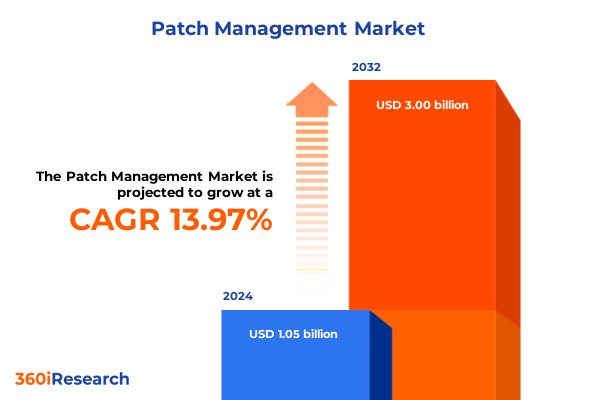

The Patch Management Market size was estimated at USD 1.20 billion in 2025 and expected to reach USD 1.35 billion in 2026, at a CAGR of 13.92% to reach USD 3.00 billion by 2032.

Exploring the Evolving Dynamics of Patch Management to Enhance Cybersecurity Resilience and Streamline Enterprise Operations with Confidence

Patch management has emerged as a foundational pillar for any organization seeking to maintain a resilient cybersecurity posture amid rapidly evolving threat landscapes. Effective patch management not only safeguards critical infrastructure from known vulnerabilities but also underpins operational continuity by preempting system downtime and compliance breaches. Over the past decade, the proliferation of cloud environments, the acceleration of digital transformation initiatives, and the rise of hybrid workplaces have introduced new complexities that demand a strategic, centralized approach to identifying, testing, and deploying patches at scale. In this context, stakeholders from IT leadership to security operations must collaborate seamlessly to ensure that patch lifecycles are streamlined without disrupting business processes. Consequently, organizations are investing in integrated tools and services designed to automate patch assessments, prioritize remediation efforts, and deliver real-time reporting across diverse technology stacks. This introduction sets the stage for a systematic exploration of how disruptive forces, policy shifts, segmentation nuances, and regional dynamics are collectively reshaping the patch management ecosystem, offering decision-makers the insights they need to strengthen defenses and optimize resource allocation.

Uncovering the Technological and Strategic Paradigm Shifts Redefining Patch Management in an Era of Accelerated Threat Evolution

Over recent years, the trajectory of patch management has been defined by profound shifts in technology architecture and cyber risk strategies. The transition from monolithic on premises infrastructures to distributed, microservices-based applications running across public, private, and hybrid clouds has necessitated reimagining patch governance models. Organizations are increasingly integrating vulnerability assessment tools with patch deployment workflows to create closed-loop systems that rapidly detect exposures and automate remediation. Moreover, the advent of zero-trust frameworks has elevated the importance of continuous patch validation, aligning remediation efforts with strict identity and access management controls. This technological revolution has coincided with a growing recognition that patch processes must be measurable and aligned with broader cybersecurity metrics, driving the adoption of analytics-driven dashboards that quantify risk reduction and time-to-remediation benchmarks. Alongside these tech-centric changes, strategic paradigms have shifted as executives prioritize resilience and cyber insurance considerations, prompting deeper collaboration between IT, risk management, and finance functions. These transformative shifts collectively underscore how dynamic forces are redefining best practices in patch management, paving the way for more agile, risk-aware, and collaborative frameworks.

Analyzing the Ripple Effects of 2025 United States Tariffs on the Global Patch Management Ecosystem and Supply Chain Continuity

The imposition of new tariffs by the United States in 2025 has introduced additional considerations for patch management vendors and end users that extend beyond the cost of hardware components. As tariffs have escalated duties on imported semiconductor parts and specialized tooling equipment, global providers have experienced increased pressure on supply chains, leading to longer lead times for critical patch deployment devices and network appliances. In response, many service providers have reevaluated sourcing strategies, shifting production toward in-country or near-shore facilities to mitigate tariff impacts and ensure consistent delivery timelines. These adjustments have also driven a recalibration of pricing models for both consulting engagements and managed services, as vendors incorporate tariff-related surcharges and logistics contingencies into contractual frameworks. Furthermore, the tariff environment has spurred innovation in virtual patching capabilities, with organizations opting for software-based mitigation techniques that reduce dependency on physical updates. As a result, while the cumulative tariff landscape has introduced short-term cost pressures, it has simultaneously accelerated the adoption of virtualization and software-centric patching strategies, ultimately fostering greater resilience and flexibility within the patch management ecosystem.

Decoding Critical Segmentation Perspectives to Illuminate How Components Platforms Deployment Modes Organization Sizes and Industries Drive Market Dynamics

An in-depth understanding of market segmentation reveals how the patch management landscape is influenced by multiple intersecting dimensions. When examined by component, the landscape encompasses services and tools, with services further categorized into consulting services and managed services while tools are differentiated as patch deployment tools and vulnerability assessment tools. This distinction underscores how organizations balance expertise-driven advisory engagements against turnkey software platforms for automated remediation. Platform segmentation highlights the diverse requirements of Linux, Mac, and Windows environments, each demanding unique update cycles and compatibility considerations that drive toolset specialization. The deployment mode dimension contrasts cloud and on-premises implementations, with cloud further subdividing into private cloud and public cloud models, reflecting varying preferences for centralized control versus pay-as-you-grow scalability. Organization size segmentation differentiates large enterprises from small and medium enterprises, signaling how resource availability and risk tolerance inform patching cadence and tool investments. Finally, the end-use industry classification spans banking, financial services and insurance, healthcare, IT and telecom, manufacturing, and retail, with manufacturing further detailed into automotive and electronics, demonstrating how industry-specific regulatory and operational demands shape patch priorities and service level agreements. By weaving these segmentation perspectives together, decision-makers can tailor strategies that align technical capabilities with organizational context and risk appetite.

This comprehensive research report categorizes the Patch Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Organization Size

- End Use Industry

Mapping Regional Variations and Growth Drivers Across the Americas Europe Middle East Africa and Asia-Pacific Patch Management Markets

Regional analysis of the patch management market brings to light stark variations driven by regulatory frameworks, technological maturity, and local cybersecurity initiatives. In the Americas, progressive data protection regulations and a high concentration of multinational headquarters have propelled rapid adoption of centralized patch automation and managed services. North American compliance mandates in sectors such as finance and healthcare necessitate rigorous patch reporting, while strategic digital transformation programs in Latin America are fostering incremental investments in integrated vulnerability engines. Across Europe, the Middle East and Africa, regulatory landscapes such as GDPR, NIS2, and regional data-sovereignty laws compel organizations to adopt localized patch governance models, with heightened demand in European financial hubs. In the Middle East and Africa, public sector modernization and infrastructure digitization initiatives are creating nascent but fast-growing markets, often supported by international partnerships. The Asia-Pacific region exhibits diverse maturity levels: advanced markets such as Japan, South Korea, and Australia are leading in automated orchestration and cross-platform tool integration, whereas emerging economies are prioritizing fundamental endpoint hardening and cloud-native patch approaches. These regional distinctions underscore how economic drivers, legislative imperatives, and infrastructure readiness collectively shape tailored patch management strategies.

This comprehensive research report examines key regions that drive the evolution of the Patch Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborations Shaping the Competitive Patch Management Market Landscape Globally

The competitive patch management landscape is characterized by the presence of established technology conglomerates, specialized security vendors, and agile niche players. Global leaders invest heavily in R&D to enhance automation capabilities, build ecosystem partnerships, and deliver unified platforms that span asset discovery, vulnerability prioritization, and patch deployment. At the same time, emerging vendors are differentiating through modular architectures, AI-driven threat intelligence integration, and lightweight agents optimized for hybrid cloud deployments. Strategic collaborations between service consultancies and platform innovators are also notable, enabling bundled offerings that combine expert advisory with turnkey managed services. Furthermore, merger and acquisition activity remains robust, as industry giants seek to bolster security portfolios through targeted acquisitions of specialists in vulnerability assessment and cloud security orchestration. Meanwhile, mid-tier and regional players tailor solutions to local compliance regimes and sector-specific workflows, forging alliances with channel partners to deliver customized, end-to-end patch services. Collectively, these competitive dynamics highlight an ecosystem in flux, where innovation, partnerships, and strategic consolidation are reshaping vendor positioning and customer options.

This comprehensive research report delivers an in-depth overview of the principal market players in the Patch Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acronis International GmbH

- Action1 Corp.

- Anakage, Inc.

- Atera Networks Ltd.

- Automox, Inc.

- ConnectWise, LLC

- Datto, Inc.

- GFI Software, Inc.

- HCL Technologies Limited

- Ivanti, Inc.

- JumpCloud, Inc.

- Kaseya Limited

- ManageEngine

- Microsoft Corporation

- NinjaRMM, Inc.

- Qualys, Inc.

- SecPod Technologies Pvt. Ltd.

- SolarWinds Corporation

- SyncroMSP, Inc.

- Syxsense, Inc.

Strategic Imperatives and Tactical Guidelines for Industry Leaders to Elevate Patch Management Practices and Mitigate Cyber Risk Effectively

To navigate the complexities of modern patch management, industry leaders should adopt a multi-pronged strategy that emphasizes automation, risk prioritization, and cross-functional alignment. First, organizations must invest in integrated platforms that couple vulnerability assessment with patch deployment workflows to eliminate manual handoffs and accelerate remediation cycles. Next, adopting risk-based prioritization frameworks enables teams to focus resources on high-impact vulnerabilities and reduce exposure windows effectively. It is equally critical to establish governance councils that bring together IT operations, security, and business stakeholders to align patch policies with organizational risk appetites and compliance mandates. Leaders should also explore advanced analytics and machine learning capabilities to predict patch failure rates and optimize scheduling around critical business processes. Embracing a hybrid deployment strategy that blends on-premises control for sensitive workloads with cloud-native flexibility for scalable environments can enhance resilience and cost efficiency. Finally, fostering a culture of continuous improvement through regular tabletop exercises, incident post-mortems, and security training ensures that both technical and non-technical teams understand their roles in maintaining an effective patch management regime.

Detailing the Comprehensive Research Framework Integrating Primary and Secondary Approaches to Ensure Rigor and Reliability in Market Analysis

This study leverages a balanced research methodology combining both primary and secondary approaches to ensure comprehensive, reliable insights. The primary research phase included in-depth interviews with IT and security leaders across key industries, alongside surveys of practitioners responsible for patch management operations in both enterprise and mid-market organizations. These engagements provided firsthand perspectives on pain points, tool preferences, and strategic priorities. Secondary research encompassed a thorough review of industry publications, regulatory documentation, vendor white papers, and public financial reports, complemented by analysis of relevant academic literature in cybersecurity risk management. Data triangulation was applied to validate findings, integrating qualitative inputs with quantitative metrics to refine segmentation frameworks and identify emerging trends. The research also incorporated vendor profiling through product demonstrations, technical datasheets, and partnership announcements to map competitive landscapes. Rigorous cross-verification methods and expert panels were employed throughout to eliminate bias and ensure that conclusions are both actionable and grounded in real-world practice.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Patch Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Patch Management Market, by Component

- Patch Management Market, by Deployment Mode

- Patch Management Market, by Organization Size

- Patch Management Market, by End Use Industry

- Patch Management Market, by Region

- Patch Management Market, by Group

- Patch Management Market, by Country

- United States Patch Management Market

- China Patch Management Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Summarizing Key Findings and Strategic Takeaways for Decision Makers to Harness Patch Management Insights for Future Preparedness and Growth

The analysis presented herein underscores the critical role of patch management as a linchpin in modern cybersecurity and operational resilience. Transformative shifts, from cloud-native architectures to zero-trust paradigms, have elevated the sophistication of remediation frameworks, while evolving policy landscapes and tariff structures have reshaped supply chains and pricing dynamics. Segmentation insights reveal how component choices, platform diversity, deployment modes, organizational size, and industry verticals each impart unique requirements and market drivers. Regional considerations further spotlight the need for compliance-aligned governance and infrastructure-sensitive strategies. Competitive analysis highlights an ecosystem marked by rapid innovation, strategic alliances, and consolidation as vendors vie to deliver end-to-end solutions. Collectively, these findings offer a roadmap for decision-makers to tailor patch management approaches that align technical capabilities with regulatory obligations, risk tolerance, and business imperatives. By synthesizing these insights, organizations can enhance their security posture, optimize resource allocation, and position themselves for continuous adaptation in an increasingly complex threat environment.

Engage with Ketan Rohom to Unlock Comprehensive Market Intelligence and Drive Informed Decisions in Patch Management

To access the full depth of analysis, granular data, and actionable insights presented in this report, reach out directly to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Ketan brings extensive expertise in cybersecurity market research and can provide tailored guidance to ensure you obtain the specific modules and data that align with your strategic priorities. Whether you are seeking detailed regional trends, competitive benchmarking, or in-depth segmentation profiles, Ketan will facilitate a seamless procurement process and answer any queries regarding customization, licensing, or delivery formats. Engage with Ketan today to transform these insights into a strategic advantage for your organization and accelerate your patch management initiatives.

- How big is the Patch Management Market?

- What is the Patch Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?