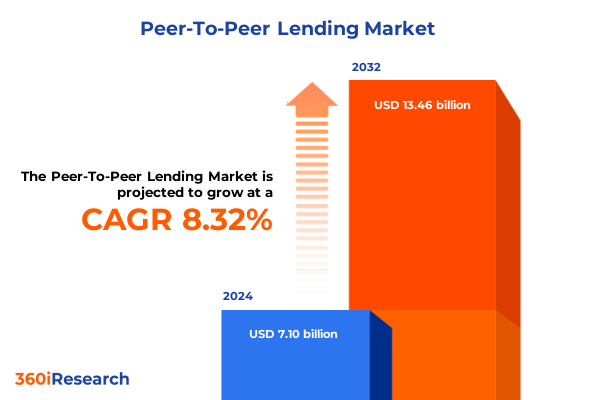

The Peer-To-Peer Lending Market size was estimated at USD 7.62 billion in 2025 and expected to reach USD 8.19 billion in 2026, at a CAGR of 8.45% to reach USD 13.46 billion by 2032.

Discover How Evolving Market Dynamics, Digital Transformation, and Regulatory Innovations Are Shaping the Peer-to-Peer Lending Landscape and Expectations

As digital platforms continue to democratize financial services, peer-to-peer lending has emerged as a cornerstone of modern finance by directly connecting borrowers with investors. This innovative model bypasses traditional banking intermediaries to deliver more efficient loan origination processes, lower operational costs, and competitive rates for both borrowers and lenders. By leveraging advanced data analytics, machine learning algorithms, and intuitive user interfaces, peer-to-peer platforms have reshaped access to credit and expanded financial inclusion across diverse demographics.

In recent years, an evolving regulatory landscape has played a pivotal role in legitimizing peer-to-peer lending while safeguarding consumer protection and financial stability. Regulatory bodies have introduced frameworks that encourage transparency, enforce rigorous risk management protocols, and define capital requirements for platform operators. Consequently, stakeholder confidence has grown, attracting institutional capital alongside retail investors and creating a more resilient ecosystem. Moreover, strategic collaborations with fintech innovators, credit bureaus, and payment processors have enhanced underwriting capabilities, fraud detection, and customer onboarding experiences.

Emerging Technologies and Regulatory Frameworks Have Catalyzed Transformative Shifts That Redefine Operations, Risk Management, and Customer Engagement in Peer-to-Peer Lending

Technological advancements have served as a catalyst for transformative shifts in peer-to-peer lending by optimizing core processes and delivering personalized borrower experiences. Automation of credit assessments through artificial intelligence and alternative data sources has reduced default rates and improved approval speeds, while blockchain-based solutions are being tested to increase transparency and streamline settlement operations. Consequently, platform operators are reimagining legacy infrastructures, investing in scalable cloud architectures, and deploying application programming interfaces that facilitate seamless integration with third-party services.

Furthermore, the entrance of institutional investors into the retail-driven peer-to-peer market has fundamentally altered capital flows and risk appetites. Institutional participation has been driven by the pursuit of diversified fixed-income portfolios and attractive return profiles that extend beyond traditional bonds. This influx of professional capital has prompted platforms to enhance credit monitoring, provide comprehensive reporting tools, and conform to heightened due diligence standards. In addition, evolving borrower expectations for user-friendly digital experiences and tailored loan offerings have spurred platform differentiation, with operators experimenting with dynamic pricing models and white-label partnerships to strengthen market positioning.

Analyzing the Ripple Effects of United States Tariffs in 2025 on Peer-to-Peer Lending Platforms, Borrower Behavior, and Investor Risk Profiles

The persistence of United States tariffs in 2025, driven by geopolitical strategies and national security considerations, has indirectly influenced peer-to-peer lending activities by affecting macroeconomic variables such as manufacturing costs and business investment cycles. Elevated tariffs on imported goods have led to cost-push inflation in certain industries, prompting small and medium enterprises to seek flexible financing alternatives. As a result, peer-to-peer platforms have observed shifts in demand patterns, with an uptick in business loans earmarked for inventory replenishment and working capital needs.

Moreover, investor risk assessments have adapted to the uncertainties engendered by trade policy fluctuations. Platforms have responded by adjusting credit scoring models to incorporate sector-specific tariff exposure and by offering more conservative pricing on loans to borrowers operating in industries with high import reliance. In parallel, regulatory agencies have maintained close surveillance of lending platforms to ensure that heightened macroeconomic volatility does not compromise systemic stability. Consequently, peer-to-peer operators are enhancing stress-testing procedures and communicating regularly with stakeholders to navigate the ripple effects of trade policy evolutions.

Uncovering Critical Segmentation Insights to Understand Lending Type, Funding Model, Loan Terms, Investor Profiles, and Loan Purposes in the Peer-to-Peer Market

A nuanced understanding of peer-to-peer lending requires a segment-by-segment analysis that delves into the distinct characteristics and performance drivers of various lender and borrower cohorts. Across lending types-spanning business loans for commercial ventures, personal loans for individual needs, and real estate loans for property investments-platforms have tailored underwriting criteria and product features to align with borrower risk profiles and capital requirements. In addition, funding models can be broadly categorized as auction-based, where lenders compete for borrower bids, and fixed-rate structures, which offer standardized pricing and predictable returns.

Examining loan tenure reveals that platforms have diversified their offerings into longer-term facilities suitable for major investments, medium-duration loans for targeted financial objectives, and short-term credit for immediate working capital requirements. Correspondingly, investor segments have expanded to include institutional players focused on portfolio diversification and retail investors pursuing yield enhancement. Finally, loan purposes span a spectrum of needs-ranging from business expense financing and debt consolidation to educational funding, home improvement projects, and medical expense coverage-highlighting the adaptability of peer-to-peer solutions to evolving consumer demands.

This comprehensive research report categorizes the Peer-To-Peer Lending market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Lending Type

- Funding Model

- Loan Term

- Investor Type

- Loan Purpose

Key Regional Dynamics Highlighting the Distinct Regulatory, Technological, and Adoption Trends Across Americas, EMEA, and Asia-Pacific in Peer Lending

Regional dynamics underscore the heterogeneous nature of peer-to-peer lending adoption and regulatory maturity across the globe. In the Americas, innovation hubs have fostered robust platform ecosystems in the United States and Canada, where progressive regulatory frameworks and mature capital markets underpin rapid growth. Conversely, Latin American markets demonstrate nascent yet accelerating adoption, as borrowers seek nontraditional financing amid banking sector constraints and credit access gaps.

Across Europe, the Middle East, and Africa, the regulatory spectrum ranges from highly structured regimes in Western Europe to emerging guidelines in the Gulf Cooperation Council and Sub-Saharan Africa. This variation has prompted platform operators to customize compliance strategies, forge alliances with local financial institutions, and adapt to diverse consumer protection standards. Meanwhile, the Asia-Pacific region exhibits a duality of advanced fintech-driven markets in Australia and China alongside rising P2P ecosystems in Southeast Asia, where digital penetration and smartphone adoption are driving new lending applications and partnerships with technology incumbents.

This comprehensive research report examines key regions that drive the evolution of the Peer-To-Peer Lending market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Peer-to-Peer Lending Platforms and Strategic Partnerships That Define Competitive Advantage and Innovation in the Market

A cadre of pioneering companies has shaped the peer-to-peer lending ecosystem through differentiated business models, strategic partnerships, and continuous product innovation. Market leaders have leveraged data-driven credit assessments to enhance loan performance, while specialized platforms have emerged to serve niche verticals such as renewable energy financing and student loans. Strategic alliances with payment processors, credit bureaus, and alternative data providers have further deepened risk management capabilities and improved borrower conversion rates.

In parallel, incumbent financial institutions and fintech incumbents have formed joint ventures with peer-to-peer platforms to harness digital distribution channels and broaden their credit offerings. Cross-border collaborations have facilitated access to new capital pools and diversified borrower profiles, while white-label solutions have empowered traditional banks to embed peer-to-peer technology within their customer interfaces. As competitive pressures intensify, platform operators are also investing in brand differentiation through enhanced customer experience, transparent fee structures, and sustainability-focused lending programs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Peer-To-Peer Lending market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bondora AS

- Debitum Network Ltd.

- Faircent

- Funding Circle Holdings plc

- Funding Societies Pte. Ltd.

- Kiva Microfunds

- Lendable Ltd.

- LenDenClub

- LendingClub Corporation

- Lendo Financial Services LLC

- Lufax Holding Ltd.

- Mintos AS

- PeerBerry UAB

- Prosper Marketplace, Inc.

- SoLo Funds, Inc.

- Transactree Technologies Pvt. Ltd.

- Upstart Holdings, Inc.

- VIA SMS Group SIA

- Wisr Limited

- Zopa Bank Limited

Actionable Strategies for Industry Leaders to Enhance Risk Management, Drive Digital Innovation, and Capitalize on Emerging Opportunities in Peer-to-Peer Lending

Industry leaders seeking to capitalize on peer-to-peer lending growth must prioritize robust risk management frameworks that integrate dynamic stress-testing and real-time portfolio surveillance. By combining predictive analytics with scenario planning, platforms can proactively identify emerging credit risks and adjust underwriting criteria accordingly. Furthermore, strengthening capital buffers and diversification strategies will mitigate concentration risks and bolster confidence among institutional investors.

To drive sustainable differentiation, executives should explore advanced digital tools-such as automated customer relationship management, AI-powered fraud detection, and blockchain-enabled settlements-to enhance operational efficiency and customer trust. Collaborating with regulatory bodies to co-develop compliance standards can also streamline market entry and foster a transparent operating environment. Finally, embracing environmental, social, and governance principles in lending policies will resonate with socially conscious investors and support long-term resilience.

Comprehensive Research Methodology Leveraging Secondary Research, Expert Interviews, and Data Triangulation for Rigorous Peer-to-Peer Lending Analysis

This research employs a multifaceted methodology combining secondary data analysis, expert interviews, and qualitative assessments to ensure comprehensive coverage of peer-to-peer lending developments. Initially, industry publications, regulatory filings, and technology white papers were reviewed to establish a foundational understanding of market drivers and structural dynamics. Subsequently, in-depth interviews with platform executives, regulatory advisors, and institutional investors provided practitioner insights into strategic priorities and operational challenges.

Moreover, data triangulation techniques were applied to cross-validate thematic findings, ensuring consistency and reliability across multiple information sources. The analysis was further enriched through peer review sessions with independent fintech analysts and academic scholars to challenge assumptions and refine interpretations. Throughout the research process, strict adherence to ethical guidelines and data quality standards was maintained to deliver credible, unbiased insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Peer-To-Peer Lending market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Peer-To-Peer Lending Market, by Lending Type

- Peer-To-Peer Lending Market, by Funding Model

- Peer-To-Peer Lending Market, by Loan Term

- Peer-To-Peer Lending Market, by Investor Type

- Peer-To-Peer Lending Market, by Loan Purpose

- Peer-To-Peer Lending Market, by Region

- Peer-To-Peer Lending Market, by Group

- Peer-To-Peer Lending Market, by Country

- United States Peer-To-Peer Lending Market

- China Peer-To-Peer Lending Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Insights on Strategic Imperatives and Future-Proofing Approaches to Sustain Growth in the Peer-to-Peer Lending Industry

In summary, the peer-to-peer lending market stands at the intersection of technological innovation, regulatory evolution, and shifting capital dynamics. Platforms that successfully integrate advanced analytics, foster strategic alliances, and maintain agile governance frameworks will be best positioned to navigate competitive pressures and macroeconomic uncertainties. As the landscape continues to mature, differentiation through customer-centric product design and responsible lending practices will emerge as critical determinants of success.

Ultimately, organizations that embrace a forward-looking posture-anticipating regulatory trends, investing in digital capabilities, and embedding ESG considerations into their core strategies-will drive sustained value creation. By synthesizing these strategic imperatives, stakeholders can harness the transformative potential of peer-to-peer lending while mitigating risks and unlocking long-term growth opportunities.

Contact Ketan Rohom to Access the Complete Peer-to-Peer Lending Market Research Report and Empower Your Strategic Decision-Making Today

To gain a deeper understanding of the peer-to-peer lending market and secure a strategic advantage, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to explore the full comprehensive market research report. Engage with Ketan to access detailed qualitative insights, expert analyses, and tailored recommendations that will empower your organization’s decision-making and foster growth in the dynamic peer-to-peer lending landscape. Begin a conversation today to unlock exclusive market intelligence and actionable strategies designed to position your business at the forefront of innovation and competitive differentiation.

- How big is the Peer-To-Peer Lending Market?

- What is the Peer-To-Peer Lending Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?