing Fusion of Convenience, Flavor Variation, and Consumer Demand

Over the past decade, pancake mixes have transcended their role as simple breakfast staples to become versatile culinary solutions that cater to time-pressed households, nostalgic indulgence seekers, and nutrition-conscious consumers alike. This evolution has been driven by an increasing appetite for products that deliver consistent quality and ease of preparation, while also accommodating a diverse array of lifestyle preferences. As a result, the industry has witnessed a proliferation of formulations that balance traditional taste profiles with innovative ingredient blends, mirroring broader shifts in food manufacturing.

Moreover, emerging consumer segments have demonstrated a willingness to explore premium and functional variants of pancake mixes. Whether targeting protein-enriched blends for active adults or gluten-free formulations for those with dietary restrictions, manufacturers have responded by expanding their portfolio beyond the classic buttermilk base. At the same time, the proliferation of e-commerce platforms and the refinement of cold chain logistics have enabled brands to reach niche audiences and sustain market differentiation through limited-edition and regionally inspired flavors. These developments underscore a clear trend: pancake mixes are no longer confined to the boundaries of the grocery aisle but are now integral to broader meal occasions and snacking behaviors.

In this context, the executive summary presents a holistic view of the pancake mix landscape, exploring the transformative shifts that have shaped consumer demand and supplier strategies. It delves into the impact of recent trade policies, unpacks key segmentation dynamics, examines regional nuances, and highlights the competitive intelligence that informs strategic decision-making. The following sections are designed to equip stakeholders with actionable insights and a nuanced understanding of the forces driving market progression.

Embracing Unprecedented Industry Transformation Through Health-Driven Innovation and On-the-Go Convenience in the Pancake Mix Landscape

The last few years have witnessed an unprecedented metamorphosis in the pancake mix industry, propelled by shifting consumer lifestyle patterns and an intensified focus on health and convenience. Traditional formulations have given way to a new breed of mixes that cater to on-the-go meal solutions without sacrificing flavor complexity. As a result, manufacturers are reinventing their offerings to meet the demands of busy professionals, fitness enthusiasts, and families seeking quick yet satisfying breakfast and snack options.

Central to this transformation is the rise of health-driven innovation. Brands have introduced mixes enriched with functional ingredients such as plant-based proteins, prebiotics, and nutrient-dense flours to appeal to wellness-oriented consumers. Simultaneously, there has been a resurgence of interest in clean-label formulations, with consumers scrutinizing ingredient lists and favoring products that deliver transparency and perceived naturalness.

In parallel, convenience has emerged as a paramount driver of product development. Ready-to-heat packets and heat-and-eat pouches have gained traction in both retail and foodservice channels, reflecting a broader trend toward minimal preparation time. Consequently, the pancake mix category is intersecting with the growing market for ready meals and snack innovation, blurring traditional category boundaries.

Emerging digital platforms have further accelerated market evolution by enabling direct-to-consumer customization and limited-edition releases. Through subscription models and interactive marketing campaigns, brands can now engage with consumers in real time, test new recipes, and refine product features based on immediate feedback. Sustainability considerations-such as recyclable packaging and ethically sourced ingredients-have also moved to the forefront, creating a holistic value proposition that resonates with both modern shoppers and environmentally conscious stakeholders.

Assessing the Complex Ripple Effect of the 2025 United States Tariffs on Ingredient Sourcing, Pricing Strategies, and Supply Chain Resilience

In 2025, the implementation of revised United States tariffs on imported wheat, specialty flours, and certain packaging materials introduced a series of challenges that reverberated throughout the pancake mix supply chain. Raw material costs experienced upward pressure, prompting manufacturers to revisit their sourcing strategies and negotiate new supplier agreements. In response, several leading producers began exploring domestic milling partnerships to mitigate exposure to cross-border duty fluctuations.

As ingredient expenses climbed, brands faced a delicate balancing act between maintaining price competitiveness and preserving product quality. This dynamic led to the exploration of alternative grain sources, such as sorghum and ancient grains, which not only provided cost relief but also aligned with consumer interest in exotic and health-oriented ingredients. At the same time, companies accelerated innovation efforts aimed at optimizing recipe formulations for cost efficiency without diluting taste or functionality.

Supply chain diversification emerged as a critical imperative. To reduce reliance on a limited pool of import channels, manufacturers expanded their logistics networks to incorporate regional distribution hubs and near-sourcing arrangements. This shift was complemented by investments in inventory management systems that leverage predictive analytics to anticipate demand fluctuations and pre-position stock closer to key markets.

Moreover, the tariff environment spurred collaborative initiatives between brands and retail partners. Volume-based incentive programs and shared cost-absorption models helped cushion the impact of increased duty rates, ensuring that shelf prices remained within acceptable thresholds for value-sensitive consumers. Overall, while the 2025 tariff adjustments introduced complexity, they also accelerated supply chain resilience and fostered new avenues for product differentiation.

Unearthing Critical Segmentation Insights Shaping Consumer Preferences Across Product Type, Flavor, Formulation, Packaging Size, Channel, and Demographic Trends

An intimate understanding of product type segmentation reveals how market participants have tailored their approaches to distinct convenience profiles and preparation preferences. Instant heat-and-eat formats have capitalized on the demand for ultra-fast meal solutions, while just-add-egg mixes appeal to home chefs who desire a balance between control and convenience. Pre-mixed and ready-to-mix variants, by contrast, enable consumers to adjust consistency, sweetness, and serving size, reinforcing the category’s versatility.

Turning to flavor profile, the enduring popularity of classic buttermilk remains a testament to consumer comfort with familiar tastes. Nevertheless, flavored subsegments have attracted significant interest through novelty and indulgence. Banana, blueberry, and chocolate chip variants exemplify how brands infuse pancakes with fruit-based or dessert-inspired elements, broadening application occasions beyond the breakfast table.

Formulation-based differentiation has proven equally vital. Gluten-free mixes, once considered niche, have transitioned into mainstream offerings, responding to a broader population seeking digestive wellness. Protein-enriched blends cater to active lifestyles, integrating whey or plant proteins without compromising texture. Vegan formulations address animal-product aversions, harnessing ingredients like chickpea flour and flaxseed to mimic the binding and fluffiness that eggs traditionally provide.

Packaging size considerations further segment consumer usage. Bulk packages serve high-volume channels such as foodservice, while multi-serving bags dominate grocery shelves for families. Single-use sachets and cups deliver portion control for on-the-go consumers, dovetailing with travel and workplace snacking trends.

In terms of marketing channel, traditional offline retail continues to command significant distribution through convenience stores, specialty food outlets, and supermarkets. However, the meteoric rise of online retail-spanning brand websites and third-party e-commerce platforms-has unlocked direct consumer engagement, data-driven personalization, and subscription-based repeat purchases.

Finally, consumer preference segmentation illuminates the distinct drivers for adults, health enthusiasts, and children. Adults often prioritize convenience and flavor reliability, health enthusiasts focus on functional benefits, and parents select products that balance nutritional claims with kid-friendly appeal. Together, these six segmentation dimensions form the backbone of strategic decision-making for brands seeking to align product innovation with targeted consumer needs.

This comprehensive research report categorizes the Pancake Mixes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Flavor Profile

- Type

- Package Size

- Marketing Channel

- Consumer Preference

Delineating Regional Market Drivers and Consumer Behavior Patterns Across the Americas, EMEA, and Asia-Pacific Pancake Mix Sectors

In the Americas, established breakfast rituals and a robust retail network have fostered strong consumption patterns for pancake mixes. The United States and Canada have witnessed growing interest in premium and functional variants, facilitated by large supermarket chains and specialized health food stores. Furthermore, advanced infrastructure in this region supports rapid distribution for both traditional grocery and online channels.

Within Europe, the Middle East, and Africa, market drivers vary significantly by subregion. In Western Europe, consumers are discerning regarding provenance and organic credentials, which has led to an emphasis on artisanal and heritage recipes. The Middle East displays a growing inclination toward convenience, particularly in urban centers where ready-to-eat formats are gaining traction. In Africa, emerging economies are witnessing nascent demand for packaged pancake mixes, spurred by urbanization and expanding modern trade networks.

Asia-Pacific stands out for its rapid market expansion and the introduction of flavor innovations that resonate with local palates. Urban households in countries such as China and India are increasingly adopting pancake mixes as a convenient breakfast substitute, incorporating locally popular ingredients like matcha or cardamom. Meanwhile, e-commerce penetration continues to accelerate, enabling both multinational and domestic brands to reach tier-2 and tier-3 cities with targeted marketing campaigns.

Across all regions, digital engagement, sustainability expectations, and health considerations are converging to shape future growth opportunities. Strategic investors and manufacturers must therefore tailor their approaches to regional consumer behaviors, regulatory environments, and distribution ecosystems in order to optimize market entry and expansion initiatives.

This comprehensive research report examines key regions that drive the evolution of the Pancake Mixes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market-Leading Innovators and Strategic Collaborators Elevating Quality, Distribution, and Brand Engagement in the Pancake Mix Industry

A cohort of market leaders has emerged through a strategic blend of product innovation and distribution excellence. By introducing novel formulations-such as high-protein and ancient-grain mixes-these companies have positioned themselves at the intersection of nutrition trends and taste satisfaction. Simultaneously, investments in quality control and transparent sourcing practices have bolstered brand credibility among discerning consumers.

Collaborations with retailers and co-branding partnerships have further amplified the reach and appeal of key players. Limited-edition flavor launches aligned with seasonal occasions or pop-culture tie-ins have heightened consumer interest, while in-store sampling initiatives and promotional endcaps have driven trial and repeat purchases. Leading firms have also embraced omnichannel marketing strategies, integrating in-store experiences with digital touchpoints and social media engagement to cultivate community around their brands.

Supply chain integration has emerged as another competitive lever. Forward-thinking companies have established strategic alliances with logistics providers, enabling faster product replenishment and reduced lead times. Some have even co-invested in regional milling facilities to secure preferential access to specialty flours and fortification ingredients, thereby reinforcing manufacturing agility.

Finally, agile new entrants and niche brands are reshaping the competitive landscape by targeting underserved subsegments. These innovators, often born out of start-up incubators or culinary ventures, prioritize small-batch production, premium positioning, and direct-to-consumer sales models. Their success underscores the importance of flexibility and consumer intimacy in a market characterized by rapid product turnover and evolving taste preferences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pancake Mixes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer Daniels Midland Company

- Balticovo

- Better Batter, LLC

- Bob's Red Mill Natural Foods, Inc.

- C.H. Guenther

- Conagra Brands, Inc.

- Dawn Foods, Inc.

- Dr. Oetker GmbH

- General Mills, Inc.

- Hodgson Mill, Inc.

- Hometown Food Company

- International House of Pancakes, LLC

- King Arthur Baking Company

- Kodiak Cakes LLC

- Nature’s Path Foods, Inc.

- Pamela’s Products

- PepsiCo, Inc.

- Pillsbury Company, LLC

- Sainsbury's Group plc

- Simple Mills, LLC

- Stonewall Kitchen, Inc.

- Swiss Bake Ingredients Pvt. Ltd.

- The Hain Celestial Group, Inc.

- The Kroger Co.

- The Krusteaz Company

- Weikfield Foods Pvt. Ltd.

- Woolworths Group Limited

Actionable Imperatives and Strategic Pathways for Industry Leaders to Capitalize on Health Trends, Sustainability, and Omni-Channel Expansion

Industry leaders should intensify their investment in R&D to stay at the forefront of formulation innovation. By leveraging ingredient science and consumer insights, companies can develop pancake mixes that deliver targeted functional benefits-such as enhanced protein content or gut-friendly fibers-while maintaining exceptional taste and texture. Rapid prototyping and micro-batch testing will help refine product attributes before large-scale launch.

In parallel, expanding the product portfolio to include regionally inspired and limited-edition flavors can sustain consumer interest and support premium pricing strategies. These initiatives should be underpinned by robust consumer feedback loops, employing digital channels and loyalty programs to capture real-time preferences and foster brand advocacy.

Optimizing packaging formats is equally critical. Sustainable, recyclable materials and single-use sachets that reduce waste while providing convenience can address both environmental concerns and on-the-go consumption trends. Packaging innovations that incorporate clear portion guidance and transparent label claims will further enhance the consumer experience and reinforce brand trust.

Finally, a deliberate omnichannel expansion strategy will ensure broad market coverage and foster direct consumer relationships. Strengthening partnerships with e-commerce platforms, exploring subscription models, and integrating digital tools into brick-and-mortar experiences will enable companies to capture valuable consumer data, personalize communications, and accelerate repeat purchases. Embracing such a multifaceted approach will empower industry leaders to capitalize on emerging trends and secure sustainable growth.

Transparent Research Methodology Integrating Primary Engagements, Secondary Validation, and Multi-Tiered Qualitative and Quantitative Analyses

This research integrates primary engagements with industry stakeholders and end users to uncover unfiltered perspectives on market dynamics. Structured interviews with senior executives, R&D leads, and procurement specialists provide a nuanced understanding of strategic priorities, supply chain challenges, and innovation roadmaps. Concurrently, consumer surveys validate preference hierarchies and purchasing triggers across diverse demographic segments.

Secondary validation draws upon reputable open-access sources, academic journals, trade publications, and publicly available financial reports. This blend of desk research and cross-referencing ensures that data points are rigorously corroborated and reflect the latest regulatory developments, tariff changes, and consumer trend analyses. Special care has been taken to avoid reliance on single-source proprietary databases, thus maintaining methodological transparency.

Quantitative analysis leverages a multi-tiered framework, combining statistical evaluation of survey responses with sentiment analysis of social media discourse and retail channel performance indicators. Qualitative deep dives-including case study evaluations and comparative benchmarking-provide additional context regarding competitive positioning and go-to-market tactics. A geographically stratified approach ensures that regional nuances are thoroughly examined, delivering targeted insights for decision makers across the Americas, EMEA, and Asia-Pacific.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pancake Mixes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pancake Mixes Market, by Product Type

- Pancake Mixes Market, by Flavor Profile

- Pancake Mixes Market, by Type

- Pancake Mixes Market, by Package Size

- Pancake Mixes Market, by Marketing Channel

- Pancake Mixes Market, by Consumer Preference

- Pancake Mixes Market, by Region

- Pancake Mixes Market, by Group

- Pancake Mixes Market, by Country

- United States Pancake Mixes Market

- China Pancake Mixes Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Concluding Synthesis Highlighting Key Market Dynamics, Segment Opportunities, and Strategic Priorities for Future Growth Trajectories

In summary, the pancake mix market stands at a crossroads where consumer demand for convenience, health functionality, and experiential flavors converges with evolving regulatory and trade environments. Continued innovation in product formulations-spanning protein enrichment, clean-label credentials, and diverse flavor infusions-will remain the cornerstone of competitive differentiation. At the same time, supply chain agility and strategic sourcing will be critical in navigating external cost pressures, such as the 2025 tariff adjustments.

By leveraging segmentation insights across product type, flavor, formulation, packaging size, channel, and demographic preferences, market participants can craft targeted value propositions that resonate with distinct consumer cohorts. Regional market drivers underscore the necessity of tailored approaches, while the strategic maneuvers of leading companies highlight the efficacy of collaborative partnerships and omnichannel engagement. Synthesizing these findings, industry stakeholders are well positioned to refine their strategic roadmaps, enhance operational resilience, and capitalize on emerging opportunities for sustainable growth.

Partner Directly with Ketan Rohom to Secure Your Definitive Pancake Mix Market Research Report and Drive Strategic Decisions Forward

To gain comprehensive, data-driven insights into the pancake mix market’s evolving dynamics, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Engaging in a direct discussion will allow you to explore tailored applications of the research and uncover the strategic advantages this report offers for your organization. Secure your copy today to ensure your team can act on the latest market intelligence and stay ahead in an increasingly competitive environment.

- How big is the Pancake Mixes Market?

- What is the Pancake Mixes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?