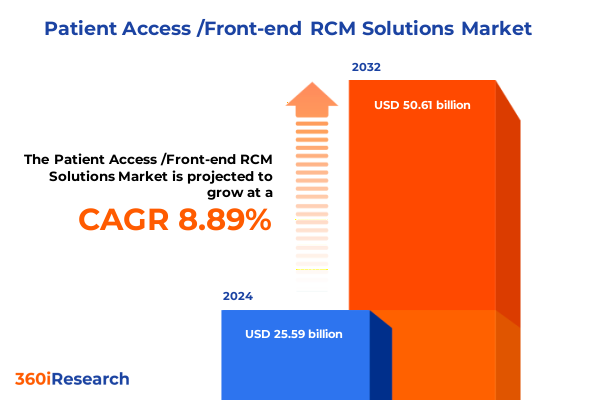

The Patient Access /Front-end RCM Solutions Market size was estimated at USD 27.68 billion in 2025 and expected to reach USD 29.93 billion in 2026, at a CAGR of 9.00% to reach USD 50.61 billion by 2032.

Harnessing Patient Access Front-End Revenue Cycle Management to Drive Operational Efficiency and Enhanced Patient Satisfaction

The ever-evolving healthcare reimbursement landscape demands innovative front-end revenue cycle management strategies to sustain margin integrity and enhance patient engagement. Patient access functions now sit at the nexus of clinical operations and financial performance, requiring a seamless interplay between registration, eligibility verification, estimate generation, scheduling, and data analytics. Against a backdrop of rising patient financial responsibility and regulatory shifts, healthcare providers and payers alike are under mounting pressure to streamline processes, reduce denials, and deliver transparent billing experiences.

This executive summary offers a strategic overview of the patient access/front-end revenue cycle management solutions market, highlighting pivotal trends that are reshaping organizational priorities. By examining technological advancements, shifting regulatory mandates, and evolving patient expectations, this report lays the groundwork for stakeholders to understand the critical drivers of innovation and pinpoint opportunities for optimization. Through a lens that balances operational efficiency with exceptional patient experience, decision-makers gain clarity on how to align investments in digital tools, process redesign, and workforce enablement to achieve sustainable performance improvements.

Unraveling the Digital Transformation and AI-Driven Evolution Shaping Patient Front-End Revenue Cycle Processes in Healthcare Delivery

Healthcare organizations are witnessing a profound transformation driven by the convergence of digital technologies, data analytics, and patient-centric approaches. Artificial intelligence and machine learning algorithms have moved beyond basic automation to deliver predictive insights in insurance eligibility verification and denial prevention, empowering teams to proactively address potential revenue leaks. Additionally, the integration of natural language processing within registration workflows has optimized patient data capture, reducing manual entry errors and accelerating throughput.

Telehealth expansion and virtual care models are further reshaping patient access operations by decentralizing scheduling and eligibility checks. Systems that once resided solely within hospital portals are now being extended to mobile applications and third-party platforms, enabling patients to manage appointments, co-pay estimates, and out-of-pocket liabilities in real time. As a result, front-end RCM solutions must evolve to support omnichannel engagements, bridging the gap between digital self-service and in-person registration while maintaining data integrity and compliance with evolving privacy regulations.

Moreover, the industry’s shift toward value-based payment models places additional emphasis on revenue cycle resilience. Under alternative reimbursement arrangements, accurate patient identification, benefit eligibility confirmation, and transparent financial counseling contribute directly to clinical quality metrics and provider reimbursement. Thus, the front-end revenue cycle is no longer solely transactional; it functions as a strategic touchpoint for fostering patient loyalty and delivering cost-effective care.

Assessing the Aggregate Consequences of Newly Enacted United States Tariffs on Healthcare Technology Supply Chains and RCM Front-End Operations

With the introduction of new tariff measures on imported medical devices, software tools, and hardware components, the cumulative economic impact on patient access/front-end RCM operations has grown more pronounced in 2025. Providers are now encountering increased costs for critical infrastructure-ranging from registration kiosks to advanced analytics platforms-which in turn may redistribute IT budgets and slow planned system upgrades. Consequently, front-end RCM leaders are reevaluating vendor partnerships and exploring alternative sourcing strategies to mitigate margin pressure.

In parallel, heightened import duties on semiconductor components are driving up prices for on-premise deployment models that rely on proprietary hardware. This has catalyzed a noticeable pivot among healthcare organizations toward cloud-first architectures, where scalability and cost predictability offer a buffer against fluctuating tariffs. The shift to cloud-based front-end solutions also reduces the reliance on localized servers and network equipment, thereby insulating operations from ongoing tariff-related volatility.

Furthermore, the tariff environment has prompted a reevaluation of software licensing and implementation services procurement. As implementation costs rise, providers are increasingly adopting modular software suites that allow phased rollouts-minimizing upfront capital expenditure and enabling incremental value realization. This cumulative impact underscores the necessity for agile procurement frameworks and deeper collaboration between supply chain, IT, and revenue cycle teams to navigate the ripple effects of trade policies.

Exploring Critical Insights from Component Based End User Deployment and Delivery Mode Segmentation in Patient Access Front-End Solutions

Insight into component segmentation reveals that charge capture, streamlined through mobile-enabled capture tools, is gaining traction as providers seek to accelerate clean claims submission. Claim scrubbing functionality, augmented by advanced rule engines, is reducing the incidence of denials even before claims leave the front-end system. Meanwhile, robust denial management modules, embedded within the registration continuum, are facilitating earlier intervention and increasing appeal success rates. Patient payment estimation tools have become indispensable for financial counseling, delivering clarity on expected liabilities and supporting point-of-service collections. Registration and eligibility verification workflows now often leverage real-time connectivity with payer systems to validate benefits and reduce authorization delays. Reporting and analytics dashboards provide operational leaders with near real-time performance visibility, enabling continuous process improvement. Scheduling solutions, which integrate capacity management and patient preferences, are optimizing resource utilization and reducing no-shows.

End-user segmentation provides further granularity on solution adoption patterns across ambulatory surgery centers, where streamlined scheduling and eligibility checks directly influence surgical throughput. Clinics benefit from cloud-enabled registration platforms that scale with fluctuating patient volumes, while diagnostic laboratories prioritize interfaces that integrate with electronic data interchange (EDI) for rapid claim adjudication. Hospitals deploy comprehensive front-end suites to unify registration, estimate generation, and patient engagement across multiple service lines. Independent physician practices, facing resource constraints, increasingly opt for modular standalone modules-rather than full integrated suites-to address specific pain points without extensive customization.

Deployment segmentation highlights a clear migration toward cloud-based front-end RCM solutions. While hybrid models support organizations transitioning from legacy on-premise systems, pure on-premise deployments are increasingly limited to large integrated delivery networks with stringent data sovereignty requirements. The delivery mode segmentation underscores the evolving dynamics between software and services. Services, encompassing implementation, support, and training, remain critical for driving user adoption and system optimization. Within the software category, integrated suites deliver end-to-end automation, whereas standalone modules offer targeted functionality that can be deployed rapidly to address high-priority use cases.

This comprehensive research report categorizes the Patient Access /Front-end RCM Solutions market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Delivery Mode

- Deployment

- End User

Mapping Regional Dynamics and Growth Drivers across Americas Europe Middle East Africa and Asia Pacific in Front-End RCM Patient Access Solutions

Regional analysis in the Americas highlights North America as an early adopter of AI-driven eligibility verification and predictive patient payment estimation tools. Regulatory incentives aimed at improving patient transparency have accelerated investments in cloud-native platforms, while Latin American markets are witnessing gradual uptake of front-end RCM solutions as healthcare digitization initiatives gain momentum. Cross-border collaborations are enabling providers in the region to leverage shared service models, catalyzing cost efficiencies and expedited technology adoption cycles.

In Europe, Middle East & Africa (EMEA), the front-end revenue cycle market is being shaped by stringent data privacy frameworks and diverse payer systems. Western European nations are emphasizing patient-centric portals and self-service registration as part of broader digital health strategies. Meanwhile, the Middle East is investing heavily in healthcare infrastructure modernization, with a focus on integrated registration and scheduling solutions that support burgeoning medical tourism. In Africa, pilot programs for mobile-enabled patient access workflows are laying the groundwork for scalable digital identity verification and eligibility screening, often in collaboration with government-led health initiatives.

Asia-Pacific registers a heterogeneous landscape, with mature markets like Australia and Japan advancing cloud-based RCM adoption through national digital health blueprints. Southeast Asian countries are emerging as high-growth arenas for standalone modules, particularly in scheduling and payment estimation, driven by the rise of private clinic networks. India and China, with their large patient populations and rapid digitalization efforts, are exploring AI-driven registration and analytics solutions to streamline operations across vast hospital systems. Collectively, the region’s diversity underscores the need for flexible deployment options and multi-language support within front-end RCM offerings.

This comprehensive research report examines key regions that drive the evolution of the Patient Access /Front-end RCM Solutions market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Innovative Leadership and Competitive Strategies of Prominent Companies Defining the Patient Access Front-End Revenue Cycle Landscape

Leading organizations at the forefront of patient access front-end RCM have distinguished themselves through strategic collaborations, continuous technology enhancements, and customer-centric service models. One category of providers delivers fully integrated suites that unify registration, eligibility, estimate calculation, and analytics within a single platform. These vendors emphasize seamless interoperability with electronic health records (EHRs) and provide extensive professional services to ensure rapid time-to-value. Another set of competitors focuses on best-of-breed standalone modules that can be layered conveniently onto existing systems, offering rapid deployment cycles and targeted return on investment for specific process improvements.

Partnership models have become a key differentiator: alliances with telehealth platforms, payment gateways, and data aggregators enable front-end RCM vendors to deliver seamless digital experiences for patients and staff alike. Companies that maintain robust developer ecosystems and open APIs are capturing market share by facilitating third-party innovation and extension of core functionalities. Furthermore, those who invest in proactive customer support-delivering regular system health checks, workflow optimization workshops, and advanced analytics training-are driving higher adoption rates and long-term account retention.

In parallel, several emerging players are leveraging advanced AI frameworks to embed continuous learning into denial management and payment estimation tools. By harnessing machine learning models trained on diverse payer policies and historical claim outcomes, these vendors are delivering more precise patient responsibility forecasts and adaptive rule sets that evolve alongside regulatory changes. Collectively, the competitive landscape is characterized by an interplay between end-to-end solution providers, niche specialists, and innovative startups that are accelerating the pace of front-end RCM transformation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Patient Access /Front-end RCM Solutions market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AccessOne

- AccuReg

- Allscripts Healthcare Solutions, Inc.

- athenahealth, Inc.

- Availity, L.L.C.

- Cerner Corporation

- Cirius Group, Inc.

- Clearwave Corporation

- Cognizant Technology Solutions Corporation

- Conduent Incorporated

- Conifer Health Solutions, LLC

- Epic Systems Corporation

- Exela Technologies, Inc.

- Experian Information Solutions, Inc.

- FinThrive, Inc.

- Genentech, Inc.

- HealthAsyst

- Kareo, Inc.

- Kyruus, Inc.

- McKesson Corporation

- NextGen Healthcare, Inc.

- Optum, Inc.

- Patient Access Solutions, Inc.

- PLEXIS Healthcare Systems, Inc.

- QWay Healthcare, Inc.

- R1 RCM Inc.

- The Craneware Group

- The SSI Group, LLC

- Vee Technologies Private Limited

- Virtusa Corporation

- Waystar LLC

Implementing Actionable Strategies and Best Practices to Enhance Patient Access Workflows and Maximize Front-End Revenue Cycle Effectiveness

Industry leaders should prioritize the integration of artificial intelligence and predictive analytics across all patient access workflows. By embedding AI-driven benefit verification and denial prediction at the point of registration, organizations can shift from reactive denial management to proactive risk mitigation. Furthermore, investing in user-centric patient portals and mobile applications that present clear visit estimates and payment options will drive greater point-of-service collections and enhance patient satisfaction.

To balance cost control with innovation, providers should adopt modular implementation strategies that decouple critical front-end functionalities for phased rollouts. This approach minimizes disruption to existing operations while delivering measurable performance improvements in high-priority areas, such as payment estimation or scheduling optimization. Concurrently, fostering cross-functional teams that include finance, clinical, IT, and patient experience stakeholders will facilitate unified governance and accelerate decision-making.

Finally, cultivating strategic partnerships with technology vendors, payer networks, and third-party integrators will expand the capabilities of front-end RCM solutions. By leveraging open APIs and data-sharing agreements, organizations can create a scalable ecosystem that supports emerging payment models, telehealth integration, and advanced patient engagement initiatives. These collaborative networks will serve as a foundation for continuous innovation and ensure resilience against future regulatory or market shifts.

Detailing a Comprehensive Research Methodology Emphasizing Rigorous Data Collection Validation and Analytical Framework for RCM Front-End Insights

This report’s findings are underpinned by a rigorous research methodology that combines primary and secondary data sources. Primary research included in-depth interviews with senior executives, revenue cycle managers, and IT decision-makers across a spectrum of provider types, including ambulatory surgery centers, hospitals, and independent physician practices. These qualitative insights were complemented by structured surveys designed to quantify adoption trends and technology priorities in patient access operations.

Secondary research encompassed the analysis of vendor collateral, industry whitepapers, regulatory filings, and historical tariff schedules to contextualize market dynamics and policy impacts. In addition, financial documents and press releases from leading technology suppliers were examined to track strategic partnerships, product launches, and innovation roadmaps. Data triangulation ensured consistency and validity, with cross-verification between primary insights and documented evidence.

Finally, ongoing validation workshops with frontline users and subject matter experts provided an interactive forum to test preliminary conclusions and refine recommendations. This iterative engagement model ensured that the final report reflects both strategic imperatives and practical considerations, equipping stakeholders with actionable intelligence to drive front-end RCM transformation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Patient Access /Front-end RCM Solutions market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Patient Access /Front-end RCM Solutions Market, by Component

- Patient Access /Front-end RCM Solutions Market, by Delivery Mode

- Patient Access /Front-end RCM Solutions Market, by Deployment

- Patient Access /Front-end RCM Solutions Market, by End User

- Patient Access /Front-end RCM Solutions Market, by Region

- Patient Access /Front-end RCM Solutions Market, by Group

- Patient Access /Front-end RCM Solutions Market, by Country

- United States Patient Access /Front-end RCM Solutions Market

- China Patient Access /Front-end RCM Solutions Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings and Strategic Imperatives to Guide Stakeholders in Navigating Patient Access Front-End Revenue Cycle Transformations

In synthesizing the critical findings of this study, it is clear that patient access and front-end revenue cycle management represent pivotal leverage points for improving financial performance and patient experience. The convergence of AI-driven eligibility verification, cloud-based architectures, and modular solution deployments is reshaping how providers manage registrations, estimates, and denials. Concurrently, regional variations in regulatory frameworks and digital maturity underscore the importance of flexible implementation strategies that can adapt to diverse market conditions.

As healthcare organizations navigate the complexities of rising patient financial responsibility and evolving payment models, the ability to deliver transparent, efficient, and patient-centric front-end processes will be a key competitive advantage. By harnessing the insights presented here, stakeholders can prioritize targeted investments, foster cross-functional collaboration, and establish the operational agility necessary to thrive amid ongoing industry transformation.

Encouraging Proactive Engagement with Our Associate Director to Secure Comprehensive Patient Access Front-End RCM Solutions for Your Organization

To explore the full suite of patient access front-end revenue cycle management insights and secure a tailored roadmap for optimizing operational performance, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Engage in a consultation to discuss your organization’s unique challenges and objectives, and discover how our comprehensive market research report can empower your strategic planning.

Partner with Ketan to unlock in-depth analysis, expert guidance, and actionable intelligence that will enable you to stay ahead of industry shifts, harness emerging technologies, and drive sustainable growth. This is your opportunity to equip your leadership team with the data-driven insights needed to elevate patient access operations and maximize revenue capture.

- How big is the Patient Access /Front-end RCM Solutions Market?

- What is the Patient Access /Front-end RCM Solutions Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?