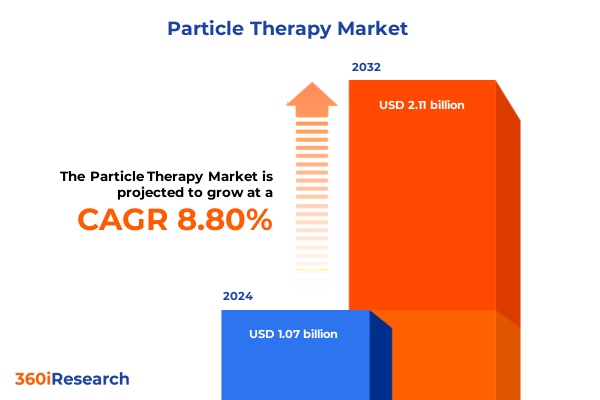

The Particle Therapy Market size was estimated at USD 1.16 billion in 2025 and expected to reach USD 1.26 billion in 2026, at a CAGR of 8.88% to reach USD 2.11 billion by 2032.

Navigating the Emergent Frontier of Particle Therapy Unveiling Scientific Progress and Market Dynamics for Advanced Oncology Care

Particle therapy has emerged as a groundbreaking modality in oncological care, leveraging charged particles such as protons and heavy ions to deliver highly precise radiation doses directly to tumors while sparing healthy tissue. This approach represents a paradigm shift from conventional photon-based radiation, offering enhanced clinical outcomes for a variety of cancer types, particularly those situated near critical organs or in pediatric cases. As technological innovations have proliferated, particle therapy centers have expanded their capabilities, demonstrating both clinical efficacy and economic viability in select indications.

Concurrent advancements in accelerator design, imaging integration, and treatment planning algorithms have markedly lowered barriers to adoption, enabling an increasing number of institutions to deploy state-of-the-art single-room systems alongside traditional multi-room facilities. The convergence of improved compact accelerator technologies, real-time imaging, and adaptive treatment protocols is reshaping the therapeutic landscape by facilitating more personalized and efficient care pathways. Transitioning from early adopters to broader clinical acceptance, particle therapy is set to redefine standard-of-care frameworks and unlock new frontiers in cancer management.

Revolutionary Technological and Clinical Transformations Reshaping Particle Therapy into a Next-Generation Cancer Treatment Paradigm

Over the past decade, transformative shifts have redefined the particle therapy ecosystem, driven by relentless innovation in beam delivery techniques and enhanced integration of complementary modalities. Developments in pencil beam scanning and intensity-modulated proton therapy have empowered clinicians to sculpt dose distributions with unprecedented accuracy, thereby improving clinical outcomes and reducing adverse effects. Simultaneously, the emergence of heavy ion centers has accentuated the potential of higher linear energy transfer particles to achieve superior biological effectiveness against radioresistant tumors.

Emerging digital health solutions, including artificial intelligence–based treatment planning and real-time adaptive controls, are facilitating more streamlined workflows and improving throughput across therapy centers. In tandem, strategic collaborations between technology providers, academic research institutions, and clinical practitioners have accelerated the validation of novel approaches and fostered a collaborative innovation environment. These pivotal shifts signify a convergence of engineering prowess and clinical insight, setting the stage for particle therapy to transition from a niche specialty toward a foundational pillar in comprehensive oncology care.

Assessing the Full-Spectrum Impact of 2025 United States Tariffs on Import Dynamics and Operational Costs in Particle Therapy Infrastructure

In 2025, the introduction of new United States tariffs on imported high-value accelerator components has exerted a multifaceted influence on the particle therapy market, substantially affecting supply chains and cost structures. Tariff adjustments on cyclotrons, synchrotrons, beam transport system elements, and specialized treatment delivery equipment have elevated procurement expenses for select imported hardware, compelling many providers to reevaluate sourcing strategies. Consequently, project timelines for new facility installations have experienced extensions as stakeholders navigate revised supplier agreements and leverage domestic manufacturing partnerships to mitigate tariff impacts.

The cumulative influence of these tariffs has also stimulated broader discussions around supply chain resilience, encouraging a strategic pivot toward localized component production and assembly operations. While short-term capital expenditures have risen, the long-term view underscores potential benefits in fostering a domestic ecosystem for advanced accelerator manufacturing. Regulatory agencies and institutional procurement teams have intensified efforts to streamline compliance processes, ensuring that tariff-induced complexities do not impede clinical adoption rates or compromise treatment accessibility for patients nationwide.

In-Depth Segmentation Perspectives Revealing Nuanced Value Drivers Across Therapy Types, Components, Systems, Applications, and End Users

An in-depth examination of market segmentation reveals critical nuances across therapy types, components, system configurations, application areas, and end users that are shaping strategic decision-making. Within therapy type, the comparative growth trajectories of heavy ion therapy versus proton therapy highlight divergent adoption curves driven by clinical evidence, capital intensity, and facility footprint considerations. Component segmentation underscores the pivotal role of cyclotrons and synchrotrons in accelerating particle beams, treatment delivery systems in precision dose administration, and beam transport system components-such as beam monitors, bending magnets, and collimators-in ensuring beam stability and conformity.

System segmentation further differentiates between multi-room installations, which support high patient volumes and diversified treatment protocols, and single-room systems, which offer flexible deployment and lower infrastructure requirements. Application area analysis identifies breast cancer, head and neck cancer, lung cancer, pediatric cancer, and prostate cancer as primary indications benefiting from superior dose distribution and reduced collateral damage. End users span private and public hospitals, research institutions, and specialty clinics including oncology clinics and radiotherapy centers, each demonstrating distinct procurement cycles, reimbursement frameworks, and operational mandates. These segmentation insights form the foundation for tailored market entry strategies and investment prioritization.

This comprehensive research report categorizes the Particle Therapy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapy Type

- Components

- System

- Application Area

- End User

Strategic Regional Highlights Illustrating Diverse Adoption Trajectories and Infrastructure Development Patterns Across Global Markets

Regional dynamics display varied maturity levels and growth engines as particle therapy expands its global footprint. In the Americas, established treatment centers benefit from robust reimbursement policies and a strong clinical evidence base, driving incremental upgrades and expansion projects. Market entrants in North America often collaborate with leading academic health centers to validate new technologies while leveraging favorable regulatory pathways to accelerate installation timelines.

Across Europe, Middle East & Africa, multi-jurisdictional regulatory frameworks and differing reimbursement schemes influence center deployment strategies, with Western Europe exhibiting higher facility densities and the Middle East & Africa demonstrating growth driven by government-sponsored health initiatives. Additionally, partnerships between public health systems and technology providers have catalyzed infrastructure development in select markets. In Asia-Pacific, rapid economic growth and increasing healthcare investments underpin a surge in demand for both single-room and multi-room systems, supported by innovative financing models and public–private partnerships aimed at broadening patient access to advanced radiotherapy options.

This comprehensive research report examines key regions that drive the evolution of the Particle Therapy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Critical Competitive Intelligence Unpacking Strategic Initiatives and Collaborative Ecosystems Among Leading Particle Therapy Providers

Leading companies in the particle therapy domain are executing multifaceted strategies to solidify their competitive positions and drive future growth. Major equipment manufacturers are investing heavily in next-generation accelerator technologies, optimizing footprint reduction, and enhancing energy efficiency to appeal to a wider range of clinical settings. In parallel, service providers are expanding their offerings to include comprehensive lifecycle support, from installation and training to maintenance and software updates, thereby strengthening long-term customer relationships.

Collaborative research partnerships have emerged as a critical avenue for innovation, as key players join forces with academic centers and clinical institutions to conduct trials that validate emerging techniques such as FLASH radiotherapy and adaptive treatment workflows. Strategic alliances with component suppliers and digital health entrants are also enabling integrated solutions that streamline treatment planning and delivery. Cost containment remains a priority, with leading organizations exploring modular architectures and shared resource models to address budgetary constraints in both public and private healthcare environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Particle Therapy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B dot Medical Inc.

- C-Rad AB

- Elekta AB

- Hitachi, Ltd.

- Ion Beam Applications S.A

- Koninklijke Philips N.V.

- Leybold by Atlas Copco Group

- Mevion Medical Systems

- Optivus Proton Therapy, Inc.

- P-Cure Ltd

- ProTom International Holding Corporation

- Provision Healthcare, LLC

- PTW Freiburg GmbH

- SAH Global LLC

- Shanghai APACTRON Particle Equipment Co., Ltd.

- Shinva Medical Instrument Co., Ltd.

- Siemens Healthineers AG

- Stantec Inc.

- Sumitomo Heavy Industries, Ltd.

- Sun Nuclear Corporation by Mirion Technologies

- Toshiba Corporation

- Xstrahl Ltd.

Pragmatic Strategic Imperatives and Operational Pathways for Industry Leaders to Capitalize on Particle Therapy Momentum

Industry leaders seeking to capitalize on particle therapy’s growing prominence must prioritize a series of strategic actions that align technological innovation with market realities. First, strengthening domestic manufacturing partnerships for critical accelerator components can mitigate tariff-induced cost pressures while cultivating local supply chain resilience. Second, forging alliances with digital health firms to integrate artificial intelligence–driven treatment planning and real-time monitoring tools can differentiate service offerings and improve throughput.

Third, expanding clinical application portfolios beyond core indications by sponsoring investigator-initiated studies can generate new evidence and support reimbursement expansion. Fourth, engaging proactively with payers and regulatory authorities to establish clear value-based reimbursement frameworks will be essential to secure sustainable revenue streams. Finally, optimizing facility deployment models through flexible single-room systems or shared resource consortiums can lower entry barriers for emerging centers and accelerate broader patient access to particle therapy treatments.

Robust Multilayered Research Methodology Integrating Primary and Secondary Sources with Expert Validation and Data Triangulation Techniques

This research employs a multilayered methodology combining primary and secondary sources, expert interviews, and rigorous data triangulation to ensure a comprehensive and unbiased market assessment. Secondary research encompassed peer-reviewed journals, conference proceedings, regulatory filings, and publicly disclosed financial reports to establish baseline understanding of technological trends, clinical landscapes, and policy frameworks. Key opinion leaders including radiation oncologists, medical physicists, healthcare administrators, and supply chain executives provided qualitative insights through structured interviews and targeted questionnaires.

Data triangulation techniques were applied by cross-referencing primary interview findings with secondary data sets, ensuring consistency and identifying emerging patterns. Quantitative inputs were validated against industry benchmarks and historical adoption trajectories, while qualitative themes underwent iterative review with external advisors to refine strategic conclusions. This structured approach underpins the credibility of the insights presented, offering stakeholders a robust foundation for informed decision-making in the rapidly evolving particle therapy market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Particle Therapy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Particle Therapy Market, by Therapy Type

- Particle Therapy Market, by Components

- Particle Therapy Market, by System

- Particle Therapy Market, by Application Area

- Particle Therapy Market, by End User

- Particle Therapy Market, by Region

- Particle Therapy Market, by Group

- Particle Therapy Market, by Country

- United States Particle Therapy Market

- China Particle Therapy Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Conclusive Reflections Synthesizing Market Trends Strategic Imperatives and Future Outlook in Particle Therapy Evolution

Particle therapy is poised at a pivotal juncture, reflecting both technological maturation and expanding clinical acceptance. The convergence of advanced accelerator designs, digital health integrations, and strategic partnerships has not only broadened the spectrum of treatable indications but also enhanced the economic feasibility of installations across diverse healthcare settings. While tariff adjustments and supply chain dynamics present short-term challenges, they simultaneously catalyze opportunities for domestic innovation and more resilient procurement strategies.

Segmentation and regional analyses underscore the importance of tailored approaches that address unique market drivers, from reimbursement landscapes to infrastructure capabilities. Competitive intelligence reveals a landscape marked by collaboration and modular innovation, with leading players solidifying their positions through integrated service models and research alliances. In this context, proactive strategic realignment and targeted investments will enable stakeholders to harness particle therapy’s transformative potential, ultimately elevating patient outcomes and reinforcing oncology care paradigms.

Engage with Our Associate Director of Sales and Marketing to Secure Comprehensive Particle Therapy Market Insights and Drive Strategic Decisions

Are you prepared to translate cutting-edge research into decisive strategic advantage through robust market intelligence on particle therapy technology and trends with Ketan Rohom, who brings extensive expertise in guiding healthcare innovators toward growth? Connect directly with our Associate Director of Sales and Marketing to explore tailored solutions, secure your comprehensive particle therapy market research report, and ensure your organization is positioned at the leading edge of oncology treatment innovation. By engaging today, you will gain exclusive access to in-depth analyses, strategic recommendations, and ongoing expert support designed to drive accelerated adoption, optimize investment decisions, and amplify competitive differentiation in this rapidly evolving field.

- How big is the Particle Therapy Market?

- What is the Particle Therapy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?