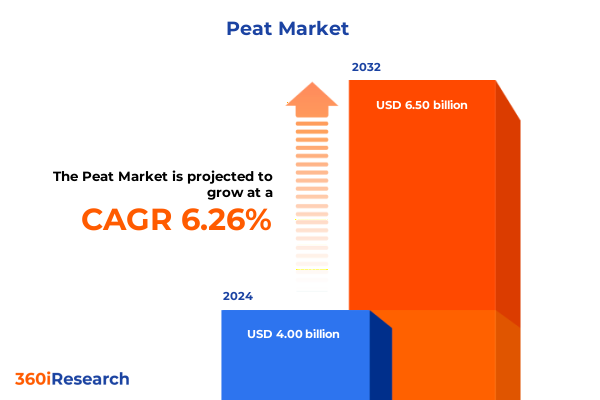

The Peat Market size was estimated at USD 4.23 billion in 2025 and expected to reach USD 4.49 billion in 2026, at a CAGR of 6.32% to reach USD 6.50 billion by 2032.

Unearthing the Vital Role of Peat across Agriculture, Energy and Environmental Applications and Its Evolution in Modern Industrial Practices

Peat is a geologically formed organic material resulting from the slow accumulation and partial decomposition of sphagnum moss and sedge vegetation under anaerobic, water-saturated conditions. Over centuries, these deposits develop unique fibric, hemic and sapric properties, establishing peatlands as the planet’s most significant terrestrial carbon reservoirs. When undisturbed, peat soils can lock away more carbon per hectare than tropical rainforests, helping to mitigate climate change; however, extraction for industrial uses releases stored carbon dioxide, underscoring the dual environmental value and vulnerability of these ecosystems.

Industry sectors leverage peat’s diverse functional characteristics across multiple applications. As a growing substrate, it enhances water retention, aeration and nutrient buffering for crop cultivation, greenhouse floriculture and nursery operations. In energy production, peat is combusted or anaerobically digested to generate heat, electricity and biogas, offering an alternative fuel source in regions lacking sustainable biomass alternatives. Additionally, its high specific surface area and adsorption capacity make peat an effective medium for heavy metal removal, phosphorus extraction and wastewater treatment, reinforcing its strategic importance across environmental management, agriculture and energy domains.

Navigating Sustainability Imperatives, Regulatory Changes and Technological Innovations Driving Peat Market Transformations Worldwide

Regulatory and sustainability pressures have catalyzed a major paradigm shift within the peat industry. Leading horticultural bodies and governments have announced phased bans and stringent restrictions on horticultural peat use to preserve carbon-rich peatlands. Despite initial pledges to eliminate peat from high-profile events by 2025, voluntary targets have been postponed amid supply chain complexities and lack of unified legislation, exposing the friction between environmental ambition and operational feasibility.

Simultaneously, innovation in peat alternatives is accelerating. The industry is actively trialing farmed sphagnum moss grown under controlled conditions, incorporating anaerobic digestate, forest co-products and compost-based substrates to replicate peat’s physicochemical performance. Such initiatives demonstrate that technically comparable and regenerative solutions can emerge when collaboration among growers, substrate manufacturers and research institutions intensifies.

Beyond alternative substrates, a circular-economy ethos is gaining momentum. Key producers and certification bodies are adopting eco-label standards, restoring exhausted peat extraction sites and investing in biodiversity recovery. These responsible sourcing frameworks, such as the Responsibly Produced Peat designation, signify the industry’s commitment to balancing raw material availability with ecosystem stewardship and long-term resource security.

Assessing the Multifaceted Impact of 2025 Tariff Policies on U.S. Peat Supply Chains, Production Costs and Industry Competitiveness

The United States’ proposed 25% tariff on Canadian sphagnum peat moss has introduced significant supply-chain uncertainty for domestic horticultural and agricultural users. Given that roughly 85% of U.S. sphagnum peat moss imports originate from Canada, this levy threatens to elevate production costs for greenhouse operators and field growers already operating under narrow margins. Industry associations have warned that the additional duties could cascade into higher retail prices for both ornamental plants and food crops, jeopardizing competitiveness and consumer affordability.

In parallel, the administration’s later imposition of a 10% reciprocal duty on a broad range of imported agricultural inputs carved out peat from the across-the-board tariff exemptions list, further complicating the duty landscape. While peat ultimately qualified for an exclusion from these newer 10% duties, the coexistence of two distinct tariff regimes has fostered ambiguity around classification, documentation and long-term sourcing strategies.

In response, coalition efforts led by AmericanHort, the American Mushroom Institute and related trade groups have petitioned for peat’s designation as a critical mineral, a status that would permanently limit duties to 10% and provide clarity for importers. These advocacy actions underscore the pivotal role of governmental engagement in mitigating financial pressures and ensuring stable access to peat-based inputs within U.S. food and ornamental plant supply chains.

Deriving Strategic Insights from Comprehensive Peat Market Segmentation Spanning Raw Types, Product Forms, Decomposition Levels and End-User Applications

Market segmentation by peat type distinguishes between moss peat and sedge peat, each offering distinct physical and chemical profiles. Moss-derived peat is characterized by its high water-holding capacity, coarse fibric structure and low pH, making it ideal for propagation and potting applications; sedge peat presents a finer texture with greater nutrient availability but lower acid content, influencing its suitability across different end-use requirements.

When considering product form, peat is available in loose bulk formats for large-scale soil amendment and potting mixes, while compressed pellets and plugs cater to precision seed-starting and small-scale propagation. These pellets, bound by biodegradable netting, expand upon hydration to deliver a ready-to-use microenvironment for seed germination, reduced transplant shock and streamlined logistics in both commercial and hobbyist contexts.

The degree of decomposition classification, spanning H1 through H10 in standardized humification scales, reflects peat maturity levels that directly affect porosity, cation exchange capacity and nutrient retention. Less decomposed H1–H4 grades ensure maximal pore volume and water retention for root development, whereas more humified H8–H10 grades offer enhanced structural stability and slower biodegradation rates for specialized filtration or substrate blends.

End-user segmentation reveals diverse industrial applications: agricultural markets leverage peat for crop cultivation and livestock bedding, energy producers integrate peat into biogas production and fuel applications, horticultural channels demand high-performance substrates for floriculture, garden centers and greenhouse operations, and water treatment facilities exploit peat’s adsorption characteristics for heavy metal removal and phosphorus recovery. Such granular segmentation underscores the necessity of tailored product development aligned with specific performance criteria.

Regarding distribution channels, traditional brick-and-mortar garden centers and agricultural supply dealers continue to serve volume-oriented procurement, while the rise of e-commerce platforms and manufacturer direct sales through company websites and third-party marketplaces has expanded reach, provided greater pricing visibility and accelerated order fulfillment for specialized peat products.

This comprehensive research report categorizes the Peat market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Peat Type

- Product Form

- Decomposition Level

- Packaging

- Application

- Distribution Channel

Identifying Regional Dynamics Shaping Peat Demand and Adoption Patterns across the Americas, EMEA and Asia-Pacific Markets

In the Americas, peat demand remains anchored by the United States’ reliance on Canadian sphagnum imports for horticulture and agriculture. The recent tariff negotiations and carve-out deliberations have heightened focus on supply-chain resilience, prompting growers and substrate producers to evaluate domestic peatland restoration projects and alternative sourcing partnerships to mitigate cross-border duty fluctuations.

Across Europe, the Middle East and Africa, regulatory interventions are steering market trajectories. The United Kingdom’s announced ban on amateur gardening peat sales by 2024, coupled with postponed commercial peat restrictions, illustrates the push-pull between legislative targets and industry readiness. Meanwhile, the Royal Horticultural Society’s extended trial timeline for peat-free operations and the European Commission’s lack of binding mandates have introduced transition periods, enabling substrate innovators to refine blends and secure regulatory alignment.

In Asia-Pacific, burgeoning urban agricultural initiatives and the adoption of hydroponic and vertical farming systems are fueling peat substrate consumption, despite limited native peat reserves. The region’s dependence on imported peat from Europe and North America is balanced by domestic peatland utilization in Indonesia and Malaysia. Concurrently, mounting environmental regulations aimed at conserving Southeast Asian peat bogs are incentivizing growers to trial cocofiber and compost-based substitutes, establishing a dual track of conventional peat use and regenerative alternative uptake.

This comprehensive research report examines key regions that drive the evolution of the Peat market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Competitive Strategies, Sustainability Commitments and Innovation Drivers of Key Global Peat Market Players

Leading substrate supplier Klasmann-Deilmann has demonstrated a concerted shift toward sustainability, halving its corporate carbon footprint while increasing renewable raw materials usage to 27% in 2023 and targeting 30% by 2025. The company’s commitment to cease new peat-extraction licenses and restore 4,916 hectares of bog biotopes evidences a proactive approach to environmental stewardship while driving operational growth.

Other prominent players such as Vapo Group, Premier Tech, Bord na Móna, Lambert Peat Moss and Sun Gro Horticulture have reinforced their market positions through strategic investments in responsibly produced peat certifications, restoration partnerships and research alliances. These firms are diversifying their product portfolios to include peat-free and blended substrates, underpinned by independent RPP audits and continuous improvement protocols, to meet evolving customer and regulatory expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Peat market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Rėkyva

- American Peat Technology, LLC

- Annapolis Valley Peat Moss Co.

- AS Tootsi Turvas

- BALT WOOD ENTERPRISE SIA

- BASF SE

- Berger Peat Moss Ltd.

- Clover Grow Limited

- Dockers LLC

- Dutch Plantin B.V.

- Elva E.P.T. Ltd.

- Ferment LLC

- Global Peat Ltd.

- HAWITA Gruppe GmbH

- Heng Huat Resources Group Berhad

- HORTIMED SIA

- Jiffy Group

- Klasmann-Deilmann GmbH

- Knaap (Thailand) Co., Ltd.

- KRONE IMPULSE LLC

- Kumaran Fibres

- Lambert Peat Moss Inc.

- Mikskaar AS

- Neova Oy

- Northern Peat & Moss Ltd.

- PEAT BASED LLC

- PEATFIELD

- Premier Tech Ltd.

- Profile Products LLC

- SAB Syker Agrarberatungs- und Handels GmbH

- Sai Cocopeat Export Private Limited

- Sun Gro Horticulture Canada Ltd.

- Theriault & Hachey Peat Moss Ltd.

- Tippland Horticulture

- UAB SOLVIKA

Actionable Strategies for Industry Leaders to Accelerate Sustainable Practices, Diversify Offerings and Mitigate Risks in the Peat Value Chain

Industry leaders should accelerate the adoption of eco-certified peat sourcing frameworks, such as third-party audited RPP standards, to differentiate their offerings and secure long-term access to responsibly managed peat resources. By actively engaging in peatland restoration and climate finance mechanisms, companies can offset carbon liabilities and strengthen stakeholder trust.

Parallel investments in alternative substrate research and strategic alliances with coir, compost and farmed moss innovators will bolster product resilience against regulatory bans. Diversification of substrate portfolios reduces exposure to single-source peat dependencies and positions organizations to capture share in emerging peat-free segments.

Finally, collaboration with trade associations to advocate for transparent tariff classification and critical mineral designation can mitigate import duty volatility. Concurrently, optimizing digital distribution channels and enhancing direct-to-customer e-commerce platforms will expand market reach and streamline end-user engagement, ensuring responsiveness to shifting procurement behaviors.

Articulating a Rigorous Mixed-Methods Research Framework Emphasizing Data Triangulation and Stakeholder Validation for Peat Market Analysis

This analysis combined extensive primary research, including structured interviews with peatland managers, substrate manufacturers, end-user representatives and policy stakeholders, to gather nuanced perspectives on operational challenges and strategic priorities. Employing methodological triangulation strengthened the reliability of qualitative insights by corroborating viewpoints across multiple expert cohorts.

Secondary research encompassed a systematic review of government trade notifications, regulatory filings, academic journals and environmental NGO reports, supplemented by analysis of substrate production and import/export data. This approach ensured comprehensive coverage of legislative shifts, sustainability standards and technological developments without reliance on proprietary market sizing forecasts.

Data validation was achieved through cross-referencing stakeholder inputs with publicly available certification audits and tariff exclusion lists. Such triangulation of diverse information sources minimized bias and enhanced the credibility of the synthesis, providing stakeholders with actionable and evidence-based strategic guidance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Peat market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Peat Market, by Peat Type

- Peat Market, by Product Form

- Peat Market, by Decomposition Level

- Peat Market, by Packaging

- Peat Market, by Application

- Peat Market, by Distribution Channel

- Peat Market, by Region

- Peat Market, by Group

- Peat Market, by Country

- United States Peat Market

- China Peat Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesis of Critical Insights on Peat Market Trends, Regulatory Evolution, Sustainability Challenges and Strategic Opportunities for Stakeholders

Throughout this executive summary, peat has emerged as an essential yet contested resource, integral to agricultural productivity, energy diversification and environmental management. The interplay between sustainability imperatives, regulatory reforms and market segmentation underscores the complexity of balancing resource availability with ecological preservation. Concurrently, the specter of U.S. tariff adjustments accentuates supply-chain fragility and the need for cohesive industry advocacy to safeguard affordable access to peat-based inputs.

Looking ahead, stakeholders must prioritize investments in responsibly produced peat, while concurrently expanding peat-free and hybrid substrate offerings to capture evolving demand. Embracing digital sales platforms and optimizing distribution models will further enhance market agility. By applying these strategic imperatives, organizations can navigate regulatory flux, accelerate sustainability transitions and secure competitive advantage in a dynamic peat market landscape.

Engage Directly with Ketan Rohom to Access Bespoke Peat Market Intelligence and Drive Strategic Growth Opportunities

Interested stakeholders are invited to connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to access bespoke insights and secure early access to the full peat market research report. Engaging with Ketan provides a unique opportunity to discuss tailored data packages, explore customized consultancy support, and ensure that your strategic initiatives are informed by the most comprehensive and up-to-date peat market intelligence available. Take the next step in driving growth and resilience within your organization by leveraging the depth and breadth of this analysis-reach out to Ketan Rohom to initiate your partnership and transform market insights into lasting competitive advantage.

- How big is the Peat Market?

- What is the Peat Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?