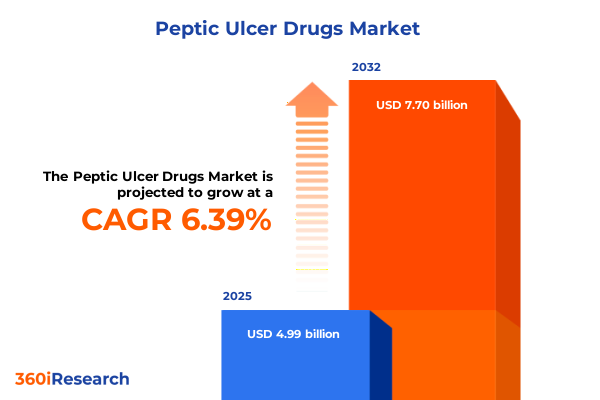

The Peptic Ulcer Drugs Market size was estimated at USD 4.99 billion in 2025 and expected to reach USD 5.26 billion in 2026, at a CAGR of 6.39% to reach USD 7.70 billion by 2032.

Charting the Next Chapter in Peptic Ulcer Care by Exploring Innovative Drug Developments and Emerging Patient-Focused Treatment Pathways

In recent years, the therapeutic landscape for peptic ulcer management has witnessed a dynamic transformation influenced by advances in molecular pharmacology and patient-centric care models. As the prevalence of acid-related diseases evolves with demographic shifts and comorbidities, stakeholders are increasingly focused on optimizing efficacy and safety profiles across both historic and innovative drug classes. This introduction sets the stage for an in-depth exploration of emerging opportunities and challenges faced by developers, clinicians, and payers within this critical segment.

Furthermore, the ongoing convergence of digital health monitoring and precision medicine has accelerated the demand for tailored treatment regimens, driving manufacturers to invest in novel formulations that balance rapid symptom relief with long-term mucosal protection. Concurrently, supply chain resilience and regulatory complexity remain pivotal considerations, particularly as raw material sourcing and international trade policies exert influence on production costs and product availability. By situating these multidimensional factors at the forefront, this summary underscores the imperative for strategic alignment across the value chain.

In this executive summary, we distill key insights across technological innovations, policy impacts, and market segmentation dynamics. Subsequent sections will examine transformative shifts and the cumulative ramifications of recent tariff adjustments, followed by granular segmentation analyses across administration routes, sales channels, brand typologies, dosage forms, end users, distribution pathways, and drug classifications. Collectively, these insights will inform actionable strategies designed to empower decision-makers responsible for steering future growth and maximizing therapeutic outcomes in peptic ulcer care.

Unveiling Radical Transformations in the Peptic Ulcer Drug Arena Driven by Technological Breakthroughs and Shifting Patient Expectations

As emerging classes of acid-suppressive agents progress from bench research into late-stage clinical trials, the architecture of peptic ulcer therapy is being reshaped. Proton pump inhibitors remain the backbone of treatment, yet next-generation formulations with sustained-release matrices and targeted delivery mechanisms are entering the fray to address refractory cases. Parallel innovations in H2 receptor antagonists include the development of novel molecular scaffolds aimed at minimizing tolerance and enhancing receptor selectivity. The interplay between these drug families is redefining therapeutic algorithms.

Moreover, the integration of digital dosing platforms and wearable monitoring systems is enabling real-time adherence tracking and early detection of adverse events. These technological intersections not only elevate patient engagement but also generate valuable real-world evidence that can inform regulatory submissions and post-marketing surveillance. Transitioning from episodic symptom management toward preventive mucosal healing strategies exemplifies a broader paradigm shift focused on long-term patient well-being rather than solely reactive intervention.

Looking ahead, cross-disciplinary collaboration among pharmaceutical developers, biotech innovators, and digital health specialists will be pivotal in unlocking the next wave of transformative therapies. As stakeholders navigate shifting reimbursement frameworks that increasingly reward outcomes over volume, a strategic emphasis on value-based care will further catalyze the adoption of integrated therapeutic solutions. This section thus elucidates the critical inflection points underpinning the evolution of peptic ulcer drug development and delivery.

Assessing the Broad Repercussions of 2025 Tariff Policies on the Peptic Ulcer Therapeutics Supply Chain and Cost Structures in the United States

The introduction of adjusted import duties in early 2025 has reverberated throughout the peptic ulcer drug supply chain, with API sourcing costs notably elevated for active ingredients predominantly imported from key overseas manufacturing hubs. These tariff revisions have prompted domestic producers to reassess procurement strategies, leading to an uptick in regional API production partnerships and near-shoring initiatives aimed at mitigating exposure to price volatility. As a result, procurement teams are balancing the trade-offs between cost containment and quality assurance.

Furthermore, downstream manufacturing facilities have responded by optimizing batch workflows and consolidating vendor relationships to absorb incremental costs without transferring undue burden onto healthcare payers. Although short-term margin compression was observed, several companies have leveraged contract manufacturing agreements that lock in input costs and stabilize production schedules. Simultaneously, regulatory bodies have signaled openness to expedited reviews of alternate API sources, reflecting a concerted effort to preserve market continuity and patient access.

Strategic dialogue among industry consortia and policymakers has underscored the importance of transparent tariff frameworks that balance national economic objectives with public health priorities. Stakeholders anticipate that ongoing tariff efficacy assessments and supply-chain stress tests will inform potential adjustments in late 2025. Ultimately, the cumulative impact of these policy shifts is catalyzing a more resilient manufacturing ecosystem geared toward sustainable growth and a robust pipeline of peptic ulcer therapeutics.

Illuminating Inside Perspectives into Diverse Peptic Ulcer Drug Segments from Administration Routes to Therapeutic Classifications

An in-depth examination of route of administration highlights that the oral pathway continues to dominate patient preference, driven by convenience and wide availability of tablet and capsule forms. Nevertheless, parenteral options maintain clinical relevance in acute or hospital-based interventions, particularly when rapid acid suppression is critical. This dual-mode paradigm underscores the necessity for product portfolios that accommodate both outpatient management and inpatient crisis care scenarios, ensuring comprehensive therapeutic coverage across diverse clinical settings.

Differentiation between over-the-counter and prescription channels illuminates shifting sales dynamics as self-care solutions gain traction amid heightened consumer health awareness. Parallel distinctions between branded and generic offerings reveal competitive intensity, with branded molecules emphasizing innovative delivery technologies and generics capitalizing on cost-effectiveness. Within dosage form segmentation, capsules, injections, and tablets each present unique formulation challenges, from stability considerations to patient adherence, necessitating targeted development strategies aligned to specific use cases and end-user requirements.

Analysis of end user categories highlights home care patients seeking convenient regimens, hospitals prioritizing rapid efficacy under acute conditions, and outpatient clinics requiring flexible administration options. Distribution channel insights further delineate the roles of hospital pharmacies, online channels, and retail outlets in shaping access and affordability. Finally, drug class stratification between H2 receptor antagonists and proton pump inhibitors, spanning agents from cimetidine to rabeprazole, emphasizes the breadth of therapeutic pathways available to clinicians.

This comprehensive research report categorizes the Peptic Ulcer Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Route Of Administration

- Brand Type

- Dosage Form

- Drug Class

- Sales Channel

- End User

- Distribution Channel

Synthesizing Key Regional Dynamics Shaping Peptic Ulcer Drug Demand across the Americas Europe Middle East Africa and Asia Pacific

In the Americas, robust healthcare infrastructure and favorable reimbursement policies have fostered rapid adoption of advanced ulcer therapeutics. North American markets are witnessing strategic collaborations between local manufacturers and international biotech firms, aimed at enhancing API supply chains and expediting product registrations. Meanwhile, Latin American markets exhibit a growing preference for cost-effective generics, driving manufacturers to tailor pricing models that align with regional purchasing power while maintaining stringent quality standards.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts are streamlining market entry, yet varied national reimbursement landscapes require nuanced market access strategies. High-income European countries are embracing value-based agreements, whereas emerging markets in the Middle East and Africa prioritize affordable oral formulations suited to expanding primary care networks. Supply chain reliability remains an overarching concern, prompting increased investment in regional distribution hubs to reduce lead times and bolster inventory resilience.

Asia-Pacific’s diverse markets present a tapestry of innovation and affordability dynamics. Leading economies such as Japan and South Korea engage in incremental reformulations of existing drug classes, while fast-growing Southeast Asian markets show strong demand for over-the-counter remedies. Local generic producers in China and India continue to scale production of both H2 receptor antagonists and proton pump inhibitors, leveraging economies of scale to support global distribution and contribute to emerging supply-chain ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Peptic Ulcer Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unraveling Strategic Moves and Competitive Positioning among Leading Peptic Ulcer Drug Manufacturers Driving Market Evolution

Leading pharmaceutical innovators have leveraged strategic alliances and acquisition pathways to fortify their portfolios in peptic ulcer care. Major multinational entities have accelerated pipeline replenishment through targeted licensing deals, focusing on companies with proprietary sustained-release technologies. At the same time, generic manufacturers have intensified R&D endeavors to improve bioavailability and differentiate their formulations through novel excipient matrices, fostering competitive parity in cost-sensitive markets.

Several industry titans have simultaneously embarked on collaborative ventures with digital health startups to integrate adherence monitoring and telemedicine support directly into their product ecosystems. By harnessing real-world data insights, these companies are refining patient support programs and enhancing market penetration, particularly in outpatient and home care settings. Concurrently, contract development and manufacturing organizations have expanded their service offerings to include end-to-end project management, enabling faster scale-up of both branded and generic candidates.

Moreover, mid-sized biotechs focusing on next-generation proton pump inhibitors and H2 receptor antagonists have attracted significant venture capital interest, underscoring the sector’s innovation potential. These agile players are leveraging targeted clinical development pathways to pursue niche indications and orphan drug opportunities, complementing larger manufacturers’ broad-spectrum portfolios. Collectively, corporate strategies reflect a concerted drive toward diversification, digital integration, and supply chain optimization, positioning the industry for sustained growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Peptic Ulcer Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AbbVie Inc.

- AstraZeneca PLC

- Boehringer Ingelheim International GmbH

- Cadila Healthcare Ltd.

- Century Pharmaceuticals Ltd.

- Daewoong Pharmaceutical Co. LTD.

- Dr. Reddy’s Laboratories Ltd

- Eisai Co. Ltd.

- F. Hoffmann-La Roche Ltd.

- GlaxoSmithKline PLC

- Hikma Pharmaceuticals PLC

- Medopharm Pvt Ltd

- Merck KGaA

- Mylan N.V.

- Novartis AG

- Pfizer Inc.

- Pharmanova India Drugs Pvt. Ltd.

- Redhill Biopharma Ltd

- Rosemont Pharmaceuticals Limited

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd.

Charting Actionable Pathways for Industry Leadership through Supply Chain Resilience and Next Generation Therapeutic Innovations

Industry leaders should prioritize diversification of raw material sourcing by establishing regional API manufacturing alliances to mitigate tariff exposure and logistical bottlenecks. By proactively engaging with emerging suppliers in near-shoring jurisdictions and securing multi-year procurement contracts, manufacturers can stabilize input costs and ensure uninterrupted production. In parallel, forging strategic partnerships with technology providers can accelerate the development of patient-centric digital tools for monitoring therapy adherence and capturing real-world outcomes, thereby enhancing product differentiation.

In addition, companies are advised to adopt a modular product portfolio that balances investment between established drug classes and breakthrough formulations. This approach enables agile reallocation of resources toward assets demonstrating strong clinical differentiation, while maintaining a reliable stream of cash-flow from core offerings. As regional reimbursement frameworks evolve toward value-based models, stakeholders should cultivate robust health economics evidence demonstrating cost-effectiveness and quality-adjusted life year gains to secure favorable formulary placement.

Finally, prioritizing data integrity through rigorous post-marketing surveillance and compliance with evolving regulatory standards will fortify market access and minimize the risk of supply disruptions. Implementing advanced analytics to monitor safety signals and gather patient feedback will empower decision-makers to refine clinical strategies in near real-time. Together, these actionable pathways will equip organizations to navigate the complex landscape of peptic ulcer therapeutics with resilience and strategic foresight.

Detailing Rigorous Research Approaches Integrating Expert Insights Quantitative Analysis and Data Validation Protocols for Robust Outcomes

The research framework integrates a comprehensive blend of qualitative and quantitative approaches designed to deliver robust, actionable insights. Primary data was gathered through structured interviews with key opinion leaders including gastroenterologists, pharmacologists, regulatory experts, and supply chain specialists. Concurrently, a global survey of healthcare providers provided quantitative validation of therapeutic adoption trends, patient adherence challenges, and formulary decision criteria across major markets.

Secondary research involved extensive review of peer-reviewed publications, regulatory filings, and patent landscapes to map innovation trajectories and competitive intelligence. Supply chain analyses leveraged customs and trade databases to assess tariff impacts and identify emerging manufacturing hubs. Market access modeling was informed by reimbursement frameworks and pricing policies sourced from leading healthcare authorities. Through data triangulation and rigorous validation checks, the methodology ensures high confidence in the findings and supports strategic decision-making.

Finally, cross-functional workshops with industry stakeholders were conducted to refine hypotheses and validate scenario analyses, facilitating a collaborative interpretation of results. The integration of multidisciplinary perspectives strengthens the relevance of the insights and aligns the research with real-world industry imperatives. This methodology underpins a transparent, reproducible process that empowers strategic planning and risk assessment for stakeholders in the peptic ulcer therapeutic space.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Peptic Ulcer Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Peptic Ulcer Drugs Market, by Route Of Administration

- Peptic Ulcer Drugs Market, by Brand Type

- Peptic Ulcer Drugs Market, by Dosage Form

- Peptic Ulcer Drugs Market, by Drug Class

- Peptic Ulcer Drugs Market, by Sales Channel

- Peptic Ulcer Drugs Market, by End User

- Peptic Ulcer Drugs Market, by Distribution Channel

- Peptic Ulcer Drugs Market, by Region

- Peptic Ulcer Drugs Market, by Group

- Peptic Ulcer Drugs Market, by Country

- United States Peptic Ulcer Drugs Market

- China Peptic Ulcer Drugs Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Converging Findings into a Comprehensive Synthesis Highlighting Strategic Imperatives for Sustained Progress in Peptic Ulcer Therapeutics

In synthesizing the landscape of peptic ulcer therapeutics, it becomes evident that the confluence of innovative drug formulations, digital health integration, and evolving policy frameworks is driving a pivotal transformation in treatment paradigms. Stakeholders who align their strategic priorities with these converging forces will be better positioned to enhance patient outcomes while sustaining competitive advantage. The dual imperatives of supply chain resilience and value-based care underscore the need for agile, evidence-driven approaches to portfolio management.

Moreover, granular segmentation insights reveal that success hinges on the ability to address varied patient needs across administration routes, therapeutic classes, and care settings. Regional dynamics further emphasize the importance of tailored market access strategies and distribution models that reflect local economic and regulatory landscapes. Corporate innovation strategies, bolstered by strategic partnerships and digital solutions, are set to accelerate the next generation of peptic ulcer therapies, offering promise for improved patient well-being.

As industry participants navigate this complex environment, the imperative to integrate rigorous research methodologies with forward-looking strategic planning remains paramount. Collectively, the insights presented here offer a comprehensive guide for stakeholders seeking to capitalize on emerging opportunities and mitigate systemic risks, ultimately driving sustained progress in the management of peptic ulcer disease.

Unlock Complete Peptic Ulcer Market Intelligence Today by Connecting with Ketan Rohom for Tailored Insights and Strategic Competitive Advantages

For leaders eager to gain a comprehensive understanding of the peptic ulcer drug market landscape, detailed insights and actionable analyses are available. To unlock the full report and explore tailored intelligence on therapeutic innovation, policy implications, and strategic segmentation, engage directly with Ketan Rohom, Associate Director of Sales and Marketing.

Reach out today to accelerate your strategic planning and secure a competitive edge in this dynamic sector. Discover how expert guidance and in-depth data can inform your next moves in peptic ulcer therapeutics by connecting with Ketan Rohom now.

- How big is the Peptic Ulcer Drugs Market?

- What is the Peptic Ulcer Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?