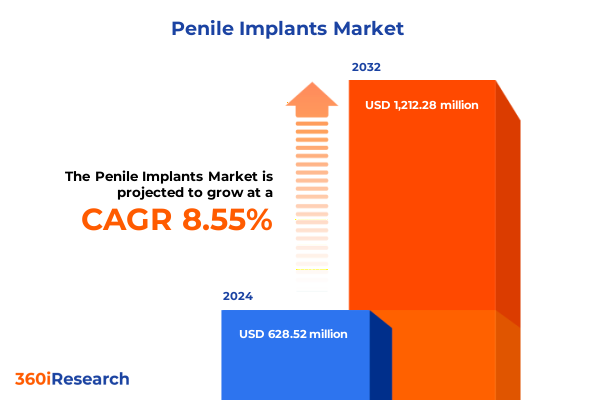

The Penile Implants Market size was estimated at USD 682.44 million in 2025 and expected to reach USD 746.07 million in 2026, at a CAGR of 8.55% to reach USD 1,212.28 million by 2032.

Exploring the Evolving Therapeutic Landscape of Penile Implants and Patient-Driven Clinical Advancements

The penile implant arena is at the intersection of medical innovation, patient-centric care, and evolving regulatory frameworks. With erectile dysfunction affecting men across diverse age groups and comorbidities, surgical implants have become a vital therapeutic avenue when first-line treatments fall short. The historical progression from rigid malleable rods to sophisticated hydraulic devices underscores a relentless industry focus on improving both functional outcomes and patient satisfaction.

Contemporary inflatable systems, now accounting for roughly 80 to 90 percent of all prostheses in the United States, have largely supplanted earlier malleable models due to their superior cosmetic and clinical performance. Moreover, recent real-world data reveal that 95 percent of patients express satisfaction with modern three-piece inflatable implants, reflecting a paradigm shift toward devices designed for natural feel, reliability, and ease of use. As stakeholders navigate this complex landscape, understanding the confluence of demographic trends, surgical practices, and technological advances is essential for anticipating future market developments.

Assessing the Impact of Cutting-Edge Technology, Demographic Trends, and Clinical Infrastructure on Penile Implant Evolution

In recent years, the penile implant sector has witnessed transformative shifts fueled by breakthroughs in materials science, pump mechanics, and infection control. The introduction of advanced antibiotic coatings and hydrophilic surfaces has significantly reduced infection rates, while novel pump designs, such as momentary-squeeze mechanisms, have simplified implantation procedures and improved patient usability. These enhancements are reshaping surgeon preferences and patient expectations in tandem.

Simultaneously, demographic factors including an aging global population and rising awareness of men’s sexual health have broadened the addressable patient base. Health systems are adapting by expanding outpatient surgery centers and specialty clinics dedicated to men’s health, further accelerating adoption. This convergence of innovation, infrastructure evolution, and patient empowerment marks a pivotal inflection point, setting the stage for next-generation device platforms and more personalized treatment pathways.

Understanding the Multifaceted Effects of U.S. Trade Policies and Tariff Adjustments on Penile Implant Costs and Supply Chains

The cumulative implications of recent U.S. trade and tariff policies have created nuanced cost pressures and supply chain considerations for penile implant manufacturers. In May 2025, the USTR’s plan to reinstate Section 301 tariffs on certain Class I and II medical devices signaled potential extension of duties to components relevant to implants, intensifying concerns over import costs and inventory strategy. Although surgical prostheses currently fall outside explicit Section 301 targets, heightened scrutiny of medical imports from China has prompted contingency planning across the sector.

Further, the implementation of elevated duties on rubber gloves and ancillary surgical accessories has already materialized with a 50 percent tariff commencing January 1, 2025, amplifying overall procedural expenditures. These layered tariff structures are driving manufacturers toward regionalized production models and forward-looking supplier diversification, while payers and providers brace for incremental cost shifts. Navigating this complex tariff landscape requires proactive scenario analysis to safeguard both margins and patient access.

Evaluating Diverse Segmentation Dynamics Illuminating Product, Channel, and Material Differentiation in the Penile Implant Sector

Delving into product diversification reveals that inflatable systems, spanning both three-piece and two-piece configurations, dominate the implant landscape owing to their superior functional fidelity and patient satisfaction profiles, whereas malleable options maintain a niche presence for select indications. From an end-user perspective, hospitals remain crucial volume drivers, yet a growing share of procedures now transpires in ambulatory surgery centers due to optimized operational efficiencies; concurrently, specialty clinics-particularly those focused on urology and plastic surgery-have emerged as pivotal points of care offering tailored expertise.

The sales ecosystem bifurcates between direct engagements, often led by manufacturers’ clinical specialists, and distribution networks encompassing both independent and manufacturer-affiliated partners, ensuring comprehensive market reach. Material innovation is a defining axis, with silicone retaining primacy for its biocompatibility, while niche titanium variants address specialized surgical requirements. Finally, pricing stratification spans economy, mid-range, and premium tiers, enabling providers to align device selection with both clinical outcomes and budgetary constraints.

This comprehensive research report categorizes the Penile Implants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Price Tier

- End User

- Sales Channel

Highlighting Regional Market Nuances and Growth Differentials Across the Americas, Europe Middle East Africa, and Asia-Pacific Territories

Regional patterns underscore the Americas as the epicenter of penile implant adoption, fueled by well-established urology infrastructure, high procedural reimbursement, and robust surgeon training programs. Within North America, leading centers consistently report expanded implant volumes, supported by a strong network of specialty men’s health clinics.

In Europe, Middle East & Africa, adoption curves vary markedly: Western Europe benefits from advanced regulatory harmonization and clinical expertise hubs, whereas emerging markets in the Middle East and Africa face challenges related to reimbursement variability and surgical training capacity. Conversely, the Asia-Pacific region exhibits accelerating uptake, driven by rising disposable incomes, expanding hospital networks, and targeted investments in men’s health services, with markets such as Japan, China, and India demonstrating the most pronounced growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Penile Implants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strengths and Innovation Strategies of Leading and Emerging Penile Implant Manufacturers

A concentrated competitive landscape anchors around two dominant players, Boston Scientific and Coloplast, whose complementary portfolios span inflatable three-piece systems, low-profile reservoirs, and antibiotic-coated cylinders, backed by decades of clinical validation. Boston Scientific’s AMS 700 platform, with its TENACIO™ pump and InhibiZone™ antibiotic treatment, commands clinician favor for its proven long-term performance and 95 percent user satisfaction rates. Coloplast’s Titan implant leverages proprietary Bioflex® material and patented lock-out safety valves to deliver unmatched cylinder strength and hydrophilic coatings for ease of placement.

Emerging entrants such as Zephyr Surgical Implants and Rigicon introduce specialized solutions-ranging from phalloplasty-specific hydraulic systems to next-generation malleable rods-challenging incumbents through niche clinical applications and geographies. This dynamic interplay of established leadership and innovative disruptors is reshaping strategic priorities around R&D investment, market expansion, and collaborative partnerships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Penile Implants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advin Health Care

- Augmenta LLC

- B. Braun Melsungen AG

- Boston Scientific Corporation

- Coloplast A/S

- Dr. Elist

- Eska Medical

- G. Surgiwear Ltd.

- Giant Medical Corporation

- InnoMedicus AG

- Kaiser Permanente

- Noble Healthcare

- Promedon S.A.

- Prometheus Group

- Rigicon, Inc.

- Silimed

- Silimed Implants Industry Ltd.

- Surgi-Tec

- Timm Medical Technologies, Inc.

- Titan Medical, Inc.

- Uromedica, Inc.

- Zephyr Surgical Implants Ltd.

- ZSI Surgical Implants S.R.L.

Implementing Strategic Partnerships, Localized Manufacturing, and Value-Based Reimbursement Models to Enhance Market Position and Patient Outcomes

Industry leaders should accelerate investments in advanced materials research to reduce mechanical failure rates and enhance device longevity, recognizing that durability remains a key patient concern. Concurrently, establishing localized assembly and component fabrication facilities within major markets can mitigate tariff exposures and streamline supply chains.

Strengthening collaborative forums among surgeons, payers, and regulatory bodies will be critical for harmonizing value-based reimbursement models that align clinical outcomes with cost efficiency. Additionally, expanding training programs in ambulatory and specialty clinic settings will extend procedural capacity and improve patient access. Finally, forging strategic alliances with digital health providers to integrate remote monitoring and patient engagement tools can differentiate offerings and elevate post-operative satisfaction.

Detailing a Comprehensive Methodology Uniting Expert Interviews Secondary Data Analysis and Scenario Planning Workshops

This study integrates qualitative insights from in-depth interviews with urology thought leaders, clinical specialists, and procurement executives, complemented by secondary research across peer-reviewed journals, regulatory filings, and public financial disclosures. Trade policy impacts were evaluated through analysis of USTR notices and validated against industry reports from leading data providers.

Segmentation and regional dynamics were derived through triangulation of surgical volume data, payer policy updates, and expert surveys, ensuring a robust perspective on device adoption patterns. Competitive intelligence involved product feature benchmarking and patent landscape scanning, while recommendation frameworks were stress-tested via scenario planning workshops with advisory board members.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Penile Implants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Penile Implants Market, by Product Type

- Penile Implants Market, by Material

- Penile Implants Market, by Price Tier

- Penile Implants Market, by End User

- Penile Implants Market, by Sales Channel

- Penile Implants Market, by Region

- Penile Implants Market, by Group

- Penile Implants Market, by Country

- United States Penile Implants Market

- China Penile Implants Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Clinical Innovation, Policy Dynamics, and Patient-Centric Strategies to Navigate Future Market Complexity and Growth

The penile implant market stands at a pivotal juncture, where clinical innovation, shifting surgical environments, and evolving trade policies converge to reshape stakeholder strategies. Manufacturers and providers who adeptly navigate complex tariff regimes, prioritize material and engineering advancements, and foster collaborative care models will be well positioned to lead the next phase of growth.

As demographic and economic forces continue to expand the addressable patient pool, sustained success will hinge on agile supply chain configurations, value-driven pricing structures, and relentless focus on patient-centric outcomes. This holistic perspective offers a blueprint for stakeholders to capitalize on emerging opportunities while safeguarding against market headwinds.

Unlock Exclusive Insights and Drive Growth by Securing Your In-Depth Penile Implant Market Research Report with Expert Guidance

Elevate your strategic decision-making today by securing your comprehensive market research report on the penile implant landscape. Ketan Rohom, Associate Director of Sales & Marketing, invites you to explore actionable insights, in-depth analysis, and forward-looking recommendations tailored to the complexities of the evolving market. Benefit from a detailed understanding of transformative industry shifts, tariff implications, segmentation dynamics, and competitive positioning to inform your next critical move. Reach out to Ketan Rohom to gain immediate access to this indispensable resource and position your organization for sustained success.

- How big is the Penile Implants Market?

- What is the Penile Implants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?