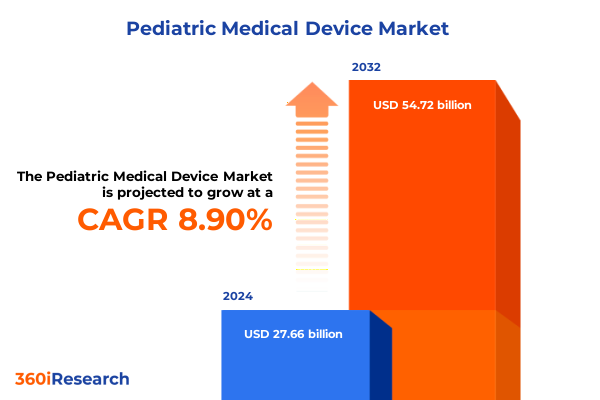

The Pediatric Medical Device Market size was estimated at USD 29.77 billion in 2025 and expected to reach USD 32.04 billion in 2026, at a CAGR of 9.08% to reach USD 54.72 billion by 2032.

Pediatric medical device market poised at a pivotal juncture as innovation and patient-centric care redefine industry priorities

Over the past decade, pediatric medical device innovation has accelerated, driven by the need to address the unique physiological and developmental considerations of infants, children, and adolescents. Leading manufacturers are prioritizing the development of non-invasive and minimally invasive solutions that reduce discomfort and promote faster recovery, particularly in neonates and infants who are especially vulnerable to procedural risks. Concurrently, integration of smart technologies such as wearable sensors and connected monitoring platforms has enabled real-time tracking of vital signs, enhancing clinical decision making and parental engagement in pediatric care.

Moreover, emerging precision medicine approaches are fostering the customization of devices to individual patient characteristics, improving the efficacy of interventions for chronic childhood conditions such as diabetes and asthma. The expansion of telehealth and remote patient monitoring has further catalyzed demand for pediatric-specific digital health platforms, facilitating continuity of care in home settings and extending access to specialist consultations for rural populations. These collaborative trends across industry stakeholders, healthcare providers, and regulatory bodies underscore a collective commitment to innovation and safety in pediatric medical device development.

However, navigating stringent regulatory requirements and ensuring compliance with pediatric-adapted standards remain critical challenges. The intricate ethical considerations surrounding clinical trials in young populations generate additional complexity, requiring robust trial designs and rigorous post-market surveillance to uphold patient safety without stifling innovation. FDA grants programs such as the Pediatric Device Consortia provide vital advisory and funding resources to support early-stage development, fostering a more predictable path from prototype to clinical adoption. Ultimately, this dynamic landscape demands agile industry strategies and ongoing collaboration to translate transformative science into tangible patient benefits.

Breakthrough technologies regulatory evolutions and telehealth adoption usher transformative shifts in pediatric medical care delivery

Breakthrough advancements in pediatric medical devices are reshaping the landscape, with cloud-powered imaging and AI-driven diagnostics moving from concept to clinical practice. The marriage of data analytics and point-of-care technologies is empowering clinicians to detect congenital anomalies earlier, while new MRI-compatible implants and adaptive orthopedic solutions minimize procedural risks for young patients. At the same time, the surge in remote patient monitoring and telehealth platforms has created a demand for pediatric-grade wearables and connected devices that seamlessly integrate with home-based care models.

Regulatory bodies are responding to these technological shifts by streamlining pathways for pediatric device approval. Initiatives such as the FDA’s Pediatric Device Consortia Grants Program have expanded support infrastructure, offering innovators expert consultation on prototyping, preclinical testing, and early feasibility trials. Meanwhile, global harmonization efforts seek to align safety and efficacy standards across major markets, reducing duplication of clinical evaluations and accelerating product launches for children worldwide.

In parallel, industry collaborations between device makers, academic research centers, and children’s hospitals are fostering co-development of tailored solutions. From AI-enhanced ultrasound systems calibrated for smaller anatomy to compact ventilators designed for neonatal intensive care units, these multi-stakeholder partnerships are driving a new era of patient-centric design. As a result, the pediatric medical device sector is experiencing a transformative shift toward integrated care ecosystems that prioritize safety, personalization, and seamless connectivity.

Escalating Section 301 adjustments enhance cost pressures and supply chain complexities for pediatric device producers across global value streams

The introduction of new Section 301 tariff increases effective January 1, 2025 has intensified cost pressures across the pediatric medical device supply chain. With duties rising sharply on components and finished devices imported from China, Europe, and other key manufacturing hubs, U.S. providers have reported elevated procurement costs and extended lead times for critical pediatric equipment. Stakeholder groups including AdvaMed and leading manufacturers warn that these elevated duties could curtail innovation investments and limit patient access to advanced pediatric technologies.

Manufacturers reliant on global supply networks face heightened complexity as they navigate tariff classifications and exclusion processes. Many pediatric-specific components, such as custom enteral syringes and respiratory masks, have been subjected to escalating duty rates, prompting some vendors to explore nearshoring or dual-sourcing strategies to mitigate fiscal impact. However, reconfiguring production for highly specialized devices is time-consuming and costly, given stringent regulatory requirements and the need for pediatric-grade materials.

In response, industry leaders are advocating for expanded exemptions and streamlined exclusion requests for life-saving pediatric products. Meanwhile, forward-looking manufacturers are investing in domestic assembly capabilities and fortified inventory buffers to preserve supply continuity. As tariffs reshape cost structures, resilient supply chain planning and proactive engagement with policymakers will be pivotal in ensuring uninterrupted delivery of critical pediatric care solutions.

Deep segmentation reveals nuanced pediatric device preferences across age groups product types and distribution channels guiding strategic investment decisions

A granular view of the pediatric medical device market reveals nuanced adoption patterns shaped by product specialization, user environments, patient age brackets, and distribution pathways. Devices range from advanced imaging modalities-such as photon-counting CT scanners and pediatric-tuned MRI systems-to life-supporting infusion pumps and neonatal ventilators engineered for the smallest patients. Alongside high-tech diagnostics, instrumentation like pediatric-specific endoscopes and surgical retractors underscores the breadth of product innovation addressing distinct clinical needs.

End-user settings span highly controlled hospital environments where complex pediatric surgeries and intensive monitoring occur, through ambulatory surgical centers increasingly equipped for minimally invasive interventions, down to home care contexts where compact monitoring devices and home oxygen concentrators support chronic care outside traditional clinical walls. Each setting imposes unique performance and training requirements, driving manufacturers to design intuitive interfaces and offer flexible service models.

Age segmentation introduces further complexity, as devices for adolescents must balance robustness with feature sets akin to adult products, while implants and monitoring tools for neonates demand ultra-miniaturization and gentle handling to protect developing tissues. Innovators must therefore calibrate device form and function against the specific anatomical and physiological demands of each pediatric subgroup.

Distribution strategies likewise vary, with manufacturers leveraging direct sales forces for large hospital systems, specialized distributors to reach regional children’s facilities, and emerging online channels to address home care and smaller clinics. These interconnected segmentation insights guide targeted resource allocation, product development, and commercial planning to ensure the right technologies reach the right patients at the right time.

This comprehensive research report categorizes the Pediatric Medical Device market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Age Group

- End User

Regional dynamics reveal divergent growth opportunities and regulatory landscapes shaping pediatric medical device adoption across major global markets

Regional dynamics are influencing the pediatric medical device landscape in distinct ways, driven by infrastructure maturity, regulatory frameworks, and demographic trends. In the Americas, a well-established healthcare ecosystem and high per-capita spending underpin rapid adoption of state-of-the-art pediatric imaging and monitoring solutions, with U.S. children’s hospitals often serving as test beds for novel technologies. Regulatory support through dedicated FDA programs further accelerates product introductions and clinical research partnerships in North America.

In Europe, harmonized medical device regulations under the Medical Device Regulation (MDR) and active pediatric research initiatives are spurring investment in child-friendly devices. Cross-border collaborations facilitate knowledge exchange, though market growth is tempered by stringent approval processes and cost-containment pressures within national health services. European developers increasingly focus on modular and upgradeable platforms to balance innovation with lifecycle cost control.

Meanwhile, the Asia-Pacific region is emerging as a high-growth frontier. Rapid economic expansion and rising healthcare spending in China, India, and Southeast Asia are driving demand for both premium pediatric devices and more affordable, essential products. Local manufacturing capabilities are strengthening, enabling global players to partner with domestic firms for cost-effective production. Government initiatives to expand pediatric care networks and establish pediatric device evaluation centers are further propelling market expansion in the region.

This comprehensive research report examines key regions that drive the evolution of the Pediatric Medical Device market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive landscape in pediatric medical devices highlights innovation partnerships and strategic positioning among leading global and specialized companies

The competitive landscape in pediatric medical devices is characterized by a blend of global medtech giants and specialized innovators. Medtronic, Philips Healthcare, GE HealthCare, and Johnson & Johnson leverage deep R&D pipelines and robust regulatory expertise to introduce feature-rich products such as AI-powered ultrasound systems and advanced pediatric heart valves. For example, Medtronic’s PulseSelect ablation system and Philips’ AI-driven neonatal ventilator exemplify how leading firms harness digital technologies for precise, minimally invasive interventions.

At the same time, Boston Scientific continues to gain traction with pediatric-specific cardiac catheters and rhythm management devices, buoyed by recent beats in quarterly profit forecasts due to sustained demand for heart devices. GE HealthCare’s neonatal MRI platform highlights another trend: optimizing imaging solutions for the smallest patients while integrating IoT and cloud-based analytics to support tele-radiology services.

Complementing these multinational leaders, specialty firms and start-ups are carving niches in areas such as pediatric orthopedics, enteral feeding technologies, and AI-enabled wearables. Collaborations between children’s hospitals, academic consortia, and innovators are accelerating early-stage development, ensuring that emerging therapies and diagnostic tools mature through real-world trials. As a result, the market is poised to benefit from a dynamic interplay of scale-driven R&D and targeted, user-driven innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pediatric Medical Device market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- B. Braun Melsungen AG

- Baxter International Inc.

- Becton, Dickinson and Company (BD)

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Cook Group Incorporated

- F. Hoffmann-La Roche Ltd.

- GE HealthCare Technologies Inc.

- Hamilton Medical AG

- Johnson & Johnson

- Koninklijke Philips N.V.

- Medtronic plc

- Siemens Healthineers AG

- Stryker Corporation

Actionable road map for pediatric device industry leaders to navigate evolving regulations supply challenges and drive patient-centric innovation

Industry leaders should prioritize integrated supply chain resilience to mitigate tariff-induced cost volatility and component scarcity. Establishing dual-sourcing partnerships and strengthening domestic assembly capabilities can preserve continuity for life-saving pediatric products. At the same time, proactive engagement with policymakers to secure tariff exemptions for critical pediatric supplies will safeguard patient access to essential care technologies.

Investment in agile product development processes that emphasize modular design and software-driven upgrades can shorten time to market for pediatric device enhancements. By leveraging feedback loops from clinical pilot programs and home care deployments, manufacturers can refine device ergonomics and usability to meet the diverse needs of infant, child, and adolescent users while reducing support overhead.

Building strategic alliances with pediatric clinical networks and academic research centers will be instrumental in securing early feasibility data and real-world evidence to support regulatory submissions. These collaborations should extend to co-developing training modules and telehealth integration frameworks, ensuring seamless adoption of remote monitoring and connected care solutions in both hospital and home environments.

Finally, fostering a patient-centric culture through participatory design workshops and caregiver advisory panels will align technology roadmaps with evolving clinical workflows and family preferences. Such engagement will not only enhance device safety and efficacy but will also build trust and advocacy among end users, driving sustained market penetration and improved pediatric outcomes.

Robust multi-stage research methodology leveraging primary interviews secondary data triangulation and rigorous validation protocols

This research integrates a multi-stage methodology combining primary and secondary research to ensure robust, unbiased insights. In the secondary phase, a comprehensive review of authoritative sources-including peer-reviewed journals, regulatory databases, and industry publications-was conducted to map historical and emerging trends in pediatric device development.

Primary research involved in-depth interviews with key stakeholders across the value chain: medical device executives, clinical specialists at children’s hospitals, regulatory experts, and supply chain managers. These qualitative discussions provided nuanced perspectives on unmet clinical needs, adoption barriers, and strategic priorities, allowing triangulation with quantitative data.

Data synthesis employed rigorous validation protocols. Cross-verification of interview findings against publicly filed financial reports and government import/export records ensured alignment on supply chain disruptions and tariff impacts. Complexities around device classification and distribution channels were addressed through iterative expert reviews, refining our segmentation framework to reflect real-world commercial dynamics.

Finally, the analytical process included scenario testing for tariff fluctuations and regulatory shifts. By stress-testing supply chain and reimbursement variables, the methodology anticipates potential disruptions, equipping decision makers with foresight on resilience strategies. Throughout, transparency in data sources and peer review mechanisms upheld the highest standards of research integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pediatric Medical Device market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pediatric Medical Device Market, by Product Type

- Pediatric Medical Device Market, by Distribution Channel

- Pediatric Medical Device Market, by Age Group

- Pediatric Medical Device Market, by End User

- Pediatric Medical Device Market, by Region

- Pediatric Medical Device Market, by Group

- Pediatric Medical Device Market, by Country

- United States Pediatric Medical Device Market

- China Pediatric Medical Device Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Comprehensive synthesis underscores critical insights drive strategic decision making and reinforce the imperative for pediatric medical device advancement

This synthesis of industry dynamics underscores the critical intersection of technological innovation, regulatory pressures, and market segmentation in shaping pediatric medical device evolution. Advanced imaging modalities, AI-enhanced analytics, and remote monitoring platforms are redefining clinical pathways, while targeted collaborations underscore the value of unified stakeholder engagement in accelerating product adoption.

The cumulative impact of Section 301 tariff adjustments highlights the imperative for supply chain agility and proactive policy advocacy to maintain device accessibility. At the same time, segmentation insights reveal that customized approaches-aligned to product type, end-user environment, age cohort, and distribution channel-are foundational to successful market entry and sustained growth.

Regionally, divergent growth trajectories in the Americas, EMEA, and Asia-Pacific offer distinct strategic opportunities. North America’s mature infrastructure supports rapid uptake of high-technology solutions, Europe’s harmonized regulations foster collaborative R&D, and Asia-Pacific’s expanding healthcare networks present large-scale adoption potential for both premium and essential devices.

Together, these insights provide a roadmap for industry leaders to refine product portfolios, optimize go-to-market strategies, and strengthen partnerships, ensuring that pediatric medical device innovation continues to deliver transformative outcomes for young patients globally.

Connect with Ketan Rohom to access detailed pediatric medical device insights tailored to your strategic growth and competitive edge

To explore how these insights can be applied to your organization’s growth strategy and gain deeper visibility into pediatric medical device trends, connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan can provide personalized guidance on leveraging the comprehensive research, offering tailored support to align your product pipelines and go-to-market strategies with evolving industry dynamics. Reach out today to schedule a consultation and secure access to the full pediatric medical device market report, empowering your team with the critical intelligence needed to outpace competition and deliver enhanced care for young patients.

- How big is the Pediatric Medical Device Market?

- What is the Pediatric Medical Device Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?