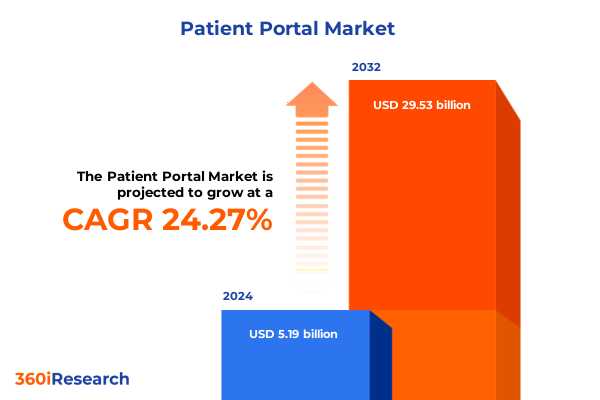

The Patient Portal Market size was estimated at USD 6.45 billion in 2025 and expected to reach USD 8.02 billion in 2026, at a CAGR of 24.26% to reach USD 29.53 billion by 2032.

Unveiling the Path Forward for Patient Portal Solutions with Comprehensive Insights into Market Dynamics and Patient Engagement Drivers

The patient portal landscape has experienced remarkable evolution as digital health continues its rapid ascent. Fueled by the demand for enhanced patient engagement and operational efficiency, portals have transformed from simple information repositories to sophisticated platforms that foster meaningful interactions between patients and providers. Stakeholders across healthcare systems are now prioritizing features such as seamless appointment scheduling, secure messaging, and integrated telehealth, recognizing these capabilities as pivotal to improving care coordination and reducing administrative burdens.

This report offers an executive-level perspective on the critical forces shaping the patient portal market. Beginning with an exploration of the macro trends driving digital health adoption, the analysis then delves into technology innovations, regulatory dynamics, and end-user expectations that define the trajectory of portal solutions. By synthesizing qualitative and quantitative insights gathered from industry leaders, technology vendors, and healthcare professionals, this executive summary provides a clear line of sight into the opportunities and challenges that lie ahead for organizations invested in patient engagement platforms.

Analyzing the Emergence of Interoperability Breakthroughs and AI-Enhanced Engagement as Catalysts for Digital Health Transformation

Digital health adoption has accelerated drastically as healthcare systems seek resilient models to deliver care beyond traditional settings. Interoperability breakthroughs, such as the implementation of open standards and application programming interfaces, have dismantled historical data silos, enabling patient portals to unify clinical records from disparate sources. Simultaneously, the integration of mobile-first approaches ensures accessibility, letting users manage their health anytime, anywhere. These shifts have not only elevated the user experience but have also incentivized providers to embrace portals as essential tools for population health management and preventive care.

Moreover, emerging capabilities like artificial intelligence–driven triage and personalized health recommendations are poised to redefine patient interactions. AI algorithms analyze medical histories and real-time wellness metrics to recommend tailored interventions, reducing the need for in-person visits and optimizing resource allocation. At the same time, heightened expectations around data security and privacy have driven investments in advanced encryption and authentication protocols, ensuring patient trust remains at the core of digital engagement strategies.

Evaluating How New Import Tariffs Are Reshaping Infrastructure Choices and Driving Cloud Adoption in Patient Portal Solutions

In 2025, a series of tariff adjustments implemented by U.S. authorities have introduced tangible effects on the patient portal solutions ecosystem. Increased duties on imported hardware components for server infrastructure led to higher capital expenditures for on-premise deployments. Vendors faced escalated supply chain costs, particularly where specialized modules relied on overseas manufacturing. These added costs compelled providers to revisit their infrastructure strategies, often prioritizing cloud-based solutions to mitigate the impact of hardware expenses.

Additionally, software licensing and maintenance fees experienced upward pressure as vendors rebalanced their pricing models to recoup tariff-induced overheads. Healthcare organizations with legacy standalone systems saw amplified concerns regarding budget predictability, triggering strategic reviews of modernization initiatives. Conversely, vendors focusing on native module integration and API-first architectures were better positioned to absorb cost fluctuations, since their solutions leveraged existing digital channels and minimized dependence on imported hardware.

Overall, the cumulative tariff effects have sharpened market preferences, accelerating the shift toward subscription-based, cloud-hosted platforms that deliver feature-rich experiences without exposing providers to the volatility of import taxes.

Decoding Strategic Deployment Preferences across Integration, Delivery Modes, End Users and Infrastructure Architectures Driving Portal Adoption

Insight into the market structure reveals that organizations are segmenting their portal strategies based on platform integration choices, balancing the benefits of comprehensive electronic health record connectivity against the flexibility of standalone systems. Entities opting for full EHR integration are increasingly gravitating toward API-based frameworks to ensure seamless data exchange, whereas others still find value in native modules that provide deep in-application workflows without extensive external integrations. Meanwhile, standalone deployments appeal to institutions seeking rapid implementation; platform agnostic solutions offer broad compatibility with diverse environments, while vendor specific offerings deliver specialized capabilities optimized for particular clinical workflows.

When examining delivery modes, user preferences bifurcate between mobile apps and web applications. The mobile channel has surged in prominence as Android and iOS variants equip patients with on-the-go access, whereas responsive and desktop browsers underpin provider-centric portals that demand comprehensive interfaces for chart reviews and administrative oversight. Similarly, examining end-user categories illuminates distinct usage patterns: chronic care patients rely heavily on continuous monitoring and prescription refill functionalities, while general users engage primarily for test results and appointment management. Providers, including administrators, nurses and physicians, leverage the portal for streamlined workflow coordination, secure messaging, and real-time access to patient-reported data.

Deployment models further differentiate market adoption. Cloud environments-whether community, private, or public-remain the fastest-growing segment due to scalability and predictable cost structures, but hybrid models that blend cloud-heavy processing with on-premise control appeal to organizations with strict data residency requirements. Pure on-premise setups continue to serve specialized sites like clinics, diagnostic labs, and hospitals that demand full operational autonomy and direct governance over their infrastructure.

This comprehensive research report categorizes the Patient Portal market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Integration

- Delivery Mode

- Deployment Model

- End User

Comparing Regional Adoption Dynamics Highlighting Americas Leadership, EMEA Variances and Asia-Pacific’s Mobile-Centric Growth Trajectory

Regionally, the Americas preserve leadership thanks to robust digital health funding and mature healthcare infrastructures that incentivize portal adoption. Providers across North and South America are intensifying their focus on patient retention through secure messaging and virtual visit capabilities, while data privacy regulations spur investments in comprehensive compliance features.

Meanwhile, Europe, Middle East & Africa exhibit heterogeneous adoption curves influenced by varying regulatory landscapes and digital maturity levels. Western European nations prioritize interoperability initiatives, whereas emerging markets in the Middle East and Africa explore modular deployments to rapidly bridge access gaps in underserved populations.

Across Asia-Pacific, rapid urbanization and mobile penetration underpin a booming market for mobile-first portal offerings. Healthcare systems in developed markets such as Japan and Australia integrate advanced AI functionalities, whereas Southeast Asian and South Asian providers often adopt cost-efficient, cloud-based solutions to extend digital care into rural communities.

This comprehensive research report examines key regions that drive the evolution of the Patient Portal market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Market Leaders and Emerging Innovators Advancing Patient Engagement through Interoperability and AI-Driven User Experiences

Leading technology vendors continue to innovate with differentiated portal offerings that address specific market needs. Established incumbents have expanded their platforms through strategic partnerships and acquisitions, bolstering interoperability and analytics capabilities. Meanwhile, nimble challengers focus on niche segments, delivering lightweight mobile experiences and rapid deployment cycles to win early adopters in emerging markets.

Several key players have invested heavily in user experience design to reduce friction and enhance patient satisfaction metrics. These enhancements include intuitive navigation, multi-language support, and integrated telehealth modules. At the same time, collaboration between portal providers and electronic health record vendors has deepened to ensure seamless data continuity, enabling healthcare organizations to harness operational efficiencies and improve clinical outcomes.

Innovation also emerges from startups leveraging artificial intelligence to automate triage and personalize health education content. By combining machine learning with robust security frameworks, these up-and-coming firms are challenging the status quo and accelerating the transformation of patient engagement strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Patient Portal market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adelante Healthcare

- AdvancedMD

- AIMDek Technologies

- Allscripts Healthcare Solutions, Inc.

- athenahealth, Inc.

- Bridge Patient Portal

- CapMinds

- Cerner Corporation

- ClinicTracker

- CureMD Healthcare

- eClinicalWorks, LLC

- Elation Health

- Epic Systems Corporation

- GE HealthCare Technologies Inc.

- Greenway Health

- InSync Healthcare Solutions

- InteliChart

- iSalus Healthcare

- Koninklijke Philips N.V.

- McKesson Corporation

- Medical Information Technology, Inc.

- Medsphere Systems

- Napier Healthcare Solutions

- NextGen Healthcare, Inc.

- Qualifacts

- Siemens Healthineers AG

- Solutionreach

- Tiga Healthcare Technologies

- Updox

- Veradigm

- ViSolve

Implementing an Agile Integration Roadmap Combined with Adaptive Infrastructure Governance and AI-Enhanced Services to Drive Competitive Differentiation

Industry leaders should prioritize a hybrid integration strategy that combines API-first approaches with selective native module enhancements to maximize interoperability without compromising implementation speed. By adopting a phased rollout, organizations can ensure initial deployments deliver critical functionality while subsequent waves refine specialized workflows and data analytics capabilities.

Providers must also evaluate their infrastructure mix, balancing the scalability and cost predictability of public cloud environments against the control and compliance benefits offered by private and on-premise configurations. A modern governance framework will allow healthcare systems to shift workloads intelligently based on data sensitivity and performance requirements.

To stay competitive, vendors should intensify investments in AI and machine learning, focusing on features that triage patient requests and deliver personalized educational interventions. Equally important is fostering strategic alliances with health IT ecosystem partners to create unified solutions that resonate with both patient and provider communities.

Detailing a Robust Mixed Methods Approach Integrating Expert Interviews, Regulatory Review and Quantitative Data Analysis for Market Validation

This research employed a multi-faceted methodology combining primary and secondary data collection tailored to the patient portal domain. Primary insights were gathered through in-depth interviews with healthcare executives, technology architects, and user experience specialists to validate market trends and technological imperatives. Complementing these inputs, a thorough review of regulatory documents, industry white papers, and case studies provided context on compliance requirements and best practices.

Quantitative data was triangulated from public financial disclosures, healthcare IT adoption surveys, and patent filings to assess vendor capabilities and innovation trajectories. Segmentation analyses were constructed by mapping technology footprints against deployment preferences and end-user behavior patterns, ensuring a robust framework that accurately reflects market realities.

Throughout the research process, rigorous quality assurance protocols were applied, including data cross-validation and peer review by subject matter experts, to guarantee the reliability and relevance of findings presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Patient Portal market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Patient Portal Market, by Integration

- Patient Portal Market, by Delivery Mode

- Patient Portal Market, by Deployment Model

- Patient Portal Market, by End User

- Patient Portal Market, by Region

- Patient Portal Market, by Group

- Patient Portal Market, by Country

- United States Patient Portal Market

- China Patient Portal Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Concluding Perspective on Embracing Interoperable, Scalable and Intelligent Patient Portal Strategies for Sustainable Digital Health Success

As healthcare continues its digital transformation journey, patient portals stand at the nexus of engagement, transparency, and operational excellence. The insights detailed in this report underscore the need for adaptable solutions that accommodate evolving regulatory demands, diverse user preferences, and fluctuating economic conditions.

Leaders who embrace interoperable architectures, refine their infrastructure strategies, and leverage AI-driven functionalities will be well-positioned to deliver superior patient experiences and achieve measurable outcomes. The iterative nature of digital innovation requires organizations to adopt continuous improvement mindsets, informed by real-world usage data and stakeholder feedback.

Ultimately, the patient portal market will be shaped by the participants who can balance rapid deployment with long-term strategic vision, ensuring their platforms remain resilient, secure, and centered on the evolving needs of patients and providers alike.

Unlock Exclusive Access to Detailed Patient Portal Market Research through Direct Engagement with Ketan Rohom

Should you wish to delve deeper into the rich findings and strategic analyses presented in this report, we invite you to secure your copy through a personalized consultation. Connect with Ketan Rohom, Associate Director, Sales & Marketing, to explore tailored insights, address any specific queries, and acquire the full breadth of research data that will empower your organization’s next move. Partnering with Ketan will ensure you receive a comprehensive package that aligns with your objectives, facilitating informed decisions and driving competitive advantage in the evolving patient portal market.

- How big is the Patient Portal Market?

- What is the Patient Portal Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?