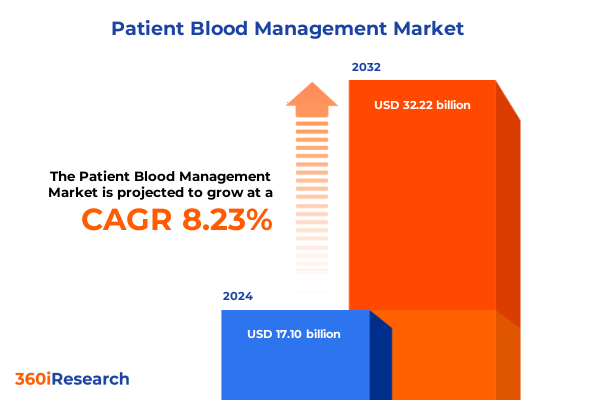

The Patient Blood Management Market size was estimated at USD 18.30 billion in 2025 and expected to reach USD 19.59 billion in 2026, at a CAGR of 8.41% to reach USD 32.22 billion by 2032.

Pioneering Patient-Centric Strategies Revolutionizing Blood Management Protocols to Enhance Clinical Outcomes and Operational Efficiency

Patient Blood Management has emerged as a cornerstone in contemporary healthcare delivery, emphasizing optimization of blood use for improved patient safety and resource stewardship. By adopting a holistic, patient-centered approach, institutions are reducing reliance on allogeneic transfusions and prioritizing interventions that preserve the patient’s own blood. This executive summary provides an informed overview of the evolving landscape of blood management, underscoring key shifts in clinical practice, regulatory drivers, and emerging technologies.

As healthcare systems strive to balance cost containment with quality outcomes, Patient Blood Management principles are increasingly integrated into perioperative care pathways. From preoperative optimization through intraoperative conservation to postoperative recovery strategies, this multifaceted discipline aligns with value-based care models. Throughout this report, we explore transformative trends, tariff impacts, segmentation insights, regional nuances, company dynamics, and actionable recommendations that equip stakeholders to navigate the changing blood management ecosystem with confidence.

Unveiling the Technological, Regulatory, and Clinical Innovations Reshaping Patient Blood Management Practices Across Healthcare Settings

The Patient Blood Management arena is undergoing a profound transformation driven by converging forces in technology, regulation, and clinical innovation. Advanced hemostasis monitoring is enabling real-time decision-making, with laboratory analyzers and point-of-care devices providing actionable data at the bedside. Concurrently, novel hemostats and sealant systems are expanding options for surgical and interventional procedures, fostering reduced bleeding complications and faster recoveries.

Regulatory bodies are reinforcing these shifts by issuing guidelines that emphasize restrictive transfusion thresholds and mandate comprehensive blood conservation training for clinical teams. At the same time, digital platforms and data analytics are powering predictive models to identify high-risk patients, optimizing inventory management while maintaining safety. Collectively, these developments signal a new era in which personalized, data-driven blood management strategies redefine standard practice across cardiovascular, oncology, and trauma care pathways.

Assessing the Far-Reaching Effects of Newly Implemented U.S. Tariffs on Blood Management Devices and Consumables in 2025

Recent changes to United States tariff policy in 2025 have cast a spotlight on the resilience of blood management supply chains, particularly for imported devices and disposables. Manufacturers of autotransfusion systems, blood component separation equipment, and filtration devices are now navigating higher import duties that cascade through pricing structures. Hospitals and specialty centers are responding by reevaluating procurement strategies, fostering closer collaboration with domestic suppliers, and exploring alternative sourcing models to maintain cost predictability.

Although these tariffs introduce near-term cost pressures, they also incentivize local manufacturing investments and bolster innovation in volume expanders and hemostat production. As supply chain realignment unfolds, stakeholders are leveraging this juncture to negotiate long-term agreements, establish strategic stockpiles, and engage in joint development initiatives with manufacturer partners. Ultimately, the tariff landscape is shaping a more diversified and resilient ecosystem for Patient Blood Management resources.

Unlocking Key Insights Through Multi-Dimensional Segmentation Revealing Critical Drivers of Patient Blood Management Adoption

A multi-dimensional segmentation framework illuminates the core drivers propelling Patient Blood Management adoption. When examining product typologies, antifibrinolytics now complement advanced autotransfusion systems, while blood management disposables such as cell washing kits, collection reservoirs, and filtration devices deliver enhanced safety and efficiency. Simultaneously, coagulation monitoring technologies span from centralized laboratory analyzers to point-of-care formats, and hemostats encompass both topical agents and integrated sealant systems.

Therapeutic pathways further delineate market dynamics, where allogeneic and autologous transfusion approaches are augmented by cell salvage processes. Specialized hemostasis management strategies range from targeted antifibrinolytic therapies to innovative topical hemostat applications, and perioperative blood conservation practices extend across intraoperative techniques, preoperative optimization protocols, and postoperative care pathways. In parallel, clinical applications within cardiovascular surgery-spanning aortic, coronary artery bypass, and valve procedures-intersect with elective and trauma surgery requirements, oncology treatment regimens including chemotherapy and radiotherapy, and obstetric emergencies. End-user environments are equally diverse, comprising ambulatory surgical centers, clinics, hospitals, and specialty treatment hubs for oncology, cardiac care, and trauma, each shaping channel preferences and support needs. By synthesizing these segmentation layers, stakeholders can calibrate strategic initiatives to address the nuanced demands of each dimension.

This comprehensive research report categorizes the Patient Blood Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Therapy Type

- Application

- End User

Exploring Distinct Regional Nuances Shaping the Evolution of Patient Blood Management Across Global Markets with Strategic Guidance for Investment and Policy

Geographical variation in Patient Blood Management underscores distinct strategic considerations across the Americas, Europe, the Middle East and Africa, and the Asia-Pacific region. In North America, mature reimbursement frameworks and well-established clinical guidelines have driven deep integration of preoperative optimization and intraoperative conservation techniques. Healthcare systems are investing in comprehensive training programs and digital platforms to ensure alignment with value-based care mandates.

In EMEA markets, evolving policy directives are accelerating adoption, especially where stringent transfusion regulations exist alongside robust national blood service infrastructures. Countries in the region are piloting innovative blood stewardship initiatives that emphasize sustainability and patient safety, often supported by public-private partnerships. Meanwhile, Asia-Pacific represents a diverse mix of advanced centers and emerging healthcare systems. Rapidly expanding surgical volumes and increasing awareness of transfusion-related risks are prompting broader uptake of cell salvage and hemostasis management therapies, buoyed by growing investment in local manufacturing and clinician education programs. These regional disparities reveal targeted opportunities for tailored program development, strategic partnerships, and policy advocacy efforts.

This comprehensive research report examines key regions that drive the evolution of the Patient Blood Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leadership Strategies and Partnership Models Employed by Leading Companies Driving Innovation in Patient Blood Management

Leading organizations in the Patient Blood Management sphere are advancing innovation through a combination of strategic partnerships, targeted acquisitions, and integrated technology offerings. Major device manufacturers have broadened their portfolios by assimilating specialized disposables and coagulation monitoring platforms, while clinical solutions providers are embedding digital analytics into perioperative workflows. Collaborative alliances between technology firms and academic research centers are yielding next-generation hemostats and volume expanders with improved efficacy and safety profiles.

Furthermore, companies bolster market presence through value-added services, offering training modules, outcome tracking dashboards, and consultancy for program implementation. By aligning product development roadmaps with evolving clinician needs and regulatory expectations, these organizations are forging competitive advantages. As the market continues to mature, sustained investment in R&D, robust supply chain partnerships, and proactive engagement with healthcare networks will differentiate the foremost innovators in Patient Blood Management.

This comprehensive research report delivers an in-depth overview of the principal market players in the Patient Blood Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Baxter International Inc.

- BioMérieux SA

- CSL Limited

- Danaher Corporation

- Fresenius Kabi AG

- Grifols, S.A.

- Haemonetics Corporation

- LivaNova PLC

- Macopharma SA

- Octapharma AG

- Roche Diagnostics International AG

- Terumo Corporation

- ZOLL Medical Corporation

Delivering Forward-Looking and Practical Recommendations to Empower Industry Leaders in Elevating Patient Blood Management Outcomes and Efficiency

Industry leaders can capitalize on the evolving Patient Blood Management landscape by adopting a set of strategic initiatives designed to foster growth and resilience. First, integrating advanced data analytics platforms into existing clinical workflows will enable real-time decision support, optimize resource utilization, and enhance compliance with transfusion guidelines. Second, investing in comprehensive clinician training programs-spanning preoperative assessment to postoperative follow-up-will drive consistent adoption and ensure measurable improvements in patient outcomes.

In parallel, strengthening relationships with regional manufacturers and distributors will mitigate supply chain disruptions and leverage tariff-induced incentives for local production. Organizations should also pursue collaborative research endeavors to validate innovative therapies, capture real-world evidence, and inform policy advocacy. Finally, aligning programmatic goals with value-based reimbursement models will unlock new revenue streams and bolster institutional reputation. Through this holistic approach, leaders will be positioned to deliver both clinical excellence and financial sustainability in Patient Blood Management.

Detailing the Rigorous Multi-Phase Research Methodology Underpinning Insights into Patient Blood Management Trends and Practices

This study leverages a rigorous, multi-phase methodology combining secondary intelligence and primary validation to produce robust insights into Patient Blood Management. Initially, an extensive review of peer-reviewed literature, clinical guidelines, and regulatory documentation established a foundational understanding of treatment paradigms and device classifications. This was complemented by analysis of proprietary technology pipelines and corporate disclosures, ensuring a comprehensive view of market dynamics.

In the primary phase, structured interviews were conducted with thought leaders in anesthesiology, transfusion medicine, and surgical specialties to capture firsthand perspectives on clinical adoption barriers and enabling factors. Additionally, quantitative surveys of procurement and supply chain executives provided clarity on purchasing criteria and tariff impact mitigation strategies. Data triangulation techniques were applied to reconcile divergent viewpoints and validate emergent themes. Finally, segmentation analysis and regional deep dives were performed to contextualize findings, resulting in a detailed, actionable framework for stakeholders navigating the Patient Blood Management domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Patient Blood Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Patient Blood Management Market, by Product Type

- Patient Blood Management Market, by Therapy Type

- Patient Blood Management Market, by Application

- Patient Blood Management Market, by End User

- Patient Blood Management Market, by Region

- Patient Blood Management Market, by Group

- Patient Blood Management Market, by Country

- United States Patient Blood Management Market

- China Patient Blood Management Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Concluding Perspectives Emphasizing Strategic Imperatives and Future Opportunities in Patient Blood Management Across Healthcare Systems

Patient Blood Management has transcended its origins as a niche clinical discipline to become integral to modern healthcare strategies, reflecting a shift towards precision-focused, resource-efficient care. Throughout this report, we have distilled pivotal trends-from advanced hemostasis monitoring and device innovations to tariff-driven supply chain realignment-demonstrating the sector’s dynamic evolution. Segmentation insights reveal how product typologies, therapy modalities, clinical applications, and end-user segments shape tailored adoption pathways.

Regional analysis highlights the need for adaptive strategies that respect local regulatory frameworks and healthcare infrastructure maturity. And a review of leading company initiatives underscores the importance of strategic collaboration and continuous innovation. In closing, stakeholders who embrace these insights and implement the recommended actions will be best positioned to deliver superior patient outcomes, enhance operational performance, and secure competitive differentiation in the rapidly advancing field of Patient Blood Management.

Engage with Associate Director Ketan Rohom to Secure Comprehensive Patient Blood Management Market Intelligence and Drive Informed Strategic Decisions

To explore this invaluable market intelligence and equip your organization with a strategic edge, connect directly with Ketan Rohom, Associate Director, Sales & Marketing. By partnering with him, you can secure the full Patient Blood Management market report, tailored client presentations, and customized data packages that align with your decision-making timeline. Ketan’s expertise in navigating complex healthcare landscapes will ensure you receive an actionable roadmap that drives growth, mitigates risk, and supports your long-term objectives. Don’t miss this opportunity to transform insights into impact-reach out today to accelerate your path toward enhanced clinical outcomes and operational performance.

- How big is the Patient Blood Management Market?

- What is the Patient Blood Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?