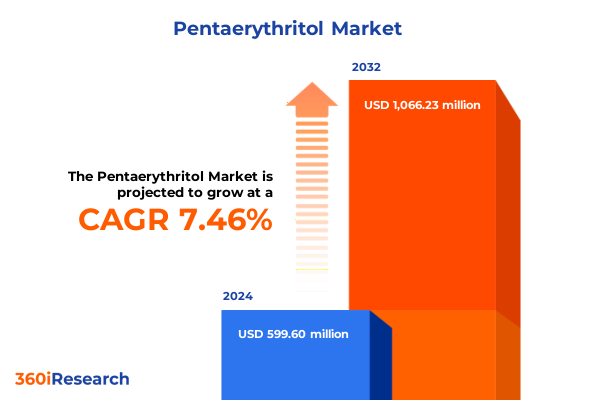

The Pentaerythritol Market size was estimated at USD 644.44 million in 2025 and expected to reach USD 699.52 million in 2026, at a CAGR of 7.45% to reach USD 1,066.22 million by 2032.

Pentaerythritol’s Critical Role as a Versatile Tetrol Drive for Adhesives, Resins, Plasticizers, Explosives, and High-Performance Applications

Pentaerythritol is an organic compound characterized by the formula C(CH₂OH)₄, and it is classified as a polyol with four hydroxyl groups attached to a neopentane core structure. This white crystalline solid serves as a foundational building block for a diverse array of industrial applications, from the synthesis of explosives such as pentaerythritol tetranitrate to the formulation of alkyd resins, plasticizers, and synthetic lubricants. Its unique combination of high flash point, low volatility, and tetrafunctional reactivity underpins its broad utility across sectors where performance and safety are paramount

As industries continue to seek materials that enhance product durability and environmental sustainability, pentaerythritol’s versatility has become increasingly valuable. It acts as a precursor for high-performance adhesives and sealants, while its derivatives enable superior weathering resistance in paints and coatings. Moreover, the compound’s role in advanced lubricant formulations for automotive and industrial applications underscores its strategic importance in both mature and emerging markets. The confluence of these drivers highlights pentaerythritol as a critical component in modern chemical manufacturing

Industry Transformation Fueled by Sustainability, High-Purity Demands, and Technological Advances Elevating Pentaerythritol Production and Applications

In recent years, the pentaerythritol landscape has undergone a fundamental transformation as producers pivot toward sustainable production methods. Leading specialty chemical firms have invested in green chemistry initiatives, integrating renewable feedstocks and hybrid energy sources to reduce carbon footprints without compromising product quality. This shift aligns with global climate targets and reflects a growing demand for bio-based pentaerythritol grades, which maintain identical performance characteristics while offering enhanced environmental credentials

Concurrently, the market is experiencing heightened demand for high-purity mono-pentaerythritol, driven by its superior reactivity in alkyd resins, adhesives, and radiation-curable formulations. Technological advancements in catalytic processes have improved yield efficiencies by up to 15 percent, enabling cost-effective production at scale. Additionally, the paints and coatings sector is increasingly transitioning to water-based formulations, further propelling pentaerythritol usage in eco-friendly surface coatings. The growing emphasis on flame retardancy has also opened new avenues, as stricter fire safety regulations globally are fueling demand for intumescent additives derived from pentaerythritol

Assessment of the Cumulative Trade Impact from 2025 Tariff Measures on United States Pentaerythritol Imports and Domestic Cost Structures

The introduction of comprehensive tariff measures in 2025 has reshaped the economics of pentaerythritol importation into the United States. Effective April 5, a baseline 10 percent ad valorem tariff was imposed on nearly all chemical imports, while additional “reciprocal” duties of 20 percent were levied on European Union-origin goods. This escalation followed the extension of Section 301 tariffs enacted in late 2024, which maintain a 25 percent burden on select Chinese-origin chemical shipments. These layered duties have elevated landed costs and compelled U.S. buyers to reassess sourcing strategies, accelerating interest in domestic and NAFTA-region production

Trade statistics underscore the magnitude of this shift: in 2023, the United States imported $55.6 million worth of pentaerythritol, sourced predominantly from Other Asia (22 percent of value), Germany (18 percent), Turkey (17 percent), Sweden (13 percent), and Spain (12 percent). Imports from China, historically susceptible to Section 301 measures, accounted for a comparatively modest 5 percent. The cumulative effect of the 2025 tariff framework has been a realignment in supplier portfolios, with increased procurement from European and non-Chinese Asian suppliers to mitigate duty exposure and safeguard supply continuity

Granular Application, End-Use, Grade, Form, Distribution, and Process Segmentation Uncovering Key Market Dynamics for Pentaerythritol

Application segmentation reveals a multi-tiered structure that defines demand patterns across downstream industries. Within adhesives and sealants, pressure-sensitive and silicone-based products rely on pentaerythritol for moisture resistance and bond strength, while alkyd resin grades divide into air drying and bake drying formulations tailored to specific coating platforms. The chemical intermediate segment bifurcates into neopentyl glycol and trimethylolpropane pathways, each unlocking distinct polyester and resin applications. Explosive-grade materials segment into nitrocellulose-based and RDX-based products, meeting stringent defense and mining specifications. Plasticizer applications traverse both phthalate and non-phthalate chemistries, reflecting evolving regulatory preferences. Synthetic lubricants further delineate into automotive and industrial formulations, each demanding precise rheological and thermal properties.

End-use industries drive additional stratification: the aerospace and defense sector integrates coatings and lubricants engineered for extreme environments, while the automotive segment bifurcates into OEM and aftermarket requirements. Coatings span liquid and powder modalities to accommodate architectural and industrial finishes, and construction leverages paints and sealants that balance application ease with long-term durability. Lubricants distinguish between automotive powertrain fluids and industrial gear oils, each requiring stringent performance metrics. Complementary segmentation by grade-commercial, industrial, and technical-ensures product suitability for varying purity thresholds, while form-based distinctions of liquid versus solid dictate handling and processing parameters. Distribution channels divide between direct enterprise partnerships and distributor network models, and the singular prominence of aldol condensation underscores the specialized production process at the heart of pentaerythritol synthesis.

This comprehensive research report categorizes the Pentaerythritol market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Grade

- Form

- Distribution Channel

- Application

- End Use Industry

Divergent Regional Demand Patterns Highlight Emerging Opportunities in the Americas, Europe Middle East & Africa, and Asia-Pacific Pentaerythritol Markets

In the Americas, pentaerythritol demand is anchored by robust automotive and construction activity. U.S. import data indicate a diverse supplier base, with Germany, Turkey, Sweden, and Spain collectively accounting for nearly 60 percent of inbound volumes in 2023. This diversity reflects both tariff-driven sourcing shifts and longstanding trade relationships that supply critical volumes for resin and plasticizer applications. Canada and Mexico similarly demonstrate steady consumption in coatings and lubricant segments, supported by NAFTA supply chain integration that reduces transit times and duty exposure

Europe, Middle East, and Africa (EMEA) exhibit a mature market landscape characterized by incremental innovations in green chemistry and stringent environmental regulations. European producers are adapting by investing in renewable feedstock integration and process intensification to remain competitive. Conversely, the Asia-Pacific region continues to outpace global peers in capacity expansion, notably through China’s addition of 150,000 tons per year of new production facilities in 2023. These expansions, coupled with strategic plant openings in India by specialty chemical firms, are positioning Asia-Pacific as the fastest-growing regional market, driven by infrastructure development, urbanization, and supportive regulatory frameworks for sustainable chemistry

This comprehensive research report examines key regions that drive the evolution of the Pentaerythritol market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Positioning Reveals Strategic Moves by Leading Pentaerythritol Producers Expanding Capacity, Innovation, and Sustainability Efforts

Perstorp has strategically expanded its global footprint with state-of-the-art production sites in Sweden, Germany, the United States, and India. The Sayakha plant in Gujarat, India, commissioned in early 2024, exemplifies this approach with an annual capacity of 40,000 metric tons of pentaerythritol and 26,000 metric tons of calcium formate. Integrated renewable feedstocks and hybrid energy systems enable Perstorp to offer ISCC PLUS-certified renewable grades alongside conventional products, reinforcing its reputation as a sustainability leader in polyol chemistry

Ercros S.A. commands a leading position in Europe through its Tortosa, Spain, facility, recognized as one of the world’s largest pentaerythritol production sites with a combined polyol capacity of 35,000 tons per year. Recent expansions have increased both pentaerythritol and dipentaerythritol capacity by 17 percent, complemented by technological upgrades that enhance energy efficiency and process performance. The Tortosa plant’s vertical integration with in-house formaldehyde production provides robust supply security and cost advantages in resin and lubricant applications

In Asia, Henan Pengcheng Group has bolstered its market presence by expanding pentaerythritol output in 2025 to meet surging construction and infrastructure demand, achieving an 18 percent improvement in global ranking. Concurrently, Yuntianhua Group has introduced high-temperature stable lubricant grades tailored to automotive applications, capturing double-digit adoption growth. These strategic investments underscore the competitive intensity among Chinese and Indian producers seeking to secure export markets and local supply chains

Hubei Yihua Chemical Industry Co. maintains leadership in Asia-Pacific with an annual production capacity exceeding 60,000 tons, supported by patented high-temperature condensation and cascade recrystallization technology that delivers purity levels above 98 percent. Solventis, while primarily a distributor, plays a critical role in Europe by offering tailored pentaerythritol derivatives and value-added formulation services from its Antwerp distribution and blending hub. This combination of integrated producers and specialized distributors shapes the competitive dynamics that define global pentaerythritol availability and performance characteristics

This comprehensive research report delivers an in-depth overview of the principal market players in the Pentaerythritol market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ataman Kimya Ltd.

- BASF SE

- Blue Bear Chemicals B.V.

- Celanese Corporation

- Chemanol

- Eastman Chemical Company

- Ercros S.A

- Exxon Mobil Corporation

- Gantrade Corporation

- Hexion Inc.

- HUBEI YIHUA CHEMICAL INDUSTRY CO., LTD.

- Kanoria Chemicals & Industries Ltd.

- KOEI CHEMICAL CO., LTD.

- Koei Pharmaceutical Co., Ltd.

- LCY GROUP

- Merck KGaA

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Perstorp Holding AB

- TER Chemicals GmbH & Co. KG

- The Chemical Company

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry (India) Pvt. Ltd.

- U-JIN Chemical Co., Ltd.

- Vizag Chemical

Actionable Strategies for Industry Leaders to Navigate Market Complexities, Capitalize on Growth Avenues, and Enhance Competitive Advantage in Pentaerythritol

Industry leaders must prioritize integration of renewable feedstocks and adoption of circular chemistry principles to align with tightening environmental regulations and customer sustainability goals. Fostering collaborative research partnerships with academic and technological institutions can accelerate the development of novel catalyst systems and process intensification techniques, unlocking higher yields and lower energy consumption.

Moreover, supply chain resilience should be bolstered through diversification of sourcing and strategic alliances within regional trade frameworks. Engaging in joint ventures or off-take agreements with feedstock producers can secure raw material availability and price stability, while investments in digital procurement platforms can enhance transparency and risk management.

Lastly, differentiation through portfolio optimization-such as high-purity grades, bio-based certifications, and tailored application solutions-will be critical for capturing premium market segments. Companies should leverage data analytics to track end-use performance and co-development opportunities, thereby establishing value-added partnerships with downstream customers.

Transparent and Rigorous Research Methodology Integrating Multisource Data, Expert Interviews, and Structured Analysis to Ensure Comprehensive Pentaerythritol Insights

This analysis integrates data from global trade databases, peer-reviewed technical literature, and company disclosures to ensure comprehensive coverage. Quantitative trade and import statistics were sourced from World Integrated Trade Solution (WITS) for 2023, while production capacity and expansion details were corroborated through official press releases and corporate websites.

Expert interviews with industry practitioners provided qualitative validation and insights into emerging process technologies and sustainability initiatives. Secondary research included technical assessments from reputable chemical community platforms, offering perspective on catalytic advancements and material performance enhancements.

Data synthesis and segmentation frameworks were applied to align with established application, end-use, and regional categorizations. Cross-verification and triangulation methods were employed to reconcile discrepancies and reinforce analytical rigor, ensuring that findings are robust and actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Pentaerythritol market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Pentaerythritol Market, by Grade

- Pentaerythritol Market, by Form

- Pentaerythritol Market, by Distribution Channel

- Pentaerythritol Market, by Application

- Pentaerythritol Market, by End Use Industry

- Pentaerythritol Market, by Region

- Pentaerythritol Market, by Group

- Pentaerythritol Market, by Country

- United States Pentaerythritol Market

- China Pentaerythritol Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Summarizing the Strategic Imperatives and Market Realities Shaping the Future Trajectory of the Pentaerythritol Industry Landscape

The pentaerythritol market stands at an inflection point where sustainability, technological innovation, and geopolitical dynamics intersect to redefine competitive positioning. Companies that successfully navigate the evolving tariff environment and prioritize green manufacturing processes will differentiate themselves in a landscape marked by both opportunity and complexity.

Strategic investments in capacity expansions, high-purity product development, and supply chain diversification will be critical to capturing growth in mature and high-potential regions. Moreover, the alignment of product portfolios with emerging end-use demands-particularly in eco-friendly coatings and high-performance lubricants-will underpin long-term value creation.

Ultimately, the industry’s trajectory will be shaped by collaborative innovation, regulatory alignment, and strategic foresight, enabling stakeholders to harness pentaerythritol’s unique properties in delivering sustainable, high-performance chemical solutions.

Secure Your Comprehensive Pentaerythritol Market Research Insights by Engaging with Ketan Rohom to Access Detailed Reports and Strategic Advisory

To secure full access to the in-depth analysis, proprietary data, and strategic insights presented in this report, please reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, who will guide you through the purchase process and ensure you receive the tailored intelligence your organization needs

- How big is the Pentaerythritol Market?

- What is the Pentaerythritol Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?