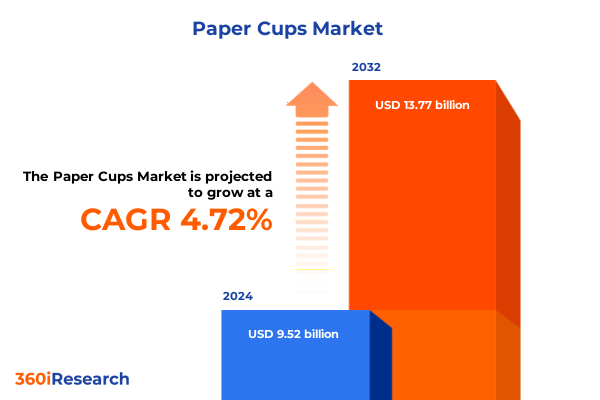

The Paper Cups Market size was estimated at USD 9.91 billion in 2025 and expected to reach USD 10.35 billion in 2026, at a CAGR of 4.80% to reach USD 13.77 billion by 2032.

Understanding the Evolution and Strategic Significance of the Global Paper Cup Market in an Era of Sustainability and Innovation

The global paper cup market has evolved from a simple convenience product to a strategic linchpin in foodservice, retail, and hospitality sectors. Heightened consumer awareness around single-use plastics has steered demand toward eco-friendly alternatives, with paper cups emerging as a preferred solution. This shift intersects with renewed regulatory pressures on polymer-based packaging, compelling manufacturers to innovate rapidly while maintaining cost efficiency. Consequently, stakeholders across the value chain are recalibrating investments in raw materials, production technologies, and end-of-life recovery systems to address both environmental imperatives and operational resilience.

Amid this dynamic backdrop, the paper cup industry faces a confluence of drivers-sustainability mandates, digitalized supply networks, and shifting consumption patterns-that redefine competitive benchmarks. Stakeholders must navigate rising raw material costs, evolving consumer expectations for performance and biodegradability, and trade policy uncertainties. As the sector charts a growth trajectory, understanding these multifaceted influences is critical for executives seeking to align product portfolios with sustainable principles and optimize production capacities. This introduction lays the groundwork for a deeper examination of transformative trends, regulatory impacts, market segmentation, and strategic imperatives that shape the current and future state of paper cup manufacturing and usage.

Identifying the Pivotal Environmental, Digital, and Operational Shifts Reshaping Paper Cup Manufacturing and Consumer Preferences Worldwide

The paper cup landscape is undergoing transformative shifts driven by environmental stewardship, digital integration, and raw material redefinitions. First, the sustainability imperative has accelerated the adoption of recycled paperboard and virgin paperboard systems optimized for compostability and recyclability. Eco-certifications and lifecycle assessments now guide product design frameworks, fostering transparency and brand credibility. Moreover, technological advances in barrier coatings and laminations have enhanced performance for both hot and cold applications, reducing reliance on traditional plastic linings.

Simultaneously, digitalization is reshaping production and distribution models. Smart manufacturing platforms equipped with IoT sensors enable real-time monitoring of machine efficiency, quality control metrics, and energy usage. As a result, manufacturers achieve leaner operations and faster response to demand fluctuations. E-commerce growth has further propelled online direct-to-consumer strategies, encouraging packaging customization and rapid fulfillment capabilities.

Additionally, supply chain agility has emerged as a critical differentiator. Companies are diversifying supplier bases, exploring regional pulp sources, and implementing advanced demand-forecasting algorithms. This proactive stance reduces vulnerability to raw material disruptions and tariff volatility. Collectively, these shifts underscore a broader movement toward resilient, high-performance, and sustainable paper cup solutions that meet both consumer expectations and corporate ESG objectives.

Examining the Full-Scale Financial and Strategic Repercussions of 2025 United States Tariff Policies on Paper Cup Supply Chains

United States tariff policies enacted in early 2025 have introduced cumulative cost pressures and strategic recalibrations across paper cup supply chains. Tariffs targeting imported paperboard from select regions led to measurable increases in raw material prices, prompting manufacturers to reassess sourcing strategies. Some producers accelerated nearshoring initiatives to minimize exposure to import levies, while others pursued renegotiated contracts with domestic pulp and paper suppliers to safeguard margins.

Furthermore, the tariff measures triggered ripple effects in related packaging segments, as freight surcharges and customs duties compounded landed costs. Consequently, several global players adjusted pricing structures for bulk orders, passing incremental expenses to commercial customers. Retail chains reacted by optimizing order volumes and exploring alternative cup formats, thereby influencing demand patterns. At the same time, investment in material substitution research gained momentum, with pilot projects examining bio-resin coatings and enhanced barrier treatments to offset potential quality trade-offs when shifting away from imported paperboard.

Strategically, these tariff adjustments underscore the need for adaptive pricing models, agile procurement systems, and diversified supply sources. Industry participants embracing advanced analytics for demand forecasting and cost modeling have maintained stronger competitive positions. As tariffs continue to shape transnational trade flows, stakeholders must remain vigilant in monitoring policy developments and integrating tariff scenarios into their strategic planning processes.

Uncovering Intricate Segment-Level Trends and Demand Drivers Across Material, Capacity, Configuration, Application, End-User, and Sales Channels

The paper cup market demonstrates nuanced demand dynamics when viewed through material, capacity, structural, application, end-user, and sales channel lenses. Material selection remains a critical axis, as decision-makers balance the environmental appeal of recycled paperboard against the performance consistency of virgin paperboard. While recycled content delivers a lower carbon footprint, virgin paperboard continues to command a premium in high-temperature applications due to its fiber integrity and barrier properties.

Capacity segmentation reveals that formats under 300 milliliters cater predominantly to on-the-go consumers seeking portion control and convenience, whereas mid-range capacities from 300 to 600 milliliters dominate mainstream beverage outlets. Larger cup sizes exceeding 600 milliliters have grown in prominence within customizable beverage chains and self-serve environments, where consumers prioritize value and sharing formats.

Structural innovations in wall configuration further delineate market offerings. Single-wall constructions address light-use scenarios such as cold juices and soft drinks, while double-wall formats have become industry standard for hot beverages, providing insulation without added sleeves. Triple-wall designs, though less common, have emerged in premium coffee segments and specialty tea boutiques to deliver superior heat retention and tactile comfort.

Application segmentation bifurcates into cold and hot beverage streams. Within cold applications, demand for juice cups has surged alongside health-focused product launches, smoothies maintain a steady share in wellness-oriented outlets, and traditional soft drink cups continue to benefit from established fast-service models. In the hot beverage realm, coffee drives the largest volume, reinforced by café expansion, while hot chocolate and tea cups maintain niche positions aligned with seasonal promotions and specialty blends.

End-user segmentation underscores a strong commercial footprint led by educational institutions, hospitality venues, and office environments that require durable, branded packaging solutions. The food and beverage industry segment leverages paper cups extensively in cafes, bakeries, event catering, and quick service restaurants, emphasizing brand visibility and operational efficiency. Residential usage remains incremental but exhibits growth potential as single-serve beverage routines expand at home.

The sales channel dimension highlights that offline distribution through convenience outlets, retail stores, and supermarkets or hypermarkets sustains the bulk of volume, offering broad market reach and instantaneous replenishment. Meanwhile, online channels encompassing direct company websites and e-commerce platforms are gaining traction, driven by subscription-based models and customized print capabilities, enabling end-users to tailor packaging aesthetics and functionality to specific occasions.

This comprehensive research report categorizes the Paper Cups market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Capacity

- Wall Configuration

- Application

- End-User

- Sales Channel

Delineating Key Regional Contrasts and Growth Dynamics Across the Americas, Europe Middle East and Africa, and Asia-Pacific Markets

Regional market dynamics illustrate differentiated growth trajectories across the Americas, Europe Middle East & Africa, and Asia-Pacific landscapes. In the Americas, robust coffee culture and established fast food ecosystems underpin consistent demand for both hot and cold beverage cups. Stakeholders benefit from mature recycling infrastructure, yet they face mounting regulatory scrutiny on single-use products, prompting a shift toward certified compostable solutions.

Conversely, the Europe Middle East & Africa region displays diverse regulatory frameworks and consumer preferences. Western European markets lead with stringent eco-packaging mandates and incentivized recycling programs, driving adoption of post-consumer recycled content. Gulf Cooperation Council countries exhibit growth in premium hospitality segments, boosting demand for high-performance double-wall configurations, while select African markets remain price-sensitive, favoring cost-effective single-wall offerings.

In the Asia-Pacific arena, rapid urbanization and rising disposable incomes fuel the expansion of quick service restaurants, cafés, and convenience stores. Manufacturers in key markets are investing in capacity expansions and advanced barrier technologies to meet the dual requirement of large-volume output and stringent quality standards. Simultaneously, government initiatives targeting plastic reduction have catalyzed pilot programs for bio-coated paper cups, laying the groundwork for broader commercialization.

Each region’s unique regulatory landscape, consumer behavior patterns, and distribution frameworks underscore the necessity for tailored strategies. Market participants able to align product portfolios with localized sustainability targets, pricing sensitivities, and channel preferences will secure first-mover advantages and long-term growth.

This comprehensive research report examines key regions that drive the evolution of the Paper Cups market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Paper Cup Manufacturers Strategic Initiatives Innovation Portfolios and Competitive Positioning in a Rapidly Evolving Market

Leading enterprises are redefining competitive dynamics through targeted product development, strategic alliances, and capacity optimization. Among top manufacturers, companies are channeling investments into next-generation barrier technologies that eliminate traditional plastic linings, positioning their offerings at the forefront of compostable packaging trends. Collaborative partnerships between papermakers and coating specialists have accelerated the scale-up of novel bio-resin formulations, enabling performance parity with legacy solutions while satisfying stringent eco-certification criteria.

Innovation portfolios underscore a bifurcated approach: one stream focuses on high-margin premium cups with advanced insulation and customization options, and the other emphasizes cost-efficient platforms for mass-market distribution. Certain market leaders have expanded regional production footprints through joint ventures and greenfield facilities, reducing freight expenditures and mitigating tariff impacts. Concurrently, digital print capabilities have become a strategic lever for customer engagement, as on-demand branding and limited-edition campaigns drive higher per-unit revenues and strengthen client loyalty.

Supply chain resilience emerges as another hallmark of top performers. By integrating real-time analytics and supplier scorecard systems, these companies maintain deeper visibility into raw material flows and quality variances. Environmental, social, and governance priorities inform sourcing decisions, with an emphasis on certified fiber origins and renewable energy utilization. Through these multidimensional strategies, leading players enhance their competitive positioning and pave the way for sustained market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Paper Cups market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bio Packaging Solution

- Brendos Ltd.

- CEE Schisler Packaging Solutions

- Choose Planet A

- Clearwater Paper Corporation

- ConverPack Inc.

- Dart Container Corporation

- EcoSoul Home Inc.

- F Bender Limited

- Genpak LLC

- Georgia-Pacific LLC

- Go-Pak Group by SCG Packaging Public Company Limited

- Huhtamäki Oyj

- Ishwara Paper Cups

- JK Paper Ltd.

- Konie Cups International, Inc.

- Leetha Industries

- Nippon Paper Industries Co., Ltd.

- Novolex

- Oji Paper Co., Ltd.

- Rachana Kraft

- Scyphus Paper Cups

- SOFi Products

- Stora Enso Oyj

- Tekni-Plex, Inc.

- UNICUP

Strategic Imperatives and Actionable Pathways for Industry Leaders to Capitalize on Sustainability, Innovation, and Supply Chain Resilience

Industry leaders should prioritize the adoption of fully compostable barrier technologies, transitioning incrementally from polyethylene to bio-resin coatings that deliver parallel performance. By forging collaborative development agreements with coating innovators, manufacturers can expedite commercial readiness and differentiate offerings in sustainability-driven segments. Furthermore, implementing modular production lines will enable rapid SKU changeovers, catering to online customization demands and reducing lead times.

Strategic procurement diversification remains crucial to hedge against policy-induced raw material volatility. Establishing supplier alliances across multiple geographies, including domestic pulp producers and certified recycled fiber brokers, will bolster supply continuity and cost predictability. Concurrently, harnessing predictive analytics for demand sensing and price forecasting will empower more accurate volume planning and dynamic pricing strategies.

To capture premium pricing opportunities, companies must invest in consumer-centric design that embraces tactile enhancements, differentiated textures, and brand storytelling through print. Joint marketing initiatives with foodservice operators can amplify visibility, while co-branding campaigns spotlight sustainability credentials. Additionally, expanding presence on e-commerce platforms with subscription bundles and seasonal exclusives will unlock new customer segments and bolster direct-to-consumer revenue streams.

Finally, aligning corporate sustainability goals with transparent reporting and third-party certifications will reinforce brand trust and unlock access to institutional contracts. By pursuing these actionable imperatives, industry stakeholders can solidify their market foothold, accelerate growth, and drive meaningful environmental impact.

Comprehensive Research Framework Combining Primary Interviews Secondary Data Analysis and Rigorous Validation Techniques

The research methodology underpinning this analysis integrates a robust combination of primary interviews, secondary data aggregation, and rigorous validation protocols. Primary data were captured through in-depth discussions with senior executives across leading paper cup manufacturers, material suppliers, and end users in foodservice and retail channels. These insights provided granular perspectives on emerging challenges, technological priorities, and strategic roadmaps.

Secondary research encompassed comprehensive reviews of industry publications, environmental regulatory filings, patent databases, and financial disclosures to map historical trends, competitive landscapes, and policy shifts. Data triangulation techniques ensured consistency across disparate sources, while quantitative analyses leveraged statistical tools to identify significant correlations between pricing dynamics, capacity expansions, and sustainability initiatives.

Additionally, the study employed scenario modeling to assess the prospective impact of evolving tariff policies and raw material cost fluctuations. Sensitivity analyses validated the robustness of key findings, revealing potential inflection points for segment growth and regional developments. Quality control measures included peer reviews by domain experts and cross-functional validation to confirm the accuracy and relevance of conclusions.

This methodological framework fosters transparency, repeatability, and strategic clarity, equipping stakeholders with a credible foundation upon which to base critical business decisions and future research endeavors.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Paper Cups market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Paper Cups Market, by Material Type

- Paper Cups Market, by Capacity

- Paper Cups Market, by Wall Configuration

- Paper Cups Market, by Application

- Paper Cups Market, by End-User

- Paper Cups Market, by Sales Channel

- Paper Cups Market, by Region

- Paper Cups Market, by Group

- Paper Cups Market, by Country

- United States Paper Cups Market

- China Paper Cups Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing Core Findings to Illuminate Opportunities Address Challenges and Shape the Future Trajectory of the Paper Cup Industry

In synthesizing the core findings, it is evident that the paper cup market stands at a strategic inflection point driven by sustainability mandates, evolving consumer behaviors, and policy stimuli. Manufacturers that have aligned their operations with environmental best practices and invested in barrier innovations are positioned to capture premium segments. Concurrently, supply chain adaptability and tariff scenario planning will continue to distinguish resilient market participants from those exposed to cost volatility.

Segmentation insights highlight material type, capacity, configuration, application, end-user, and sales channel as critical levers for strategic focus. Tailoring product portfolios to these dimensions enables more precise alignment with customer requirements and regional regulatory frameworks. Meanwhile, regional contrasts underscore the importance of localized strategies that reconcile growth objectives with infrastructure maturity and cultural preferences.

Leading companies have demonstrated that multifaceted innovation-spanning chemistry, digital customization, and sustainable procurement-serves as a powerful differentiator. As the industry progresses, actionable imperatives such as adopting compostable technologies, diversifying suppliers, and leveraging dynamic analytics will be essential to sustaining competitive advantages.

Ultimately, stakeholders equipped with these insights can navigate market complexities, harness emerging opportunities, and contribute meaningfully to a circular economy. This conclusion reiterates the critical role of strategic alignment, operational excellence, and environmental stewardship in shaping the future of paper cup manufacturing and consumption.

Engage with Ketan Rohom to Unlock In-Depth Market Insights and Secure Your Exclusive Paper Cup Industry Research Report Today

I invite industry decision-makers and strategic procurement teams to connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure immediate access to the full paper cups market research report. By initiating this engagement, stakeholders gain privileged insights into emerging material innovations, tariff impacts, and regional growth catalysts that can inform pivotal business decisions. Ketan Rohom will facilitate customized data packages aligned with unique organizational objectives and provide additional consulting support to translate these insights into executable strategies. Act now to leverage this comprehensive analysis for competitive advantage and to shape your next phase of product development, sustainability initiatives, and market expansion plans

- How big is the Paper Cups Market?

- What is the Paper Cups Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?