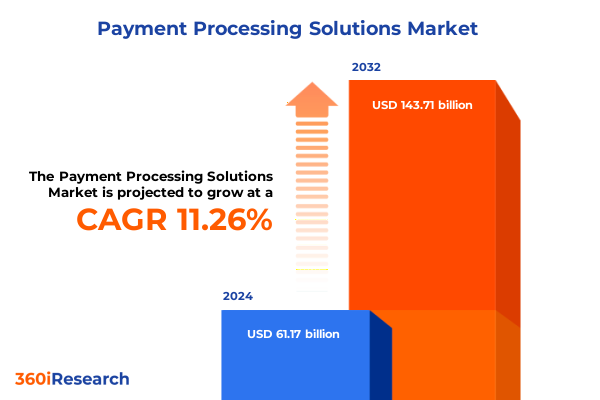

The Payment Processing Solutions Market size was estimated at USD 68.08 billion in 2025 and expected to reach USD 75.23 billion in 2026, at a CAGR of 11.26% to reach USD 143.71 billion by 2032.

Defining the Next Wave in Payment Processing Solutions to Propel Seamless Transactions Efficiency and Customer Satisfaction in a Dynamic Digital Ecosystem

In recent years, the global payments landscape has undergone a profound evolution as digital commerce has surged and consumer expectations have shifted decisively toward seamless, frictionless transactions. Businesses are under growing pressure to offer instantaneous and secure payment experiences across online, in-store, and mobile channels, compelling providers to rethink legacy infrastructures and embrace agile, interoperable platforms. This introduction sets the scene for an industry defined by relentless innovation, where the imperative to reduce transaction latency and optimize customer journeys drives continuous reinvention.

Moreover, accelerated by widespread adoption of contactless technologies and the rapid proliferation of e-wallets, organizations are prioritizing integration of modern payment rails that can support omnichannel scenarios without compromising on security or user experience. Fraud prevention, data privacy, and regulatory compliance have emerged as foundational pillars, demanding that solution providers deliver robust risk management frameworks alongside intuitive payment interfaces. As a result, alliances between financial institutions, technology vendors, and regulatory bodies are reshaping the way value is delivered to end users.

Against this backdrop of heightened digital expectations, the payment processing ecosystem has become a dynamic battleground where cutting-edge technology, customer-centric design, and strategic partnerships intersect. The next sections of this executive summary will explore transformative shifts in innovation, the ripple effects of new United States tariffs on supply chains, nuanced segmentation insights that uncover untapped opportunities, and regional dynamics that inform tailored growth strategies. By weaving together these threads, this report illuminates the complex interplay of factors shaping the future of payment processing solutions.

Ultimately, this introduction underscores the criticality of strategic agility and data-driven decision making for organizations seeking to capitalize on emerging trends. Navigating the tradeoffs between speed, security, and scalability will define market leaders in the years ahead, making a thorough understanding of the evolving landscape essential for decision-makers at every level.

Navigating Technological Advances Strategic Partnerships and Emerging Business Models Reshaping the Future of Payment Processing Across Global Markets

Digital payment methodologies have advanced at an unprecedented pace, catalyzed by rapid adoption of mobile wallets, contactless solutions, and in-app payment experiences that place convenience at the forefront. This section examines how technology giants and nimble fintech startups alike are introducing features such as tokenization, biometric authentication, and real-time settlement to reduce friction and reinforce trust. As consumers increasingly expect one-click payment flows, the pressure on incumbents to modernize legacy platforms has intensified, driving innovation in user experience design and backend processing architecture.

Meanwhile, strategic partnerships are redefining market dynamics, with banks and payment processors collaborating on open banking initiatives that leverage application programming interfaces (APIs) to enable data-rich transactions and value-added services. These alliances are giving rise to ecosystems where core banking functions, payment orchestration layers, and third-party applications converge to deliver a seamless, connected journey from checkout to reconciliation. By sharing infrastructure and insights, stakeholders are unlocking new monetization models while reducing costs associated with maintaining siloed systems.

Artificial intelligence and machine learning are also playing a transformative role within fraud detection and risk management, enabling behavioral analytics and adaptive learning models that can identify anomalies in real time. Concurrently, distributed ledger technologies are being piloted to streamline cross-border payments by reducing settlement times and lowering counterparty risk. Although blockchain implementations remain nascent, their potential to transform conventional clearing and settlement processes has elevated them to strategic priority for forward-thinking organizations.

Collectively, these technological advances and evolving business models represent a fundamental shift from traditional transaction processing toward a service-oriented, software-driven paradigm. As market participants embrace the notion of payment-as-a-service and subscription-based pricing for platform access, the concept of payment processing is expanding beyond transaction capture to include integrated analytics, loyalty orchestration, and embedded finance functionalities.

Assessing the Cumulative Effect of 2025 United States Tariffs on Global Payment Processing Flows Operational Costs and Cross-Border Trade Dynamics

With the implementation of a new series of tariffs in 2025, the United States has introduced additional duties on imported hardware components and peripheral devices used in payment processing systems. These measures, intended to protect domestic manufacturing and encourage onshore production, have had significant downstream effects on the supply chains that underpin point-of-sale terminals and self-service kiosks. Increased import costs are being passed along to merchants and service providers, creating upward pressure on capital expenditures for hardware modernization initiatives.

Consequently, payment terminal manufacturers are exploring alternative sourcing strategies, including relocating assembly operations to jurisdictions exempt from punitive duties or negotiating cost-sharing arrangements with key customers. This realignment has spurred a wave of contract revisions and strategic reviews, as stakeholders seek to balance supply chain resilience against the risk of shrinking margins. In parallel, warehouse and logistics partners are adjusting freight routes and distribution centers to mitigate tariff impacts, although longer transit times and elevated shipping tariffs have introduced additional complexity to the procurement process.

Furthermore, the cumulative impact of tariffs has extended to cross-border transaction fees and currency exchange spreads, since some payment service providers are offsetting higher input costs by revising their pricing structures. Small and medium-sized merchants, in particular, face challenges in absorbing these incremental expenses, which may result in slower adoption of newer technologies or deferral of terminal upgrades. Inflationary pressures on end-consumer prices can also erode transaction volumes, creating a feedback loop that influences both merchant and issuer economics.

In response, industry leaders are investing in tariff avoidance mechanisms such as free trade agreements and bonded warehousing, while also exploring software-centric solutions that decouple revenue growth from hardware dependency. As policymakers consider adjustments to existing trade measures, the evolving dialogue between government authorities and industry consortia will be critical in shaping a more balanced ecosystem that supports innovation without sacrificing competitiveness.

Unlocking Market Potential Through InDepth Segmentation Analysis Spanning Payment Modes Components Deployment Models Organizational Scales and Industries

A comprehensive segmentation lens reveals that payment processing demand varies substantially depending on the chosen mode of transaction. Bank transfers continue to serve as a reliable backbone for high-value B2B settlements, while credit and debit card usage dominate consumer retail environments. E-wallets have seen explosive growth in regions with mature digital infrastructure, catering to on-the-go shoppers who value speed and ease of use. Each payment mode carries distinct cost structures, settlement timelines, and regulatory requirements, influencing how solution providers prioritize feature development and integration services.

Examining the component spectrum, the market splits into services and solutions, each of which encompasses specialized subcategories. Within services, managed offerings deliver end-to-end operational support and maintenance, while professional services focus on bespoke consulting, system implementation, and customization. On the solutions side, hardware systems include contactless terminals optimized for tap-and-go payments, mobile point-of-sale configurations for on-the-move transactions, and fixed POS terminals embedded in retail fixtures. Software platforms cover transaction orchestration, reconciliation tools, and analytics dashboards designed to empower merchants with actionable insights.

Deployment preferences further differentiate market needs, as organizations weigh the benefits of cloud infrastructures against the control offered by on-premises installations. Hybrid cloud arrangements provide a middle path, enabling sensitive data to reside in private environments while leveraging public cloud scalability for non-critical workloads. Private cloud deployments appeal to businesses requiring stringent compliance and data sovereignty, whereas public cloud installations offer rapid scalability for enterprises focused on minimal capital expenditure and accelerated time to market.

Organization size and industry adoption patterns also drive segmentation nuances. Large enterprises demand highly scalable, customizable payment ecosystems that can integrate with global ERP systems and loyalty platforms. Small and mid-sized companies often opt for turnkey solutions that minimize implementation complexity and upfront costs. In terms of end-use sectors, banking and financial services firms emphasize transaction security and regulatory alignment, government agencies prioritize accessibility and auditability, healthcare providers seek seamless patient billing experiences, while retail and transportation sectors focus on high-throughput terminals and frictionless customer interactions.

This comprehensive research report categorizes the Payment Processing Solutions market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Payment Mode

- Component

- Deployment Mode

- Organization Size

- End-Use Industry

Exploring Payment Processing Development Imperatives Growth Drivers and Market Dynamics Across the Americas Europe Middle East and Africa and Asia Pacific

Across the Americas, the payment processing environment is characterized by a mature digital commerce ecosystem in the United States and Canada, where regulatory initiatives such as the Durbin Amendment and bespoke state-level privacy laws shape service offerings. Mexico and Brazil are witnessing rapid e-wallet adoption and a surge in contactless payments, driven by government support for financial inclusion. This regional complexity necessitates flexible platforms that can adapt to diverse regulatory obligations, varying fraud profiles, and a wide range of cross-border transaction patterns.

This comprehensive research report examines key regions that drive the evolution of the Payment Processing Solutions market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators Shaping the Payment Processing Sphere Through Strategic Alliances Technological Leadership and Operational Excellence

Leading network operators continue to innovate by expanding tokenization frameworks and optimizing clearing and settlement rails to support higher transaction volumes and lower latency thresholds. These incumbents leverage decades of infrastructure investment and global reach to pilot advanced authentication technologies and integrated loyalty ecosystems that extend beyond basic transaction processing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Payment Processing Solutions market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adyen N.V.

- American Express Company

- Authorize.Net LLC

- Block, Inc.

- BlueSnap, Inc.

- Checkout.com Ltd

- Elavon, Inc.

- Fiserv, Inc.

- Global Payments Inc.

- Marqeta, Inc.

- Mastercard Incorporated

- Mollie B.V.

- Payoneer Inc.

- PayPal Holdings, Inc.

- PayU Global B.V.

- Razorpay Software Private Limited

- Stripe, Inc.

- Verifone, Inc.

- Visa Inc.

- Worldpay, Inc.

Crafting Strategic Imperatives for Industry Leaders to Harness Payment Processing Innovations Optimize Operations and Navigate Regulatory Complexities

In order to thrive amid rapid technological change and evolving regulatory landscapes, organizations should adopt modular, API-first payment platforms that facilitate seamless integration with new payment rails and third-party service providers. Embracing open banking strategies by establishing strategic partnerships with fintech innovators can unlock new revenue streams and accelerate time to market for value-added services.

Detailing Rigorous Research Methodology Encompassing Data Collection Analytical Frameworks and Validation Protocols for Payment Processing Market Insights

This report’s findings are underpinned by a rigorous research methodology that blends qualitative depth with quantitative validation. Primary interviews were conducted with C-suite executives, technical architects, and regulatory experts across leading financial institutions and payment technology firms to capture nuanced perspectives on market drivers and adoption challenges.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Payment Processing Solutions market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Payment Processing Solutions Market, by Payment Mode

- Payment Processing Solutions Market, by Component

- Payment Processing Solutions Market, by Deployment Mode

- Payment Processing Solutions Market, by Organization Size

- Payment Processing Solutions Market, by End-Use Industry

- Payment Processing Solutions Market, by Region

- Payment Processing Solutions Market, by Group

- Payment Processing Solutions Market, by Country

- United States Payment Processing Solutions Market

- China Payment Processing Solutions Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Summarizing Critical Insights and Strategic Pathways to Leverage Payment Processing Innovations for Sustainable Growth and Competitive Advantage in a Dynamic Market

The payment processing landscape is at an inflection point where technological innovation, regulatory realities, and shifting consumer behaviors converge. Organizations that proactively align their strategies with emerging digital payment trends, navigate tariff and compliance challenges, and leverage detailed segmentation insights will be best positioned to secure a competitive advantage and drive sustainable growth.

Connect with Associate Director Sales and Marketing to Secure Exclusive Payment Processing Market Insights through a Research Report Purchase

To explore how these comprehensive insights can directly inform your strategic roadmap and operational priorities, please connect with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to purchase the full research report and gain immediate access to in-depth analysis, proprietary data, and tailored guidance that can elevate your organization’s payment processing capabilities to the next level

- How big is the Payment Processing Solutions Market?

- What is the Payment Processing Solutions Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?