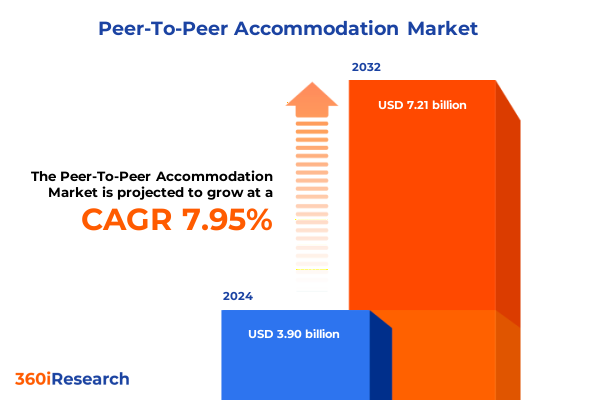

The Peer-To-Peer Accommodation Market size was estimated at USD 4.22 billion in 2025 and expected to reach USD 4.49 billion in 2026, at a CAGR of 7.93% to reach USD 7.21 billion by 2032.

Shaping the Future of Peer-to-Peer Accommodation with Digital Innovation, Authentic Hospitality, and Next-Generation Traveler Expectations

The peer-to-peer accommodation sector has undergone a remarkable transformation over the past decade, driven by rapid advancements in digital platforms. Travelers now prioritize flexibility and authenticity, and intuitive mobile interfaces have become the primary gateway for discovery and booking. Seamless in-app payment systems and instant messaging between hosts and guests have elevated the overall experience, fostering stronger bonds and trust within the community.

Concurrently, the rise of remote work has blurred the lines between business travel and leisure. Professionals increasingly seek work-friendly environments that combine comfortable living spaces with reliable connectivity and dedicated work nooks. In response, many hosts have reimagined their properties as multifunctional sanctuaries that cater to both productivity and relaxation.

Sustainability and local engagement have also moved to the forefront of traveler decision-making. A growing demand for eco-conscious stays has prompted hosts to adopt green practices, from solar heating to zero-waste amenities, while platforms integrate carbon-offset options and regional partnerships to support community-driven experiences.

Amid these shifts, regulatory frameworks have evolved to balance economic opportunity with community impact. Cities and municipalities are refining their licensing, taxation, and safety standards, compelling both platforms and hosts to adapt swiftly and strategically to remain compliant and competitive.

Uncovering the Transformative Forces Redefining Peer-to-Peer Accommodation from Advanced Technologies to Sustainable and Regulatory Evolution

Artificial intelligence and machine learning have rapidly emerged as transformative forces in the peer-to-peer accommodation landscape. Platforms are leveraging AI to optimize dynamic pricing, deliver highly personalized recommendations, and automate customer service functions, creating frictionless interactions that enhance satisfaction on both sides of the marketplace.

Alongside AI, the automation of booking processes has streamlined operations for hosts and guests alike. From instant verification to contactless check-in, these technological improvements are reducing administrative burdens and accelerating transaction times, allowing hosts to focus on elevating the guest experience rather than logistical details.

Sustainability continues to reshape market expectations, as travelers increasingly seek eco-friendly homes and locally sourced amenities. Property owners are responding by implementing renewable energy systems, supporting community artisans, and integrating green certifications into their listings-moves that resonate strongly with the growing segment of conscious consumers.

The proliferation of digital nomad culture represents another seismic shift. With more people embracing location independence, extended-stay bookings are on the rise, prompting platforms to introduce specialized filters and subscription plans tailored to long-term stays. This evolution underscores the importance of agility and continuous innovation as core drivers of success in this dynamic sector.

Analyzing the Cumulative Economic Ripple Effects of 2025 United States Tariff Policies on Peer-to-Peer Accommodation and Traveler Behavior

As the United States approaches its baseline tariff threshold of 15–50%, consumers and businesses alike have begun to feel the repercussions in everyday spending. Economists warn that up to 65% of increased import costs will be passed along to end users, contributing to a projected 2% rise in overall price levels in 2025-marking the highest effective tariff rate since 1911.

The hospitality sector has not been spared. According to STR, U.S. hotel occupancy fell by 2.3 percentage points in March 2025 compared to the previous year, and revenue per available room declined by over 4%. Urban centers near the Canadian and Mexican borders have experienced the steepest declines, highlighting the close link between trade policy and cross-border tourism flows.

In response to mounting costs and geopolitical uncertainty, border-region hotels have witnessed a sharp retreat in international guest bookings. The added expenses associated with higher import duties on supplies and furnishings have led some operators to delay property improvements and scale back renovation plans, further compounding challenges in maintaining competitive standards.

Meanwhile, a cautious consumer outlook has taken hold. Major brands report that travelers are adopting a “wait-and-see” approach, hunting for deals and postponing discretionary trip planning until there is greater clarity around trade policies and price stability, signaling a more deliberate and value-seeking booking behavior across the board.

In-Depth Segmentation Analysis Revealing How Property Type, Booking Method, Distribution Channels, and Traveler Profiles Shape Peer-to-Peer Accommodation Dynamics

The accommodation market’s nuances become apparent when examining property type segmentation. Entire homes remain the flagship offering, encompassing apartments, cabins, houses, and villas that cater to travelers seeking private and versatile spaces. Meanwhile, private-room and shared-room options continue to meet the needs of cost-conscious and community-minded guests who prioritize social interaction and affordability.

Booking type segmentation further reveals distinct user behaviors and preferences. Instant-book listings appeal to guests who value immediacy and certainty, enabling seamless transactions without host approval. Conversely, request-based bookings attract travelers who prioritize personalization and engagement, often leading to richer host–guest interactions rooted in mutual understanding and tailored hospitality.

Distribution channel segmentation underscores the importance of digital accessibility. Mobile apps are the dominant medium for on-the-go explorers who depend on real-time updates and location-based search filters, while web-based platforms remain integral for in-depth research and comparative analysis, offering broad visibility through robust search and filter functionalities.

Analyzing traveler type segmentation illuminates divergent demand patterns. Business travelers frequently opt for streamlined, reliable listings that promise consistency and work-ready amenities, whereas leisure guests gravitate toward unique, experiential properties that enhance their journey with local character and adventure-focused amenities.

This comprehensive research report categorizes the Peer-To-Peer Accommodation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Property Type

- Booking Type

- Distribution Channel

- Traveller Type

Regional Perspectives on Peer-to-Peer Accommodation: How Americas, Europe-Middle East-Africa, and Asia-Pacific Markets Drive Unique Traveler and Host Experiences

In the Americas, peer-to-peer accommodation has matured into an indispensable facet of travel culture. The United States remains a central hub, where occupancy metrics have recently dipped, reflecting broader economic headwinds. Canada, as the leading source of cross-border visitors, recorded a more than 70% drop in travel bookings for the April–September 2025 period relative to 2024, underscoring the sensitivity of the region to policy shifts and geopolitical sentiment.

Across Europe, the Middle East, and Africa, regulatory diversity and cultural richness have fueled a resilient market. In 2025, European visitation to the United States declined by 17%, highlighting evolving traveler priorities and the allure of regional exploration. Localized platforms in key EMEA markets are gaining traction by offering tailored experiences that resonate with domestic and intra-regional travelers seeking heritage-rich destinations and city-break flexibility.

The Asia-Pacific region is witnessing the fastest expansion in both supply and demand. Outbound travel from this market is poised for robust growth, with spending projected to reach USD 2.5 trillion by 2029. Digital platforms have unlocked new corridors of mobility, and intra-regional journeys are set to account for a majority of trips by the end of 2025. From coastal villas in Southeast Asia to urban lofts in East Asia, peer-to-peer accommodation continues to capitalize on the region’s appetite for authentic, digitally enabled stays.

This comprehensive research report examines key regions that drive the evolution of the Peer-To-Peer Accommodation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape and Strategic Positioning of Leading Peer-to-Peer Accommodation Platforms Highlighting Innovation, Market Responses, and Differentiation Strategies

Leading platforms have each carved out unique strategic positions within the peer-to-peer accommodation ecosystem. Airbnb remains the most visible brand, continuously expanding its offerings into long-term stays and integrated experiences, though recent reports indicate that guests are adopting more conservative booking patterns in light of economic uncertainty.

Marriott International’s Home & Villas division has leveraged its global network and loyalty programs to attract travelers seeking the reliability of a traditional hospitality brand combined with the authenticity of private home rentals. Despite cautious economic forecasts, the segment’s alignment with business traveler preferences and brand trust has bolstered its competitive standing.

Hilton’s foray into alternative accommodations, under the umbrella of its extended-stay and home rental initiatives, has been underscored by a focus on consistency and operational excellence. By incorporating contactless services and flexible cancellation policies, the company has sought to appeal to the “wait-and-see” consumer mindset, positioning itself as a dependable option amid market volatility.

Additional players such as Vrbo and emerging niche platforms are intensifying competition by emphasizing curated, local experiences and segment-specific amenities, ensuring that the market remains dynamic and responsive to evolving consumer demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Peer-To-Peer Accommodation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 9flats

- Agoda Company Pte. Ltd.

- Airbnb Inc.

- Blueground Inc.

- Booking.com B.V.

- Couchsurfing International Inc.

- Flipkey Inc.

- HomeExchange.com Inc.

- Homestay Technologies Limited

- HomeToGo GmbH

- Hostelworld

- Lifealike Limited

- MakeMyTrip Ltd.

- MyTwinPlace

- OneFineStay

- Oravel Stays Private Limited OYO

- Sonder Holdings Inc.

- Trip.com Group Ltd.

- TripAdvisor LLC

- Tujia

- Vacasa Inc.

- Vrbo Enterprises LLC

- Wimdu

Actionable Strategic Recommendations Empowering Industry Leaders to Navigate Disruption, Enhance Guest Experiences, and Capitalize on Future Peer-to-Peer Accommodation Trends

Industry leaders must embrace agility, leveraging data-driven insights to navigate shifting traveler expectations and evolving regulatory landscapes. By implementing advanced analytics, platforms can anticipate demand fluctuations and tailor offerings in real time, ensuring optimal utilization and guest satisfaction.

Cultivating host education programs will foster quality consistency and safeguard community relations. Helping hosts understand regulatory requirements and best practices in hospitality will not only enhance guest experiences but also mitigate potential compliance challenges.

Partnerships with local governments and tourism boards can unlock co-marketing opportunities and streamline licensing processes. Collaborative frameworks that support sustainable tourism practices will reinforce brand credibility and demonstrate a commitment to community well-being.

Innovating payment and loyalty structures-such as dynamic pricing coupled with rewards for sustainable stays-can stimulate demand while reinforcing environmental and social governance principles. Platforms that align financial incentives with positive guest and host behaviors will secure long-term loyalty and market resilience.

Comprehensive Research Methodology Explaining Data Sources, Analytical Framework, and Validation Techniques Underpinning the Peer-to-Peer Accommodation Study

This study is underpinned by a robust mixed-methods approach that combines primary interviews with industry experts, host surveys, and traveler feedback, alongside secondary research from reputable databases, trade journals, and regulatory filings. This comprehensive framework ensures a balanced perspective that captures both qualitative nuances and quantitative signals.

Data collection involved syndicated sources for occupancy, pricing, and consumer sentiment metrics, augmented by proprietary platform data to analyze booking patterns and host behavior. Rigorous data cleaning and triangulation techniques were applied to guarantee accuracy and consistency across disparate sources.

A structured thematic analysis of interview transcripts identified emerging themes in technology adoption, regulatory shifts, and sustainability practices. These insights were further validated through comparative case studies of markets across the Americas, EMEA, and Asia-Pacific to elucidate regional variations.

All findings were subject to peer review by an internal panel of hospitality and travel research specialists, ensuring analytical rigor and practical relevance. Ethical guidelines were strictly adhered to, and all data handling complied with prevailing privacy regulations and industry standards.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Peer-To-Peer Accommodation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Peer-To-Peer Accommodation Market, by Property Type

- Peer-To-Peer Accommodation Market, by Booking Type

- Peer-To-Peer Accommodation Market, by Distribution Channel

- Peer-To-Peer Accommodation Market, by Traveller Type

- Peer-To-Peer Accommodation Market, by Region

- Peer-To-Peer Accommodation Market, by Group

- Peer-To-Peer Accommodation Market, by Country

- United States Peer-To-Peer Accommodation Market

- China Peer-To-Peer Accommodation Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Concluding Insights on Peer-to-Peer Accommodation’s Evolution, Strategic Imperatives, and the Road Ahead for Platforms, Hosts, and Stakeholders

The peer-to-peer accommodation market stands at a pivotal juncture, shaped by the convergence of technological innovation, evolving traveler behaviors, and regulatory evolution. Digital platforms have redefined how properties are discovered and booked, while the rise of remote work has blurred traditional travel boundaries, spurring demand for versatile, multifunctional stays.

Tariff policies and broader economic dynamics have introduced new complexities, tempering consumer confidence and reshaping booking patterns. While border regions have borne the brunt of cross-border traveler declines, proactive platforms and diversified offerings have demonstrated resilience by adapting to localized preferences.

Segmentation analysis underscores the importance of property type, booking methodology, channel selection, and traveler profile in crafting targeted strategies. Regional perspectives reveal distinct market drivers, from the mature Americas to the growth-focused Asia-Pacific, each presenting unique opportunities and challenges.

As the sector moves forward, industry participants who embrace data-driven decision-making, cultivate strong host relationships, and align their value propositions with sustainability and local engagement will be best positioned to thrive. The future of peer-to-peer accommodation hinges on continuous adaptation and a steadfast focus on delivering authentic, technology-enhanced experiences.

Secure Your Access to Exclusive Peer-to-Peer Accommodation Market Intelligence by Connecting with Ketan Rohom for Tailored Research Solutions

Embark on the journey to harness unparalleled insights in the peer-to-peer accommodation realm by reaching out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan’s deep expertise in lodging platforms and traveler behavior equips him to tailor a comprehensive research package that meets your specific strategic objectives. By engaging directly, you can secure priority access to our latest data-driven analyses, customized benchmarking tools, and exclusive trend forecasts. Let Ketan guide you through our suite of market intelligence solutions, ensuring you gain a competitive edge and make informed decisions in this dynamic sector. Connect with Ketan today to elevate your understanding and drive actionable outcomes with our authoritative market research report.

- How big is the Peer-To-Peer Accommodation Market?

- What is the Peer-To-Peer Accommodation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?