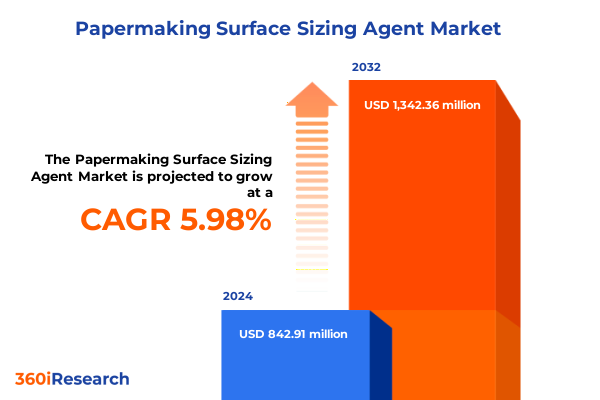

The Papermaking Surface Sizing Agent Market size was estimated at USD 881.47 million in 2025 and expected to reach USD 938.90 million in 2026, at a CAGR of 6.19% to reach USD 1,342.36 million by 2032.

Exploring the Critical Role of Surface Sizing Agents in Modern Papermaking to Elevate Printability Resilience and Environmental Stewardship at Scale

Surface sizing agents represent a pivotal component in the papermaking value chain, directly influencing surface strength, printability, and water resistance. These additives form a thin film on paper fibers, adjusting hydrophobicity and providing the precise balance of porosity required by various printing and converting processes. With increasing demands for high-quality graphic paper, packaging solutions, and tissue products, papermakers are refining surface sizing chemistries to meet stringent performance criteria.

Identifying the Technological Developments and Sustainability-Driven Innovations Reshaping the Surface Sizing Agent Landscape for Future-Ready Papermaking

The surface sizing agent market is witnessing a profound transformation driven by converging technological breakthroughs and sustainability imperatives. The rapid rise of digital printing technologies has heightened requirements for uniform surface porosity and precise ink absorption control, prompting developers to engineer specialized alkyl ketene dimer and styrene acrylic chemistries tailored for inkjet and laser applications. At the same time, evolving environmental regulations have phased out legacy materials such as PFAS, accelerating the shift toward low-VOC, water-based dispersions and bio-based alternatives like modified starch and lignin derivatives. This dual pressure from end-use performance specifications and regulatory mandates is redefining formulation priorities and driving hybrid solutions that blend natural and synthetic polymers to achieve both functional excellence and eco-compliance.

Analyzing How United States Tariffs Implemented in 2025 Reshaped Logistics Cost Structures and Competitive Positioning within the Surface Sizing Agent Market

The introduction of new U.S. trade measures in 2025 has significantly altered cost structures and sourcing strategies within the surface sizing agent sector. Presidential proclamations enacted higher ad valorem duties-25% on imports from Mexico and Canada and a 10% levy on Chinese-origin chemicals-under national security provisions, followed by a brief moratorium on certain North American imports that ended in March. These policy shifts disrupted established cross-border supply chains, leading to immediate repricing of key synthetic agents such as AKD and ASA and compelling manufacturers to explore domestic production or alternative sourcing through exempt markets. Concurrently, Section 301 tariff escalations on select Chinese chemical imports have elevated duties on specialized surface sizing agents to approximately 6.5%, incentivizing local procurement and bolstering U.S. capacity expansions among leading suppliers.

Decoding How Product Types End Use Categories and Distribution Channels Define Demand Patterns and Advancement Opportunities in the Surface Sizing Agent Market

A granular segmentation of the surface sizing agent market reveals nuanced demand drivers and formulation preferences across distinct categories. When evaluating product type, starch-based offerings-comprising both modified and native starch derivatives-deliver strong environmental appeal for packaging and tissue applications, while synthetic variants such as alkyl ketene dimer, alkyl succinic anhydride and styrene acrylic dominate in high-speed print grades that require precise fluid management. Shifting focus to end-use sectors uncovers that sustainable packaging continues to command significant attention, as stakeholders prioritize recyclability and barrier performance, whereas tissue producers increasingly leverage bio-polymers to enhance softness and absorbency. Writing and printing grades, meanwhile, rely on advanced synthetic chemistries to meet exacting print quality and ink stability standards. Distribution channel analysis highlights the strategic role of direct partnerships with large-scale paper mills to secure supply continuity, while distributor networks remain essential for smaller converters and niche paper producers seeking specialized formulations.

This comprehensive research report categorizes the Papermaking Surface Sizing Agent market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Distribution Channel

- End Use

Analyzing the Americas Europe Middle East & Africa and Asia-Pacific to Reveal Growth Drivers Challenges and Strategic Imperatives in Surface Sizing Agents

Regional dynamics in the surface sizing agent market are shaped by diverse regulatory frameworks, raw material availability and customer priorities across global zones. In the Americas, U.S. environmental directives such as EPA’s low-emission mandates and evolving trade policies have accelerated the development of localized production hubs and encouraged partnerships between North American chemical producers and paper mills. Europe, Middle East & Africa markets are navigating stringent REACH requirements, carbon border adjustment mechanisms and ambitious recycling targets that favor bio-based and size-reversible agent innovations, prompting R&D investments in enzyme-assisted and hybrid chemistries. Asia-Pacific continues to drive global consumption growth, buoyed by government incentives under trade agreements like RCEP that reduce tariffs on key materials and catalyze capacity additions; cost-sensitive paper manufacturers in this region are particularly active in adopting starch-modified and microemulsion-based systems to optimize performance and affordability.

This comprehensive research report examines key regions that drive the evolution of the Papermaking Surface Sizing Agent market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Collaborations Alliances and Strategic Moves Driving Innovation and Competitive Advantage in Surface Sizing Agents

Leading industry participants are leveraging technological synergies and strategic collaborations to consolidate market share and advance product innovation. Major chemical firms such as BASF and Dow continue to expand their bio-based sizing agent portfolios, integrating advanced polymer and enzyme chemistries to address regulatory demands and performance benchmarks. Specialty additive providers like Solenis and Kemira have fortified their market positions through targeted acquisitions and co-development agreements with paper producers, enhancing supply chain resilience and accelerating product customization. Meanwhile, agile regional players including Eastman and Ashland are forming alliances with equipment manufacturers to incorporate real-time monitoring and dosing controls, enabling customers to achieve precise sizing levels and reduce waste.

This comprehensive research report delivers an in-depth overview of the principal market players in the Papermaking Surface Sizing Agent market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ashland Global Holdings Inc.

- Cargill, Incorporated

- Clariant AG

- Evonik Industries AG

- HEMIPAZ CORPORATION

- Kemira Oyj

- Nouryon Chemicals B.V.

- Novozymes A/S

- SNF Floerger S.A.

- Solenis LLC

- Synthomer plc

Strategies for Industry Leaders to Seize Emerging Opportunities Enhance Operational Excellence and Secure Competitive Edge in Surface Sizing Agent Applications

Industry leaders can position themselves for sustainable growth by adopting a multi-faceted strategic agenda. Prioritizing research investments in bio-based and pH-neutral chemistries will address tightening environmental standards and emerging end-use demands. Embracing digital transformation-through automated dosing systems, process analytics and real-time quality controls-will enhance operational efficiency and reduce variability in paper production. Securing diversified supply chains by cultivating partnerships in tariff-exempt regions and expanding local manufacturing footprints will mitigate geopolitical risks and cost volatility. Finally, aligning product development with circular economy principles-such as formulating size-releasing agents compatible with high-recycled-content fibers-will deliver differentiated value and support long-term market positioning.

Outlining Comprehensive Research Approaches Data Collection Methods and Analytical Frameworks to Deliver Insights into the Surface Sizing Agent Sector

This analysis integrates a comprehensive research methodology blending primary and secondary data sources to ensure robust, actionable insights. Primary research encompassed interviews with senior executives from leading chemical suppliers and papermaking companies, coupled with surveys of key industry stakeholders to gauge emerging priorities and investment drivers. Secondary data were sourced from regulatory filings, patent databases and peer-reviewed literature, providing context on environmental mandates and technological advancements. Market segmentation and regional mapping were conducted through data triangulation, validated with expert panel reviews. Analytical frameworks including Porter’s Five Forces and SWOT assessments were applied to evaluate competitive dynamics, while scenario analysis explored potential tariff and regulatory developments to stress-test strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Papermaking Surface Sizing Agent market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Papermaking Surface Sizing Agent Market, by Type

- Papermaking Surface Sizing Agent Market, by Distribution Channel

- Papermaking Surface Sizing Agent Market, by End Use

- Papermaking Surface Sizing Agent Market, by Region

- Papermaking Surface Sizing Agent Market, by Group

- Papermaking Surface Sizing Agent Market, by Country

- United States Papermaking Surface Sizing Agent Market

- China Papermaking Surface Sizing Agent Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Synthesizing Core Insights on Technological Innovation Market Dynamics and Strategic Priorities to Guide Stakeholders in the Surface Sizing Agent Market

The surface sizing agent market is at an inflection point where performance-driven innovation, evolving trade policies and sustainability leadership intersect. Technological advancements in bio-based chemistries and digital dosing systems are redefining product capabilities, even as new tariff measures and environmental regulations introduce complexity into supply chain and cost structures. Competitive landscapes continue to shift as key players consolidate their positions through strategic collaborations, while region-specific dynamics present both challenges and opportunities for growth. As stakeholders navigate these multifaceted pressures, a balanced strategy that integrates operational excellence, regulatory foresight and circular economy principles will be critical to capturing future upside.

Connect with Associate Director Sales & Marketing Ketan Rohom to Secure In-Depth Surface Sizing Agent Market Research Insights and Propel Strategic Growth

I appreciate your interest in our comprehensive analysis of the papermaking surface sizing agent market. To secure the full market research report packed with detailed segmentation, in-depth regional breakdowns, competitive intelligence, and tailored strategic recommendations, please connect directly with Ketan Rohom, Associate Director, Sales & Marketing. Ketan can walk you through the report highlights, discuss customized research services, and facilitate a seamless purchase process that aligns with your company’s objectives. Reach out now to translate these insights into actionable strategies that will position your organization for success in the evolving surface sizing agent landscape.

- How big is the Papermaking Surface Sizing Agent Market?

- What is the Papermaking Surface Sizing Agent Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?