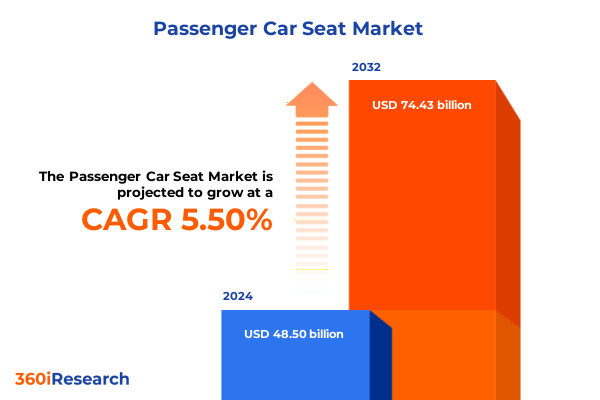

The Passenger Car Seat Market size was estimated at USD 51.17 billion in 2025 and expected to reach USD 54.00 billion in 2026, at a CAGR of 5.69% to reach USD 75.43 billion by 2032.

Discover how evolving consumer expectations, technological breakthroughs, and regulatory shifts are redefining the passenger car seat market landscape

The passenger car seat industry stands at a pivotal moment, driven by a combination of shifting consumer expectations, rapidly advancing technology, and evolving regulatory requirements. As drivers increasingly seek comfort, customization, and safety, manufacturers and suppliers must navigate a complex landscape of innovations and standards. This executive summary lays the groundwork for understanding the forces reshaping the market, outlining the key themes and strategic considerations that will guide decision-making in the months and years ahead.

By framing the primary objectives and scope of this analysis, we aim to equip stakeholders with a clear perspective on the dynamics influencing design, production, and distribution of passenger car seats. From material choices to integration of smart features, the industry’s future hinges on its ability to adapt and anticipate change. This introduction sets the stage for a deeper exploration of transformative trends, policy impacts, and critical segments that define the competitive landscape.

Explore the groundbreaking trends in automotive seating driven by electrification, connectivity, and sustainable materials reshaping vehicle interiors

The automotive seating sector is experiencing unprecedented transformation as electrification and connectivity extend beyond the powertrain to interior comfort components. Electric vehicles demand lighter and more energy-efficient seating solutions, prompting material innovations and streamlined manufacturing processes. Simultaneously, the integration of sensors and connectivity modules is turning seats into interactive hubs that monitor occupant health, enhance safety, and deliver personalized comfort settings in real time.

Environmental sustainability has become a powerful catalyst for change, driving research into recycled and bio-based fabrics as well as low-emission foams. Regulatory pressures aimed at reducing vehicle weight and carbon footprints further incentivize the adoption of novel composites and manufacturing techniques. Together, these shifts are redefining how industry players approach product development and supply chain management, fostering collaboration across traditional boundaries between automakers, material scientists, and technology providers.

Examine the compounded effects of US federal tariffs on imported materials and components transforming cost structures in the passenger car seat sector

In recent years, the United States government has recalibrated its trade policy stance, extending tariffs on key raw materials and components that feed into the car seat value chain. Steel and aluminum levies introduced under Section 232 continue to ripple through procurement strategies, elevating costs for frame and support structures. Meanwhile, Section 301 tariffs targeting electronic modules and sensor technology from select trade partners are driving manufacturers to reassess sourcing origins and consider nearshoring options to mitigate expense volatility.

The cumulative effect of these measures has been a marked shift toward diversified supplier bases and increased investment in domestic manufacturing capacities for critical inputs. Companies are engaging in scenario planning to model potential tariff escalations in 2025, prioritizing flexible contracts and dual-sourcing agreements. Ultimately, the tariff environment is reshaping cost structures and prompting a strategic realignment of global supply networks to safeguard margins and maintain product innovation roadmaps.

Uncover deep segmentation-driven insights revealing how platform, vehicle type, seat configuration, material, mechanism, technology, price, and end-user impact strategies

A nuanced understanding of market segmentation reveals the breadth of opportunities and challenges across distinct product and customer dimensions. Analysis based on platform distinguishes between aftermarket channels, where customization and retrofit demand prevail, and original equipment where integration with vehicle assembly lines dictates stringent quality standards. When considering vehicle type, the outlook varies significantly between nimble coupes and hatchbacks, multifurpose MPVs, traditional sedans, and SUV platforms that increasingly prioritize premium seating configurations.

Seat type is another critical axis, with front seats commanding focus for ergonomic innovation while rear seating must balance safety compliance and modular flexibility, whether in the center position or along the sides. Material segmentation underscores diverse consumer preferences for premium leathers-from nappa to genuine variants-alongside synthetic alternatives and subcategories of knitted or woven fabrics. Mechanism choices between electric and manual adjustments influence product complexity, just as advanced seating technologies-such as carbon fiber–based heated elements, air-cell massage systems, or passive versus active ventilation-drive differentiation. Finally, price positioning spans from economy to mid-range, premium, and luxury tiers, and end-user applications bifurcate between commercial fleet operators and personal vehicle owners, each demanding tailored feature sets and service models.

This comprehensive research report categorizes the Passenger Car Seat market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform

- Vehicle Type

- Seat Type

- Material

- Mechanism

- Technology

- End User

Analyze regional dynamics across the Americas, EMEA, and Asia-Pacific that are influencing demand patterns, regulatory pressures, and supply chain configurations

Regional market dynamics underscore divergent growth trajectories and regulatory frameworks across key geographies. In the Americas, strong demand for SUVs and light trucks fuels investment in premium seating with multi-zone climate control and integrated safety sensors. Trade agreements and localized production incentives have encouraged several suppliers to expand manufacturing footprints close to major automotive hubs in North America and Brazil.

In Europe, Middle East, and Africa, stringent safety and emissions regulations coupled with rising consumer expectations for comfort and personalization are driving adoption of high-end upholstery options and advanced seat electronics. The Asia-Pacific region remains the largest volume market, with China, India, and Southeast Asia investing heavily in both OEM seating lines and emerging aftermarket trends. Rapid urbanization and rising disposable incomes are propelling demand for innovative seating solutions tailored to electrified and hybrid vehicle platforms.

This comprehensive research report examines key regions that drive the evolution of the Passenger Car Seat market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Delve into strategic moves by leading seating suppliers and automotive OEMs highlighting innovations, collaborations, and competitive positioning in the global landscape

Market leaders are leveraging strategic partnerships, targeted acquisitions, and technology alliances to secure competitive advantage. Major seating suppliers are augmenting traditional mold and foam expertise with in-house capabilities for sensor integration, software development, and data analytics. Collaboration with tier-one electronics firms is enabling seamless seat-to-vehicle network connectivity, while joint ventures with material innovators are accelerating the introduction of sustainable and lightweight components.

Automotive OEMs are meanwhile strengthening vertical integration, investing in internal seating divisions and forming long-term supply agreements to lock in capacity and control quality. Emerging players are differentiating through niche specialization in areas such as high-performance sport seating or luxury bespoke interiors. The resulting landscape is one of dynamic competition, where speed to market and depth of technological expertise are becoming as critical as traditional scale economies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Passenger Car Seat market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adient PLC

- Bharat Seats Limited

- Brose Fahrzeugteile SE & Co. KG

- C.I.E.B. Kahovec, spol. s r. o

- Camaco, LLC

- Daewon Kang Up Co., Ltd.

- EWON Comfortech Co., Ltd.

- Faurecia Group

- Franz Kiel GmbH

- Freedman Seating Company

- Gentherm Inc.

- GRL A.Ş.

- Guelph Manufacturing Group

- KARL MAYER Holding GmbH & Co. KG

- Lear Corporation

- Magna International Inc.

- NHK Spring Co., Ltd.

- Phoenix Seating Limited

- Summit Group Company

- TACHI-S ENGINEERING U.S.A. INC.

- Tata AutoComp Systems Ltd.

- Toyota Boshoku Corporation

- TS Tech Co., Ltd.

- TUNATEK OTOMOTİV LTD.

- VOGELSITZE GmbH

Actionable strategies for industry stakeholders to capitalize on growth drivers, navigate regulatory challenges, and strengthen resilience in the car seat market

To navigate this evolving environment successfully, industry stakeholders should prioritize multi-stakeholder collaboration to align design, engineering, and supply chain objectives. Forging robust partnerships with raw material suppliers and technology providers will enhance agility, enabling rapid iteration on prototype designs and swift scaling of successful innovations. Additionally, implementing flexible manufacturing systems with modular tooling will allow for seamless transitions between different vehicle programs and seating configurations.

Companies should also adopt a proactive approach to regulatory intelligence, establishing dedicated teams to monitor tariff developments and safety or environmental standards. Investing in advanced analytics and digital twin simulations can improve scenario planning and cost optimization under multiple trade and policy outcomes. Finally, building talent pipelines through partnerships with universities and technical institutes will ensure access to the specialized skills needed for next-generation seating technologies.

Understand the rigorous research methodology combining primary interviews, secondary data analysis, and validation to ensure comprehensive market insights

This report’s findings are grounded in a rigorous research framework that combines primary and secondary methodologies to ensure comprehensive market coverage and insight accuracy. Primary research involved in-depth interviews with key executives from automotive OEMs, seating component suppliers, and materials producers, supplemented by discussions with regulatory experts and industry associations. These interactions provided nuanced perspectives on strategic priorities, innovation roadmaps, and policy impacts.

Secondary research encompassed an extensive review of industry publications, trade journals, patent filings, and relevant government documents to contextualize trends and validate primary data. Proprietary databases, technical white papers, and financial reports were triangulated to corroborate qualitative insights with quantitative evidence. Finally, data normalization and validation processes ensured consistency across regions and segments, providing stakeholders with a reliable foundation for strategic planning and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Passenger Car Seat market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Passenger Car Seat Market, by Platform

- Passenger Car Seat Market, by Vehicle Type

- Passenger Car Seat Market, by Seat Type

- Passenger Car Seat Market, by Material

- Passenger Car Seat Market, by Mechanism

- Passenger Car Seat Market, by Technology

- Passenger Car Seat Market, by End User

- Passenger Car Seat Market, by Region

- Passenger Car Seat Market, by Group

- Passenger Car Seat Market, by Country

- United States Passenger Car Seat Market

- China Passenger Car Seat Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2385 ]

Synthesize the executive summary’s core findings to highlight pivotal market shifts, stakeholder implications, and future trajectories for automotive seating

In summary, the passenger car seat market is at the nexus of technological innovation, shifting consumer priorities, and evolving regulatory landscapes. The interplay between sustainability mandates, electrified powertrains, and human-centric design is catalyzing a wave of product and process transformations. Market players that embrace digital integration and flexible manufacturing, while maintaining a keen eye on policy developments, will be best positioned to capture emerging opportunities.

As competitive dynamics intensify, differentiation through advanced seating technologies and strategic supply chain configurations will define the leaders. This executive summary encapsulates the essential insights needed to navigate complexities and drive growth. The subsequent sections of the full report offer a deeper dive into data-driven analyses and case studies that illustrate best practices and success factors shaping the automotive seating landscape.

Seize the opportunity to elevate your decisions with exclusive research insights by connecting with Ketan Rohom, expert Associate Director in Sales & Marketing

Take the next step toward informed decision-making and strategic growth today by engaging directly with Ketan Rohom, Associate Director, Sales & Marketing, who can provide personalized support and valuable insights. Secure a tailored walkthrough of the comprehensive report to uncover actionable data that addresses your unique challenges and identifies high-impact opportunities. Empower your stakeholders with the clarity they need to navigate market complexities with confidence and make decisions grounded in authoritative research. Reach out now to ensure your organization capitalizes on emerging trends and maintains a competitive edge.

- How big is the Passenger Car Seat Market?

- What is the Passenger Car Seat Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?