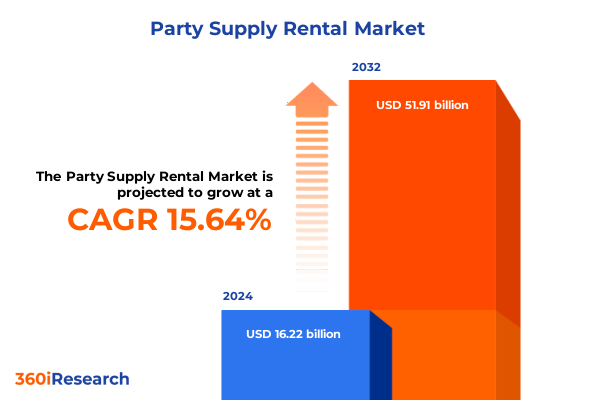

The Party Supply Rental Market size was estimated at USD 18.65 billion in 2025 and expected to reach USD 21.45 billion in 2026, at a CAGR of 15.74% to reach USD 51.91 billion by 2032.

Discover the Transformative Dynamics Shaping the Party Supply Rental Industry and Set the Stage for an Executive Level Strategic Overview

The landscape of party supply rentals has become increasingly complex, influenced by rising customer expectations, evolving event formats, and technological advancements. As organizations strive to curate unforgettable experiences, the demand for seamless rental solutions encompassing decorations, entertainment equipment, furniture, tableware, and tents has intensified. This shift underscores the necessity for a comprehensive exploration of market dynamics, competitive strategies, and operational best practices that can inform executive-level decision making.

Against a backdrop of dynamic consumer preferences and emerging regulatory environments, this executive summary provides a foundational overview of the critical forces shaping the party supply rental sector. By examining transformative shifts, regulatory impacts, segmentation insights, and regional nuances, executives will gain clarity on the strategic imperatives required to navigate volatility and unlock new avenues for growth. The subsequent sections distill complex data into actionable intelligence, ensuring that industry leaders are equipped with the foresight and flexibility to thrive.

Explore How Digitalization, Sustainability, and Hybrid Formats Are Revolutionizing Party Supply Rentals for Modern Event Experiences

In recent years, the emergence of digital platforms has revolutionized the way clients source and reserve party supplies. Online booking portals and mobile applications now facilitate faster selection, real-time availability checks, and integrated payment options, enabling rental companies to deliver a streamlined customer journey. Concurrently, the rise of experiential events has fueled demand for immersive lighting installations, custom centerpieces, and interactive photo booths, prompting operators to invest in innovative equipment and design expertise.

Sustainability has also become a defining factor in purchase decisions, with planners seeking eco-friendly furniture rentals crafted from recycled materials, energy-efficient lighting solutions, and reusable tableware. This environmental consciousness has driven suppliers to adopt circular economy principles, reconfigure reverse logistics, and implement rigorous sanitation protocols. Additionally, hybrid event formats-combining in-person attendance with virtual participation-have grown in prominence, compelling companies to offer modular sound systems and adaptable dance floors that seamlessly transition between live and digital environments.

Understand the Cumulative Impact of 2025 United States Tariffs on Imported Party Supplies and How Operators Are Adapting Their Supply Chains

The imposition of new tariffs in 2025 has exerted pressure on the supply chain for imported party rental equipment, particularly impacting items sourced from key manufacturing hubs. Tent structures, frequently procured from overseas suppliers, have seen material costs escalate as steel and aluminum tariffs translate into higher inbound prices. These added expenses have forced rental operators to reevaluate vendor contracts and explore domestic fabrication alternatives to maintain margin stability.

Likewise, lighting fixtures and sound systems, many of which originate from specialized manufacturers abroad, have experienced cost increases that erode profitability on high-volume event bookings. In response, industry participants are adjusting pricing models and negotiating long-term agreements that amortize tariff fluctuations. At the same time, companies are accelerating investments in local production capabilities and strategic warehousing to mitigate future tariff volatility, ensuring a resilient and cost-efficient inventory strategy.

Gain Deep Segmentation Insights That Illuminate Product, Event, Duration, Customer, and Distribution Nuances for Enhanced Strategy

The party supply rental market is characterized by a diverse array of product types, encompassing decorations rentals such as centerpieces, floral arrangements, and lighting, alongside entertainment equipment like dance floors, photo booths, and sound systems. Furniture rentals and tableware services, which cover casual and themed sets, accommodate the aesthetic demands of various event themes, while tent rentals-including clear span, frame, and pole structures-provide essential shelter and spatial flexibility. Recognizing these nuances enables operators to tailor inventory holdings and develop specialized packages that resonate with client preferences.

Event type segmentation reveals that weddings, encompassing both destination and traditional ceremonies, continue to drive consistent rental volumes, whereas corporate gatherings such as conferences, product launches, and seminars demand technical equipment and refined décor palettes. Festivals, whether cultural celebrations, food-centric gatherings, or music-oriented spectacles, place a premium on scalable and durable infrastructure. Private parties and nonprofit fundraisers each present unique logistical considerations and service expectations, further underscoring the importance of a segmented approach.

Differing rental durations-from single-day engagements to weekly and monthly arrangements-also shape operational scheduling and revenue streams, requiring sophisticated inventory management systems. Furthermore, customer typologies including caterers, corporate clients, event planners, government entities, and individual consumers exhibit varied purchasing behaviors, influencing tailored marketing strategies. Distribution channels have evolved to encompass both offline showrooms and online storefronts, with omnichannel integration now essential for capturing a broader client base and ensuring seamless fulfillment.

This comprehensive research report categorizes the Party Supply Rental market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Event Type

- Rental Duration

- Customer Type

- Distribution

Uncover Distinct Regional Trends and Demand Drivers Across the Americas, Europe Middle East & Africa, and Asia-Pacific Rental Markets

Regional dynamics within the party supply rental sector reveal distinct patterns across the Americas, Europe, Middle East & Africa, and Asia-Pacific territories. In North America, high per capita event spending and advanced logistic networks support a mature rental ecosystem, with major metropolitan areas leading in demand for sophisticated décor and technical equipment. Latin American markets are experiencing gradual growth, driven by expanding middle-class populations and the rising popularity of destination weddings and large-scale festivals.

Across Europe, the proliferation of boutique-style events and city-wide cultural festivals has created niche opportunities for specialized rentals, while Middle Eastern markets emphasize opulent setups for gala events and high-profile corporate functions. African regions showcase burgeoning demand for outdoor celebrations that rely on tent structures and modular furniture, whereas Asia-Pacific markets are characterized by rapid convergence of traditional ceremonies with modern experiential trends. Understanding these regional distinctions is crucial for devising footprint expansion plans, optimizing inventory placement, and forecasting logistical requirements.

This comprehensive research report examines key regions that drive the evolution of the Party Supply Rental market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyze How Leading Rental Providers Are Leveraging Partnerships, Technology, and Sustainability to Differentiate Their Offerings

Leading companies in the party supply rental sector have differentiated themselves through strategic partnerships with event planners, technology vendors, and sustainable materials suppliers. By forging alliances with logistics providers, some operators have enhanced last-mile delivery capabilities and elevated service reliability. Others have invested heavily in proprietary digital platforms that integrate customer relationship management, inventory tracking, and real-time analytics, thereby unlocking operational efficiencies and personalized client engagement.

A focus on sustainability has also emerged as a competitive imperative, with top-tier providers sourcing biodegradable décor components and LED-based lighting systems to reduce carbon footprints. Several market leaders have pursued targeted acquisitions to expand geographic reach and product portfolios, while niche specialists have carved out strong reputations by catering to high-touch events such as luxury weddings and large-scale public festivals. These varied approaches underscore the importance of strategic innovation, operational agility, and customer-centric value propositions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Party Supply Rental market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A Classic Party Rental

- All City Rentals

- All Occasions Party Rental

- American Party Rental

- Avalon Tent and Party

- BabyQuip

- Baker Party Rentals

- Big D Party Rentals

- Bright Event Rentals, LLC

- Celebration Party Equipment Rentals, Inc.

- Cheers Party Rentals

- CORT Party Rental

- Diamond Event & Tent

- Eventective, Inc.

- J&S Party Rental

- Jump Monkey's Party Rental

- Karlorent

- KM Party Rental

- La Piñata Party Rental, Inc

- Montana Party Rentals

- ONE STOP PARTY STORE

- Party Reflections, Inc.

- Party Rentals, Inc.

- Pico Party Rents

- Pleasanton Rentals

- Premiere Events

- Reventals Event Rentals

- Sainath Decorators

- Taylor Rental

- Ventura Rental Center

Implement Actionable Strategies in Digital Transformation, Supply Chain Resilience, and Sustainable Practices to Drive Market Leadership

Industry leaders should prioritize the development of integrated digital solutions that simplify client workflows from inspiration to execution. By deploying intuitive online configurators and augmented reality previews, providers can facilitate design customization and drive higher conversion rates. Additionally, cultivating strategic relationships with domestic fabricators and local artisans will bolster supply chain resilience and reduce exposure to international tariff fluctuations.

To address evolving environmental concerns, companies should incorporate circular economy principles by implementing reusable assets and end-of-life recycling programs for décor elements. Leveraging data analytics to forecast event trends and optimize inventory allocation will further enhance operational precision and lower carrying costs. Finally, investing in workforce training on contactless delivery protocols and advanced equipment handling will ensure consistent service quality and reinforce brand reputation.

Understand the Rigorous Mixed Methodology Employed to Deliver Reliable Insights on Party Supply Rental Market Dynamics

This research approach combined extensive primary interviews with event planners, rental operators, logistics experts, and material suppliers to capture nuanced perspectives on market dynamics. In parallel, a comprehensive secondary review of industry publications, regulatory filings, and tariff schedules was conducted to contextualize cost structures and trade policy impacts. All data points underwent rigorous triangulation to validate consistency across multiple sources and ensure analytical integrity.

Quantitative analyses employed statistical modeling techniques to assess segmentation patterns and regional demand forecasts, while qualitative insights were derived from structured discussions with C-suite executives and operational leads. By synthesizing these methodologies, the study delivers a holistic view of market drivers, competitive landscapes, and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Party Supply Rental market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Party Supply Rental Market, by Product Type

- Party Supply Rental Market, by Event Type

- Party Supply Rental Market, by Rental Duration

- Party Supply Rental Market, by Customer Type

- Party Supply Rental Market, by Distribution

- Party Supply Rental Market, by Region

- Party Supply Rental Market, by Group

- Party Supply Rental Market, by Country

- United States Party Supply Rental Market

- China Party Supply Rental Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Synthesize Digital, Sustainable, and Compliance Drivers to Forge a Cohesive Strategy for Future Growth

The confluence of digital innovation, sustainability imperatives, and evolving event formats has redefined the competitive terrain for party supply rental businesses. Operators who align their strategies with these transformational forces will be better equipped to capture new growth avenues and enhance customer satisfaction. Simultaneously, navigating regulatory headwinds such as tariffs demands proactive supply chain reconfiguration and strong vendor relationships.

By integrating segmentation intelligence, regional trend analysis, and competitor benchmarking, industry stakeholders can formulate robust strategies that balance agility with precision. Ultimately, success will hinge on an unwavering commitment to service excellence, informed decision making, and continuous adaptation to the changing needs of event planners and attendees alike.

Unlock Tailored Strategic Insights and Partner with Associate Director Ketan Rohom to Elevate Your Competitive Advantage in Party Supply Rentals

For organizations seeking to gain an in-depth understanding of the evolving forces and competitive dynamics at play within the party supply rental industry, this market research report offers an indispensable resource. Engage directly with Associate Director Ketan Rohom to uncover tailored strategic insights, detailed segment analyses, and actionable recommendations designed to elevate your operational effectiveness and drive sustainable growth.

By partnering with Ketan Rohom, you will benefit from personalized guidance on how to leverage data-driven intelligence to optimize your product offerings, streamline supply chain operations, and capitalize on emerging regional and event-driven opportunities. Connect today to secure your copy of the comprehensive study and position your organization at the forefront of innovation and resilience in the rapidly changing landscape of party supply rentals.

- How big is the Party Supply Rental Market?

- What is the Party Supply Rental Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?