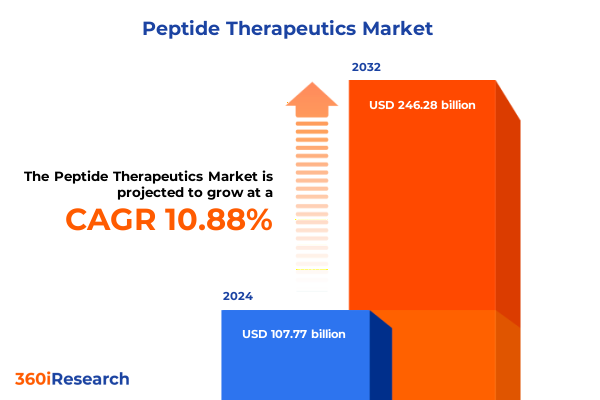

The Peptide Therapeutics Market size was estimated at USD 117.77 billion in 2025 and expected to reach USD 128.70 billion in 2026, at a CAGR of 11.11% to reach USD 246.28 billion by 2032.

Unraveling the Evolving Promise of Peptide Therapeutics in Modern Healthcare Dynamics Worldwide and the Strategic Implications for Stakeholders

The rapidly evolving domain of peptide therapeutics stands at the intersection of biology, chemistry, and clinical innovation, offering a versatile platform for targeting complex diseases with precision. Peptides-short chains of amino acids linked by peptide bonds-exhibit the specificity of biologics while maintaining favorable manufacturing and stability characteristics. This dual advantage has prompted a growing number of companies and academic institutions to channel research efforts toward harnessing peptide constructs for applications ranging from metabolic regulation to oncology. As scientific understanding of structure–function relationships deepens, legacy barriers related to bioavailability and immunogenicity are being progressively addressed through advanced design and formulation strategies. Consequently, established pharmaceutical players and agile biotech innovators alike are aligning pipelines to capture the therapeutic potential of these molecules.

From a regulatory perspective, agencies have demonstrated increasing receptivity to peptide-based modalities, reflecting a shift in approval pathways that once focused almost exclusively on small molecules and monoclonal antibodies. Methodological frameworks for assessing safety, immunogenic risk, and quality control have matured, enabling faster transitions from bench to clinic. This regulatory momentum is complemented by advances in analytical instrumentation, high-throughput screening, and computational modeling, which together accelerate candidate selection and process optimization. Market participants are also navigating an increasingly complex intellectual property landscape, balancing the desire to protect proprietary synthetic routes and delivery innovations with the imperative to collaborate through licensing or co-development agreements. As a result, strategic alliances have become a hallmark of the ecosystem, fostering resource sharing and risk mitigation.

Against this backdrop, decision-makers must reconcile ambitious growth aspirations with operational constraints. They face challenges that span the entire value chain-from sourcing specialized raw materials under evolving trade conditions, to scaling manufacturing processes that demand both throughput and quality consistency. Simultaneously, end users in clinical care settings are seeking treatments that deliver rapid onset of action, minimal off-target effects, and cost-effective production. This executive summary distills the most salient trends, regulatory shifts, and market dynamics shaping the peptide therapeutics landscape, equipping stakeholders with the insights needed to navigate the next phase of growth and innovation.

Examining the Transformative Shifts Reshaping the Peptide Therapeutics Landscape Through Technological, Regulatory, and Market-Driven Innovations

The peptide therapeutics field has witnessed transformative shifts over recent years, propelled by breakthroughs in synthesis, delivery technologies, and regulatory frameworks. Early exploratory efforts centered on natural peptides extracted from biological sources, but the advent of robust solid-phase synthesis and recombinant expression methods has democratized access to tailor-made peptide sequences. As a result, developers now routinely incorporate non-canonical amino acids and backbone modifications to improve stability, potency, and target affinity. This synthetic versatility has been complemented by algorithm-driven design, which leverages structural databases to predict and optimize peptide–target interactions with unprecedented accuracy.

Concurrently, novel delivery platforms are reshaping administration paradigms. Injectable formulations once dominated clinical use, yet the growing demand for patient-centric care models has stimulated interest in alternative routes such as inhalation and transdermal systems. Advances in nanoparticle carriers and mucoadhesive formulations have enabled peptides to traverse physiological barriers more efficiently, opening new opportunities for both acute and chronic indications. Regulatory bodies have responded by issuing updated guidance documents that streamline clinical development pathways for these innovative delivery modes, reducing uncertainty for sponsors.

Across the ecosystem, strategic collaborations are forging a new operational blueprint. Pharmaceutical titans are engaging with contract development and manufacturing organizations, biotech firms, and academic consortia to co-develop proprietary platforms and share R&D burdens. This collaborative ethos extends to data sharing and open innovation consortia, where collective efforts accelerate validation of sequence libraries and formulation platforms. Taken together, these transformative shifts underscore the increasing maturity and sophistication of the peptide therapeutics sector, marking a departure from early-stage experimentation toward a landscape characterized by scalable manufacturing, regulatory alignment, and patient-focused delivery.

Analyzing the Cumulative Impact of New United States Tariff Measures Introduced in 2025 on Peptide Therapeutics Supply Chains and Stakeholder Strategies

In 2025, newly implemented tariff measures introduced by the United States government have had a cumulative impact on the supply chains underpinning peptide therapeutics, prompting manufacturers to reassess sourcing strategies and cost structures. Critical raw materials, including specialized resins for solid-phase synthesis and housing for recombinant expression systems, have become subject to higher import duties, driving procurement teams to explore alternative suppliers or secure domestic production agreements. This recalibration has tested existing supplier relationships and accelerated the adoption of dual-sourcing models to mitigate exposure to any single trade regime.

The tariff landscape has also influenced capital allocation decisions within development pipelines. Cost-sensitive small and mid-sized companies have faced heightened pressure to balance innovation with financial prudence, resulting in a more selective approach to program advancement. In parallel, larger integrated pharmaceutical organizations have leveraged their global footprint to reoptimize manufacturing footprints, shifting portions of peptide production to facilities in low- or mid-tariff jurisdictions. These strategic moves have alleviated some margin compression and safeguarded production continuity amid regulatory and geopolitical uncertainties.

Beyond manufacturing, service providers offering contract research and manufacturing have begun incorporating tariff considerations into their value propositions. They are investing in tariff-compliant facilities and transparent cost pass-through mechanisms, thereby enhancing supply chain resilience for their clients. Collectively, these adjustments underscore the imperative for stakeholders to integrate tariff scenario planning into strategic roadmaps, ensuring that peptide therapeutic portfolios remain both commercially viable and operationally agile in a shifting trade environment.

Unveiling Key Segmentation Insights to Decode Diverse Market Dynamics Across Product Types, Synthesis Techniques, Administration Routes, Applications and End Users

The peptide therapeutics market presents a mosaic of opportunity when dissected across product types ranging from antimicrobial peptides designed to disrupt bacterial cell walls to cell penetrating sequences that ferry cargo into cells, peptide hormones that mimic endogenous signaling molecules, and peptide vaccines engineered to elicit targeted immune responses. Each of these categories commands distinct development paradigms, commercial dynamics, and regulatory considerations. Antimicrobial peptides, for instance, are advancing as alternatives to conventional antibiotics amid rising antimicrobial resistance, whereas peptide vaccines leverage modular epitope constructs for rapid adaptation to emerging viral threats.

Synthesis techniques further stratify the landscape into recombinant peptides produced via genetically engineered hosts and synthetic peptides assembled through solid-phase chemistries. Recombinant routes offer scale and post-translational modification fidelity, appealing to programs focused on complex cyclic or glycosylated peptides. Conversely, synthetic approaches provide precise control over amino acid sequence and chemical modifications, reducing batch-to-batch variability and permitting incorporation of non-standard residues for enhanced stability or target specificity.

The choice of route of administration adds another layer of complexity, encompassing inhalation, injectable, oral, topical, and transdermal options. Injectable modalities-which include intramuscular, intravenous, and subcutaneous delivery-remain prevalent due to established safety and predictable bioavailability. Nevertheless, oral formulations delivered as capsules, liquids, or tablets are gaining traction for chronic therapies, driven by patient convenience. In parallel, topical and transdermal platforms are advancing for localized or sustained systemic delivery, leveraging permeation enhancers and micro-needle technologies.

Application areas span cardiovascular diseases addressing heart failure and hypertension, infectious diseases targeting hepatitis, HIV, and influenza, metabolic disorders such as diabetes and obesity, and oncology therapies against breast cancer, lung cancer, and melanoma. Each vertical exhibits unique clinical endpoints, regulatory pathways, and reimbursement dynamics that inform go-to-market strategies. Finally, end users in clinics, hospitals, and research institutes dictate adoption rates and procurement priorities. Clinics and hospitals balance therapeutic benefits with formulary decisions and administration capabilities, while research institutes drive early-stage innovation and proof-of concept studies. Together, these segmentation insights paint a nuanced picture of where to focus R&D efforts, partnership models, and commercialization tactics.

This comprehensive research report categorizes the Peptide Therapeutics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Synthesis Technique

- Route Of Administration

- Application

- End User

Exploring Regional Insights Revealing Varied Adoption Patterns and Strategic Priorities Across the Americas, EMEA, and Asia-Pacific Healthcare Markets

Regional differences in peptide therapeutics adoption reveal how geographic factors shape strategic priorities and investment patterns. In the Americas, strong pharmaceutical hubs in North America coexist with rapidly growing markets in Latin America. Regulatory bodies in the United States and Canada have streamlined pathways for peptide approvals, driving momentum in clinical pipeline expansions. Regional manufacturers benefit from deep-rooted supply chain networks and established public-private partnerships, enabling faster scale-up of manufacturing capacity compared to other territories. The Americas also exhibit sophisticated payer landscapes that emphasize real-world evidence generation, further incentivizing developers to demonstrate patient-reported outcomes alongside traditional clinical endpoints.

Across Europe, the Middle East, and Africa, diverse healthcare systems influence both the uptake and pricing of peptide therapies. Western European countries place high value on innovation but balance cost considerations through health technology assessments, compelling sponsors to demonstrate comparative effectiveness. In emerging European and Middle Eastern markets, government-led initiatives are expanding access to advanced therapeutics, while regional manufacturing alliances are being forged to encourage localized production and reduce reliance on distant suppliers. In Africa, nascent clinical research infrastructure is gradually integrating peptide studies into broader capacity-building efforts, supported by international funding and collaborative networks.

Asia-Pacific markets are characterized by a broad spectrum of maturity levels. Leading economies such as Japan, South Korea, and Australia feature advanced regulatory frameworks and thriving biotech sectors, with strong domestic pipelines for peptide hormones and oncology agents. Concurrently, Southeast Asian and South Asian markets prioritize cost-effective therapies to address large patient populations affected by metabolic and infectious diseases. Incentives for biosimilar development and technology transfer programs are proliferating, fostering an environment where local companies partner with multinational sponsors to co-create regionally tailored peptide solutions. Taken together, these regional insights guide stakeholders toward targeted strategies, aligning product positioning, reimbursement planning, and development collaborations with local market dynamics.

This comprehensive research report examines key regions that drive the evolution of the Peptide Therapeutics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Dissecting the Strategic Moves and Technological Innovations of Leading Biotech and Pharmaceutical Players Pioneering Peptide Therapeutics

Leading companies are driving the peptide therapeutics sector forward through strategic investments, platform innovations, and partnerships that span the value chain. Established pharmaceutical firms have augmented R&D by acquiring or licensing peptide platform technologies from specialized biotech ventures. These alliances grant access to proprietary sequence libraries, formulation expertise, and automated synthesis capabilities. In parallel, agile biotechnology firms continue to pioneer novel classes of peptides, securing early-stage financing to validate first-in-class candidates and negotiate co-development agreements.

Contract development and manufacturing organizations have also emerged as key enablers, expanding dedicated peptide synthesis and formulation capacity to support the growing demand from sponsors. These providers are integrating digital manufacturing tools, continuous flow reactors, and single-use bioreactors to enhance process efficiency and reduce contamination risk. By offering turnkey services that encompass analytical method development, scale-up manufacturing, and regulatory filing support, they help bridge the gap between laboratory innovation and commercial supply.

On the discovery front, computationally driven peptide design platforms are gaining traction as essential differentiators. Companies that leverage machine learning to predict peptide bioactivity and off-target effects can streamline candidate triage and optimize lead sequences with fewer experimental iterations. Meanwhile, cross-sector collaboration with diagnostic firms is creating companion assays to monitor peptide pharmacokinetics and pharmacodynamics in real time, strengthening the evidence base for clinical decision making. Collectively, these corporate strategies underscore a rapidly maturing ecosystem in which technological leadership, manufacturing excellence, and collaborative networks define competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Peptide Therapeutics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amgen Inc.

- AstraZeneca PLC

- Bachem Holding AG

- Bristol Myers Squibb Company

- Eli Lilly and Company

- GlaxoSmithKline plc

- Ipsen S.A.

- Merck & Co., Inc.

- Novartis AG

- Novo Nordisk A/S

- Pfizer Inc.

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd.

- Zealand Pharma A/S

Actionable Recommendations Guiding Industry Leaders to Optimize Pipeline Development, Streamline Manufacturing, and Enhance Market Penetration Strategies

To navigate the complexities of the peptide therapeutics landscape, industry leaders should take decisive action across pipeline development, manufacturing, and market engagement. They must first prioritize the integration of advanced analytical and design technologies into early R&D workflows, ensuring that candidate selection emphasizes stability and target specificity from the outset. By investing in computational tools and high-throughput biophysical screening, organizations can reduce development timelines and de-risk late-stage failures.

Concurrently, firms should strengthen supply chain resilience by diversifying raw material sourcing and exploring tariff-efficient manufacturing locations. Establishing strategic agreements with multiple suppliers and evaluating on-shore production options will mitigate disruptions arising from evolving trade policies. In parallel, the adoption of continuous manufacturing and digital process controls can lower production costs while maintaining quality consistency across batches.

On the commercialization front, developers must engage payers and regulatory authorities early to align on clinical endpoints and real-world evidence requirements. Building partnerships with healthcare systems and patient advocacy groups can generate supportive data and foster adoption among key prescribers. Additionally, companies should explore differentiated delivery platforms that enhance patient convenience, such as oral or transdermal formulations, to expand addressable patient populations. By implementing these actionable recommendations, industry leaders will be well positioned to capitalize on the growing therapeutic promise of peptides and secure long-term commercial success.

Outlining the Rigorous Research Methodology Including Data Collection, Expert Consultations, and Analytical Frameworks That Underpin the Insights

The research methodology underpinning this analysis is built on a rigorous, multi-pronged approach designed to ensure depth, accuracy, and relevance. The process began with extensive secondary research, drawing on peer-reviewed journals, patent databases, and publicly available regulatory filings to map out scientific advances, platform technologies, and clinical outcomes. This desk research provided a comprehensive baseline understanding of key molecules, synthesis modalities, and formulation trends.

To validate and augment these findings, primary interviews were conducted with thought leaders across academic centers, biotechnology firms, contract development organizations, and healthcare providers. These discussions yielded firsthand insights into emerging applications, development challenges, and strategic partnerships. Insights from regulatory affairs experts were incorporated to clarify recent guidance changes and approval pathways, while input from supply chain professionals shed light on the effects of evolving trade measures.

Quantitative data on peptide pipeline activity, clinical trial phases, and manufacturing capacity utilization were supplemented by qualitative inputs gathered through expert panels and validation workshops. A triangulation framework was employed to cross-verify data points across multiple sources, enhancing confidence in the conclusions drawn. Finally, thematic analysis techniques were applied to distill key trends and formulate actionable recommendations. This holistic methodology ensures that the report’s findings accurately reflect the current state of peptide therapeutics and anticipate near-term developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Peptide Therapeutics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Peptide Therapeutics Market, by Product Type

- Peptide Therapeutics Market, by Synthesis Technique

- Peptide Therapeutics Market, by Route Of Administration

- Peptide Therapeutics Market, by Application

- Peptide Therapeutics Market, by End User

- Peptide Therapeutics Market, by Region

- Peptide Therapeutics Market, by Group

- Peptide Therapeutics Market, by Country

- United States Peptide Therapeutics Market

- China Peptide Therapeutics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing the Critical Takeaways Emphasizing the Strategic Imperatives and Forward-Looking Perspectives in the Peptide Therapeutics Arena

In synthesizing the insights across scientific innovation, market segmentation, regional dynamics, and corporate strategies, several strategic imperatives emerge for stakeholders in peptide therapeutics. First, technology integration across design and manufacturing is paramount to improving candidate quality and reducing time-to-clinic. Second, segmentation analysis reveals that tailoring approaches by product type, synthesis route, administration method, application area, and end user will maximize clinical impact and commercial uptake. Third, the introduction of new tariff measures in 2025 underscores the need for proactive supply chain planning to safeguard margins and ensure uninterrupted production.

Regionally, success depends on aligning product portfolios with local regulatory landscapes and healthcare infrastructure. The Americas benefit from streamlined approval pathways and payer ecosystems that value real-world evidence, while EMEA markets demand robust health technology assessments and cost-effectiveness demonstrations. Asia-Pacific presents opportunities through partnerships that enable technology transfer and shared risk. Moreover, the competitive landscape is defined by companies that combine platform innovations with scalable manufacturing capabilities and strategic collaborations that accelerate market entry.

Ultimately, the peptide therapeutics sector is entering a new phase of maturity, marked by the convergence of scientific rigor, commercial sophistication, and regulatory alignment. Stakeholders who adopt a holistic view-integrating advanced design, resilient supply chains, and targeted go-to-market strategies-will be best positioned to translate the promise of peptides into tangible patient benefits and sustainable business growth.

Engage Directly with Associate Director Ketan Rohom to Access Comprehensive Market Intelligence and Propel Your Peptide Therapeutics Strategy

To explore how these in-depth insights can empower your strategic objectives and accelerate your success in peptide therapeutics, reach out directly to Associate Director Ketan Rohom. Leveraging his extensive expertise in market intelligence and stakeholder engagement, he can guide you through the full range of analytical deliverables, customize data extracts to your precise areas of interest, and facilitate a seamless procurement process. Initiating a dialogue with Ketan ensures that you gain immediate access to comprehensive findings, raw data tables, and expert interpretations that will inform your next steps in research, development, and commercial strategy. Whether you are advancing a novel peptide candidate through clinical validation or optimizing post-launch support for an established therapy, this report is designed to serve as your strategic compass. Contact Ketan to secure the report today and transform these actionable insights into competitive advantage.

- How big is the Peptide Therapeutics Market?

- What is the Peptide Therapeutics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?