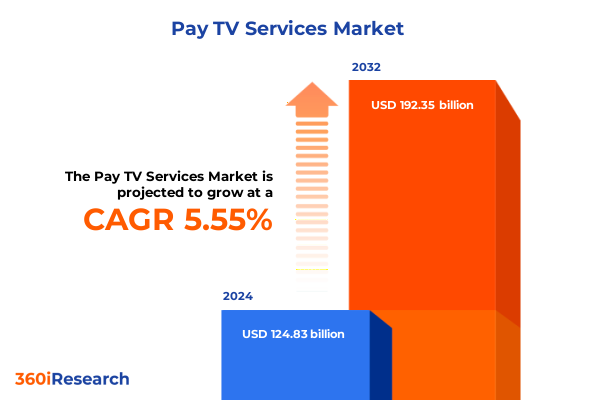

The Pay TV Services Market size was estimated at USD 131.92 billion in 2025 and expected to reach USD 138.43 billion in 2026, at a CAGR of 5.53% to reach USD 192.35 billion by 2032.

Exploring the Evolution and Dynamics of Pay TV Services as Traditional Models Converge with Streaming Innovations to Redefine Content Delivery

The pay television ecosystem has undergone profound transformation over the past decade, evolving from a decades-old model of linear channel distribution to a complex network of digital and hybrid offerings. Traditional cable and satellite services once dominated viewership with bundled packages that offered predictable revenue streams for operators. However, the rapid proliferation of high-speed broadband networks and smart devices has democratized access to content, empowering consumers to break free from legacy models and select services that align precisely with their viewing preferences. This shift has not only redefined consumer expectations but also set the stage for intensified competition across the entire pay TV value chain.

By 2025, the number of traditional pay TV subscriptions in the United States is projected to dip beneath 50 million, representing only about 35% of American households compared to 85% in 2015. Concurrently, global streaming video revenue is expected to surpass $213 billion, overtaking pay TV earnings of $188 billion as consumers gravitate toward on-demand experiences that prioritize flexibility and personalization. The maturation of streaming services, the adoption of ad-supported tiers, and the integration of advanced recommendation engines have further accelerated this convergence, as legacy operators scramble to defend customer loyalty and pursue growth through digital extensions of their core offerings.

Moreover, cable providers and digital studios alike are embracing hybrid bundling strategies that merge linear channels with over-the-top (OTT) platforms, signaling a return to curated content packages reminiscent of traditional cable but enhanced by modern distribution technologies. Strategic alliances-such as bundled subscriptions to Disney+, Hulu, and Max-and partnership deals between network operators and streaming providers reflect a broader industry imperative: to deliver seamless, end-to-end experiences that capture audiences across multiple screens and contexts. As a result, the competitive frontier now spans service quality, content depth, and technological agility, positioning pay TV services at the intersection of innovation and legacy brand equity.

Unveiling Major Disruptions Transforming the Pay TV Landscape from Cord Cutting Trends to Ad Supported Models and Hybrid Bundling Strategies

Consumer behavior around television consumption has shifted decisively toward cord-cutting, driven by the appeal of lower-cost, à la carte streaming options and the desire for ad-supported tiers. In the United States alone, non-pay-TV households are projected to swell to 77.2 million by 2025, while pay TV households will decline to an estimated 56.8 million as viewers abandon legacy contracts in favor of flexible digital alternatives. This exodus has compelled operators to rethink business models, emphasizing value-added services, personalized content, and tiered pricing structures.

In parallel, the explosion of free ad-supported streaming television (FAST) channels and the growing sophistication of targeted advertising have propelled advanced TV ad spending, even as traditional upfront revenue experienced a 20.5% decline amid tariff-induced economic uncertainty. To navigate this dual challenge of fragmentation and price pressure, pay TV providers are deploying integrated user interfaces that unify linear programming, streaming libraries, and third-party apps. Initiatives such as unified search functions, voice-activated recommendations, and cross-platform single-sign-on capabilities are rapidly becoming baseline expectations for consumers, underscoring the centrality of user experience in retention strategies.

Furthermore, operators are leveraging the expansion of 5G fixed wireless access (FWA) as a complementary distribution channel to traditional broadband, unlocking new revenue streams and delivering high-quality video playback in regions with limited fiber infrastructure. This deployment of mobile-based connectivity solutions not only broadens market reach but also positions pay TV services to capitalize on emerging use cases such as cloud gaming integration and multi-screen live sports broadcasts. Collectively, these transformative shifts are reshaping the competitive landscape and defining a new era of hybrid pay TV offerings.

Assessing the Comprehensive Ripple Effects of 2025 US Tariffs on Consumer Electronics Supply Chains and Pay TV Service Cost Structures

In early 2025, the United States implemented a set of broad-based tariffs aimed at consumer electronics, with television imports facing particular scrutiny. Proposed levies of up to 20% on Chinese-manufactured TV sets could drive prices higher by as much as 23%, contributing to an estimated $711 million in additional consumer expenditures over the subsequent year and a 4% increase in overall television pricing. Retailers and manufacturers are already bracing for margin compression, as importers seek to absorb or pass through these cost increases amid an environment of price-sensitive consumers.

Beyond headline TV prices, executive orders issued in January 2025 imposed a 25% tariff on imports from Mexico and Canada, along with a 10% duty on Chinese-sourced content delivery hardware, effective from February 1 and February 4, respectively. This trilateral tariff structure has precipitated a strategic pivot within supply chains, with leading set-top box OEMs exploring assembly shifts to Vietnam and Southeast Asia to regain tariff-free status. Meanwhile, major retailers are adjusting inventory levels and pre-ordering volumes, navigating the delicate balance between stock availability and cost containment in anticipation of further policy volatility.

However, a pivotal ruling by the United States Court of International Trade in May 2025 challenged the executive’s authority to impose these broad-based levies under the International Emergency Economic Powers Act, issuing a permanent injunction to halt enforcement of the contested duties. This judicial intervention has introduced a layer of legal uncertainty, underscoring the critical need for industry participants to monitor evolving trade policies and build agile procurement strategies. As regulatory developments unfold, service providers and hardware partners must remain vigilant and prepared to recalibrate operational plans to mitigate cost shocks and safeguard profitability.

Deriving Powerful Insights from Key Segmentation Dimensions Illuminating Service Types Subscription Tiers Devices Quality and End User Behaviors

Understanding the pay TV services market demands an appreciation of the underlying segmentation dimensions that dictate consumer preferences and competitive positioning. By deconstructing offerings along service type-from cable television and IPTV to OTT delivery and satellite television-industry stakeholders can identify which channels command premium interest and where incremental innovations can unlock new value. Meanwhile, subscription tiers, differentiated by basic and premium packages with specialized options for movies and sports programming, reveal consumer willingness to pay for curated experiences and exclusive live content.

Device types further illuminate usage patterns, as audiences toggle between televisions in living rooms, personal computers for on-demand streaming, mobile devices for viewing on the go, gaming consoles for integrated multimedia, and tablets for portable convenience. High Definition, Standard Definition, and Ultra HD offerings underscore the critical importance of video quality in shaping brand perception and consumer satisfaction. Finally, end-user segmentation into residential households and commercial venues-spanning corporate offices and hospitality environments-unveils distinct deployment requirements, content licensing considerations, and service level priorities that inform both pricing models and distribution partnerships.

This comprehensive research report categorizes the Pay TV Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Subscription Tier

- Device Type

- Video Quality

- End User

Mapping Critical Regional Dynamics in the Americas EMEA and Asia Pacific Revealing Divergent Pay TV Trajectories and Growth Opportunities

Across the Americas, the composition of pay TV households has shifted dramatically, with traditional subscriptions projected to account for just 34% of U.S. households by 2025-down from historic highs of 85% in 2015-and a corresponding rise to 77.2 million non-pay-TV homes as cord cutting becomes the prevailing consumer choice. In Latin American markets, where broadband expansion lags, satellite and IPTV services continue to retain a modicum of resilience, underscoring the importance of infrastructure investments in bridging digital divides and stabilizing subscriber bases.

Meanwhile, Europe, the Middle East, and Africa are experiencing heterogeneous outcomes across developed and emerging markets. Western Europe is expected to lose nearly 9 million pay TV subscribers between 2023 and 2029, driving household penetration down to 53% amidst self-imposed cord-cutting trends and competitive pressure from pan-regional OTT offerings. In the Middle East and Africa, revenue streams are increasingly challenged by piracy, regulatory constraints, and content fragmentation, prompting operators to explore value‐added bundling and localized programming to sustain engagement.

In contrast, the Asia-Pacific region exhibits a unique balance of scale and growth potential: its multichannel subscriber base remains substantial at approximately 659.5 million connections, even as household penetration eased from 62.9% to 61.5% and pay TV revenues grew 3.1% to $30.3 billion in 2024. Markets such as mainland China and India continue to add new subscribers to traditional and IPTV platforms, while advanced economies in the region leverage ultra-high-definition content and bundling innovations to extract higher ARPU per user.

This comprehensive research report examines key regions that drive the evolution of the Pay TV Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Approaches and Performance Metrics of Leading Pay TV Players Charting the Course for Future Competitiveness

Leading pay TV providers are at a crucial inflection point, as evidenced by Comcast’s Q1 2025 results: the company reported a net loss of 427,000 video customers and 199,000 broadband subscribers as streaming alternatives continue to capture market share. Despite these headwinds, Comcast’s strategic emphasis on bundling mobile and broadband services yielded 323,000 new wireless lines, highlighting the value of converged offerings in stabilizing customer relationships. Meanwhile, the company’s Peacock streaming platform achieved 41 million subscribers, marking a 20% year-over-year increase and illustrating the potential to offset declines in legacy segments.

Beyond traditional operators, pure-play streaming services are recalibrating their strategies to resemble pay TV 2.0. Omdia notes that Netflix, Disney+, Paramount+, Amazon Prime Video, and Max are increasingly adopting ad-supported tiers, bundling models, and sports rights acquisitions, effectively mirroring the curated content packages of cable systems while leveraging digital delivery efficiencies. However, profitability challenges persist: analysts at TD Cowen have revised down revenue and profit forecasts for major media conglomerates grappling with the economic strain of content budgets and subscriber saturation.

In the news and niche sports segment, Fox News Media has diversified beyond cable into streaming, podcasts, and digital advertising, generating an estimated $500 million annually and amassing up to 2.5 million subscribers on Fox Nation as part of a broader strategic pivot. This multi-platform approach underlines the growing imperative for pay TV and media brands to cultivate direct-to-consumer channels, diversify monetization tactics, and forge partnerships that extend reach beyond traditional distribution corridors.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pay TV Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Altice USA, Inc.

- AT&T Inc.

- Charter Communications, Inc.

- Comcast Corporation

- Dish Network Corporation

- Groupe Canal+ S.A.

- Liberty Global plc

- Sky Group Limited

- Telefónica, S.A.

- Vodafone Group Plc

Delivering Tactical and Strategic Recommendations to Empower Industry Leaders in Adapting to Digital Disruption and Regulatory Challenges

To thrive in an environment defined by digital disruption and regulatory uncertainty, industry leaders must embrace adaptive, customer-centric strategies backed by robust data analytics. Investing in hybrid set-top box solutions that seamlessly integrate OTT applications with linear channels will enhance user stickiness and unlock new cross-sell opportunities. Meanwhile, deploying low-cost, plug-and-play streaming devices can serve as effective anti-churn tools, enabling operators to phase out legacy hardware without sacrificing recurring revenue.

Diversifying supply chains away from tariff-exposed geographies is paramount; establishing manufacturing partnerships in regions with favorable trade agreements will help contain costs and mitigate policy-driven price volatility. Concurrently, expanding ad-supported tiers and FAST channel portfolios will engage price-sensitive segments and drive incremental ad revenue, while preserving subscription floor yields. Collaboration with leading sports leagues and content creators to secure exclusive live programming can further bolster differentiated value propositions.

Finally, leveraging AI-driven recommendation engines and unified content discovery interfaces will elevate personalization, reduce churn, and support high-precision targeting for both subscription and advertising monetization models. By aligning organizational structures, revenue models, and technology roadmaps around these imperatives, pay TV operators and media companies can navigate the rapidly evolving landscape with agility and foresight.

Articulating the Rigorous Research Methodology Incorporating Primary Interviews Secondary Data Analysis and Robust Segmentation Frameworks

This analysis is grounded in a comprehensive research methodology combining primary and secondary sources. Extensive interviews were conducted with senior-level executives across leading service providers, hardware manufacturers, and content licensors to capture firsthand perspectives on market dynamics, investment priorities, and strategic initiatives. These insights were supplemented by quantitative data from public financial disclosures, government trade databases, and industry analytics to ensure accuracy and breadth of coverage.

Secondary research comprised a detailed review of regulatory filings, trade publications, and news outlets to track tariff developments, policy actions, and competitive moves. Market segmentation frameworks were applied to parse service types, subscription tiers, device categories, video quality standards, and end-user segments, enabling a granular understanding of demand drivers and value pools. Data triangulation and scenario analysis techniques were employed to validate findings and test the resilience of strategic recommendations under varying macroeconomic and policy conditions.

Throughout the study, rigorous verification protocols were followed to cross-reference multiple sources, mitigate bias, and ensure the reliability of qualitative assessments and quantitative projections. This holistic approach has yielded a robust blueprint for stakeholders seeking to capitalize on emerging opportunities, navigate risks, and chart a sustainable path forward in the evolving pay TV services landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pay TV Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pay TV Services Market, by Service Type

- Pay TV Services Market, by Subscription Tier

- Pay TV Services Market, by Device Type

- Pay TV Services Market, by Video Quality

- Pay TV Services Market, by End User

- Pay TV Services Market, by Region

- Pay TV Services Market, by Group

- Pay TV Services Market, by Country

- United States Pay TV Services Market

- China Pay TV Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Reflections on the Post Tariff and Streaming Convergence Era Defining the Future Landscape of Pay TV Services

The pay TV services sector stands at a crossroads, shaped by the dual forces of digital innovation and trade policy headwinds. As traditional subscription models yield to agile streaming ecosystems, operators and content providers must reconcile legacy infrastructure investments with the imperative to deliver seamless, differentiated experiences across all screens. The confluence of tariff-induced cost pressures and cord-cutting trends underscores the importance of strategic flexibility, diversified monetization, and consumer-centric design.

Segmentation insights reveal that service type, subscription tier, device preference, video quality expectations, and end-user context each represent a vector of opportunity or risk. Regional trajectories further highlight that market maturity, infrastructure readiness, and regulatory environments will drive heterogeneous outcomes across the Americas, EMEA, and Asia-Pacific. Meanwhile, competitive benchmarks from leading players illustrate how converged offerings, content bundling, and digital extensions can serve as effective defense and growth levers.

In conclusion, stakeholders who proactively embrace hybrid distribution models, deploy innovative hardware solutions, and forge adaptive supply chains will be best positioned to thrive amid evolving consumer behaviors and policy landscapes. By integrating deep market intelligence with agile execution frameworks, industry leaders can not only preserve core audiences but also unlock new revenue streams, ensuring a resilient and vibrant future for pay TV services.

Connect Directly with Ketan Rohom to Access Exclusive Insights and Acquire the Comprehensive Pay TV Services Market Research Report

Ready to gain actionable insights and strategic foresight tailored to the rapidly evolving pay TV services market? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure access to our comprehensive market research report. Elevate your decision-making with data-driven analysis and expert guidance-connect now to embark on your path to competitive advantage.

- How big is the Pay TV Services Market?

- What is the Pay TV Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?