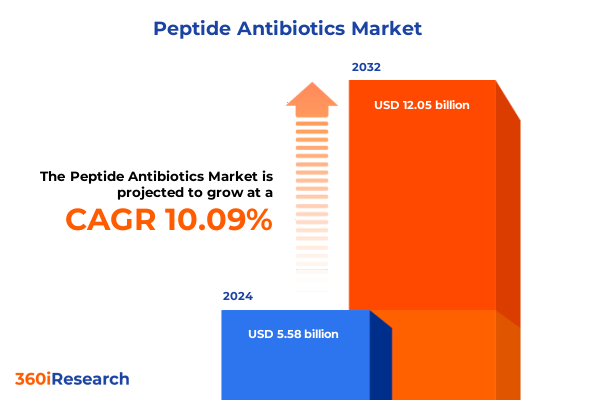

The Peptide Antibiotics Market size was estimated at USD 532.67 million in 2025 and expected to reach USD 576.96 million in 2026, at a CAGR of 9.28% to reach USD 991.61 million by 2032.

Steering Through the Era of Peptide Antibiotics Integrating Novel Biotherapeutics to Counteract Escalating Antimicrobial Resistance Patterns

The global healthcare landscape is confronting an unprecedented escalation in antimicrobial resistance, compelling stakeholders to explore innovative therapeutic classes that transcend the limitations of traditional small-molecule antibiotics. Amid this urgency, peptide antibiotics have surged to the forefront as a versatile and potent alternative, marrying targeted bactericidal activity with a lower propensity for resistance development. Transitioning from being niche candidates in early-stage research to becoming strategic assets within pharmaceutical pipelines, these compounds are redefining treatment paradigms for both Gram-positive and Gram-negative infections.

As technological advancements in peptide design, high-throughput screening, and synthetic biology coalesce, the complexity of development pathways is being streamlined. This convergence is catalyzing accelerated timelines from discovery to clinical proof of concept, enabling industry leaders to capitalize on robust pipelines that span natural lipopeptides to fully synthetic analogs. Concurrently, regulatory agencies are demonstrating greater receptivity to peptide-derived therapeutics, instituting guidance frameworks that support adaptive trial designs and expedited pathways for agents addressing unmet needs.

Against this backdrop of innovation and regulatory evolution, stakeholders are intent on harnessing the full potential of peptide antibiotics. By strategically contextualizing recent pipeline achievements, manufacturing breakthroughs, and policy reforms, this report establishes a comprehensive foundation for understanding the transformative impact of peptide antibiotics, setting the stage for subsequent discussions on market dynamics, segmentation insights, and actionable strategies.

Unveiling the Paradigm Shifts Redefining Peptide Antibiotics Landscape Driven by Technological Breakthroughs and Evolving Regulatory Frameworks

The peptide antibiotics landscape has undergone remarkable shifts over recent years, driven by the convergence of advanced molecular engineering and a reinvigorated regulatory ecosystem. Whereas traditional discovery approaches relied heavily on serendipitous screening of natural products, contemporary methods leverage computational design, machine learning–enhanced optimization, and modular synthesis platforms to engineer peptides with superior potency, stability, and pharmacokinetic profiles.

At the same time, collaborative consortia between academic institutions, biotech innovators, and large pharmaceutical companies have emerged as pivotal catalysts for pipeline expansion. By pooling expertise across proteomics, structural biology, and medicinal chemistry, these alliances have unlocked new classes of cyclic lipopeptides and synthetic analogs that demonstrate broadened spectra of activity. Moreover, manufacturing innovations-such as cell-free peptide synthesis and continuous-flow reactors-are mitigating cost and scalability challenges that once hindered commercial viability.

Regulatory bodies have correspondingly adapted their frameworks to accommodate these technological advances. New guidance documents enable rolling submissions and adaptive trial methodologies, expediting the progression of high-priority antimicrobial agents. Collectively, these transformative shifts underscore an industry in metamorphosis, where scientific ingenuity and policy support are synchronizing to propel peptide antibiotics toward mainstream therapeutic relevance.

Examining the Far Reaching Repercussions of 2025 United States Import Tariffs on Peptide Antibiotics Supply Chains and Cost Dynamics

In 2025, the imposition of revised United States import tariffs on key active pharmaceutical ingredient sources has reverberated through the peptide antibiotics supply chain, prompting recalibrations across cost structures and sourcing strategies. As a substantial portion of peptide intermediates and raw materials originate from global manufacturing hubs, tariff escalations have accentuated the need for supply chain resilience, compelling stakeholders to assess nearshoring, vertical integration, and multi-sourcing approaches.

Heightened import duties have manifested in elevated input costs for synthetic peptides and natural extracts alike, translating into tighter margins for contract development and manufacturing organizations. This economic pressure has, in turn, accelerated interest in alternative production modalities such as domestic microbial fermentation platforms and recombinant expression systems. By transitioning part of the production footprint back to local facilities, manufacturers are seeking to mitigate tariff exposures while enhancing quality oversight and reducing lead times.

Concurrently, procurement teams have intensified supplier due diligence, factoring in total landed costs that incorporate tariffs, logistics, and regulatory compliance overhead. Strategic partnerships with domestic API producers have gained prominence, underscoring a broader shift towards securing critical materials within a more controlled regulatory and geopolitical environment. Ultimately, these developments highlight the enduring impact of 2025 tariff policies on cost dynamics and supply chain strategies in the peptide antibiotics sector.

Deciphering the Multifaceted Segmentation Panorama of Peptide Antibiotics Illuminating Variations in Product Routes Formulations and Sources

The peptide antibiotics market can be dissected through a multifaceted segmentation prism that reveals distinct pathways for product development and commercialization. When considered by product category, Bacitracin and Colistin continue to benefit from deep clinical legacies, whereas Daptomycin and Polymyxin B are experiencing rejuvenated interest through analog engineering and novel formulations. Each molecule’s intrinsic activity spectrum and safety profile dictate its positioning in treatment algorithms, influencing R&D prioritization and lifecycle management strategies.

Route of administration segmentation further nuances these insights. Intravenous formulations maintain dominance in acute care hospital settings, providing rapid systemic concentrations for life-threatening infections. However, the emergence of intramuscular options offers field-deployable alternatives for outpatient or emergency interventions, while oral peptide formulations-once constrained by gastrointestinal stability challenges-are witnessing breakthroughs through advanced delivery technologies. Topical applications similarly leverage localized dosing to address skin and soft tissue infections with minimal systemic exposure.

Formulation dynamics underscore continuing innovation across injectable, powder, and topical platforms. Injectable peptides, whether lyophilized powders or ready-to-use solutions, remain central to inpatient and specialty care. Powder dosage forms, optimized for reconstitution, combine storage stability with on-demand preparation flexibility. Meanwhile, topical creams and ointments are being reformulated to improve penetration and patient adherence. Source attributes, spanning naturally derived antimicrobial peptides to fully synthetic analogs, shape considerations around IP exclusivity, regulatory pathways, and manufacturing complexity.

Applications stretch beyond clinical treatment into food preservation, capitalizing on peptides’ capacity to inhibit spoilage organisms without compromising human health. Veterinary uses, particularly in livestock and aquaculture, leverage species-specific formulations that align with antimicrobial stewardship goals. End-use settings range from clinics and hospitals to veterinary clinics, each demanding customized distribution and support frameworks. Distribution channels-hospital pharmacies, online dispensaries, and retail outlets-complete this segmentation matrix, underscoring the need for tailored commercial strategies attuned to distinct customer journeys and regulatory requirements.

This comprehensive research report categorizes the Peptide Antibiotics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Route Of Administration

- Formulation

- Source

- Application

- End Use

- Distribution Channel

Exploring the Distinctive Regional Dynamics Shaping Peptide Antibiotics Adoption and Implementation Across Major Global Market Zones

Regional dynamics exert a profound influence on the adoption and commercialization trajectories of peptide antibiotics across the Americas, Europe Middle East & Africa, and Asia-Pacific zones. In the Americas, heightened investments in antimicrobial stewardship programs and robust regulatory incentives have fostered an environment conducive to both innovation and early adoption of novel peptide entities. Strategic partnerships between biotech startups and leading contract manufacturing organizations underscore a deep commitment to translating laboratory breakthroughs into clinical realities.

Across Europe Middle East & Africa, stringent pricing and reimbursement frameworks coexist with progressive public health mandates aimed at curbing antibiotic resistance. This combination has stimulated interest in value-based contracting models for peptide therapies, aligning payment structures with clinical outcomes. Collaborative regulatory harmonization efforts within the European Union continue to streamline approval processes, while emerging markets in the Middle East and Africa are gradually expanding their antimicrobial arsenals through public–private collaborations and capacity-building initiatives.

The Asia-Pacific region represents a complex tapestry of high-growth potential markets and divergent regulatory environments. Major hubs such as Japan and South Korea leverage advanced biomanufacturing infrastructures and proactive antimicrobial drug policies, whereas Southeast Asian regions are balancing the dual imperatives of affordability and access. China’s evolving regulatory landscape, coupled with the expansion of domestic peptide synthesis capabilities, is reshaping global supply chains and fostering opportunities for cross-border technology transfers. Collectively, these regional insights provide a nuanced perspective on how geographic factors shape peptide antibiotics strategies and market entry priorities.

This comprehensive research report examines key regions that drive the evolution of the Peptide Antibiotics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Positioning and Innovative Portfolios of Leading Peptide Antibiotic Developers and Market Innovators Across the Value Chain

Within the peptide antibiotics sphere, a cadre of leading companies is orchestrating strategic initiatives that span from early discovery to global commercialization. Multinational pharmaceutical enterprises are integrating peptide programs into broader antimicrobial platforms, leveraging existing R&D infrastructures and global marketing channels to optimize product launch trajectories. Their activities often emphasize late-stage clinical development, lifecycle extension strategies, and strategic alliances with specialized peptide biotech firms.

Simultaneously, agile biotech innovators are carving out competitive niches by harnessing proprietary peptide libraries, platform technologies for sequence optimization, and advanced formulation expertise. These companies prioritize targeted indications, leveraging adaptive regulatory pathways to expedite first-in-human trials and generate real-world evidence. Partnerships with contract research labs and academic institutions further amplify their capacity to de-risk candidate portfolios and scale manufacturing processes efficiently.

Contract development and manufacturing organizations (CDMOs) have also emerged as pivotal players, offering turnkey peptide synthesis, purification, and formulation services that address cost and scalability constraints. By specializing in novel expression systems, continuous-flow peptide assembly, and advanced analytics, these service providers enable both established and emerging companies to accelerate time-to-market and maintain rigorous quality standards. This collaborative ecosystem underscores a dynamic interplay among strategic players, each contributing distinct competencies across the peptide antibiotics value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Peptide Antibiotics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- AMP Biotech, Inc.

- ANI Pharmaceuticals, Inc.

- AstraZeneca plc

- Bachem Holding AG

- ContraFect Corporation

- CordenPharma International GmbH

- Cumberland Pharmaceuticals Inc.

- Eli Lilly and Company

- GlaxoSmithKline plc

- Lytix Biopharma AS

- Melinta Therapeutics, LLC

- Merck & Co., Inc.

- Nabriva Therapeutics plc

- Neuland Laboratories Limited

- Novabiotics Ltd.

- Novartis AG

- Peptilogics, Inc.

- Pfizer Inc.

- Phoenix Biotechnology, Inc.

- PolyPeptide Group AB

- Sanofi S.A.

- Teva Pharmaceutical Industries Ltd.

- Thermo Fisher Scientific Inc.

- Xellia ApS

Delivering Pragmatic Strategic Roadmaps for Industry Leaders to Maximize Peptide Antibiotics Potential Amid Regulatory and Commercial Complexities

Industry leaders seeking to harness the full potential of peptide antibiotics must adopt a suite of targeted strategies that address scientific, regulatory, and commercial imperatives. First, diversifying research pipelines through investment in computational peptide design and high-throughput screening platforms can accelerate candidate identification while optimizing activity and stability profiles. Pairing these efforts with translational partnerships ensures that promising leads advance swiftly through preclinical validation.

Second, proactive engagement with regulatory agencies via early scientific advice and adaptive trial design proposals can de-risk development timelines and secure priority review designations for candidate molecules addressing critical unmet needs. Embedding health economics expertise within development teams can further inform evidence generation plans that align with value-based reimbursement frameworks.

Third, strengthening supply chain resilience through a dual-sourcing strategy-combining domestic microbial fermentation with selective import of specialized intermediates-can mitigate the impact of geopolitical shifts and tariff volatility. Establishing collaborative research programs with leading academic centers in key regional markets will also foster local innovation while facilitating market access.

Finally, building robust digital and patient support platforms enhances market penetration by streamlining prescription pathways, improving adherence, and generating real-world data on safety and efficacy. By integrating these recommendations into cohesive action plans, industry leaders will be well-positioned to navigate the complexities of the peptide antibiotics landscape and deliver optimal patient outcomes.

Unraveling the Comprehensive Research Methodology Underpinning Insight Generation Across Peptide Antibiotic Market Analyses and Data Integrity Frameworks

The insights presented in this report are grounded in a rigorous methodology that integrates primary and secondary research modalities to ensure data integrity and analytical robustness. Primary research included interviews with senior executives, R&D heads, and supply chain experts across pharmaceutical and biotech organizations, providing firsthand perspectives on development challenges and market strategies. Additionally, consultations with key opinion leaders and regulatory affairs specialists illuminated evolving policy landscapes and clinical adoption drivers.

Secondary research encompassed an exhaustive review of peer-reviewed journals, patent filings, regulatory guidance documents, and conference proceedings, enabling triangulation of emerging trends in peptide synthesis, formulation advances, and clinical trial outcomes. Epidemiological databases and antimicrobial resistance surveillance reports supplemented this analysis, offering contextual understanding of infection prevalence and resistance patterns across major geographies.

Quantitative data analytics and qualitative thematic analysis were applied to synthesize these diverse inputs into coherent insights. Segmentation schemas were validated through cross-referencing distribution channel metrics, end-use consumption data, and product pipeline disclosures. Regional assessments leveraged trade databases and policy review frameworks to map market entry barriers and growth enablers. The result is a holistic examination of the peptide antibiotics ecosystem, underpinned by transparent, replicable research practices.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Peptide Antibiotics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Peptide Antibiotics Market, by Product

- Peptide Antibiotics Market, by Route Of Administration

- Peptide Antibiotics Market, by Formulation

- Peptide Antibiotics Market, by Source

- Peptide Antibiotics Market, by Application

- Peptide Antibiotics Market, by End Use

- Peptide Antibiotics Market, by Distribution Channel

- Peptide Antibiotics Market, by Region

- Peptide Antibiotics Market, by Group

- Peptide Antibiotics Market, by Country

- United States Peptide Antibiotics Market

- China Peptide Antibiotics Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Concluding Perspectives Synthesizing Key Insights to Illuminate the Future Trajectory of Peptide Antibiotics Innovation and Market Integration

As the global medical community grapples with mounting antimicrobial resistance, peptide antibiotics stand out as a beacon of innovation, offering mechanisms of action and therapeutic indices distinct from conventional agents. The confluence of advanced design capabilities, supportive regulatory reforms, and evolving supply chain strategies augurs well for the maturation of this therapeutic class. Through strategic segmentation, nuanced regional understanding, and close collaboration among biopharma stakeholders, peptide antibiotics are poised to assume a central role in future treatment arsenals.

Key transformative shifts-ranging from computational discovery to adaptive clinical pathways-have recalibrated traditional development paradigms, enabling more agile responses to urgent public health imperatives. Meanwhile, the implications of recent tariffs underscore the importance of resilient sourcing and domestic manufacturing, driving structural adaptations that extend beyond cost considerations to encompass quality assurance and supply security.

Looking forward, the ability of industry leaders to translate these insights into targeted R&D investments, value-based market access strategies, and integrated digital ecosystems will determine the pace and scale of peptide antibiotic adoption. By synthesizing segmentation nuances, regional dynamics, and company-level innovations, stakeholders can chart a path toward sustainable commercialization and enduring clinical impact in the fight against resistant infections.

Secure Your Competitive Edge with Exclusive Peptide Antibiotics Market Intelligence Available for Purchase Through Ketan Rohom Associate Director of Sales

To gain unparalleled access to comprehensive insights, strategic analyses, and expert perspectives within the peptide antibiotics domain, reach out to Ketan Rohom, Associate Director of Sales. His deep understanding of both the scientific nuances and market dynamics ensures that you receive tailored guidance on leveraging this research to drive competitive advantage. By engaging with him, you will secure an exclusive market analysis report that aligns with your organizational objectives and empowers informed decision-making. Take the decisive step toward optimizing your product development roadmaps, forging high-value partnerships, and navigating evolving regulatory landscapes by contacting Ketan Rohom today to purchase this essential market intelligence report.

- How big is the Peptide Antibiotics Market?

- What is the Peptide Antibiotics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?