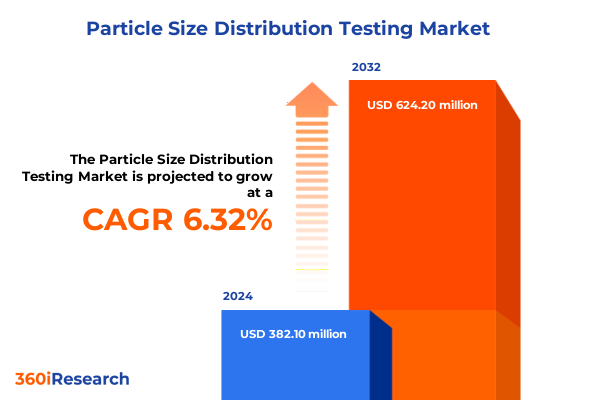

The Particle Size Distribution Testing Market size was estimated at USD 401.20 million in 2025 and expected to reach USD 427.99 million in 2026, at a CAGR of 6.51% to reach USD 624.20 million by 2032.

Understanding the Core Principles and Evolving Importance of Particle Size Distribution Testing Across Diverse Industrial Applications in a Competitive Market Landscape

Particle size distribution testing has emerged as a foundational practice underpinning quality assurance, process efficiency, and regulatory compliance across a wide array of industries. By quantifying the range of particle diameters within a sample, organizations can optimize product performance, reduce waste, and drive innovation in formulations and processes. In recent years, the rapid expansion of advanced analytical techniques combined with increasingly stringent regulatory frameworks has elevated the strategic importance of particle size characterization. Stakeholders from research laboratories to manufacturing facilities now regard distribution metrics as critical input parameters for process control, product development, and competitive differentiation.

Moreover, the rise of digitalization and connectivity has transformed how laboratories and production lines monitor and interpret particle size data. Automated systems now facilitate real-time process adjustments, while cloud platforms aggregate data from multiple sources to deliver predictive insights. These developments have converged to create a dynamic environment where precision measurement intersects with data science, driving continuous improvement cycles and enabling manufacturers to respond swiftly to evolving market demands. Consequently, organizations that master both the technical and analytical dimensions of particle size distribution gain a decisive edge in quality, cost control, and innovation acceleration.

Exploring the Paradigm-Shifting Technological, Regulatory, and Sustainability Innovations Reshaping Particle Size Distribution Testing Practices Globally

The particle size distribution testing landscape is undergoing transformative shifts driven by technological breakthroughs and heightened regulatory expectations. Cutting-edge techniques such as dynamic image analysis and advanced laser diffraction are being integrated with artificial intelligence algorithms to enhance accuracy and throughput. As a result, real-time monitoring solutions are rapidly replacing traditional offline methods, enabling adaptive control strategies and reducing batch-to-batch variability.

Simultaneously, sustainability imperatives are reshaping test method selection and workflow design. Water-based wet laser diffraction has gained traction over solvent-based approaches, aligning analytical protocols with corporate environmental commitments. At the same time, miniaturized Coulter Counter modules are allowing on-site testing with minimal resource consumption. In parallel, sedimentation and sieving techniques have benefited from automation and robotics, shortening analysis cycles and enhancing data repeatability without sacrificing robustness.

Regulatory bodies worldwide have tightened requirements for particle size specifications in pharmaceuticals, food and beverage products, and specialty chemicals. This convergence of innovation and compliance has created a new era in which test systems must balance speed, precision, and validation rigor. Consequently, laboratories and production units are seeking unified platforms that can seamlessly transition between multiple methods-whether at line, inline, or offline-and generate audit-ready documentation that complies with ISO standards and pharmacopoeial guidelines.

Analyzing the Far-Reaching Effects of New United States Tariff Measures Implemented in 2025 on Particle Size Distribution Testing Supply Chains and Costs

The introduction of new United States tariffs in 2025 has exerted a cumulative effect on supply chain dynamics and cost structures within the particle size distribution testing market. With import duties applied to key analytical instruments and consumables, service providers and end users have had to reassess sourcing strategies and operational budgets. Equipment vendors faced increased landed costs for laser diffraction modules, Coulter Counter cartridges, and specialized sieving meshes, leading many to adjust pricing or offer bundled maintenance agreements to mitigate customer impact.

Moreover, manufacturers of test consumables, such as calibration standards and sample preparation reagents, encountered elevated raw material prices. These cost pressures have rippled through the value chain, prompting some laboratories to optimize test frequencies or consolidate orders to achieve volume discounts. At the same time, distribution partners have adapted by diversifying their portfolios to include domestic suppliers of sieving equipment and sedimentation accessories, reducing reliance on tariff-exposed imports.

Despite these challenges, market participants have leveraged tariff-driven disruption as an impetus to innovate. Collaborative partnerships between instrument makers and local suppliers have accelerated the development of modular test platforms that can be assembled and serviced domestically. Consequently, the sector is moving toward a more resilient supply network, with improved turnaround times and greater transparency in total cost of ownership calculations.

Unveiling Critical Segmentation Insights Across Test Methods End Use Industries Material Types Applications and Particle Size Ranges Driving Market Dynamics

Critical segmentation insights reveal that the choice of test method plays a pivotal role in data accuracy and operational fit. Laser diffraction remains the cornerstone of high-throughput analysis, with dry laser diffraction favored for powders and wet laser diffraction essential for slurries and suspensions. Coulter Counter technology excels in precise volumetric sizing, particularly for submicron to micron ranges, while dynamic image analysis offers detailed morphological characterization alongside size distribution metrics. Meanwhile, sedimentation techniques maintain relevance for coarse particles where gravitational settling provides clear separation, and both stack and vibratory sieving continue to serve as cost-effective approaches for routine screening.

End use industry requirements further refine method selection. In bulk and specialty chemical production, robust inline systems support continuous process monitoring. Cosmetics manufacturers emphasize wet methods to simulate real-world formulations, and food and beverage processors rely on sieving and dynamic imaging to ensure texture and mouthfeel consistency in beverages, dairy, and grain-based products. The mining sector deploys sedimentation for coal assessments and laser-based modules for metal ore grading, whereas pharmaceutical organizations integrate multiple test protocols-active pharmaceutical ingredient evaluation, excipient profiling, and final formulation testing-to meet regulatory compliance and optimize bioavailability.

Material type also dictates analytical pathways. Mineral particles require ruggedized test chambers, while polymers and food ingredients often call for specialized dispersion techniques. Applications span at line, inline, and offline process monitoring; finished product inspection and incoming ingredient verification; ISO and pharmacopoeia compliance checks; and formulation development and process research. Furthermore, particle size categories-coarse, micro, submicron, and nanoparticles-demand tailored calibration standards and sample handling to ensure reproducible outcomes.

This comprehensive research report categorizes the Particle Size Distribution Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test Method

- Material Type

- Particle Size Range

- Application

- End Use Industry

Illuminating Key Regional Trends and Growth Drivers in the Particle Size Distribution Testing Market Across the Americas EMEA and Asia-Pacific Territories

Regional dynamics in the Americas illustrate a mature testing environment where advanced analytical platforms coexist with decentralized service models. North American pharmaceutical and specialty chemical hubs invest heavily in inline laser diffraction and AI-driven dynamic image analysis, while Latin American mining operations prioritize sedimentation and sieving methods that withstand harsh field conditions. Across this region, there is a strong emphasis on integrating process analytical technology into continuous manufacturing frameworks, with service labs providing rapid-turnaround contract testing solutions.

In Europe, Middle East, and Africa, stringent regulatory climates drive widespread adoption of validated test methods. Pharmaceutical centers in Western Europe rely on dry and wet laser diffraction systems to meet EMA guidelines, whereas cosmetics producers in the Middle East explore vibratory sieving for granular product quality assessment. African extractive industries continue to employ sedimentation and stack sieving for mineral characterization, although emerging economies are beginning to invest in more sophisticated image-based analyzers to enhance export-grade ore quality.

Meanwhile, Asia-Pacific demonstrates the fastest growth trajectory, fueled by expanding food and beverage, pharmaceutical, and cosmetics manufacturing bases. APAC laboratories are rapidly upgrading from manual sieving to automated inline systems, and regional governments are encouraging domestic test method development through standardization initiatives. This convergence of expanding end use sectors and supportive policy frameworks is elevating demand for turnkey analytical solutions across coarse particles to nanoparticle ranges.

This comprehensive research report examines key regions that drive the evolution of the Particle Size Distribution Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players and Competitive Strategies Shaping Innovation Partnerships and Service Differentiation in the Particle Size Distribution Testing Sector

Leading companies in the particle size distribution testing arena are forging competitive strategies centered on technological leadership and service differentiation. Established manufacturers of laser diffraction equipment are investing in modular designs that can be upgraded in the field, reducing installed base obsolescence and extending equipment lifecycles. Concurrently, several vendors have introduced subscription-based business models that bundle system hardware, software updates, and calibration services under a single recurring fee, simplifying budget allocation for end users.

Complementing instrument innovation, software providers are integrating machine learning capabilities to automate data interpretation and flag out-of-spec samples. This trend has lowered the barrier to entry for smaller laboratories lacking specialized analytical expertise. At the same time, authorized service networks are expanding their geographic reach to ensure consistent maintenance and compliance support in key markets, particularly across Asia-Pacific and parts of Latin America.

Strategic partnerships between instrumentation companies and materials suppliers are also reshaping the competitive landscape. Collaborations on custom dispersion mediums and application-specific calibration kits allow providers to deliver turnkey solutions tailored to distinct industry needs, from polymer compounding to nanoparticle research. These alliances enhance customer retention and foster joint innovation, positioning partners as trusted advisors in the evolving particle characterization domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Particle Size Distribution Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anton Paar GmbH

- Beckman Coulter, Inc.

- Bettersize Instruments Ltd.

- Brookhaven Instruments Corporation

- Fritsch GmbH

- HORIBA, Ltd.

- IZON Science Limited

- LUM GmbH

- Malvern Panalytical Ltd

- Mettler-Toledo International Inc.

- Micromeritics Instrument Corporation

- Microtrac, Inc.

- Shimadzu Corporation

- Sympatec GmbH

- Verder Scientific GmbH & Co. KG

Delivering Strategic Operational and Technological Recommendations to Empower Industry Leaders in Optimizing Particle Size Distribution Testing Capabilities

Industry leaders are encouraged to adopt an integrated approach that unites advanced test methods, data analytics, and supply chain resilience. Initiating pilot programs to evaluate the performance of inline laser diffraction in parallel with at line dynamic image analysis can reveal optimal method pairings for specific material streams. In addition, establishing regional calibration hubs will mitigate the impact of tariff-related disruptions by localizing critical consumable production and service capabilities.

Furthermore, organizations should prioritize software interoperability and data standardization to accelerate cross-functional collaboration between R&D, quality control, and production teams. Investing in cloud-based platforms that centralize particle size data will enable predictive maintenance, facilitate compliance reporting, and support continuous process improvement initiatives. To reinforce sustainability objectives, leaders should transition to wet testing methods that minimize hazardous solvent use and explore recyclable sieving media to reduce waste cohorts.

Finally, forming strategic alliances with instrumentation providers and academic institutions can drive co-development of next-generation test modalities, such as acoustic spectrometry or microfluidic sizing, ensuring a pipeline of innovation that maintains competitive advantage. By executing these recommendations, organizations will strengthen their analytical infrastructure, optimize operational performance, and unlock new avenues for product differentiation.

Describing a Robust Multi-Method Research Methodology Incorporating Primary Expert Interviews Secondary Data Analysis and Comprehensive Validation Processes

The research framework underpinning this executive summary combined rigorous primary and secondary data gathering with a multi-tier validation process. Expert interviews were conducted with laboratory directors, process engineers, and quality assurance managers across chemical, pharmaceutical, and food and beverage sectors to capture firsthand insights into test method selection, instrumentation challenges, and future needs. These qualitative findings were triangulated with published industrial standards, patent filings, and regulatory guidelines to ensure alignment with the latest compliance requirements and technological advancements.

Secondary sources included peer-reviewed journals, technical whitepapers, and industry conference proceedings detailing innovations in imaging algorithms, dispersion techniques, and sample handling. Each data point was assessed for recency and relevance, with particular attention paid to developments post-2022. Moreover, case studies from leading service laboratories provided practical examples of method integration and cost optimization strategies.

Finally, a validation phase engaged an independent panel of particle characterization specialists to review draft insights and verify analytical accuracy. This iterative feedback loop ensured that the executive summary reflects both academic rigor and commercial applicability, offering stakeholders a reliable foundation for informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Particle Size Distribution Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Particle Size Distribution Testing Market, by Test Method

- Particle Size Distribution Testing Market, by Material Type

- Particle Size Distribution Testing Market, by Particle Size Range

- Particle Size Distribution Testing Market, by Application

- Particle Size Distribution Testing Market, by End Use Industry

- Particle Size Distribution Testing Market, by Region

- Particle Size Distribution Testing Market, by Group

- Particle Size Distribution Testing Market, by Country

- United States Particle Size Distribution Testing Market

- China Particle Size Distribution Testing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Summarizing Pivotal Insights Emerging Opportunities and Future Trajectories to Guide Stakeholder Decision-Making in Particle Size Distribution Testing Markets

In summary, particle size distribution testing has evolved from a niche analytical task into a strategic enabler of product quality, process efficiency, and regulatory compliance. The convergence of advanced measurement technologies with AI-driven analytics and sustainability imperatives is redefining how laboratories and production units approach particle characterization. Meanwhile, the 2025 United States tariffs have catalyzed supply chain adaptability and fostered domestic innovation in instrument assembly and resource localization.

Key segmentation insights highlight the importance of selecting methods that align with material type, particle size range, and end use industry. Regional variances demonstrate that mature markets in the Americas and EMEA demand validated high-throughput systems, while Asia-Pacific’s rapid growth favors modular, cost-effective solutions. Competitive dynamics are shaped by collaborative partnerships, subscription-based models, and the integration of machine learning for automated data interpretation.

Looking ahead, stakeholders should embrace integrated testing platforms that span at line, inline, and offline applications, ensure data interoperability across business functions, and invest in local service infrastructures. By doing so, they will secure resilience against external shocks, accelerate time-to-market, and maintain leadership in a landscape where precise particle characterization is key to innovation and market success.

Accelerate Your Market Intelligence by Engaging with Ketan Rohom for the Definitive Particle Size Distribution Testing Report

To unlock unparalleled insights into particle size distribution testing, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging directly with his team ensures you receive personalized guidance tailored to your organization’s unique needs. Whether you require custom data segmentation, deeper regional analysis, or strategic implications for specific end use industries, Ketan can facilitate the delivery of the comprehensive market research report.

Acting now will empower your strategic planning and procurement cycles. By collaborating with Ketan, you’ll gain access to exclusive datasets, expert commentary, and forward-looking perspectives that competitors may overlook. His expertise in bridging technical rigor with actionable business intelligence guarantees you maximize return on investment when integrating these insights into your decision-making frameworks.

Don’t leave critical knowledge to chance. Connect with Ketan Rohom today to secure the full Particle Size Distribution Testing Market Research Report. His consultative approach ensures clarity on scope, deliverables, and pricing, enabling your team to move quickly from insight to action. Transform your understanding of market dynamics, optimize supply chain resilience in light of tariff changes, and unlock growth opportunities across test methods, material types, and regional markets.

Schedule your consultation now to begin leveraging this definitive resource for enhancing operational efficiency, regulatory compliance, and innovation pathways within the particle size analysis landscape.

- How big is the Particle Size Distribution Testing Market?

- What is the Particle Size Distribution Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?