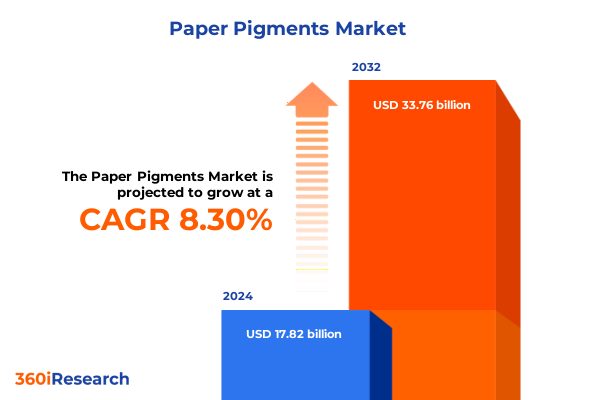

The Paper Pigments Market size was estimated at USD 19.32 billion in 2025 and expected to reach USD 20.95 billion in 2026, at a CAGR of 8.29% to reach USD 33.76 billion by 2032.

How Innovative Approaches in Paper Pigment Formulation Are Reshaping Industry Standards and Driving Sustainable Performance

In an era defined by sustainability mandates and performance-driven applications, the paper pigments domain has become a focal point for innovation. Traditional formulations are giving way to advanced composites that not only enhance opacity, brightness, and printability but also address environmental and regulatory pressures. As global demand for high-quality coated and specialty papers continues to evolve, industry stakeholders are reevaluating raw material selection and processing techniques to maintain a competitive edge.

Against this backdrop, the interplay between material science breakthroughs and shifting customer expectations is reshaping strategic priorities. Manufacturers are increasingly investing in research to optimize pigment particle morphology and surface treatment, unlocking superior coating uniformity and reduced binder usage. Meanwhile, end users are seeking formulations that enable lighter paper grades without sacrificing performance, driving the integration of fine and superfine calcium carbonate and kaolin derivatives.

This introduction establishes the critical themes that underpin the rest of the executive summary: technological advancement, environmental responsibility, and market-driven segmentation. By examining these areas in detail, the following sections will illuminate transformative shifts, policy impacts, and actionable recommendations poised to guide decision-makers toward sustainable growth within the paper pigments industry.

Emerging Technological and Environmental Shifts Transforming the Global Paper Pigments Landscape Beyond Conventional Boundaries

The landscape of paper pigments has undergone profound transformation as new environmental regulations converge with material science advancements. Historically reliant on traditional mineral fillers, the industry has seen a surge in demand for pigments engineered to maximize resource efficiency and reduce carbon footprint. Consequently, partnerships between pigment producers and coating equipment manufacturers are driving hybrid systems that integrate in situ surface functionalization, resulting in enhanced brightness and improved adhesion while minimizing energy consumption during drying phases.

Simultaneously, digital printing technologies are exerting pressure on formulation requirements, compelling suppliers to develop pigments with tailored particle size distributions that optimize ink transfer and color fidelity. This evolution in application technology has prompted a strategic shift toward precision-engineered pigments, elevating performance benchmarks and fostering a new era of customization.

Moreover, the convergence of circular economy principles with consumer preferences for recycled content has fueled research into alternative feedstocks and closed-loop manufacturing. Pigment producers are collaborating with paper mills to establish reclamation programs that reclaim spent coating suspensions, regenerate mineral quality, and reintroduce them into the production cycle. Through these efforts, the landscape is shifting from linear supply chains to regenerative networks that prioritize both economic viability and environmental stewardship.

Assessing the Comprehensive Effects of 2025 United States Tariffs on Supply Chains Innovation and Competitive Dynamics in Paper Pigments Market

In 2025, the imposition of tariffs by the United States on select imported paper pigment minerals has introduced a new dynamic to global supply chains. Tariffs targeting high-purity calcium carbonate and specialty clays have prompted manufacturers to reassess sourcing strategies, leading to nearshoring initiatives and the negotiation of long-term supply contracts. These actions, in turn, have reshaped pricing structures and compelled suppliers to absorb increased duties or pass costs along the value chain.

Consequently, some end users are accelerating investment in domestic production capacity, aiming to mitigate exposure to trade policy volatility. This strategic realignment has created opportunities for local mineral processors to scale operations, invest in beneficiation technologies, and offer just-in-time delivery models. Yet despite these efforts, lingering uncertainty over tariff renewals continues to influence capital allocation and inventory management practices.

Furthermore, the competitive dynamics among international producers have intensified, as exporters seek to maintain market share by enhancing service agreements and offering value-added technical support. In parallel, alliances between pigment manufacturers and logistics providers have been fortified to optimize cross-border transportation and reduce lead time variability. As a result, the cumulative impact of these tariff measures extends beyond immediate cost implications, fundamentally altering the competitive landscape and emphasizing supply chain resilience.

Deep Insights into Market Segmentation Revealing Diverse Type Application End User Grade and Distribution Channel Implications for Strategic Growth

Analyses of the market based on type reveal that calcium carbonate dominates due to its cost efficiency and superior brightness enhancement. Ground calcium carbonate, with its angular particles, delivers excellent opacity in lower-grade papers, while precipitated calcium carbonate offers refined particle size for high-precision coatings and specialty grades. Kaolin’s role remains critical, as calcined grades enhance ink retention and print definition, coated kaolin improves smoothness for premium publications, and hydrous kaolin provides versatility in both coating and filling applications. Talc endures as a niche filler, with cosmetic grade used in lightweight specialty papers and industrial grade deployed for its plate-out resistance in high-speed operations.

Turning to application segmentation, paper coating maintains its position as a growth driver, with blade coating ensuring uniform pigment laydown in packaging board, gravure coating optimizing ink receptivity for flexible packaging, and roll coating balancing productivity with cost efficiency in commercial printing. Conversely, paper filling continues to address bulk and rigidity needs, where internal sizing compounds improve moisture resistance from within the fiber matrix and surface sizing enhances water repellency and print durability.

End user segmentation underscores the diversity of demand profiles: packaging applications prioritize pigment formulations that deliver stiffness and print contrast for boxboard, corrugated, and flexible substrates. In printing and writing, book publishers value fine rheology control for crisp text reproduction, magazine producers seek high-gloss coatings, and newspapers demand cost-optimized fillers for rapid production runs. Specialty papers, including security documents, leverage unique pigment treatments for anti-counterfeiting, while tissue manufacturers utilize ultrafine calcium carbonate for softness and opacity enhancement.

Examining grade segmentation, fine pigments remain the workhorse for standard paper grades, where standard fine delivers balanced properties and ultrafine variants enable lighter paper grammages. Super fine pigments cater to high-end segments, with extra super fine grades achieving exceptional smoothness for luxury printing and ultra super fine offering the ultimate surface clarity for niche applications. Finally, distribution channel segmentation highlights the interplay between direct sales, where global manufacturers provide bespoke solutions and local producers offer swift technical support, and distributor networks that blend offline relationship-based channels with digital platforms enhanced by e-commerce capabilities.

This comprehensive research report categorizes the Paper Pigments market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Grade

- Distribution Channel

- Application

- End User

Regional Dynamics Shaping Paper Pigments Demand Highlighting Unique Drivers and Opportunities across Americas EMEA and Asia Pacific Territories

Across the Americas, the paper pigments sector benefits from robust packaging and printing industries that demand consistent pigment performance and reliable supply. The North American market exhibits a strong focus on environmental compliance, with producers advancing carbon capture initiatives and water reuse schemes to adhere to stringent regulations. In Latin America, emerging beverage and e-commerce sectors drive growth in corrugated and flexible packaging, encouraging local pigment refiners to adopt modular processing units that reduce capital intensity and accelerate market entry.

In Europe, Middle East & Africa, sustainability agendas are paramount. European mills leverage closed-loop coating systems and renewable energy integration, while Middle Eastern manufacturers invest in salt-tolerant pigment treatments to suit the region’s unique water profiles. African markets, though smaller in scale, present opportunities in tissue and agricultural paper applications, prompting partnerships that focus on low-cost, low-water-use pigment production methods. This regional tapestry underscores a commitment to circular economy principles and resource optimization.

The Asia-Pacific region remains the largest consumer of paper pigments, driven by rapid expansion in publishing, commercial printing, and packaging. Domestic capacity in China and India is surging, with investments in ultra-fine calcium carbonate and high-grade kaolin to support premium product lines. Additionally, Southeast Asian mills are exploring digital printing applications, leading to demand for pigments engineered for high ink absorption and quick drying. Across these territories, regional dynamics intertwine as global producers adapt strategies to capture local nuances and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Paper Pigments market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Analysis Uncovers Leading Innovators Strategic Partnerships and Investment Trends among Top Paper Pigments Manufacturers

The competitive landscape is anchored by established mineral giants and innovative specialty firms. Leading global suppliers are investing in nanostructured pigment development to unlock unmatched brightness and barrier properties, while mid-sized enterprises focus on niche applications such as security paper additives and embossing-grade fines. Several manufacturers have forged strategic partnerships with research institutes to accelerate next-generation pigment surface chemistries, fostering a rapid cycle of innovation.

Consolidation trends are evident as top-tier producers pursue acquisitions that expand geographic coverage and broaden product portfolios. In certain regions, joint ventures have emerged to pool resources for co-investment in beneficiation facilities and shared logistics hubs. Beyond mergers, alliances between pigment vendors and paper mills are deepening, with collaborative innovation centers established to co-develop customized formulations that address specific paper grade requirements.

Investment in sustainability is also reshaping corporate strategies. Industry leaders are embedding lifecycle assessments into R&D, quantifying environmental impact from extraction through end-of-life. Such efforts yield product certifications that resonate with eco-conscious brands and mill operators. Simultaneously, digital customer platforms are being deployed to enhance technical support and streamline order management, elevating the customer experience and reinforcing supplier differentiation in a crowded market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Paper Pigments market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Altana AG

- Ashapura Group

- BASF SE

- Carmeuse Holding S.A.

- Clariant AG

- DIC Corporation

- Ferro Corporation

- Heubach GmbH

- Huntsman International LLC

- Imerys S.A.

- J.M. Huber Corporation

- Kemira Oyj

- Kronos Worldwide, Inc.

- LANXESS AG

- Lomon Billions Group Co., Ltd.

- Minerals Technologies Inc.

- Omya AG

- Pidilite Industries Limited

- Quarzwerke GmbH

- Sibelco NV

- Sudarshan Chemical Industries Ltd.

- Sun Chemical Corporation

- The Chemours Company

- Thiele Kaolin Company

- Tronox Holdings plc

- Venator Materials PLC

Practical Strategies and Roadmap Recommendations to Empower Industry Leaders in Optimizing Sustainability Innovation and Supply Chain Resilience

To navigate the complexities of evolving regulations and technological advancements, industry participants must prioritize the integration of sustainability into every stage of pigment production. Central to this approach is the adoption of energy-efficient milling and drying technologies, which can significantly reduce greenhouse gas emissions and operating costs. Coupled with targeted R&D in bio-based surfactants and renewable binder systems, these investments will future-proof operations against tightening environmental standards.

Simultaneously, enhancing supply chain resilience through diversification of raw material sources and development of regional processing hubs can shield organizations from geopolitical and trade policy disruptions. Forging strategic alliances with logistics providers and local mineral processors will enable just-in-time delivery models and buffer against tariff volatility, ensuring consistent supply for critical coating and filling operations.

On the innovation front, industry leaders should establish collaborative partnerships with technology startups and academic research centers to accelerate the commercialization of advanced pigment functionalities, such as embedded antimicrobial properties and smart coatings for intelligent packaging. By co-investing in pilot programs and joint development agreements, companies can access cutting-edge innovations while sharing risk.

Finally, leveraging digitalization across sales and technical support functions will enhance customer engagement and streamline order-to-delivery cycles. Implementing advanced analytics to predict demand patterns and optimize inventory, alongside interactive digital platforms for formulation customization, will position organizations as responsive and customer-centric partners.

Rigorous Research Methodology Detailing Data Collection Analytical Frameworks and Validation Processes Ensuring Robust Insights in Paper Pigments Study

This analysis is grounded in a rigorous primary research framework that involved in-depth interviews with senior executives across pigment manufacturers, paper mills, and coating formulators. These consultations provided qualitative insights into strategic priorities, technology adoption rates, and the impact of trade policies on sourcing decisions. Complementing primary data, an exhaustive review of industry publications, environmental regulation databases, and patent filings informed the identification of emerging trends and breakthrough innovations.

Quantitative validation was achieved through data triangulation, enriching stakeholder feedback with shipment statistics, trade flow records, and production capacity figures obtained from neutral customs and industry associations. This multi-source approach ensures that findings reflect both the macroeconomic context and site-level operational realities. Analytical frameworks were applied consistently across segmentation, tariff impact analysis, and competitive benchmarking to maintain methodological integrity and comparability.

To ensure the robustness of conclusions, key assumptions were stress-tested under various policy and demand scenarios, with sensitivity analyses highlighting critical variables. All data inputs were subjected to accuracy checks and reconciliation exercises, and evolving regulatory changes were continuously monitored throughout the research cycle. The result is a comprehensive, validated set of insights designed to support informed strategic planning and operational decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Paper Pigments market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Paper Pigments Market, by Type

- Paper Pigments Market, by Grade

- Paper Pigments Market, by Distribution Channel

- Paper Pigments Market, by Application

- Paper Pigments Market, by End User

- Paper Pigments Market, by Region

- Paper Pigments Market, by Group

- Paper Pigments Market, by Country

- United States Paper Pigments Market

- China Paper Pigments Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Synthesizing Key Findings and Future Perspectives to Inspire Strategic Decision Making in the Evolving Paper Pigments Landscape

The synthesis of technological advancements, policy influences, and market segmentation reveals a dynamic paper pigments sector poised for continued evolution. Innovations in particle engineering and surface treatments are unlocking new performance realms, supporting lighter, stronger, and more sustainable paper products. Meanwhile, the ripple effects of tariffs underscore the necessity of agile sourcing strategies and regional production investments.

As organizations navigate this transformative period, the interplay between sustainability objectives and customer-driven performance will define competitive differentiation. Embracing circular manufacturing practices and forging cross-industry collaborations can deliver both environmental benefits and cost efficiencies. By integrating the segmented market insights, regional dynamics, and company strategies outlined in this summary, decision-makers are equipped to chart a course toward resilient growth and perpetual innovation in the paper pigments landscape.

Contact Ketan Rohom to Unlock Exclusive Access to In Depth Paper Pigments Market Research Insights and Drive Your Strategic Initiatives Forward

To explore the full breadth of insights within this comprehensive paper pigments market research report and capitalize on untapped opportunities, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He will guide you through tailored solutions that align with your strategic objectives and ensure you harness these findings effectively. Whether you seek deeper analysis on technological innovations, supply chain resilience, or regional dynamics, Ketan will facilitate seamless access and provide personalized support to drive your organization’s growth. Don’t miss this chance to transform data into decisive action and gain a competitive advantage.

- How big is the Paper Pigments Market?

- What is the Paper Pigments Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?