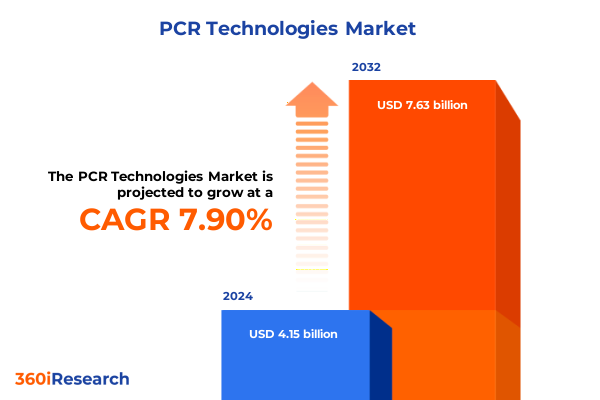

The PCR Technologies Market size was estimated at USD 4.45 billion in 2025 and expected to reach USD 4.78 billion in 2026, at a CAGR of 7.99% to reach USD 7.63 billion by 2032.

Unveiling How PCR Technologies Revolutionize Molecular Diagnostics and Drive Unprecedented Innovations in Research and Clinical Applications Globally

Since Kary B. Mullis developed the polymerase chain reaction in 1983, PCR has fundamentally changed molecular science by enabling the exponential amplification of specific DNA sequences

This breakthrough technique quickly earned widespread adoption across biochemistry, forensics, and medical diagnostics. By replicating target DNA segments billions of times within hours, laboratories achieved unprecedented sensitivity for pathogen detection, genetic disorder screening, and evolutionary biology studies

Over subsequent decades, PCR has evolved from a manual procedure requiring repeated enzyme additions to a streamlined, automated method powered by thermostable polymerases. The foundational principles of thermal cycling-denaturation, annealing, and extension-remain central, while enhancements in primer design and instrumentation have propelled the technology into complex clinical and research applications

As PCR continues to underpin critical discoveries and diagnostics, this report explores the strategic shifts, market dynamics, and actionable insights shaping its future trajectory, providing decision-makers with a clear understanding of where the technology stands today and how it will evolve.

Exploring Transformative Advances in PCR Enabled by Automation, High-Precision Partitioning, AI-Powered Analytics and Portable Point-of-Care Solutions

Real-time PCR, often referred to as quantitative PCR, monitors DNA amplification as it happens, allowing researchers and clinicians to derive quantitative or semi-quantitative data from minute samples. This technique relies on either fluorescent dyes that intercalate with double-stranded DNA or sequence-specific probes that emit signals only upon hybridization, enabling precise measurement of genetic targets in fields ranging from virology to oncology

Digital PCR represents a further refinement, partitioning reactions into thousands of micro- or nanoliter-scale volumes to achieve absolute quantification without the need for standard curves. By counting individual positive partitions and applying Poisson statistics, digital PCR delivers heightened sensitivity for rare mutation detection and copy number variation analysis, establishing new benchmarks for molecular precision in research and clinical diagnostics

At the intersection of automation and analytics, platforms such as Roche’s LightCycler PRO System incorporate advanced temperature control, updated software algorithms, and integrated workflows that transition seamlessly from research assays to in vitro diagnostic applications. Meanwhile, point-of-care systems like the cobas Liat bring PCR testing directly to patient environments with rapid turnaround times of under 30 minutes, driving decentralized decision-making at the bedside and in field settings

Analyzing the Compounding Effects of U.S. 2025 Tariff Measures on Supply Chains, Costs and Innovation in PCR Technologies

In April 2025, the U.S. Department of Commerce initiated Section 232 investigations targeting pharmaceutical and semiconductor imports, signaling potential tariffs ranging from 10 percent to 25 percent based on national security considerations. This focused inquiry extends existing broad duties and could impose new levies on critical PCR components manufactured overseas

Industry analysts warn that announced tariffs of 20 percent on EU imports and over 30 percent on Chinese goods will erode profit margins for life-science tools providers and elevate end-user costs. Cost of goods sold for major manufacturers could rise by an average of 2 percent, with companies such as Agilent and Bruker facing COGS increases above this level, ultimately translating to higher instrument and reagent prices for laboratories

Academic and commercial research labs are already bracing for “sticker shock,” as new tariffs on Chinese, Mexican, and Canadian imports raise prices for essential scientific instruments and consumables by up to 25 percent. Institutions operating under tight grant budgets and fixed reimbursement rates may delay equipment upgrades or reduce testing volumes in response to inflated procurement expenses

Meanwhile, Chinese pharmaceutical and biotech firms are reconfiguring supply chains by stockpiling raw materials, substituting local reagent sources, and exploring onshore testing alternatives to mitigate import cost volatility. This strategic pivot underscores the broader fragility of global PCR supply networks amid ongoing U.S.-China trade tensions

Against this backdrop, PCR technology stakeholders must evaluate tariff risks, diversify sourcing strategies, and engage with policymakers to preserve innovation momentum and maintain cost-effective access to critical molecular diagnostics solutions.

Deciphering Core PCR Market Segmentation to Illuminate Product, Technique, Application and End-User Dynamics

The PCR market is structured by product type, differentiating between core instruments such as fluorescence detectors, thermal cyclers, and robotic liquid handlers; reagents and consumables like buffers, primers, and probes; and software and services including data analysis platforms and primer design tools. Each category carries distinct cost structures, regulatory considerations, and innovation dynamics that influence procurement and adoption cycles.

Technique segmentation spans conventional amplification methods through to advanced modalities such as hot-start PCR, methylation-specific PCR, and multiplex PCR, while also incorporating emerging approaches like digital PCR and reverse transcription PCR. These methodological variations address diverse analytical needs, from single-gene expression studies to highly sensitive rare event detection.

Applications drive demand across diagnostic testing, environmental monitoring, gene expression analysis, and nucleic acid sequencing, reflecting PCR’s adaptability to contexts as varied as infectious disease surveillance, cancer biomarker identification, and forensic investigations. Standard validation and verification protocols ensure compliance with evolving regulatory frameworks and performance standards.

End-user segmentation captures usage by academic and government research institutions, healthcare providers including hospitals and diagnostic centers, pharmaceutical and biotechnology firms, and applied industries. Understanding each segment’s purchasing drivers-whether cost efficiency, throughput, or regulatory certification-enables tailored market strategies and service offerings.

This comprehensive research report categorizes the PCR Technologies market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technique

- Application

- End-user

Uncovering Regional Nuances in PCR Technology Adoption Amidst Varied Research Investments and Trade Environments Across the Globe

In North America, robust federal and private sector research funding underpins extensive PCR adoption, yet recent tariffs on imports from Canada and Mexico have introduced material cost increases of up to 25 percent. Canada and Mexico, critical suppliers of lab instruments and reagents, face new trade levies that academic and commercial laboratories must navigate within constrained grant budgets and reimbursement models. Despite these challenges, U.S. government R&D spending rose by 1.7 percent in 2023, maintaining its position as a global funding leader while highlighting the tension between policy-driven cost pressures and innovation support

Within Europe, the Middle East, and Africa, cumulative R&D expenditure grew modestly at 1.6 percent across the EU, with Germany’s pace slowing to 0.8 percent and France experiencing a slight decline. Regional harmonization under the European Medicines Agency and cross-border collaborations continue to facilitate access to cutting-edge PCR platforms, even as the broader economic environment necessitates careful balancing of domestic manufacturing incentives against integrated continental supply chains

Asia-Pacific has emerged as the largest region for R&D spending, accounting for nearly 46 percent of global research investment in 2023. China’s R&D outpaced the OECD average with 8.7 percent growth, narrowing its gap with the United States to 96 percent in PPP-adjusted terms. India’s expanding economy and government digitalization initiatives have driven a projected 11 percent rise in tech spending, while Southeast Asian nations pursue strategic partnerships to strengthen local PCR infrastructure and onshore production capabilities

This comprehensive research report examines key regions that drive the evolution of the PCR Technologies market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Market Leader Strategies from Thermo Fisher, Qiagen, Bio-Rad and Roche That Shape Competitive PCR Innovation Landscapes

Thermo Fisher Scientific’s Q2 2025 earnings outperformed projections, with adjusted earnings per share of $5.36 and revenues of $10.85 billion driven by resilient demand for laboratory products and services. The company attributed supply chain resilience and “practical process improvement” strategies to mitigating tariff-related cost pressures, reflecting its capacity to navigate macroeconomic headwinds alongside competitors such as Danaher

Qiagen has articulated a target of 7 percent annual sales growth through 2028, emphasizing core PCR-based diagnostics for cancer and infectious disease applications. The company plans to streamline its portfolio by phasing out low-margin test systems and redirecting resources toward high-yield molecular platforms, reinforcing its position in a market with accelerating demand for precision testing

Bio-Rad Laboratories expanded its digital PCR offerings through the acquisition of Stilla Technologies in February 2025, strengthening its droplet digital portfolio and accelerating development of next-generation quantitative PCR solutions. This strategic move underscores its commitment to segment leadership via targeted inorganic growth

Roche Diagnostics, a pioneer in PCR since acquiring core patents in 1992, recently introduced the LightCycler PRO System, which merges automated thermal cycling with advanced software to bridge translational research and clinical workflows. This launch reaffirms Roche’s heritage in molecular diagnostics and its focus on user-driven innovation across research and healthcare settings

This comprehensive research report delivers an in-depth overview of the principal market players in the PCR Technologies market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Agilent Technologies, Inc.

- Analytik Jena GmbH+Co. KG

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Bioneer Corporation

- Danaher Corporation

- Enzo Biochem Inc.

- Eppendorf SE

- F. Hoffmann-La Roche Ltd.

- HiMedia Laboratories Pvt. Ltd

- Illumina, Inc.

- JN Medsys Pte. Ltd.

- Merck KGaA

- Norgen Biotek Corp.

- Perkin Elmer, Inc.

- Promega Corporation

- Qiagen N.V.

- QuantuMDx Group Ltd

- Sansure Biotech, Inc.

- Siemens Helathineers AG

- Standard BioTools Inc.

- Takara Bio, Inc.

- Thermo Fisher Scientific, Inc.

- TransGen Biotech Co., LTD.

Elevating Resilience and Growth Through Strategic Supply Chain Diversification, Technology Collaboration and Regulatory Engagement in PCR

Industry leaders must prioritize supply chain diversification by identifying and qualifying onshore and nearshore suppliers for critical PCR consumables, thereby insulating operations from evolving tariff regimes and minimizing procurement risks.

Investing in digital and real-time PCR platforms, alongside advanced data analytics and AI-driven interpretation tools, will strengthen assay precision, enhance throughput, and unlock new applications in rare variant detection and personalized medicine.

Collaboration with technology partners-ranging from software developers for robust bioinformatics workflows to instrument manufacturers for seamless automation-can accelerate go-to-market timelines and deliver differentiated offerings tailored to diagnostic and research laboratories.

Engaging proactively with regulatory agencies and trade policymakers to shape pragmatic tariff exemptions and harmonized certification pathways will preserve innovation incentives and ensure uninterrupted access to market-leading PCR solutions.

Employing Rigorous Qualitative and Quantitative Research Methods Combining Desk Research, Expert Interviews, and Industry Validation for Unbiased Insights

The research methodology underpinning this analysis integrates comprehensive desk research, including evaluation of public trade filings, earnings reports, and peer-reviewed literature, to establish a robust secondary information base. Industry regulatory records and government R&D statistics were examined to contextualize policy impacts and funding trends.

Primary validation was conducted through interviews with key opinion leaders in molecular diagnostics, supply chain specialists, and laboratory directors to capture experiential insights on technology adoption, cost pressures, and innovation priorities.

A structured framework for market segmentation was applied to classify products, techniques, applications, and end users, ensuring consistency in comparative analyses across regions and stakeholder groups.

Findings were synthesized using a triangulation approach, cross-referencing data points from diverse sources to enhance accuracy and minimize bias, resulting in actionable insights tailored to strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our PCR Technologies market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- PCR Technologies Market, by Product Type

- PCR Technologies Market, by Technique

- PCR Technologies Market, by Application

- PCR Technologies Market, by End-user

- PCR Technologies Market, by Region

- PCR Technologies Market, by Group

- PCR Technologies Market, by Country

- United States PCR Technologies Market

- China PCR Technologies Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Insights to Chart a Clear Path Forward for PCR Stakeholders in an Evolving Scientific and Regulatory Landscape

PCR technologies have evolved from a seminal laboratory technique into a multifaceted ecosystem encompassing conventional, real-time, and digital platforms that address diverse analytical needs across research, diagnostics, and environmental monitoring.

Trade policy shifts, particularly U.S. tariff measures, are reshaping cost dynamics and supply chain architectures, prompting stakeholders to recalibrate sourcing strategies and invest in domestic capacity expansion to sustain innovation momentum.

Regional variations in R&D intensity and funding emphasize the importance of localized strategies, with Asia-Pacific emerging as a pivotal growth engine even as North America and EMEA maintain robust collaborative networks and regulatory frameworks.

Market leaders are leveraging mergers, acquisitions, and product enhancements to fortify their positions, underscoring the criticality of agility, technological collaboration, and regulatory engagement in advancing PCR’s impact on global health and research outcomes.

Connect with Ketan Rohom to Access Comprehensive PCR Technologies Market Research and Unlock Actionable Insights for Your Organization

Engaging with Ketan Rohom, Associate Director of Sales & Marketing, offers an opportunity to access a detailed PCR Technologies market research report that delves into the strategic dynamics, segmentation insights, and regional analyses influencing this critical sector. By partnering directly with Ketan, organizations can obtain customized data packages, expert guidance on interpreting complex trends, and targeted recommendations to inform investment, product development, and go-to-market strategies.

This collaboration streamlines the procurement of in-depth market intelligence, ensuring that decision-makers receive timely updates on evolving technologies, tariff implications, and competitive movements. Reach out to Ketan to secure your copy of the comprehensive report and empower your team with the knowledge necessary to stay ahead in the rapidly advancing PCR landscape.

- How big is the PCR Technologies Market?

- What is the PCR Technologies Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?