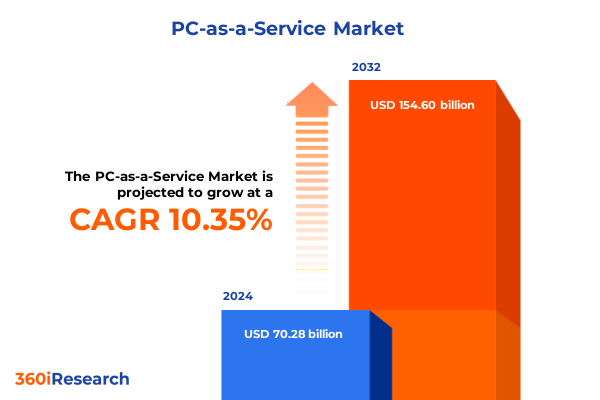

The PC-as-a-Service Market size was estimated at USD 77.21 billion in 2025 and expected to reach USD 84.92 billion in 2026, at a CAGR of 10.42% to reach USD 154.60 billion by 2032.

An Insightful Overview Setting the Stage for Understanding the Growing Importance and Strategic Benefits of PC-as-a-Service Models Across Industries

In today’s rapidly evolving IT environment, PC-as-a-Service has emerged as a transformative model that alleviates the burden of traditional device ownership by offering bundled hardware, software, and support services under a unified subscription. This approach marks a fundamental shift away from large upfront capital expenditures toward predictable operating expenditures, enabling organizations to align spending directly with user needs and business growth. By outsourcing device lifecycle management, from procurement through retirement, enterprises can focus on core competencies while ensuring employees have access to modern, secure endpoints.

As businesses face mounting pressure to maintain agility, safeguard sensitive data, and minimize total cost of ownership, PC-as-a-Service models deliver a streamlined path to achieving these goals. Leading providers leverage standardized deployment methodologies, proactive maintenance, and flexible upgrade paths to address evolving requirements. This introduction sets the stage for a deeper exploration of the forces reshaping the PC-as-a-Service market over the coming sections, including technological innovations, regulatory impacts, and strategic recommendations for industry leaders seeking to harness its full potential.

Emerging Technological and Operational Paradigm Shifts Reshaping How Organizations Leverage PC-as-a-Service to Drive Efficiency and Innovative IT Strategies

The PC-as-a-Service landscape is being redefined by advancements in virtualization, automation, and artificial intelligence. Virtualization software solutions now enable dynamic provisioning of desktops, allowing IT teams to scale user environments instantly in response to shifting workloads. At the same time, the rise of edge computing has encouraged service providers to integrate localized processing capabilities within endpoint devices, reducing latency for mission-critical applications. These technological shifts not only enhance end-user experience but also fortify organizational resilience in the face of network disruptions.

Operationally, managed services providers are adopting predictive analytics to preempt hardware failures and optimize device performance. By leveraging telemetry data, these providers can schedule maintenance before users experience downtime, thereby upholding service level agreements and contributing to continuous productivity. Meanwhile, the integration of security software has become more sophisticated, with zero-trust principles embedded directly within device firmware. As these elements converge, businesses are increasingly viewing PC-as-a-Service as a strategic enabler rather than a cost-containment tactic.

Analyzing the Cumulative Effects of Newly Imposed Tariffs on Hardware Components and Service Costs in the United States PC-as-a-Service Market Environment

In early 2025, the United States introduced a series of tariffs targeting critical hardware components, including semiconductors and memory modules, directly affecting PC-as-a-Service offerings. These levies have led to incremental cost pressures on device procurement, prompting service providers to reassess pricing structures and renegotiate supplier contracts. Although many providers have absorbed a portion of these increases to maintain competitive subscription rates, the cumulative impact has begun to influence contract durations and upgrade cycles.

Beyond immediate cost implications, tariffs have accelerated diversification of global supply chains. Service providers are investing in alternative sourcing strategies, including partnerships with non-US manufacturers and regional assembly facilities, to mitigate future duties. At the same time, the threat of additional regulatory actions has encouraged organizations to adopt multi-vendor approaches, ensuring continuity of service and reducing reliance on single geographies. These strategic adjustments underscore the market’s adaptability in the face of evolving trade policies.

Deep Investigation into Component, Payment, Deployment, Industry, and Organizational Size Segmentation Revealing Nuanced Insights for PC-as-a-Service Adoption

Deconstructing the PC-as-a-Service market through diverse segmentation lenses reveals nuanced dynamics that shape value propositions for different customer profiles. When viewed through the prism of component types, hardware deployments span desktops and laptops, each offering distinct performance, portability, and cost considerations. Complementing hardware, managed services and professional services ensure devices remain optimized, while security software and virtualization software integral to software bundles fortify operational integrity and streamline user environments.

Payment models further differentiate portfolio offerings, as organizations choose between pay-per-use arrangements that scale costs with actual consumption or subscription options that lock in predictable monthly fees. Deployment models also influence decision making, with cloud-based solutions providing remote management and scalability benefits, whereas on-premises installations afford greater control over data residency and compliance. Industry verticals-from banking, financial services, and insurance to education, government, healthcare, IT & telecom, and manufacturing-exhibit unique priorities around service reliability, regulatory adherence, and customization. Finally, the contrast between large enterprises and small and medium-sized enterprises highlights divergent needs for standardized enterprise-grade solutions versus budget-sensitive, modular packages.

This comprehensive research report categorizes the PC-as-a-Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Payment Model

- Deployment Model

- Industry Vertical

- Organization Size

Comparative Examination of PC-as-a-Service Growth and Maturity Across Americas, Europe Middle East & Africa, and Asia-Pacific Regions Highlighting Core Trends

Regional variations play a pivotal role in shaping adoption strategies for PC-as-a-Service. In the Americas, strong leasing traditions and mature financing ecosystems have accelerated acceptance of subscription-based endpoint management. Providers routinely tailor their offerings to comply with stringent data privacy regulations, ensuring that service level agreements reflect regional compliance standards while offering end-to-end visibility across device fleets.

Conversely, Europe, Middle East & Africa markets are characterized by a heightened focus on cybersecurity and data sovereignty. Enterprises in these regions often prefer on-premises or hybrid deployment models to satisfy GDPR and local data protection mandates, driving innovation in secure virtualization and containerization technologies. In Asia-Pacific, rapid digital transformation initiatives have spurred demand for cloud-based PC-as-a-Service solutions, particularly in education and public sector segments that seek fast deployment and centralized management capabilities. Accordingly, service providers continue to expand regional data centers and local support networks to meet diverse performance and compliance requirements.

This comprehensive research report examines key regions that drive the evolution of the PC-as-a-Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Technology Providers Driving Innovation and Competitive Positioning in the Global PC-as-a-Service Ecosystem

Leading technology companies are redefining the PC-as-a-Service ecosystem by combining device innovation with comprehensive lifecycle services. Market incumbents such as HP, Dell, and Lenovo leverage their global supply chain reach and financing partnerships to offer scalable subscription bundles that include hardware refresh cycles, managed maintenance, and end-of-life recycling. These providers emphasize integrated security software suites and virtualization platforms to differentiate their offerings and address enterprise concerns around data protection and user mobility.

In the software and services domain, specialists such as Microsoft, VMware, and Citrix bring virtualization expertise and endpoint security tools that complement hardware offerings, enhancing user experience through seamless application streaming and multi-factor authentication. Managed service providers, including IBM and regional IT integrators, focus on customizing professional services engagements-ranging from deployment workshops to ongoing help desk support-to ensure alignment with sector-specific compliance and performance standards. As competition intensifies, companies are also forging partnerships to combine strengths, delivering holistic solutions that optimize cost structures and expedite time to value.

This comprehensive research report delivers an in-depth overview of the principal market players in the PC-as-a-Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acer Incorporated

- Amazon Web Services Inc.

- Arrow Electronics Inc.

- ATEA Group

- Capgemini Services SAS

- CDW Corporation

- Citrix Systems, Inc.

- CompuCom Systems, Inc.

- Dell Technologies Inc.

- Fujitsu Limited

- Hemmersbach Holding GmbH

- Hewlett Packard Enterprise Company

- Hewlett-Packard Inc.

- Insight Enterprises, Inc.

- Intel Corporation

- International Business Machines Corporation

- Lenovo Group Ltd.

- Microsoft Corporation

- Nutanix, Inc.

- Oracle Corporation

- SHI International Corp

- Softcat plc

- Telia Company AB

- Utopic Software

- Zones, LLC

Targeted Strategic Recommendations to Empower Industry Leaders in Maximizing Operational Efficiency and Value Realization Through PC-as-a-Service Transformations

To capitalize on the transformative potential of PC-as-a-Service, industry leaders should prioritize building flexible contract frameworks that align with evolving user demands. Incorporating provisions for scalable device upgrades and adjustable payment schedules will help preserve budget agility and accommodate shifts in workforce composition. Equally important is the selection of service partners with proven expertise in security software integration and virtualization, ensuring that endpoint environments remain resilient against emerging cyber threats.

Leaders must also invest in change management initiatives to support seamless adoption. Comprehensive training programs for IT staff and end users reduce resistance, while clear governance models facilitate swift decision-making during deployment phases. Furthermore, continuous performance monitoring-leveraging analytics dashboards and KPIs tied to device uptime, support response times, and user satisfaction-will provide actionable feedback for iterative improvements. By adopting a proactive stance on these areas, organizations can harness PC-as-a-Service not merely as a procurement mechanism but as a catalyst for broader digital transformation.

Rigorous Research Framework and Methodological Approach Underpinning the Comprehensive Analysis of PC-as-a-Service Market Dynamics and Trends

This analysis is grounded in a multi-faceted research methodology that balances primary and secondary data collection. Primary insights were obtained through interviews with IT decision-makers, managed service executives, and end-user representatives across multiple industries. These conversations provided real-world perspectives on deployment challenges, security priorities, and cost-management strategies. Secondary research drew on publicly available regulatory documents, industry white papers, and technology vendor publications to construct a detailed view of market trends and tariff impacts.

The data synthesis process involved data triangulation techniques to validate findings and ensure accuracy. Segmentation analysis was conducted by mapping component types, payment and deployment models, industry verticals, and organization sizes against adoption behaviors and value drivers. Regional comparisons leveraged market intelligence reports and provider case studies to highlight geographic nuances. Ethical guidelines and data privacy standards were rigorously maintained throughout, with all information anonymized when necessary and cross-checked by subject matter experts for consistency.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our PC-as-a-Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- PC-as-a-Service Market, by Component Type

- PC-as-a-Service Market, by Payment Model

- PC-as-a-Service Market, by Deployment Model

- PC-as-a-Service Market, by Industry Vertical

- PC-as-a-Service Market, by Organization Size

- PC-as-a-Service Market, by Region

- PC-as-a-Service Market, by Group

- PC-as-a-Service Market, by Country

- United States PC-as-a-Service Market

- China PC-as-a-Service Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Reflections on Key Findings and Strategic Implications for Future PC-as-a-Service Adoption and Organizational Digital Transformation Journeys

The findings of this report underscore that PC-as-a-Service is no longer a niche offering but a strategic imperative for organizations seeking to modernize IT infrastructure and strengthen operational resilience. By embracing bundled hardware, software, and managed services, enterprises can unlock predictable budgeting, improved security postures, and enhanced user productivity. The interplay between technology innovations-such as virtualization and edge computing-and adaptive business models underscores the versatility of this approach.

Looking ahead, continuous evolution in regulatory landscapes, tariff regimes, and digital transformation priorities will shape the next phase of market growth. Organizations that proactively refine contract structures, invest in security-first deployments, and cultivate strong partnerships will be best positioned to reap sustained benefits. Ultimately, the PC-as-a-Service paradigm represents more than a procurement strategy; it embodies a holistic framework for driving end-to-end IT modernization and future-proofing digital workplaces.

Connect with Ketan Rohom to Secure Your PC-as-a-Service Market Research Report and Gain Strategic Insights to Drive Your IT Modernization Initiatives

If you are ready to gain a competitive edge and make informed investment decisions for your organization’s IT infrastructure, reach out to Ketan Rohom, Associate Director, Sales & Marketing. His expertise in PC-as-a-Service market dynamics will ensure you receive a tailored research package that aligns precisely with your strategic priorities. Don’t miss the opportunity to access comprehensive insights and guidance designed for decision-makers seeking to modernize endpoints, optimize costs, and enhance user experiences. Contact Ketan today to secure the report that will empower your next phase of digital transformation and long-term success.

- How big is the PC-as-a-Service Market?

- What is the PC-as-a-Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?