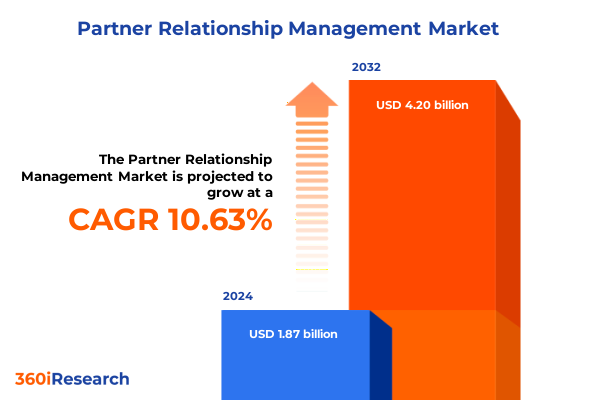

The Partner Relationship Management Market size was estimated at USD 27.64 billion in 2025 and expected to reach USD 30.01 billion in 2026, at a CAGR of 9.41% to reach USD 51.89 billion by 2032.

Unveiling partner relationship management as the catalyst for collaborative growth and competitive advantage in digital ecosystems

Partner relationship management has emerged as the strategic linchpin for organizations seeking to unlock collaborative growth and sustained competitive advantage. In an era defined by intricate ecosystems and interdependent value chains, the ability to engage, enable, and empower partners effectively distinguishes market leaders from laggards. Rather than treating alliances as transactional arrangements, forward-looking enterprises view partner networks as dynamic extensions of their go-to-market strategy, driving innovation and scale through co-development and joint value creation.

Over the past decade, digital transformation initiatives have reshaped how enterprises interact with their channel and technology partners. Traditional partner portals have evolved into intelligent platforms that leverage data analytics, workflow automation, and integrated communications to deliver personalized partner experiences. As organizations face increasing pressure to accelerate time to market and enhance customer outcomes, the agility of their partner networks becomes paramount. Consequently, partner relationship management platforms now serve as the connective tissue that synchronizes product roadmaps, marketing initiatives, training programs, and performance tracking across diverse partner cohorts.

For decision-makers in both enterprise and mid-market segments, the mandate is clear: cultivate a partner ecosystem that is transparent, responsive, and aligned to strategic objectives. This requires not only the deployment of advanced PRM solutions but also a cultural shift toward shared accountability and continuous optimization. By investing in the right processes and technologies now, organizations can establish a solid foundation for long-term collaboration, unlocking new revenue streams and reinforcing their competitive positioning.

Exploring the seismic shifts in partner relationship management driven by AI integration, cloud transformation, and evolving partner ecosystems globally

The landscape of partner relationship management is undergoing seismic change driven by the integration of artificial intelligence, the proliferation of cloud-native architectures, and the evolution of partner ecosystems into integrated marketplaces. AI-powered recommendation engines now analyze partner performance metrics in real time, surfacing insights that enable program managers to tailor enablement, incentivization, and co-selling activities with unprecedented precision. At the same time, the migration toward cloud transformation has liberated organizations from on-premise constraints, fostering the rapid deployment of new features and ensuring seamless scalability.

Meanwhile, partner ecosystems are shifting from rigid, hierarchical structures into modular, open networks that facilitate co-innovation and shared revenue models. Collaborative development environments and API-driven integrations have become essential, allowing solution providers to embed partner capabilities directly into their offerings. This transition has elevated the role of the PRM platform from a passive repository of collateral to an active orchestrator of joint value creation, enabling real-time collaboration on product enhancements, marketing campaigns, and customer support workflows.

In this new paradigm, organizations that embrace data-driven decision-making and foster a culture of continuous improvement will outperform those that cling to legacy channel approaches. By harnessing the power of AI, cloud, and open ecosystems, enterprises can cultivate highly engaged partner communities that innovate faster, respond more effectively to market shifts, and deliver superior end-customer outcomes.

Analyzing the cumulative repercussions of 2025 United States tariffs on technology partnerships, supply chains, and strategic planning for solution providers

In 2025, United States tariffs continue to reverberate across technology supply chains, exerting pressure on partner networks and elevating the cost of hardware, software licenses, and support services. The latest tranche of duties, enacted under Section 301 measures and counter-tariff authority, has intensified custom duties on semiconductors, networking equipment, and enterprise storage solutions-critical components that underpin modern partner offerings. These increased import costs have been absorbed unevenly, with technology partners and resellers facing margin compression and end customers experiencing higher sticker prices.

As a result, channel programs have had to adapt quickly to preserve partner loyalty and maintain revenue momentum. Some global vendors have responded by localizing assembly and manufacturing operations, shifting production to tariff-exempt jurisdictions, or renegotiating supply agreements to mitigate direct duty impacts. Yet these strategic moves often introduce operational complexity and lengthened lead times, which in turn test the resilience of partner enablement and fulfillment processes. Across the board, solution providers are reevaluating pricing models, loyalty incentives, and contract structures to accommodate the new tariff environment without undermining partner satisfaction.

Looking ahead, the ability to navigate these trade headwinds will hinge on strategic diversification and agility. Successful organizations are exploring alternative component sources, forging deeper alliances with regional system integrators, and investing in digital fulfillment capabilities that reduce reliance on high-tariff imports. By integrating tariff risk assessments into their partner program frameworks, enterprises can safeguard profitability, sustain partner engagement, and position their networks to capitalize on emerging opportunities in an increasingly protectionist landscape.

Revealing how varied segmentations of components, partner types, business models, industries, deployments, and enterprise sizes drive PRM strategies

As organizations refine their partner relationship management strategies, nuanced segmentation insights reveal the pivotal factors shaping program success. When examining PRM solutions from a component perspective, services-including partner onboarding, performance tracking, and sales and marketing support-have emerged as critical differentiators, while packaged solutions deliver the core functionality for seamless collaboration. These elements work in concert to enable organizations to tailor partner journeys, monitor engagement efficacy, and drive pipeline growth.

Equally important is the diversity of partner types that populate the ecosystem. Consulting partners bring domain expertise and strategic advisory services; reseller partners excel in rapid market reach; service partners deliver deployment, customization, and managed services; and technology partners contribute specialized capabilities and integrations. Each of these partner profiles demands bespoke engagement models, incentive structures, and enablement pathways in order to maximize their unique contributions to the overall value chain.

Business models further delineate the PRM landscape, spanning fee-for-service arrangements that emphasize project-based engagements, traditional licensing models for perpetual software access, and subscription models that align with recurring revenue imperatives. This spectrum of models underscores the importance of flexibility in partner agreements and platform configurations, enabling companies to adapt to partner preferences and market dynamics. Across industries-from automotive and banking, financial services and insurance to healthcare, IT and telecom, manufacturing, and retail and consumer goods-the interplay between deployment preferences, such as cloud-based versus on-premise solutions, and organization size, whether large enterprises or small and medium enterprises, dictates customization needs, compliance considerations, and total cost of ownership expectations.

This comprehensive research report categorizes the Partner Relationship Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Partner Type

- Business Model

- Industry Type

- Deployment

- Organization Size

Uncovering regional market nuances in the Americas, Europe–Middle East–Africa, and Asia-Pacific that drive partner collaboration, engagement, and growth

Regional variations in partner relationship management adoption and maturity underscore the importance of localized strategies. In the Americas, established digital ecosystems and mature channel programs foster broad adoption of advanced PRM platforms. Organizations in this region leverage comprehensive training modules, joint marketing initiatives, and integrated analytics to optimize partner performance and measure program ROI. Meanwhile, evolving regulatory frameworks and shifting trade policies have prompted firms to incorporate compliance-focused features into their PRM roadmaps.

Across Europe–Middle East–Africa, heterogeneity among national markets presents both challenges and opportunities. While Western Europe exhibits high levels of digital collaboration and standardized partner frameworks, markets in the Middle East and Africa are characterized by rapid digital leapfrogging and nascent channel maturity. Consequently, PRM platforms in this region must offer robust localization capabilities, flexible language support, and modular deployment options to accommodate diverse partner skill levels and infrastructure constraints.

The Asia-Pacific region continues to outpace global growth benchmarks, driven by digitally native enterprises and vibrant startup ecosystems. Market leaders in APAC are embracing cloud-first PRM deployments and embedding advanced AI-driven enablement tools that support multi-language, multi-currency operations. By forging strategic alliances with regional system integrators and leveraging partner marketplaces, organizations in this region are expanding their footprint and delivering tailored solutions that resonate with local consumer and enterprise requirements.

This comprehensive research report examines key regions that drive the evolution of the Partner Relationship Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting strategic innovations by leading PRM solution providers that shape competitive dynamics and enhance partner experiences globally

Leading PRM solution providers have distinguished themselves through strategic innovations that elevate partner engagement and streamline operational workflows. Salesforce’s PRM module continues to expand its partner marketplace capabilities, embedding AI-driven lead scoring and automated co-selling workflows directly within the CRM interface. In parallel, Microsoft’s Partner Center has focused on enhanced partner performance analytics and deeper integration with Azure Marketplace, fostering a cohesive experience for technology partners and managed service providers.

Emerging best-of-breed vendors, such as Impartner and Zift Solutions, have doubled down on modular platform architectures, enabling organizations to rapidly configure onboarding, training, and incentive management modules without extensive customization. These providers have also integrated advanced channel analytics dashboards that deliver real-time visibility into partner pipeline health, deal registration status, and revenue contribution metrics. By offering pre-built connectors to key ERP and marketing automation systems, they reduce implementation timelines and accelerate time to value.

Complementary platforms like Allbound and Channeltivity are differentiating through user-centric design and streamlined workflows that support modern channel programs. Their emphasis on collaborative content libraries, integrated partner learning journeys, and automated certification interfaces reflects a broader market shift toward continuous partner enablement. Together, these strategic moves from leading PRM vendors are reshaping the competitive landscape and setting new benchmarks for partner experience excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Partner Relationship Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Affise Inc.

- Allbound, Inc.

- AppDirect, Inc.

- Channeltivity, LLC

- Crossbeam

- Impartner Inc.

- International Business Machines Corporation

- Kademi Ltd

- Kiflo Company

- LogicBay Corporation

- Magentrix Corporation

- MaxBill

- Microsoft Corporation

- Mindmatrix Inc.

- Oracle Corporation

- Partner Pulse

- PartnerStack

- Performance Horizon Group Limited

- Salesforce, Inc.

- SAP SE

- Varega Ltd.

- Venminder, Inc.

- Zift Solutions

- ZINFI Technologies, Inc.

- Zoho Corporation Pvt. Ltd.

Delivering recommendations for industry leaders to fortify partner ecosystems, harness emerging technologies, and mitigate regulatory headwinds

To navigate the evolving partner management landscape and sustain competitive advantage, industry leaders should prioritize the deployment of AI-driven analytics within their PRM platforms. By leveraging predictive insights into partner performance, organizations can proactively identify high-value collaborators, optimize incentive allocations, and streamline lead routing processes. In parallel, a shift toward modular, cloud-native architectures enables rapid feature rollouts and continuous enhancements without disrupting existing workflows.

Given the lingering impact of 2025 United States tariffs, it is critical to embed tariff-risk assessments and alternative sourcing options into partner program governance. Organizations that diversify their component suppliers and establish local assembly partnerships will reduce exposure to duty fluctuations and preserve margin integrity. Moreover, developing dynamic pricing models that accommodate cost variances empowers partners to maintain competitive offerings without sacrificing profitability.

Finally, a robust partner training and certification framework, coupled with integrated digital engagement tools, will drive deeper partner loyalty and capability uplift. By personalizing learning journeys, harnessing gamification elements, and linking certification achievements to tangible incentives, enterprises can cultivate a culture of continuous improvement. These targeted measures will collectively fortify partner ecosystems, elevate program ROI, and position organizations to capitalize on emerging market opportunities.

Detailing a robust research methodology combining primary interviews, quantitative analytics, and secondary research to underpin authoritative PRM insights

This analysis is underpinned by a rigorous research methodology that combines in-depth primary interviews, extensive quantitative analytics, and targeted secondary research. Over the course of this study, we conducted structured interviews with senior executives, channel managers, and partner program architects across leading enterprises to capture firsthand insights into evolving PRM priorities and challenges.

Complementing these qualitative findings, a comprehensive survey was administered to a broad cross-section of partner stakeholders, yielding statistically significant data on platform adoption rates, engagement metrics, and satisfaction drivers. Secondary research sources, including industry whitepapers, trade publications, and public filings, were triangulated to validate trends and contextualize strategic initiatives within the broader market environment. Together, these methodological pillars ensure that our conclusions and recommendations are both empirically grounded and strategically actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Partner Relationship Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Partner Relationship Management Market, by Component

- Partner Relationship Management Market, by Partner Type

- Partner Relationship Management Market, by Business Model

- Partner Relationship Management Market, by Industry Type

- Partner Relationship Management Market, by Deployment

- Partner Relationship Management Market, by Organization Size

- Partner Relationship Management Market, by Region

- Partner Relationship Management Market, by Group

- Partner Relationship Management Market, by Country

- United States Partner Relationship Management Market

- China Partner Relationship Management Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing findings to underscore the strategic importance of partner relationship management in driving sustainable growth amid evolving market dynamics

Throughout this report, we have synthesized leading-edge trends, tariff-induced challenges, segmentation dynamics, and regional specificities to illuminate the strategic imperative of partner relationship management. The acceleration of AI integration, the maturation of cloud ecosystems, and the evolving nature of trade policies underscore the necessity for agile, data-driven PRM frameworks. Segmentation analysis reveals that customization across components, partner types, business models, industries, deployments, and organization sizes is essential for tailored program success.

Regional insights demonstrate that while mature markets in the Americas and Europe–Middle East–Africa demand compliance-focused, localized solutions, the Asia-Pacific region is spearheading rapid adoption of cloud-first, AI-enabled platforms. Leading solution providers continue to innovate, setting new standards for partner engagement, performance analytics, and co-selling orchestration. The recommendations outlined herein-spanning AI investment, modular architectures, tariff risk mitigation, and continuous partner enablement-provide a clear roadmap for industry leaders seeking to strengthen their partner ecosystems and drive sustainable growth.

Connect with Ketan Rohom to secure the partner relationship management market research report and empower strategic decision-making for your organization

We invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to access the definitive partner relationship management market research report. By engaging directly, you gain tailored insights and expert guidance that will inform your strategic decision-making and drive measurable improvements in partner engagement. Don’t miss this opportunity to elevate your partner ecosystem, optimize governance, and secure a competitive edge amid evolving market complexities. Reach out today to take the next step toward transformational growth.

- How big is the Partner Relationship Management Market?

- What is the Partner Relationship Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?