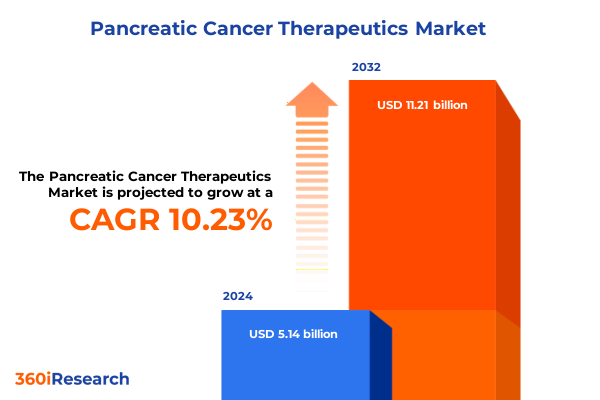

The Pancreatic Cancer Therapeutics Market size was estimated at USD 5.61 billion in 2025 and expected to reach USD 6.12 billion in 2026, at a CAGR of 10.39% to reach USD 11.21 billion by 2032.

Understanding the Evolving Landscape of Pancreatic Cancer Therapeutics and Why Innovative Patient-Centric Treatment Strategies Have Become Critical

Pancreatic cancer remains one of the most lethal malignancies, characterized by late-stage diagnosis and limited treatment options. Over the past decade, incremental advances in surgical techniques and chemotherapy regimens have marginally extended survival, but overall prognosis persists at less than a year for many patients. Consequently, there is an urgent imperative to innovate beyond conventional cytotoxic approaches and harness novel modalities that can intercept the disease at molecular and immunologic levels. This report examines how recent breakthroughs-from checkpoint inhibitors to targeted small molecules-are reshaping the therapeutic landscape and redefining clinical expectations.

The rising incidence of pancreatic cancer, coupled with the mounting global healthcare burden, has galvanized pharmaceutical and biotech stakeholders to prioritize investment in the pancreatic oncology pipeline. Clinical trial activity has surged, with multiple phase II and phase III studies exploring combination regimens designed to overcome the tumor’s immunosuppressive microenvironment. Moreover, advances in genomic profiling and biomarker-driven patient selection are enabling more precise, personalized interventions. Against this backdrop, an integrated view of therapeutic strategies is essential to identify high-value opportunities and anticipate market dynamics over the coming five years.

How Cutting-Edge Immunotherapies, Precision Diagnostics, and Combined Modalities Are Redefining Pancreatic Cancer Treatment Possibilities

Transformative shifts in the pancreatic cancer space are driven by an enhanced understanding of tumor biology and immune evasion mechanisms. Recent research has illuminated the complex interplay between pancreatic tumor cells and their stromal milieu, revealing pathways that can be targeted to modulate immune infiltration. As a result, checkpoint inhibitors that block PD-1 and CTLA-4 checkpoints are being tested in combination with cytotoxic chemotherapy to bolster antitumor responses, while novel cell therapies seek to leverage engineered T cells capable of penetrating the dense desmoplastic stroma.

Furthermore, precision medicine has gained traction through companion diagnostics that stratify patients by actionable genetic alterations and tumor mutational burden. This stratification facilitates the deployment of targeted therapies, such as small-molecule kinase inhibitors and monoclonal antibodies, in appropriately selected cohorts. Alongside these developments, minimally invasive liquid biopsy platforms are emerging as vital tools to monitor therapeutic efficacy and detect early resistance. Collectively, these converging advances signal a new era of multi-modal regimens, where the integration of immunotherapy, targeted agents, and cutting-edge diagnostics creates a more dynamic and responsive treatment paradigm.

Assessing the Financial and Operational Consequences of United States Import Tariffs on Pancreatic Cancer Therapeutics Development in 2025

In 2025, the implementation of new United States tariffs on pharmaceutical imports and raw materials has introduced additional cost pressures on pancreatic cancer drug development and supply chains. Active pharmaceutical ingredients sourced from overseas laboratories now incur elevated duties, prompting manufacturers to reassess supplier relationships and manufacturing footprints. As raw material costs rise, companies are confronted with the dual challenge of preserving R&D investment while maintaining competitive pricing for emerging therapies.

In response, leading biopharmas have accelerated efforts to diversify and nearshore critical production processes, thereby mitigating tariff-related risks and ensuring continuity of supply. Some organizations have entered strategic partnerships with domestic contract manufacturing organizations to localize key manufacturing steps, while others are exploring vertically integrated production models. Despite these mitigations, the cumulative impact of tariffs has led to modest upward pressure on the cost of clinical trial execution, driving sponsors to optimize trial design and patient enrollment strategies. Ultimately, stakeholders are compelled to innovate across the value chain-not only in therapeutic mechanisms but also in operational efficiency-to sustain momentum in pancreatic cancer research and commercialization.

Integrating Multiple Segmentation Dimensions to Illuminate Diverse Pancreatic Cancer Therapeutic Strategies and Patient Journeys

The pancreatic cancer therapeutics market encompasses multiple interlocking dimensions that collectively inform strategic decision-making. From a therapeutic modality perspective, traditional chemotherapy remains foundational, yet immunotherapy and targeted approaches are rapidly expanding their footprint, with cell therapy and checkpoint inhibitors advancing most swiftly. These are complemented by combination therapy strategies aimed at synergistically harnessing distinct mechanisms of action. Underlying these modalities, the drug class dimension reveals a growing emphasis on cellular therapies and monoclonal antibodies, alongside established small molecule inhibitors and peptides that address specific oncogenic drivers.

Treatment line segmentation further differentiates the market opportunity, as first-line interventions prioritize efficacy and tolerability to maximize patient outcome, second-line treatments emphasize overcoming resistance and disease progression, and third-line options focus on salvage therapies that offer incremental survival benefit. Administration routes also shape development priorities, with intravenous delivery dominating due to its suitability for complex biologics and oral formulations gaining ground as convenience and patient adherence become key differentiators. Additionally, subcutaneous administration is under exploration for certain targeted agents. Finally, the end-user landscape spans cancer centers where specialized care protocols are prevalent, hospitals that provide broad inpatient support, specialty clinics equipped for outpatient infusions, and emerging home care settings that aim to reduce hospitalization time and enhance patient quality of life.

This comprehensive research report categorizes the Pancreatic Cancer Therapeutics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapeutic Modality

- Drug Class

- Treatment Line

- Route Of Administration

- End User

Uncovering Regional Disparities in Regulatory Pathways, Access Dynamics, and Clinical Adoption of Pancreatic Cancer Therapies

Regional variations exert a profound influence on the development, approval, and adoption of pancreatic cancer treatments. In the Americas, strong investment in biotech innovation and well-established regulatory pathways in the United States and Canada facilitate rapid market entry for novel therapies. Conversely, differences in payer coverage policies and reimbursement rates across Latin America can slow commercial uptake despite growing diagnostic capabilities. Meanwhile, Europe, the Middle East, and Africa present a heterogeneous landscape: Western European nations often lead in clinical trial participation and early access programs, while Eastern Europe and parts of Africa contend with infrastructure constraints that limit advanced diagnostic and treatment deployment.

In the Asia-Pacific region, surging healthcare spending and expanding private-sector investment are fueling both local development and licensing agreements for pipeline candidates. Countries such as Japan and South Korea benefit from strong regulatory alignment with global standards, streamlining approvals for immunotherapies and targeted agents. Yet, in emerging markets like India and Southeast Asia, challenges persist in scaling up specialized care pathways and ensuring equitable access. As a result, global players are tailoring market entry strategies, engaging regional partners, and investing in capacity-building initiatives to navigate this intricate mosaic of regulatory, economic, and clinical factors.

This comprehensive research report examines key regions that drive the evolution of the Pancreatic Cancer Therapeutics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating How Strategic Alliances, Acquisitions, and Focused Innovation by Leading Biopharma Entities Are Shaping the Pancreatic Cancer Pipeline

Major pharmaceutical and biotechnology companies are forging the path forward in pancreatic cancer therapeutics, each leveraging distinct strengths and strategic initiatives. Prominent immuno-oncology leaders are expanding checkpoint inhibitor portfolios through combination trials, while established biotech innovators focus on next-generation cell therapies designed to surmount the tumor microenvironment’s barriers. Concurrently, companies with robust small molecule expertise are advancing selective kinase inhibitors targeting mutated oncogenes prevalent in subsets of pancreatic tumors.

Strategic partnerships and licensing deals are a hallmark of the sector, as larger pharmas collaborate with specialized biotech firms to accelerate late-stage development and broaden geographic reach. Mergers and acquisitions have also played a pivotal role, enabling organizations to integrate complementary pipelines and consolidate resources for large-scale clinical programs. In parallel, venture-backed startups are emerging with highly focused approaches, such as peptide-based vaccines and oncolytic virus platforms, attracting significant venture capital and securing fast-track designations from regulatory authorities. These collective efforts underscore a competitive yet collaborative ecosystem poised to deliver meaningful therapeutic advancements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pancreatic Cancer Therapeutics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca PLC

- Bayer AG

- Bristol-Myers Squibb Company

- Celgene Corporation

- Eisai Inc.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- Genentech, Inc.

- GlaxoSmithKline plc

- Ipsen S.A.

- Janssen Pharmaceuticals, Inc.

- Johnson & Johnson

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd.

Proactive Strategies for Biopharma Executives to Accelerate Clinical Development, Secure Market Access, and Enhance Patient Outcomes in Pancreatic Oncology

Industry leaders seeking a competitive edge in the pancreatic cancer therapeutics arena should prioritize forging multidisciplinary collaborations that span basic research, clinical development, and real-world evidence generation. By engaging academic centers and patient advocacy groups early in trial design, sponsors can enhance protocol relevance, streamline recruitment, and bolster trial retention. In addition, integrating advanced analytics into biomarker discovery efforts will illuminate responder profiles, supporting more targeted and efficient clinical programs.

Moreover, diversifying supply chains through partnerships with domestic manufacturers and adopting flexible production technologies can mitigate geopolitical and tariff risks. To optimize market access and uptake, companies should actively engage with payers and health technology assessment bodies, presenting robust health-economic dossiers that demonstrate value across diverse healthcare systems. Finally, investing in digital health solutions, such as remote monitoring and telehealth platforms, will not only improve patient engagement but also generate real-world data that underpins outcome-based contracting and personalized care pathways.

Detailing the Robust Multimodal Research Approach Combining Expert Interviews, Clinical Data Analysis, and Strategic Trial Registry Review

This analysis draws on a blend of primary and secondary research methodologies to ensure rigor and reliability. Primary research involved in-depth interviews with oncology thought leaders, clinical investigators, and insurance payers, capturing firsthand insights into unmet needs and market dynamics. These qualitative inputs were complemented by a systematic review of clinical trial registries, regulatory filings, and published literature to validate therapeutic trends and emerging mechanisms of action.

Secondary research encompassed the examination of company press releases, investor presentations, and conference proceedings, alongside proprietary databases tracking patent filings and licensing agreements. Data triangulation techniques were employed to reconcile discrepancies between sources, and all findings underwent a multi-tiered quality assurance process involving cross-functional expert reviews. This methodological framework ensures that the insights and recommendations presented reflect the latest developments and offer a comprehensive perspective on the pancreatic cancer therapeutics landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pancreatic Cancer Therapeutics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pancreatic Cancer Therapeutics Market, by Therapeutic Modality

- Pancreatic Cancer Therapeutics Market, by Drug Class

- Pancreatic Cancer Therapeutics Market, by Treatment Line

- Pancreatic Cancer Therapeutics Market, by Route Of Administration

- Pancreatic Cancer Therapeutics Market, by End User

- Pancreatic Cancer Therapeutics Market, by Region

- Pancreatic Cancer Therapeutics Market, by Group

- Pancreatic Cancer Therapeutics Market, by Country

- United States Pancreatic Cancer Therapeutics Market

- China Pancreatic Cancer Therapeutics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Strategic Imperatives and Innovative Pathways to Propel the Next Wave of Pancreatic Cancer Treatment Advances

Pancreatic cancer therapeutics stands at a pivotal juncture where scientific breakthroughs and operational strategies intersect to redefine patient care. Although traditional treatment modalities maintain a crucial presence, the convergence of immunotherapy, targeted drugs, and precision diagnostics heralds a new chapter in clinical management. Nevertheless, stakeholders must remain vigilant to external pressures, including tariff-induced cost fluctuations and region-specific access barriers, which can shape investment and commercialization pathways.

By synthesizing segmentation insights, regional nuances, and competitive positioning, this report underscores the indispensable need for adaptive strategies. As the pipeline evolves, success will hinge on the ability to integrate multi-dimensional data, collaborate across the value chain, and align development efforts with payer and patient priorities. Ultimately, those organizations that balance scientific innovation with agile operational frameworks will spearhead the next generation of pancreatic cancer therapies and drive meaningful improvements in patient survival and quality of life.

Connect With Ketan Rohom to Unlock Exclusive Pancreatic Cancer Therapeutics Intelligence and Advance Your Strategic Decision Making

To explore tailored insights and secure access to the most detailed analysis of the pancreatic cancer therapeutics market-covering emerging innovations, competitive landscapes, and strategic imperatives-reach out today to Ketan Rohom, Associate Director of Sales & Marketing. Engaging directly with Ketan will ensure you receive a personalized overview of key findings, strategic recommendations, and bespoke data subsets aligned with your organizational priorities. Don’t miss this opportunity to stay ahead of transformative shifts in therapeutic modalities and capitalize on emerging growth prospects with comprehensive, data-driven intelligence.

- How big is the Pancreatic Cancer Therapeutics Market?

- What is the Pancreatic Cancer Therapeutics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?