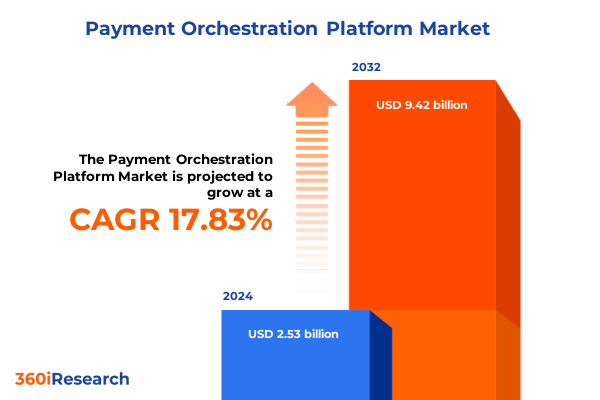

The Payment Orchestration Platform Market size was estimated at USD 9.32 billion in 2025 and expected to reach USD 10.39 billion in 2026, at a CAGR of 12.02% to reach USD 20.65 billion by 2032.

Unifying fragmented payment ecosystems through advanced orchestration solutions to empower merchants with flexibility, control, and revenue-driven insights

Payment orchestration platforms have emerged as a critical solution for merchants seeking to unify fragmented payment infrastructures into a seamless, efficient ecosystem. By integrating multiple payment service providers, optimizing routing logic, and consolidating transaction data, orchestration systems empower businesses to reduce transaction failures, enhance authorization rates, and deliver consistent checkout experiences across channels. Merchants can now view their entire payment landscape through a single pane of glass, unlocking the visibility required to make data-driven decisions and adapt rapidly to shifting consumer preferences.

In recent years, the payments landscape has undergone remarkable transformation driven by the explosive growth of digital transactions. In 2023 alone, digital payments expanded by 19%, with over 317 billion transactions processed globally, and more than half of merchants-53%-adopted orchestration platforms to manage multiple gateways and improve transaction approval rates by over 26%. As emerging payment methods such as buy-now-pay-later and cryptocurrencies gain traction, orchestrating a diverse array of options has become essential for optimizing revenue streams and minimizing operational complexity.

Harnessing AI, Real-Time Payments, and Embedded Finance to Revolutionize Payment Orchestration for Unprecedented Operational Agility and Customer Experience

The payment orchestration sector is rapidly evolving beyond simple transaction routing to embrace advanced technologies and broadened capabilities that redefine how payments are processed and analyzed. Artificial intelligence and machine learning are now integral to modern orchestration platforms, providing real-time analytics and predictive routing that anticipate failure patterns and dynamically steer transactions toward the optimal provider. Automation of payment workflows through AI has increased by 33% year-on-year, enabling merchants to reduce false declines and enhance revenue efficiency.

Concurrently, the integration of alternative payment methods-including buy-now-pay-later solutions, cryptocurrencies, and open banking rails-has reshaped merchant strategies. In 2023, 34% of consumers utilized buy-now-pay-later services, and nearly half of orchestration solutions now support these providers, unlocking access to previously underserved market segments. Additionally, 47% of platforms have adopted open banking rails alongside traditional card networks, further diversifying payment choices and enhancing cross-border commerce resilience.

Strategic alliances and market consolidation continue to accelerate, with both established payment service providers and specialist orchestration vendors pursuing mergers and acquisitions to scale their offerings and extend global reach. Industry leaders are also broadening their horizons to include adjacent services-such as fraud prevention, digital identity verification, and logistics orchestration-positioning their platforms as comprehensive commerce enablers rather than mere transaction conduits.

Data and analytics are playing an increasingly prominent role, as merchants demand actionable insights to fine-tune routing rules and optimize acceptance rates. By unifying payment data estates, orchestration platforms deliver granular visibility into customer behavior, gateway performance, and geographic trends, empowering decision-makers to prioritize investments and streamline operations.

Assessing the Broad Spectrum Effects of 2025 U.S. Tariff Policies on Cross-Border Payment Flows, Merchant Costs, and Operational Complexity

The cumulative impact of U.S. tariff policies implemented in 2025 has introduced new layers of complexity to cross-border e-commerce and payment infrastructures. With the removal of the de minimis exemption on May 2, 2025, over 94% of businesses now face increased customs delays, as enhanced valuation scrutiny and documentation requirements slow shipments and inflate logistics costs. This shift has amplified the need for payment orchestration platforms to incorporate real-time tax and duty calculations alongside foreign exchange adjustments.

As heightened tariffs have disrupted traditional supply chains, merchants have reevaluated fulfillment models, moving toward in-country warehousing to mitigate delivery uncertainties. These adaptations have driven carriers to layer additional fuel surcharges and compliance fees onto shipment costs, which now represent a larger share of total landed expenses. In turn, merchants are leveraging orchestration platforms to automate tariff-induced pricing adjustments and reduce manual reconciliation challenges.

Retailers are also responding to these pressures by implementing price increases and narrowing product assortments. Reports indicate that some online marketplaces have quietly raised prices on essential household items by an average of 5.2% between January and July 2025, citing new tariff burdens as a key driver. Meanwhile, major e-commerce platforms have paused or diversified direct shipments from China, reflecting a broader trend of rerouting supply chains to alternative manufacturing hubs.

In aggregate, these tariff changes have depressed Chinese-origin e-commerce exports to the U.S. by approximately 65% in early 2025, prompting many platforms to strengthen regional payment routing strategies and integrate localized service providers to preserve conversion rates. Payment orchestration solutions have thus become instrumental in helping merchants seamlessly incorporate tariff-compliance workflows, optimize cross-border routing, and sustain customer satisfaction amidst evolving trade policies.

Decoding Market Opportunities through Deployment Modes, End-Use Scenarios, Organizational Structures, Payment Methods, and Sector-Specific Demands

A nuanced understanding of market segmentation reveals distinct drivers and adoption patterns across deployment modes, end-use scenarios, organizational sizes, payment methods, channels, verticals, and solution components. In terms of deployment, cloud-based orchestration has garnered traction for its rapid scalability and continuous feature updates, whereas hybrid environments are preferred by organizations seeking a balance between innovation and data sovereignty. On-premise solutions, while representing a smaller share, remain relevant for highly regulated industries that require localized control over sensitive payment data.

Examining end-use distinctions, B2C merchants prioritize frictionless consumer experiences and broad method acceptance, whereas B2B enterprises focus on robust invoicing capabilities, net-payment terms management, and enhanced reconciliation tools. Among organizational size segments, large enterprises leverage orchestration to manage complex multi-regional estates and global acquiring networks. Conversely, small and medium enterprises-particularly micro and small businesses-are increasingly adopting subscription-based orchestration offerings to accelerate time to market without significant upfront investments.

Payment method diversity also drives architecture choices, as merchants seek to integrate core methods such as credit cards, bank transfers, and digital wallets alongside emerging alternatives like buy-now-pay-later, crypto payments, and direct debit. Channel segmentation fuels demand for unified commerce platforms that blend storefront transactions, online checkouts, and omnichannel loyalty integrations. Vertically, the BFSI sector emphasizes compliance and risk mitigation, e-commerce players concentrate on conversion rate optimization, healthcare providers demand strong encryption and privacy controls, and retail brands require seamless point-of-sale integration.

Across all these layers, the component landscape is anchored by platform services delivering core orchestration capabilities, supported by integration services that connect disparate gateways and tokenization solutions. Analytics services-spanning predictive models and real-time dashboards-are essential for merchants seeking to harness transaction data and drive continuous improvement in routing, fraud prevention, and customer engagement.

This comprehensive research report categorizes the Payment Orchestration Platform market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Payment Method

- Deployment Mode

- Organization Size

- End Use

- Vertical

- Channel

Illuminating Geographic Variations in Payment Demands and Technology Adoption across Americas, EMEA, and Asia-Pacific Markets

Regional market dynamics present unique opportunities and challenges for orchestration adoption. In the Americas, digital payment growth is propelled by strong card infrastructure and rising digital wallet usage, with 39% of online payments in North America executed through digital wallets in 2024, outpacing credit card usage in the same channel at 32%. U.S. merchants benefit from mature processing networks and streamlined regulatory frameworks, which facilitate the rapid rollout of new orchestration capabilities.

Europe, the Middle East, and Africa exhibit a more heterogeneous landscape shaped by diverse regulatory regimes and open banking initiatives. While only 24% of consumers in Europe express a preference for innovative payment methods-compared to 53% in Asia-Pacific-stringent directives such as PSD2 and GDPR have spurred investments in secure APIs, strong customer authentication, and robust data governance processes. Consequently, orchestration platforms in EMEA must prioritize modular compliance workflows and localized integrations to address regional variations.

Asia-Pacific remains the fastest-growing region, driven by mobile-first economies and pervasive QR code-based ecosystems. Over 80% of consumers in markets like the Philippines, Malaysia, and Thailand now use mobile wallets for in-store payments, while driving home a 311% increase in mobile wallet adoption in Southeast Asia between 2020 and 2025. The UPI system in India and unified QR standards across Indonesia have catalyzed broad-based digital payment acceptance, urging orchestration providers to offer language, currency, and local method support to capture this dynamic growth corridor.

This comprehensive research report examines key regions that drive the evolution of the Payment Orchestration Platform market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Payment Orchestration Innovators and Emerging Challengers Shaping the Future of Unified Commerce Infrastructure

Leading payment orchestration providers are defining the competitive landscape through differentiated value propositions and targeted expansion strategies. Established players such as Braintree (acquired by PayPal), Stripe, Checkout.com, and Razorpay continue to innovate with developer-friendly APIs and embedded finance offerings, enhancing their platforms with native tokenization and intelligent routing capabilities. Concurrently, enterprise-focused vendors like ACI Worldwide and CyberSource cater to complex omnichannel retail and hospitality clients by integrating terminal management and global acquiring networks.

Market consolidation has also reshaped the roster of key participants, as financial technology firms and investors pursue acquisitions to broaden service scopes. Notable transactions include PayU’s acquisition of ZOOZ Mobile, Payoneer’s integration of Optile, and TokenEx’s purchase of IXOPAY, signaling heightened interest from tokenization specialists and payment networks in expanding orchestration footprints. Emerging challengers such as Pagos and Gr4vy are leveraging modular, API-first platforms to target underserved segments, emphasizing rapid integration times and transparent pricing models.

In parallel, strategic alliances between orchestration vendors and complementary solution providers are accelerating time to value for merchants. Partnerships with fraud prevention specialists, digital identity platforms, and logistics orchestration services are enabling unified ecosystems that transcend the traditional bounds of payment processing. As data and analytics capabilities mature, vendors with robust intelligence modules will gain prominence, offering merchants the ability to surface real-time insights and actuarial recommendations directly within orchestration dashboards.

This comprehensive research report delivers an in-depth overview of the principal market players in the Payment Orchestration Platform market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACI Worldwide, Inc.

- Adyen N.V.

- Aevi International GmbH

- Akurateco Lab

- APEXX Fintech Limited

- BlueSnap Inc.

- BR-DGE by Comcarde Limited

- BridgerPay

- CellPoint Digital Ltd.

- Corefy

- Gr4vy, Inc.

- Ikajo International B.V.

- Integrated Research

- IXOLIT Group

- Justt Fintech Ltd.

- Linked2pay

- ModoPayments, LLC

- Monei Digital Payments SL

- Nexio

- PayDock Pty Ltd.

- Payoneer Global Inc.

- PPRO Financial Ltd.

- Rebilly, Inc.

- Recurly, Inc.

- Spreedly, Inc.

- Stripe, Inc.

- Very Good Security, Inc.

- Visa Inc.

- When Then Limited

- WLPayments B.V.

- Worldline S.A.

- Worldpay, Inc.

- Zai Auatralia Pty.Ltd.

Strategic Steps for Industry Leaders to Enhance Payment Flow Resilience, Drive Revenue Growth, and Excel in an Evolving Orchestration Landscape

Industry leaders seeking to harness the full potential of payment orchestration platforms should prioritize strategic architecture decisions and continuous optimization cycles. First, adopting a modular, API-driven framework enables rapid integration of new payment methods, alternative rails, and third-party services without disrupting core processing workflows. This approach supports agile experimentation and reduces technical debt over time.

Next, embedding advanced analytics and machine learning models is crucial for maximizing transaction success and minimizing revenue leakage. By leveraging predictive routing based on historical performance data, merchants can dynamically adjust gateway priorities and fallback mechanisms to improve authorization rates. It is equally important to establish clear performance metrics-such as transaction approval delta, cost per transaction, and dispute ratios-to guide iterative enhancements.

Additionally, organizations must invest in comprehensive compliance infrastructure to address evolving regulatory requirements across regions. Automated reporting tools, role-based access controls, and encryption standards should be integrated within the orchestration stack to ensure both audit readiness and customer data protection. Collaboration with regional payment service providers and compliance experts will streamline local market entries and mitigate legal risks.

Finally, building strategic partnerships with fraud prevention and identity verification specialists will strengthen risk management postures. By incorporating multi-factor authentication, device fingerprinting, and real-time velocity checks, merchants can proactively detect and respond to suspicious behaviors. Coordinating these safeguards within the orchestration layer not only centralizes control but also enhances the overall customer experience by reducing unnecessary friction.

Combining Primary Expert Interviews, Comprehensive Secondary Analysis, and Rigorous Data Validation for Unbiased Payment Orchestration Insights

The research methodology employed for this payment orchestration market report combines multiple layers of qualitative and quantitative analysis to ensure robust, unbiased insights. Primary research included in-depth interviews with senior executives, payment architects, and IT decision-makers across leading merchants, networks, and solution providers. These expert conversations yielded firsthand perspectives on implementation challenges, ROI considerations, and strategic roadmaps.

Secondary research encompassed a comprehensive review of industry publications, regulatory filings, technology whitepapers, and corporate materials. Emphasis was placed on triangulating publicly available data points-such as transaction volume reports, adoption surveys, and tariff announcements-to construct an accurate view of market dynamics. Segmentation frameworks were validated through multiple sources to confirm deployment, end-use, organization size, and component categorizations.

Data validation was conducted through cross-source comparisons and peer reviews by subject-matter experts within the payments ecosystem. Analytical models were stress-tested against known market events-such as the May 2025 de minimis exemption removal-to verify that insights aligned with real-world developments. Finally, continuous quality assurance processes ensured consistency in terminology, metric definitions, and narrative coherence throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Payment Orchestration Platform market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Payment Orchestration Platform Market, by Component

- Payment Orchestration Platform Market, by Payment Method

- Payment Orchestration Platform Market, by Deployment Mode

- Payment Orchestration Platform Market, by Organization Size

- Payment Orchestration Platform Market, by End Use

- Payment Orchestration Platform Market, by Vertical

- Payment Orchestration Platform Market, by Channel

- Payment Orchestration Platform Market, by Region

- Payment Orchestration Platform Market, by Group

- Payment Orchestration Platform Market, by Country

- United States Payment Orchestration Platform Market

- China Payment Orchestration Platform Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Embracing Payment Orchestration as the Cornerstone for Driving Seamless, Secure, and Scalable Financial Transactions across Modern Business Ecosystems

As digital commerce continues to expand in complexity and scale, payment orchestration platforms will remain indispensable for merchants striving to deliver seamless, secure, and scalable transaction experiences. The convergence of artificial intelligence, alternative payment methods, and regulatory imperatives has elevated orchestration from a niche solution to a foundational element of modern financial operations.

By understanding the cumulative effects of global tariff policies, leveraging nuanced segmentation insights, and tailoring strategies to regional variations, organizations can effectively navigate evolving market conditions. Leading vendors and challengers alike are investing in modular architectures, analytics-driven optimization, and strategic partnerships to meet the diverse demands of end-users across B2B, B2C, and enterprise segments.

Ultimately, embracing payment orchestration as a core component of commerce infrastructure will empower businesses to maximize revenue, enhance customer satisfaction, and maintain resilience amidst ongoing technological and regulatory shifts. The insights presented in this executive summary provide a roadmap for confidently engaging with this dynamic sector and positioning for sustained growth in the years ahead.

Contact Associate Director for Customized Insights and Exclusive Access to the Comprehensive Payment Orchestration Market Research Report Today

To gain immediate access to a comprehensive, in-depth analysis of payment orchestration platform dynamics, connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan’s expertise in payments and digital commerce will guide you to the insights and strategic guidance tailored to your organization’s needs. Reach out today for a personalized consultation, detailed pricing information, and exclusive sample chapters to understand how this report can support your upcoming initiatives and drive your competitive advantage in a rapidly evolving payments landscape.

- How big is the Payment Orchestration Platform Market?

- What is the Payment Orchestration Platform Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?