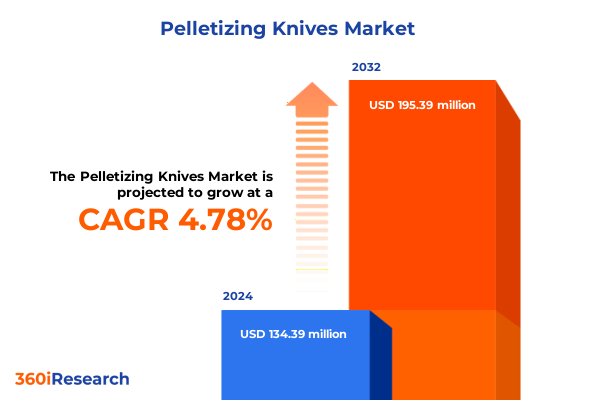

The Pelletizing Knives Market size was estimated at USD 139.44 million in 2025 and expected to reach USD 147.04 million in 2026, at a CAGR of 4.93% to reach USD 195.39 million by 2032.

Setting the Stage for Precision and Productivity with Pelletizing Knives Driving High-Quality Pellet Production and Operational Efficiency

Pelletizing knives serve as the linchpins of pellet production processes, ensuring the precise shearing and sizing of extruded materials into uniform pellets. Whether in food processing, animal feed production, biomass energy generation, chemical synthesis, or pharmaceutical manufacturing, these cutting tools directly influence product quality, operational throughput, and maintenance cycles. As industries increasingly prioritize high-performance materials and reliable equipment, the importance of selecting and maintaining robust pelletizing knives has never been greater.

In this context, understanding the fundamental mechanics of pelletizing knife operation is essential. Sharpness retention, material compatibility, and thermal stability govern knife lifespan, while blade geometry and clearance settings dictate pellet consistency and residue generation. Because these variables interact dynamically, operators must balance initial cost considerations against long-term performance outcomes and service intervals.

Against a backdrop of growing demand for sustainable practices and stringent regulatory standards, pelletizing knife technology has evolved to embrace advanced alloys, coatings, and design refinements. This report introduces key drivers, offers in-depth analysis of emerging trends, and sets the stage for how strategic application of segmentation, regional insights, and supplier selection can unlock new levels of efficiency and product excellence.

Embracing Next-Generation Innovations and Sustainable Practices Redefining Pelletizing Knives for Unmatched Durability and Smart Maintenance

The pelletizing knife landscape is undergoing a transformative evolution propelled by sustainability mandates, technological breakthroughs, and supply chain realignments. First, the drive for circular economies has elevated the demand for wear-resistant alloys and enhanced coatings that slash maintenance requirements and extend service life. Manufacturers now lean on advanced metallurgy to mitigate material fatigue, thereby reducing downtime and waste while boosting operational sustainability.

Simultaneously, digitalization is emerging as a game-changer through the integration of smart maintenance platforms. Predictive analytics and remote monitoring solutions now enable real-time wear assessment and proactive replacement scheduling, effectively reducing unplanned stoppages and optimizing inventory management. These capabilities marry seamlessly with rapid-change knife systems, empowering operations to adapt swiftly to shifting throughput demands.

Moreover, heightened regulatory scrutiny on emissions and particle generation has driven innovations in blade geometry, minimizing fines and ensuring consistent pellet density. Coupled with energy-saving features such as variable frequency drives and regenerative braking, modern pelletizing setups demonstrate notable reductions in power consumption and environmental impact. Finally, amid geopolitical shifts and trade uncertainties, suppliers are localizing component sourcing, reinforcing resilience against tariff fluctuations and logistics disruptions, which collectively redefines competitive benchmarks and operational excellence.

Assessing the Ripple Effects of 2025 U.S. Steel and Aluminum Tariffs on Pelletizing Knife Supply Chains and Cost Structures

In March and June 2025, U.S. steel and aluminum tariffs surged, imposing duties ranging from 25 percent to 50 percent on a wide array of imports. These measures, enacted under Section 232 to bolster domestic production, have directly impacted the cost structure of pelletizing knives, which rely heavily on imported tool and alloy steels. Manufacturers are now confronting elevated raw material expenses, which, in turn, compress profit margins and compel strategic supply chain adjustments.

Industry accounts reveal that some producers pre-stocked critical steel grades to hedge against tariff hikes, mitigating immediate cost shocks but straining working capital. Others have expedited partnerships with alternative suppliers in tariff-exempt regions or pursued partial relocalization of procurement. As a result, procurement teams must navigate shifting duty regimes, customs compliance demands, and fluctuating lead times, all while maintaining blade quality and performance.

Consequently, knife manufacturers and end-users are exploring design optimizations to maximize yield from lower-cost materials where feasible. Meanwhile, service providers are witnessing increased demand for knife regrinding and refurbishment as cost-effective alternatives to new blade purchases. Looking ahead, sustained tariff uncertainty underscores the need for agile sourcing frameworks and diversified supplier networks to safeguard operational continuity and cost predictability.

Unveiling Market Dynamics through Application and Material Segmentations Shaping Pelletizing Knife Preferences and Distribution Channels

A closer look at market segmentation reveals nuanced demand patterns and application-specific requirements shaping pelletizing knife design and distribution strategies. Within pellet mill types, fixed flat die configurations grant straightforward installation and maintenance simplicity, whereas ring die systems accommodate higher throughput and finer pellet tolerances, driving divergent knife geometries and wear considerations. This mill-type distinction influences supplier portfolios and aftermarket stocking practices.

Turning to industry applications, animal feed producers emphasize hygiene, cross-contamination prevention, and corrosion resistance, particularly for aqua, cattle, poultry, and swine feeds. Biomass energy sectors, processing agricultural residues, bamboo, rice husk, and wood pellets, prioritize abrasion resistance and thermal stability to handle heterogeneous feedstocks. Chemical and pharmaceutical clients demand exceptional cutting precision and polished finishes to comply with rigorous purity standards and regulatory mandates.

Material composition further refines market dynamics. Alloy steels such as 4140 and 4340 offer balanced toughness and affordability, while stainless grades 304 and 316 deliver superior corrosion resistance for wet or corrosive environments. High-wear tool steels like Grade D2 and Grade M2 serve extreme abrasion contexts, guiding inventory segmentation and replacement cycle forecasting.

Finally, sales channels bifurcate into OEM partnerships-which facilitate integrated knife-machine sourcing and long-term service agreements-and aftermarket distribution, where rapid availability and expert support drive buyer loyalty. Understanding these intersecting segment dimensions is crucial for tailoring product development, go-to-market strategies, and customer support frameworks.

This comprehensive research report categorizes the Pelletizing Knives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Pellet Mill Type

- Material Type

- Application Industry

Navigating Regional Nuances to Optimize Pelletizing Knife Performance in Americas, EMEA, and Asia-Pacific Amid Varied Economic Drivers and Regulatory Landscapes

Regional market characteristics underscore divergent growth drivers and investment priorities across the Americas, EMEA, and Asia-Pacific. In the Americas, robust agricultural feed operations and expanding biomass energy projects have elevated demand for high-durability knives and local aftermarket support. North American producers leverage domestic steel capabilities but remain vigilant of policy shifts affecting import duties and raw material flows.

Europe, the Middle East, and Africa present a mosaic of regulatory landscapes and sustainability mandates. European feed and chemical sectors are early adopters of eco-friendly pelletizing solutions, prioritizing knife designs that minimize particle emissions and energy footprints. EMEA manufacturers are consolidating supply chains to balance cost pressures with stringent environmental targets, often sourcing specialized stainless and tool steels within regional trade blocs.

In Asia-Pacific, rapid industrialization and growing pharmaceutical and chemical manufacturing hubs drive significant uptake of both standard and advanced pelletizing knives. Price sensitivity coexists with rising quality expectations, prompting suppliers to establish local production facilities and technical service centers. Japanese and South Korean OEMs are particularly influential, integrating smart maintenance features into knife assemblies and setting benchmarks for operational reliability.

By appreciating these regional distinctions-spanning economic drivers, regulatory frameworks, and supply chain configurations-industry participants can optimize regional strategies, mitigate compliance risks, and align investments with localized growth opportunities.

This comprehensive research report examines key regions that drive the evolution of the Pelletizing Knives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies of Leading Manufacturers Driving Innovation Sustainability and Market Expansion in Pelletizing Knife Industry

Leading manufacturers in the pelletizing knife arena are deploying distinct strategies to secure competitive advantage and drive market expansion. ASGCO Manufacturing focuses on customized alloy formulations and rapid prototyping capabilities, enabling quick adaptation to evolving pellet mill requirements. Leitz GmbH & Co. KG has differentiated itself through precision engineering and comprehensive service offerings, supporting blade refurbishment and lifecycle management across global OEM networks.

Zenith Cutter leverages a century of metallurgy expertise to introduce novel blade geometries and inlaid carbide solutions tailored for high-wear environments. By integrating research and development centers in Europe and Asia, the company fine-tunes product specifications to regional feedstock characteristics. SIJ Ravne Systems strengthens its market position through a robust portfolio encompassing both standard and niche specialty knives, reinforcing customer trust via stringent quality certifications.

Great Lakes Industrial Knife Company emphasizes a customer-centric approach, offering in-house grinding, CNC sharpening, and rapid delivery from U.S. facilities to minimize downtime. This model has resonated strongly with North American biomass and feed processors facing tight operational schedules. Across the board, these key players are forging strategic partnerships with equipment OEMs, investing in digital maintenance platforms, and expanding service footprints to capture aftermarket revenue and bolster client retention.

This comprehensive research report delivers an in-depth overview of the principal market players in the Pelletizing Knives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bühler AG

- Clextral SAS

- Conair Corporation

- Coperion GmbH

- Davis-Standard LLC

- Entek Engineering Pvt. Ltd.

- Gala Industries Inc.

- Gneuss GmbH

- Maag Pump Systems AG

- Nordson Corporation

Implementing Proactive Measures to Enhance Pelletizing Knife Performance Mitigate Risk and Capitalize on Emerging Industry Opportunities

Industry leaders should prioritize an agile procurement framework that blends domestic and international sourcing to buffer against tariff volatility and logistics disruptions. By establishing multi-tiered supplier agreements and regional service hubs, organizations can ensure continuity of blade availability and optimize cost efficiencies. Moreover, leveraging predictive maintenance technologies will enable data-driven knife replacement schedules, reducing unplanned stoppages and inventory carrying costs.

Investing in advanced material research-particularly in wear-resistant alloys and sustainable coatings-can yield significant operational gains and extend service intervals. Collaborations with specialty steel producers and research institutions will accelerate innovation cycles and secure early access to next-generation metallurgical solutions. Concurrently, knife manufacturers should offer tailored refurbishment programs, positioning regrinding and reconditioning as cost-effective life-cycle management services.

Finally, aligning product development with application-specific requirements-such as designing knives for moisture-prone biomass feedstocks or high-hygiene feed operations-will reinforce value propositions. By delivering end-to-end solutions that integrate blade design, digital monitoring, and aftermarket support, industry participants can deepen customer relationships and unlock sustainable revenue streams.

Detailing Rigorous Research Approaches Integrating Qualitative and Quantitative Analysis to Deliver Transparent Insights

This report synthesizes findings from a rigorous research methodology combining extensive primary and secondary data collection. Desk research encompassed analysis of industry publications, technical white papers, and regulatory frameworks to establish foundational insights into pelletizing knife technologies and market drivers.

Primary research involved in-depth interviews with key stakeholders, including equipment OEM engineers, procurement directors, and materials specialists, to validate trends, gauge adoption challenges, and capture emerging priorities. These qualitative insights were complemented by case studies illustrating successful implementations of advanced maintenance systems and material innovations.

Quantitative data analysis was conducted through examination of trade data, customs filings, and industry association statistics to elucidate shipment patterns, tariff impacts, and regional consumption dynamics. Cross-validation of findings across multiple sources ensured data integrity and reliability. Finally, synthesizing these diverse inputs enabled the construction of a cohesive perspective on current industry trajectories and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pelletizing Knives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pelletizing Knives Market, by Pellet Mill Type

- Pelletizing Knives Market, by Material Type

- Pelletizing Knives Market, by Application Industry

- Pelletizing Knives Market, by Region

- Pelletizing Knives Market, by Group

- Pelletizing Knives Market, by Country

- United States Pelletizing Knives Market

- China Pelletizing Knives Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings to Guide Strategic Decisions on Pelletizing Knife Innovation Operational Excellence and Market Adaptation

As the pelletizing knife market advances amid sustainability pressures, technological innovation, and geopolitical headwinds, stakeholders must navigate a complex interplay of material, regulatory, and operational factors. The convergence of predictive maintenance, advanced metallurgy, and localized sourcing models is reshaping value chains and redefining cost structures.

Key findings underscore that tailored segmentation strategies-spanning mill types, industry applications, material grades, and sales channels-are essential for aligning product offerings with customer requirements. Moreover, regional nuances in economic priorities and regulatory demands necessitate targeted go-to-market approaches to optimize resource allocation and accelerate market penetration.

Looking ahead, companies that embrace integrated solutions-combining designed-to-specification knives, smart monitoring, and lifecycle management services-will lead the way in operational excellence. By translating these insights into proactive strategies, organizations can secure resilience, drive efficiency gains, and maintain a competitive edge in an evolving industry ecosystem.

Engage with Ketan Rohom to Access Comprehensive Market Intelligence on Pelletizing Knives and Elevate Your Strategic Planning Today

To explore deeper insights and gain a competitive edge in pelletizing knife selection and deployment, engage directly with Ketan Rohom, Associate Director Sales & Marketing. He will guide you toward the customized data, strategic analyses, and expert support necessary to optimize your operations and capitalize on emerging market dynamics. Reach out to secure your comprehensive market research report and take the next step toward elevating your pelletizing knife strategies today.

- How big is the Pelletizing Knives Market?

- What is the Pelletizing Knives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?