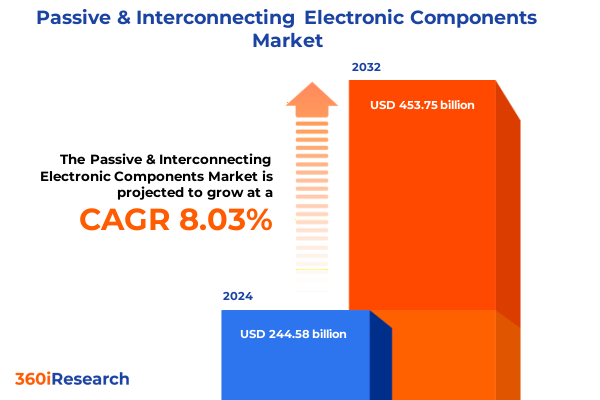

The Passive & Interconnecting Electronic Components Market size was estimated at USD 78.69 billion in 2025 and expected to reach USD 82.81 billion in 2026, at a CAGR of 5.52% to reach USD 114.66 billion by 2032.

An introduction to the significance and evolving role of passive and interconnecting electronic components within industrial and consumer technology platforms

The realm of passive and interconnecting electronic components forms the backbone of virtually every modern electronic system. As foundational elements, capacitors, resistors, inductors, connectors, and switches enable signal integrity, power management, and mechanical interfacing that collectively sustain the performance and reliability of high-speed communications networks, automotive electronics, medical devices, and industrial control systems. While these components are often overshadowed by their active counterparts, their role is indispensable, with incremental innovations driving efficiency gains, miniaturization, and cost reductions across countless end-user applications.

Against a backdrop of accelerated digital transformation and ever-tightening performance specifications, the passive and interconnecting components sector has become a critical focal point for design engineers and procurement teams alike. Design cycles now prioritize component selection based not only on electrical parameters, but also on thermal stability, material composition, environmental compliance, and life-cycle sustainability. Annual iterations in dielectric materials and packaging formats have blurred the lines between conventional passive elements and emerging smart capacitors or integrated filters, unlocking new avenues for system-level improvement.

This executive summary establishes the scope of our analysis by first introducing the defining characteristics and market significance of passive and interconnecting electronic components. Building on that foundation, we explore the transformative shifts reshaping the industry, then assess the cumulative impact of United States tariffs implemented through 2025. Subsequent sections unpack segmentation insights, regional dynamics, and competitive positioning, culminating in actionable recommendations designed to inform strategic decision-making. Through rigorous methodology and expert validation, this report delivers a comprehensive lens on a sector poised for continued evolution and critical technological innovation.

Examining the dramatic technological breakthroughs and evolving design paradigms that are redefining passive and interconnecting electronic component development and applications

In recent years, the passive and interconnecting components marketplace has experienced unprecedented transformation driven by a confluence of technological breakthroughs and shifting end-user requirements. Rapid advancements in material science have yielded novel dielectric compositions and polymer blends that elevate thermal tolerance and voltage endurance while reducing form factors. At the same time, evolving design paradigms in sectors such as 5G communications and electric vehicles have demanded components with ever-lower parasitic values and enhanced high-frequency performance.

Digitalization has further accelerated change. The integration of advanced data analytics and modeling tools into component design workflows enables predictive optimization of parasitic parameters, leading to higher yields and shorter development cycles. Moreover, the widespread adoption of system-on-chip and heterogeneous integration architectures has intensified demand for ultra-miniature passive components and high-density interconnect solutions. These trends underscore a fundamental shift from generic parts sourcing toward a collaborative co-development model in which suppliers contribute proprietary design expertise early in the system architecture phase.

As the industry continues to evolve, sustainability considerations have grown in importance. Regulatory authorities and end users are increasingly evaluating components based on recyclability, lead-free compliance, and carbon footprint metrics. This regulatory impetus catalyzes renewed focus on material selection and supply chain transparency. Looking ahead, the interplay between smart packaging technologies, additive manufacturing, and digital twins promises to redefine how passive and interconnecting elements are conceptualized, engineered, and integrated into next-generation electronic platforms.

Analyzing the comprehensive ripple effects of 2025 United States tariffs on supply chains, cost structures, and strategic sourcing for passive electronic components

The cumulative imposition of United States tariffs through 2025 has exerted profound influence on the passive and interconnecting component supply chain and cost structure. Since the initial levy targeting select component imports, procurement teams have navigated fluctuating duty rates, prompting strategic realignments in sourcing footprints. While localized production in Mexico and Southeast Asia has mitigated some cost pressures, manufacturers continue to encounter steep logistical and compliance burdens associated with preferential origin verification and anti-dumping provisions.

These tariff dynamics have upended traditional supplier relationships. Design engineers and buyers have been compelled to reevaluate long-standing vendor partnerships, with many opting to qualify second-tier suppliers in lower-tariff regions or negotiate dual-sourcing agreements to hedge against future escalations. Simultaneously, tier-one global manufacturers have accelerated capital investments in domestic production facilities to secure tariff immunity, though these projects often face protracted lead times and significant up-front costs.

Despite these challenges, the tariff environment has spurred innovation in supply chain management. Advanced analytics platforms now enable real-time monitoring of duty exposure and landed costs, while collaborative customs brokerage solutions streamline documentation workflows. As duty rates stabilize, industry participants are poised to capitalize on insights gleaned during this period of volatility, refining strategic sourcing frameworks, and fortifying resilience against future geopolitical disruptions.

Unveiling critical segmentation insights to understand market dynamics across component types, mounting methods and material, frequency, temperature and end-use applications

Understanding the market through a lens of detailed segmentation reveals nuanced demand patterns and strategic imperatives for component manufacturers and distributors. When viewed by component type, capacitors dominate in terms of diversity and application breadth, connectors offer critical pathways for signal integrity, inductors and transformers underpin power conversion circuits, resistors remain fundamental for voltage and current control, and switches and relays facilitate system-level protection and control. These distinctions guide prioritization of R&D resources and inform portfolio balancing strategies.

Mounting type segmentation further illuminates the divide between surface mount devices that cater to high-density, automated assembly processes and through-hole variants that remain vital for power electronics and ruggedized applications. Meanwhile, dielectric material choices-from aluminum electrolytic and ceramic to polymer, supercapacitor, and tantalum formulations-drive thermal and frequency performance, shaping selections for everything from consumer gadgets to aerospace systems.

Frequency range delineations distinguish low-frequency parts optimized for power management and signal conditioning from radio frequency products critical to 5G infrastructure and radar platforms. Likewise, operating temperature segmentation underscores the need for high-temperature components in industrial and automotive under-hood environments versus standard variants suited for consumer and telecom hardware. When classification extends to end-user industries such as aerospace, automotive, consumer electronics, energy, healthcare, industrial, and telecommunications, further clarity emerges around prioritizing certification requirements and tailored value propositions. Finally, application-based segmentation across circuit protection, EMI suppression, power management, and signal filtering highlights cross-cutting functionality that transcends discrete end markets, enabling strategic alignment of product innovation with evolving system-level architectures.

This comprehensive research report categorizes the Passive & Interconnecting Electronic Components market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Category

- Mounting Type

- Dielectric Material

- Frequency Range

- Application Area

- End User Industry

- Distribution Channel

Mapping regional performance and growth prospects for passive and interconnecting components across the Americas, EMEA, and Asia-Pacific technology landscapes

Regional analysis exposes the unique dynamics shaping passive and interconnecting component demand across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, robust automotive and aerospace sectors have sustained steady uptake of advanced capacitors and connectors, while reshoring initiatives driven by supply chain risk management have spurred capacity expansion in Mexico and the southern United States. Ongoing investments in renewable energy and microgrid deployments also underpin growth in power management components, even as tariff policy introduces periodic uncertainty.

Across Europe, Middle East & Africa, stringent regulatory standards and sustainability mandates have elevated the importance of RoHS compliance, REACH registration, and circular design principles. Telecommunications modernization projects in the Middle East and 5G network rollouts in western Europe generate demand for high-performance radio frequency filters and EMI suppression modules. Meanwhile, industrial automation expansion in North Africa and the Levant fuels uptake of ruggedized resistors and inductors designed for harsh operating conditions.

Asia-Pacific remains the epicenter of global manufacturing, with China, Japan, South Korea, and Taiwan leading in production capacity and technological prowess. Rapid electrification in India and Southeast Asia drives need for high-temperature power management capacitors, while ongoing semiconductor industry investments in Japan and Taiwan reinforce demand for precision connectors and low-loss passive components. Collaborative joint ventures and technology transfers across the region continue to optimize cost structures and accelerate time to market.

This comprehensive research report examines key regions that drive the evolution of the Passive & Interconnecting Electronic Components market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting strategic positioning and competitive strengths of leading manufacturers and innovators driving the passive and interconnecting electronic components industry forward

A closer look at leading companies underscores how strategic positioning and innovation investments differentiate market frontrunners from the broader competitive field. Established manufacturers with integrated global footprints leverage high-volume fabrication capabilities and advanced materials science expertise to deliver broad product portfolios that cater to multiple end markets simultaneously. These organizations often prioritize cross-divisional collaboration, enabling rapid adaptation of automotive-grade technologies for use in industrial or consumer electronics segments.

Mid-tier players have carved niches by focusing on specialized applications, such as ultra-low-loss RF inductors or high-reliability aerospace capacitors, reinforcing their competitive edge through deep domain knowledge and targeted certification credentials. These firms frequently partner with engineering services providers and contract manufacturers to scale production efficiently while maintaining strict cost and quality controls.

Smaller innovators are disrupting traditional value chains by introducing hybrid component-packaging solutions that integrate passive elements directly into printed circuit boards or flexible substrates. Their agile R&D teams harness digital simulation tools and additive manufacturing techniques to accelerate development cycles, creating new benchmarks for miniaturization and performance. Across the competitive spectrum, leading companies are unifying digital transformation efforts with sustainability roadmaps, demonstrating that strategic alignment of technological advancement and environmental stewardship can yield enduring competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Passive & Interconnecting Electronic Components market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ABB Ltd.

- Amphenol Corporation

- Analog Devices, Inc.

- Bourns, Inc.

- Broadcom Inc.

- Fujitsu Limited

- GE Vernova Group

- Hirose Electric Co., Ltd.

- Hitachi Ltd.

- Infineon Technologies AG

- Intel Corporation

- Johanson Technology, Inc.

- KOA Corporation

- Kyocera Corporation

- Murata Manufacturing Co., Ltd.

- Nichicon Corporation

- Nippon Chemi-Con Corporation

- NXP Semiconductors N.V.

- Ohmite Manufacturing Company

- ROHM Co., Ltd

- Samsung Electronics Co., Ltd.

- Samwha Capacitor Group

- Sumida Corporation

- Taiyo Yuden Co., Ltd.

- TDK Corporation

- TE Connectivity Ltd.

- TT Electronics PLC

- Vishay Intertechnology, Inc.

- Yageo Corporation

Providing targeted, actionable recommendations to equip industry leaders with strategies for innovation, supply chain optimization and market leadership in 2025 and beyond

To thrive amid escalating cost pressures, regulatory complexity, and technological disruption, industry leaders must adopt a multifaceted strategic approach. First, optimizing supplier networks through a balanced blend of nearshore and onshore sourcing will alleviate tariff exposure while preserving access to critical manufacturing capacity. Concurrently, implementing advanced analytics to monitor supply chain risk and landed cost fluctuations will yield actionable insights for timely procurement decisions.

Investing in next-generation material platforms and packaging methodologies is also essential. By collaborating with dielectric and polymer specialists, companies can pioneer components that meet stricter performance and sustainability mandates. Additionally, aligning R&D priorities with emerging system-level trends-such as renewable energy storage, autonomous vehicles, and next-generation wireless infrastructure-will ensure portfolio relevance and market differentiation.

Leadership teams should further cultivate strategic partnerships across the ecosystem, including co-development agreements with OEMs and joint ventures with manufacturing service providers. This collaborative stance accelerates time to market and shares the burden of capital investment for advanced production facilities. Finally, integrating lifecycle assessment frameworks and circular economy principles into product design and end-of-life recovery strategies will not only satisfy regulatory demands but also foster brand reputation among environmentally conscious customers.

Detailing the comprehensive research methodology, data collection processes, and analytical approaches underpinning this passive and interconnecting electronic components study

The insights presented in this report derive from a comprehensive research methodology that integrates both primary and secondary data sources. We conducted in-depth interviews with design engineers, procurement specialists, and senior executives at leading component manufacturers to capture real-world perspectives on emerging requirements and procurement strategies. These qualitative inputs were complemented by secondary research encompassing industry publications, regulatory filings, trade association reports, and advanced analytics from proprietary databases.

To ensure analytical rigor, we employed data triangulation techniques, cross-referencing supplier shipment records, customs data, and financial reports to validate market patterns. Segmentation frameworks were defined using a combination of bottom-up sizing-aggregating component shipments by type and application-and top-down analysis through end-user demand models. Scenario analysis and sensitivity testing provided additional confidence in the robustness of identified trends and strategic inferences.

Our methodological protocol was overseen by a dedicated quality assurance team, which applied strict peer review and consistency checks to all quantitative and qualitative findings. This structured approach guarantees that the report’s conclusions accurately reflect current industry dynamics and provide a reliable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Passive & Interconnecting Electronic Components market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Passive & Interconnecting Electronic Components Market, by Component Category

- Passive & Interconnecting Electronic Components Market, by Mounting Type

- Passive & Interconnecting Electronic Components Market, by Dielectric Material

- Passive & Interconnecting Electronic Components Market, by Frequency Range

- Passive & Interconnecting Electronic Components Market, by Application Area

- Passive & Interconnecting Electronic Components Market, by End User Industry

- Passive & Interconnecting Electronic Components Market, by Distribution Channel

- Passive & Interconnecting Electronic Components Market, by Region

- Passive & Interconnecting Electronic Components Market, by Group

- Passive & Interconnecting Electronic Components Market, by Country

- United States Passive & Interconnecting Electronic Components Market

- China Passive & Interconnecting Electronic Components Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2862 ]

Synthesizing key findings and strategic implications to conclude insights on the evolving landscape of passive and interconnecting electronic components industry

The passive and interconnecting electronic components industry stands at a pivotal juncture where technological innovation, regulatory pressures, and global trade dynamics intersect. Foundational advances in dielectric materials and packaging techniques are enabling smaller, more efficient components that meet the demanding performance thresholds of next-generation electronics. Simultaneously, tariff-driven supply chain recalibrations have underscored the value of resilient sourcing strategies and advanced cost-monitoring tools.

Segmentation insights reveal that targeting growth in specialized end-user industries such as automotive electrification, aerospace avionics, and high-speed telecommunications will require tailored product portfolios and certification credentials. Regional analysis confirms that while Asia-Pacific maintains leadership in volume manufacturing, opportunities abound in the Americas and EMEA for capacity expansion and compliance-driven value propositions. Competitive positioning varies across established global players, niche specialists, and agile innovators, each leveraging unique strengths to capture emerging market niches.

By synthesizing these findings, it becomes clear that companies who proactively align their R&D investments, supply chain configurations, and sustainability initiatives will be best positioned to capitalize on the evolving landscape. Strategic collaboration, digital transformation, and lifecycle optimization emerge as universal imperatives for securing a sustainable competitive advantage in this essential industry segment.

Engage with Associate Director Ketan Rohom to access the full passive and interconnecting electronic components market research report and capitalize on strategic insights today

If you seek to gain a competitive edge through in-depth market intelligence, reach out directly to Associate Director, Sales & Marketing, Ketan Rohom. His expertise will guide you to the tailored data sets and strategic frameworks required to navigate cost volatility, regulatory shifts, and emerging technology paradigms. By engaging with Ketan, you will secure advanced access to proprietary insights on tariff impacts, segmentation nuances, and regional growth drivers. His support ensures your organization can act decisively, whether optimizing global supply chains or accelerating product development in high-growth sectors. Connect today to request a personalized briefing and explore customizable research packages designed to align with your strategic objectives and investment priorities

- How big is the Passive & Interconnecting Electronic Components Market?

- What is the Passive & Interconnecting Electronic Components Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?