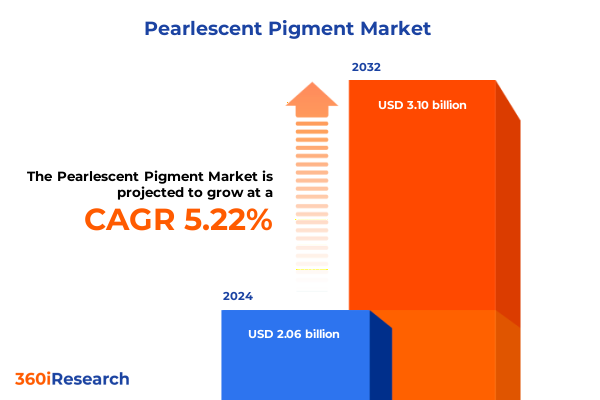

The Pearlescent Pigment Market size was estimated at USD 2.17 billion in 2025 and expected to reach USD 2.29 billion in 2026, at a CAGR of 5.21% to reach USD 3.10 billion by 2032.

Unlocking the Iridescent World of Pearlescent Pigments and Their Pivotal Role Across Cosmetics, Coatings, Plastics, Printing, and Textiles

The pearlescent pigments industry is distinguished by the unique optical effects generated when ultra-thin coating layers on mica substrates manipulate light to produce iridescent and shimmering finishes. Classification under the Harmonized Tariff Schedule confirms that pigments coated with titanium dioxide fall into subheading 3206.19.0000 at a 6% ad valorem rate while those based on iron oxides are classified under code 3206.49.2000 at 6.5% ad valorem. These distinctions underscore the technical precision demanded in sourcing and applying these specialty materials.

Across applications the demand for pearlescent pigments has surged as leading automotive OEMs and custom shops leverage these effect pigments to create luxurious color shifts and dynamic finishes on highend vehicles. Meanwhile the cosmetics sector has embraced sustainable synthetic mica and highperformance interference pigments to deliver naturalradiant skineffects in eye makeup lip products and nail formulations. Innovations such as borosilicatebased pigments that enhance color purity at minimal dosage levels illustrate the growing sophistication of R&D in this arena.

How Sustainability, Digital Printing, and Technological Innovations Are Redefining Competitive Dynamics in the Pearlescent Pigments Industry

In recent years the pearlescent pigments landscape has been transformed by a convergence of sustainability mandates digital printing technologies and advanced nanostructured materials. Regulated markets in Europe and North America have prioritized ecofriendly formulations driving pigment suppliers to develop lowVOC waterborne grades and biomassbalanced mica analogs. At the same time digital inkjet and flexographic printing solutions now incorporate pearlescent pigments to meet brand owners’ needs for luxurypackaging and anti counterfeiting features.

Moreover automotive coatings have witnessed a shift toward multi layer interference pigments engineered for superior UV resistance and color travel under varying light conditions. Partnerships between pigment manufacturers and OEMs are accelerating product cocreation models that integrate advanced pigment formulations into both waterborne and solventborne coating platforms. This collaborative innovation ecosystem signals a new era where technological advances and regulatory pressures coalesce to redefine competitive dynamics in the pearlescent pigments industry.

Assessing the Combined Effect of Base Duties and Section 301 Additional Levies Reshaping Import Costs for Pearlescent Pigments in 2025

The cost structure for importing pearlescent pigments into the United States is shaped by base duties under HTSUS chapter 32 and additional Section 301 tariffs levied in response to China’s trade practices. Mica based pigments coated with titanium dioxide are subject to a 6% ad valorem rate under code 3206.19.0000 while iron oxide variants carry a 6.5% duty under code 3206.49.2000. Beyond these base rates imports from China have faced supplementary duties first imposed in 2018 and extended through August 31, 2025, on a tranche of goods including specialty chemical pigments.

The fouryear review of Section 301 tariffs culminated in a three month extension of 164 exclusions along with 14 exclusions for solar equipment, yet pearlescent pigments largely remain outside these relief measures. Consequently importers incur cumulative ad valorem charges of up to 31.5% for pigment entries, altering cost competitiveness and incentivizing qualification of alternative origin sources. As a result procurement teams are reassessing supplier portfolios to mitigate escalating landed costs and sustain margin integrity amid persistent trade tensions.

Decoding Market Diversity Through Form, Type, Application, and End Use Segments as Drivers of Strategic Decision Making in Pearlescent Pigments

The market’s breadth is reflected in diverse product forms types applications and end use verticals. Liquids excel in highviscosity coatings and printing ink formulations where ease of dispersion and consistency are paramount. Conversely powder grades dominate the plastics and cosmetics sectors, enabling precise dosing and broad compatibility with exotic polymer matrices and specialty wax blends. Type selection ranges from natural mica pigments prized for their costeffectiveness to synthetic fluorophlogopite and engineered platelets that maximize reflectivity and purity without heavy metal content. Titanium dioxide based grades deliver robust opacity and brightness for highimpact decorative applications.

Application segmentation reveals that pearlescent pigments are indispensable in architectural automotive and industrial coatings where multi layer interference delivers unrivaled depth. In cosmetics these pigments add luminosity to eye face lip and nail products, leveraging lowdosage highimpact formulations. Plastics benefit through integration into polyethylene polypropylene and PVC masterbatches for packaging films and molded goods. Printing uses span digital flexographic and gravure inks to achieve luxury packaging effects while textiles exploit both natural and synthetic fiber substrates to introduce iridescent finishes. End use verticals cover automotive aftermarket and OEM, commercial and residential construction, consumer goods packaging in food beverage and pharmaceutical categories, as well as haircare oral care and skincare in personal care formulations.

This comprehensive research report categorizes the Pearlescent Pigment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Type

- Application

- End Use

Mapping Regional Demand Patterns to Reveal How Americas, EMEA, and AsiaPacific Are Steering Growth Trajectories in the Pearlescent Pigments Sector

Regional dynamics vary significantly across Americas EMEA and AsiaPacific. In North America the United States remains a central hub for highend automotive paints and premium cosmetic applications, with major imports sourced predominantly from China and India. Shipment data indicates China accounts for approximately 83% of U.S. pigment entries followed by India at 17%, reflecting a concentrated supply chain that underscores both opportunity and risk in tariff management and quality assurance.

Europe Middle East & Africa exhibit growing demand for certified sustainable pigments aligned with REACH and voluntary ecolabels. Leading suppliers are enhancing transparency in supply chain practices and advancing products with thirdparty sustainability certifications. Meanwhile AsiaPacific leads production with China and India as principal manufacturing hubs, and regional consumption is fueled by rapid automotive growth in India and luxury packaging expansion in Southeast Asia. These regional patterns emphasize the importance of differentiated go to market strategies tailored to local regulatory landscapes and evolving buyer preferences.

This comprehensive research report examines key regions that drive the evolution of the Pearlescent Pigment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Moves, Innovation, and Consolidation Among Leading Players Shaping the Future of the Global Pearlescent Pigments Market

Industry participants are navigating a landscape marked by strategic acquisitions product innovation and capacity expansions. In August 2024 Merck KGaA agreed to divest its Surface Solutions business to China’s Global New Material International for approximately $720 million, reflecting consolidation trends and China’s vertical integration in synthetic mica production. This transaction underscores shifts in global supply chain ownership and scale efficiencies.

Concurrently Sudarshan Chemical Industries strengthened its European footprint by acquiring Germany’s Heubach Group, increasing its operational presence across 19 sites and diversifying its product portfolio. This acquisition enhances access to highpurity pigments and broadens technology capabilities in specialty effect pigments. Innovation remains pivotal as Eckart introduced its Mirage Twinkling Gold pigment featuring a calcium sodium borosilicate substrate with enhanced sparkle and microplastic free composition, exemplifying market leaders’ focus on performance and compliance differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pearlescent Pigment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Chengdu Hongyu Chemical Co., Ltd.

- ECKART GmbH

- Geotech International B.V.

- KOEL Co., Ltd.

- Kolorjet Chemicals Pvt. Ltd.

- Kuncai Europe GmbH

- L'Arca Srl

- Merck KGaA

- Oxen Special Chemicals Co., Ltd.

- Rika Technology Co., Ltd.

- Sensient Technologies Corporation

- Shandong Duratec Technology Co., Ltd.

- Smarol Technology Co., Ltd.

- Sun Chemical Corporation

- Vibfast Pigments Pvt. Ltd.

- YORTAY Chemical Pigment Co., Ltd

- Zhejiang Yuanfeng Chemical Co., Ltd.

Practical Strategies for Industry Leaders to Navigate Tariff Pressures, Embrace Sustainability, and Capitalize on Emerging Growth Opportunities

To thrive in an environment defined by tariff fluctuations and heightened sustainability expectations, industry leaders should pursue a multi pronged strategy. First optimizing supply chains through dual or multi sourcing arrangements can mitigate risk associated with Section 301 levy exposure while enabling cost negotiations grounded in volume leverage. Second intensifying R&D investments aimed at lowcarbon and biodegradable pigment platforms will align product portfolios with tightening environmental regulations and end user ESG commitments. By leveraging biomassbalanced processes similar to those pioneered by major raw material suppliers, companies can differentiate on sustainability credentials and capture emerging demand segments.

Additionally collaborating across the value chain through cocreation labs with OEMs brand owners and end users fosters accelerated innovation cycles and market validation. Implementing advanced data analytics tools to forecast regional demand shifts and tariff impact scenarios further empowers decision makers to dynamically adapt commercial strategies and secure competitive advantage.

Comprehensive Research Approach Combining Desk Research, Expert Interviews, and Harmonized Tariff Data to Ensure Rigorous Market Analysis

Our research methodology integrates extensive desk research expert consultations and analysis of harmonized tariff data to ensure robust market insights. We reviewed primary source documents from U.S. Customs rulings and HTSUS classifications to accurately profile base duty structures. We also analyzed Office of the U.S. Trade Representative Federal Register notices and KPMG summaries to map exclusion timelines and Section 301 levy extensions through August 31, 2025, ensuring current understanding of trade policy impacts. In parallel we conducted structured interviews with pigment formulators and procurement executives to validate pricing dynamics and assess supply chain resilience. Finally we synthesized thirdparty industry reports and company press releases to triangulate segmentation drivers and emerging technological innovations, delivering a rigorous evidencebased perspective.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pearlescent Pigment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pearlescent Pigment Market, by Form

- Pearlescent Pigment Market, by Type

- Pearlescent Pigment Market, by Application

- Pearlescent Pigment Market, by End Use

- Pearlescent Pigment Market, by Region

- Pearlescent Pigment Market, by Group

- Pearlescent Pigment Market, by Country

- United States Pearlescent Pigment Market

- China Pearlescent Pigment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Bringing Together Insights to Provide a Cohesive Perspective on Market Trends, Regulatory Impacts, and Future Directions for Pearlescent Pigments

Throughout this executive summary we have illuminated key facets shaping the pearlescent pigments industry, from fundamental classification and market segmentation to transformative shifts in sustainability and digital printing. The compounded impact of base duties and Section 301 tariffs underscores the urgency for strategic supply chain diversification while regulatory extensions offer focused relief yet leave core pigment categories largely exposed to additional levies. Regional dynamics reveal distinct demand drivers across Americas, EMEA and AsiaPacific, guiding tailored commercial tactics in automotive coatings, cosmetics and packaging applications. Competitive insights highlight consolidation trends and product innovation as leading companies recalibrate scale and performance differentiation. By synthesizing these findings, stakeholders are equipped to navigate complex trade environments, anticipate evolving regulatory requirements and capitalize on the accelerating demand for next generation sustainable pearlescent pigments.

Take Action Today to Secure InDepth Pearlescent Pigments Market Insights and Partner with Our Expert Ketan Rohom to Elevate Your Competitive Edge

Don’t let uncertainty hold you back from making informed strategic decisions in the dynamic pearlescent pigments market. Reach out to Ketan Rohom Associate Director Sales & Marketing at 360iResearch to discuss how our comprehensive market intelligence can address your unique challenges and propel your business growth. Whether you are evaluating supply chain diversification navigating complex tariff landscapes or innovating with nextgeneration sustainable pigments our tailored insights will empower you to stay ahead of the curve. Engage directly with Ketan to secure exclusive access to our fullreport findings and personalized advisory services and transform market intelligence into competitive advantage.

- How big is the Pearlescent Pigment Market?

- What is the Pearlescent Pigment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?