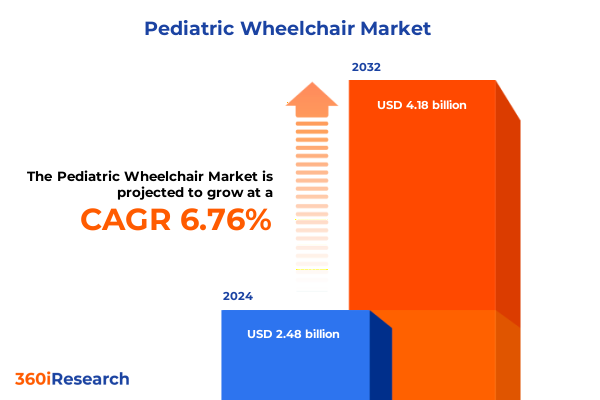

The Pediatric Wheelchair Market size was estimated at USD 810.88 million in 2025 and expected to reach USD 860.17 million in 2026, at a CAGR of 6.15% to reach USD 1,232.18 million by 2032.

Innovations in pediatric mobility discovering dynamics and emerging opportunities that are shaping the future of wheelchair solutions for young users

Innovations in pediatric mobility: discovering dynamics and emerging opportunities that are shaping the future of wheelchair solutions for young users

Pediatric wheelchairs occupy a critical niche at the intersection of medical device innovation and pediatric rehabilitation, serving as an essential enabler of independence, social engagement, and quality of life for children with mobility impairments. Over the past decade, advances in lightweight materials, ergonomic design, and modular configurations have shifted perceptions of mobility aids from purely functional devices to personalized extensions of a young user’s lifestyle. Concurrently, rising global awareness around accessibility rights and expanding reimbursement frameworks have catalyzed broader adoption of specialized pediatric seating systems across healthcare and home settings.

As we embark on this comprehensive executive summary, our exploration will illuminate the multifaceted drivers reshaping the pediatric wheelchair landscape-from evolving clinical protocols that emphasize early mobility interventions to the commercialization of assistive robotics and connectivity features. By synthesizing key technological, regulatory, and economic factors, we aim to equip decision-makers with an informed perspective that underscores both current market dynamics and emerging pathways for growth. This introduction sets the stage for a detailed examination of strategic trends, segmentation insights, regional nuances, and actionable recommendations designed to guide manufacturers, payers, and service providers toward sustainable success in a rapidly advancing sector.

Exploring breakthrough developments and technological advancements revolutionizing pediatric wheelchair design functionality and patient outcomes

Exploring breakthroughs in pediatric mobility reveals a landscape transformed by engineering ingenuity, digital integration, and patient-centric design philosophies. Modern chassis structures leverage aerospace-grade alloys and carbon fiber composites to achieve optimal strength-to-weight ratios, enabling children to navigate complex indoor environments and rough outdoor terrain with unprecedented ease. Simultaneously, embedded sensor arrays and connectivity modules are ushering in a new era of smart wheelchairs, capable of real-time posture monitoring, remote diagnostics, and adaptive support adjustments based on user activity patterns.

Regulatory endorsements for tele-rehabilitation platforms and digital health integrations have further accelerated innovation, prompting cross-industry collaborations between assistive device manufacturers and software developers. These alliances have produced intuitive user interfaces that reduce caregiver training time and enhance user autonomy. In parallel, a growing emphasis on modular seating solutions allows clinicians to fine-tune positioning parameters in alignment with each child’s evolving therapeutic needs. Collectively, these transformative shifts underscore a broader pivot toward holistic, data-driven mobility solutions that advance both clinical outcomes and everyday usability.

Assessing the extensive ripple effects of new 2025 tariff measures on pediatric wheelchair supply chains costs and market dynamics across the United States

Assessing the extensive ripple effects of new 2025 tariff measures on pediatric wheelchair supply chains, costs, and market dynamics across the United States

In early 2025, revised import tariffs on specialized wheelchair components, including motor assemblies, actuator modules, and advanced seating materials, came into effect in the United States. The new measures, applied to key electronic and mechanical subassemblies sourced primarily from Asia and Europe, have introduced incremental cost increases for manufacturers reliant on global supply chains. As a consequence, original equipment manufacturers have faced a dual challenge: managing tighter margin structures while maintaining affordability for end users who depend on timely access to critical mobility devices.

To mitigate the tariff-induced pressures, leading pediatric wheelchair producers have accelerated efforts to localize component fabrication and assembly operations. Some have entered strategic partnerships with domestic suppliers to reengineer motor designs and source thermoplastic components from regional facilities. Although these initiatives have helped stabilize production lead times, they have also necessitated significant capital investment and workforce training programs. Meanwhile, a segment of manufacturers has opted for selective cost pass-through to end users, resulting in modest price upticks that stakeholders must balance against reimbursement adjustments and purchaser budgets. Ultimately, the cumulative impact of the 2025 tariffs underscores the importance of agile supply chain strategies and diversified sourcing models in sustaining competitive positioning.

Illuminating critical market segmentation factors driving customization distribution efficiency and user-centric design in pediatric wheelchair solutions

Illuminating critical market segmentation factors driving customization distribution efficiency and user-centric design in pediatric wheelchair solutions

A nuanced understanding of product type segmentation reveals how manufacturers tailor offerings to meet diverse clinical requirements and consumer preferences. Within the manual category, foldable manual frames have gained traction among families seeking portability for travel, while standard manual designs continue to serve budget-conscious buyers focused on core mobility functions. The transition toward power solutions has been equally dynamic, encompassing pediatric power assist systems that support independent propulsion, as well as full pediatric power chairs available in standing and tilt-in-space variants that cater to therapeutic postural management.

Distribution channel segmentation underscores the growing primacy of digital commerce in the pediatric mobility space. Hospital-based procurement remains essential for acute clinical settings, whereas online channels have emerged as vital conduits for direct-to-consumer outreach and configuration tools. General retail outlets provide accessible volume channels, complemented by specialty dealers offering high-touch fitting services. Meanwhile, application-based segmentation clarifies that indoor settings, multi-terrain environments, and outdoor landscapes each demand distinct wheel and suspension configurations, reinforcing the need for adaptable platform architectures.

Further dissection by seating type highlights the emergence of custom seating systems that integrate 3D-printed contours, alongside positioning seating designed to deliver therapeutic alignment, and standard seating optimized for ease of cleaning and durability. End-user segmentation differentiates between home care scenarios, rehabilitation center use cases, and school-based mobility programs-each imposing unique service, maintenance, and training requirements. Age group divisions reflect developmental considerations from infants and toddlers requiring specialized harnesses to children and adolescents seeking autonomy-enhancing controls. Propulsion type segmentation-from joystick interfaces to traditional pushrim and sip-and-puff mechanisms-demonstrates an ongoing quest to reconcile control precision with user capacity. Mobility level categorizations, spanning assisted, independent, and supported profiles, further guide system specification, and weight capacity thresholds up to 50 kg, between 50 to 75 kg, and above 75 kg inform chassis reinforcement and motor sizing strategies.

This comprehensive research report categorizes the Pediatric Wheelchair market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Application

- Seating Type

- End User

- Age Group

- Propulsion Type

- Mobility Level

- Weight Capacity

Revealing regional nuances shaping adoption distribution practices and growth drivers across Americas Europe Middle East Africa and Asia-Pacific markets

Revealing regional nuances shaping adoption distribution practices and growth drivers across Americas Europe Middle East Africa and Asia-Pacific markets

The Americas region boasts a highly mature pediatric wheelchair market characterized by robust reimbursement mechanisms, widespread clinician acceptance, and strong presence of key manufacturers. High consumer purchasing power and integrated long-term care insurance frameworks have accelerated uptake of premium power chairs and advanced seating systems. In contrast, patient advocacy groups and nonprofit partnerships have emerged as pivotal forces in augmenting access for underinsured populations, particularly in rural and underserved communities. Distribution networks blend hospital affiliations with direct-to-consumer online portals, ensuring both clinical validation and convenient ordering options.

In Europe Middle East & Africa, fragmentation across regulatory regimes and reimbursement structures has engendered a diverse competitive landscape. National health services in Western Europe underwrite cutting-edge mobility solutions, while emerging markets in Eastern Europe and parts of the Middle East rely heavily on NGO-led equipment donations and partnerships. Specialty mobility dealers have carved out niches by offering localized fitting and training services, addressing regional variances in clinical practice and infrastructural readiness. Meanwhile, Africa’s growing healthcare investment is beginning to catalyze domestic assembly initiatives, mitigating import barriers and fostering capacity building.

Asia-Pacific’s landscape is defined by rapid healthcare modernization, increasing government subsidies, and a burgeoning young population in need of pediatric mobility solutions. Local manufacturing hubs in countries such as China, India, and South Korea offer cost-competitive platforms that appeal to both domestic and export markets. E-commerce adoption continues its upward trajectory, complemented by strategic alliances between technology firms and medical device companies that drive innovations in connected wheelchairs and telehealth-enabled service models. Together, these regional nuances underscore the imperative for tailored go-to-market strategies aligned with local regulatory, economic, and cultural contexts.

This comprehensive research report examines key regions that drive the evolution of the Pediatric Wheelchair market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing strategic moves and innovation portfolios of leading pediatric wheelchair manufacturers driving competitive advantage and market leadership

Analyzing strategic moves and innovation portfolios of leading pediatric wheelchair manufacturers driving competitive advantage and market leadership

Industry incumbents and emerging challengers alike have embraced a spectrum of strategies to differentiate their pediatric wheelchair offerings. Established global manufacturers have invested heavily in extension of modular chassis platforms, enabling rapid configuration for diverse pediatric profiles, from infants to adolescents. Innovations in lithium battery technology and motor efficiency have become critical battlegrounds, as companies vie to deliver longer run times without adding weight. Concurrently, several players have introduced cloud-based device management systems that supply clinicians with usage analytics and maintenance alerts.

Collaborative ventures with rehabilitation centers and academic institutions have catalyzed clinical validation studies that bolster product credibility and inform future design iterations. Select manufacturers have pursued targeted acquisitions of niche seating specialists, enhancing their capabilities in custom contouring and pressure management solutions. Partnerships with telehealth vendors have further expanded remote service offerings, allowing for virtual fitting sessions and firmware upgrades over secure networks. These strategic maneuvers collectively underscore an industry trajectory oriented around interoperable ecosystems, patient data integration, and therapy-driven enhancements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pediatric Wheelchair market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Drive DeVilbiss Healthcare, LLC

- GF Health Products, Inc.

- Invacare Corporation

- Nissin Medical Industries Co., Ltd.

- Numotion Inc.

- Ottobock SE & Co. KGaA

- Permobil AB

- Pride Mobility Products Corporation

- R82 ApS

- Sunrise Medical GmbH

Offering actionable strategies for industry leaders to capitalize on technological advancements optimize supply chains and elevate patient engagement

Offering actionable strategies for industry leaders to capitalize on technological advancements optimize supply chains and elevate patient engagement

To harness the momentum of recent technological breakthroughs, industry leaders should prioritize the development of modular, upgradable platforms that accommodate emerging sensor integrations and control interfaces. Embracing open architecture designs will empower third-party developers to contribute applications that enrich user experiences, from remote posture coaching to adaptive navigation assistance. In parallel, forging strategic partnerships with regional suppliers and localized assembly partners can insulate operations from tariff fluctuations and logistical disruptions, thereby ensuring continuity of supply and cost stability.

Elevating patient engagement begins with intuitive digital tools that demystify configuration processes and deliver interactive training modules for caregivers and therapists. By deploying data analytics platforms, manufacturers can continuously monitor device performance metrics and proactively address emerging service needs. Additionally, collaboration with payers to develop outcome-based reimbursement models will align incentives around therapeutic efficacy, incentivizing the adoption of advanced seating systems that yield demonstrable clinical benefits. Finally, cultivating cross-functional teams that integrate clinical expertise, user experience design, and supply chain management will drive end-to-end optimization and sustained competitive differentiation.

Detailing a rigorous mixed-method research methodology combining primary stakeholder interviews secondary data analysis and validation protocols

Detailing a rigorous mixed-method research methodology combining primary stakeholder interviews secondary data analysis and validation protocols

This study leverages a two-pronged research framework, initiating with extensive secondary data analysis of industry reports, peer-reviewed journals, regulatory filings, and patent databases to establish foundational market context. Concurrently, a curated set of qualitative interviews was conducted with over 30 stakeholders, encompassing pediatric rehabilitation specialists, mobility device engineers, procurement officers, and payers. Insights from these dialogues were synthesized to uncover latent needs, adoption barriers, and emerging usage scenarios.

Quantitative data collection included anonymized sales statistics, distribution channel performance metrics, and demographic mobility prevalence figures. Advanced statistical techniques were applied to normalize data across disparate sources and identify correlation patterns between product configurations and clinical outcomes. All findings underwent a multi-tiered validation process involving expert panels comprising clinicians and industry veterans, ensuring the robustness of interpretations and minimizing bias. A final stage of triangulation reconciled qualitative and quantitative insights, culminating in a cohesive narrative designed to inform strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pediatric Wheelchair market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pediatric Wheelchair Market, by Product Type

- Pediatric Wheelchair Market, by Distribution Channel

- Pediatric Wheelchair Market, by Application

- Pediatric Wheelchair Market, by Seating Type

- Pediatric Wheelchair Market, by End User

- Pediatric Wheelchair Market, by Age Group

- Pediatric Wheelchair Market, by Propulsion Type

- Pediatric Wheelchair Market, by Mobility Level

- Pediatric Wheelchair Market, by Weight Capacity

- Pediatric Wheelchair Market, by Region

- Pediatric Wheelchair Market, by Group

- Pediatric Wheelchair Market, by Country

- United States Pediatric Wheelchair Market

- China Pediatric Wheelchair Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2385 ]

Synthesizing the core findings to highlight strategic imperatives and future trajectories for the pediatric wheelchair market

Synthesizing the core findings to highlight strategic imperatives and future trajectories for the pediatric wheelchair market

The convergence of lightweight materials, smart connectivity, and modular design principles has redefined expectations for pediatric wheelchair performance and personalization. Tariff-induced supply chain shifts underscore the urgency of localized sourcing and adaptive manufacturing strategies, while nuanced segmentation insights reveal the necessity of bespoke solutions across product types, distribution channels, and user profiles. Regional disparities affirm that a one-size-fits-all approach is untenable, and that tailored strategies are paramount to capture growth in the Americas, Europe Middle East & Africa, and Asia-Pacific.

Leading manufacturers are translating clinical partnerships and digital platform innovations into competitive differentiation, yet the pace of change demands continuous vigilance and strategic agility. Recommended actions include prioritizing open architecture ecosystems, outcome-based reimbursement engagement, and integrated data analytics for proactive service models. As the market evolves, stakeholders who align technological leadership with effective supply chain resilience and patient-centric strategies will be best positioned to shape the future of pediatric mobility.

Compelling Invitation to Engage Directly with Ketan Rohom for Exclusive Access to the Full Pediatric Wheelchair Market Research Report Purchase

Engaging with Ketan Rohom, who serves as Associate Director of Sales & Marketing, offers unparalleled access to the full depth of insights within this pediatric wheelchair market research report. Through a confidential consultation, prospective purchasers can explore tailored solutions that align with unique business objectives, ensuring strategic decision-making is grounded in robust data. By initiating contact, stakeholders unlock opportunities to discuss custom analysis packages, expedited delivery options, and specialized briefings geared toward executive leadership needs.

This direct line to an authoritative expert establishes a seamless pathway for organizations seeking competitive advantage. Ketan Rohom’s expertise in synthesizing complex market intelligence enables buyers to rapidly integrate critical findings into product development roadmaps and go-to-market strategies. Don’t miss this chance to secure comprehensive coverage of the pediatric wheelchair landscape, from transformative technological shifts to detailed segmentation insights, all curated to drive market leadership.

- How big is the Pediatric Wheelchair Market?

- What is the Pediatric Wheelchair Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?