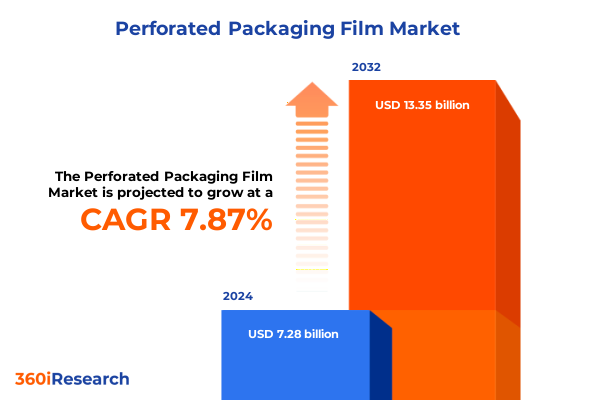

The Perforated Packaging Film Market size was estimated at USD 7.84 billion in 2025 and expected to reach USD 8.50 billion in 2026, at a CAGR of 7.89% to reach USD 13.35 billion by 2032.

Exploring how shifting consumer priorities sustainability mandates and regulatory pressures have elevated the significance of perforated packaging films in modern supply chains

Perforated packaging film has emerged as a critical enabler for preserving product freshness, optimizing shelf life, and meeting evolving consumer demands for transparency and convenience. In recent years, manufacturers and brand owners have grappled with a complex convergence of environmental regulations, shifting dietary preferences, and the need to reduce food waste. These factors have collectively intensified the focus on tailor-made film solutions that not only maintain product integrity but also align with sustainability objectives and circular economy goals.

Consequently, the role of perforated film has expanded beyond traditional moisture and gas transmission control to encompass broader performance metrics such as recyclability, compatibility with automated packaging lines, and multi-layer barrier functionalities. As stakeholders along the supply chain-from growers and processors to retailers-seek to enhance operational efficiency and minimize losses, the strategic importance of precise perforation patterns and advanced film formulations has become unmistakable. This introduction sets the stage for a holistic examination of market shifts, regulatory influences, segmentation dynamics, and actionable strategies that define the current and future trajectory of the perforated packaging film landscape.

Examining the convergence of digital innovation sustainability breakthroughs and regulatory developments reshaping perforated film production and application

A transformation is underway in the perforated packaging film sector, driven by the imperative to marry environmental stewardship with robust functional performance. The integration of digital printing capabilities has empowered brand owners to customize packaging aesthetics without compromising barrier properties or perforation precision. Simultaneously, manufacturers are investing in automation to enhance throughput, reduce human error, and enable complex multi-layer film constructions with microperforation features that precisely regulate respiration and moisture exchange.

Moreover, sustainability has ascended as a transformative catalyst. Innovations in mono-material film architectures facilitate easier recycling, while emerging biodegradable polymers present alternative pathways to minimize environmental footprints. In parallel, pressure from retailers and consumer advocacy groups has accelerated the adoption of water jet and laser perforation technologies, which offer cleaner processing and tighter control over pore size distributions. These advances underscore a shift from one-size-fits-all solutions toward highly engineered films that address specific end-use requirements, lifecycle considerations, and brand storytelling objectives.

Regulatory landscapes have also evolved, as agencies enact stricter guidelines on packaging waste, material composition, and food contact safety. In response, industry players are forming cross-sector partnerships to share best practices, co-develop novel perforation methods, and streamline compliance workflows. Collectively, these transformative shifts reflect a market in which agility, collaboration, and technological prowess are paramount for capturing value and sustaining competitive advantage.

Unpacking how 2025 United States import levies on polymer resins and packaging materials are transforming cost structures supply chain strategies and industry resilience

The imposition of new United States tariffs in 2025 on select polymer resins and auxiliary packaging materials has reverberated throughout the perforated film value chain. Polyethylene variants, in particular, have experienced upward cost pressure as import duties have increased raw material expenditures for producers reliant on overseas feedstocks. These changes have prompted manufacturers to explore alternative sourcing strategies, including near-shoring resin procurement and forging strategic alliances with domestic polymer suppliers to mitigate exposure to import levies.

In addition to polyethylene, polypropylene resins used in biaxially oriented film layers have also been subject to heightened duties, compelling film converters to rationalize product portfolios and prioritize high-margin, value-added offerings like multilayer cast films with laser-engineered perforations. Concurrently, many companies have accelerated capital investments in debottlenecking domestic production lines to offset lead-time volatility and ensure uninterrupted supply for end-use sectors that depend on precision-perforated solutions.

Indeed, the cumulative impact of the 2025 tariffs extends beyond direct cost implications. It has reshaped negotiation dynamics between buyers and suppliers, driven consolidation among small converters unable to absorb escalated input costs, and spurred a wave of process optimization initiatives aimed at enhancing material yield, reducing scrap, and reclaiming value from off-grades. Collectively, these developments underscore the strategic imperative for industry participants to continuously adapt supply chain architectures and drive operational resilience in an evolving trade regime.

Gaining a comprehensive perspective on application driven material innovations film architectures and perforation technologies defining segment specific requirements

A nuanced understanding of market segmentation reveals vital insights into the application-driven, material-centric, and technological variables that define demand for perforated packaging films. In the bakery and confectionery domain, where breathability and moisture control are paramount, perforated solutions are tailored for bread, cakes, pastries, and confectionery items to strike the right balance between staling prevention and aroma preservation. Similarly, dairy applications leverage precise microperforations in multilayer films to maintain uniform respiration rates, while fresh produce films incorporate macroperforation patterns designed to support the respiration needs of fruits and vegetables without permitting microbial ingress. Meat and poultry packaging demands macroperforation configurations for chicken, fish, seafood, and red meat, optimizing purge release and preventing drip accumulation during storage and transportation.

Material selection offers another layer of differentiation. High-density, linear low-density, and low-density polyethylene substrates deliver variable tensile and barrier characteristics, enabling formulation of films across blown, cast, and co-extruded constructions. Biaxially oriented polypropylene and cast polypropylene (CPP) variants further unlock high-clarity, stiffness, and sealing performance, whereas polyvinyl chloride remains a niche choice for specialized applications requiring exceptional printability.

Film type segmentation illuminates the roles of blown film single- and multilayer architectures, which provide cost-effective permeability control, versus cast film constructions that facilitate ultra-fine microperforation. Co-extruded films-ranging from two- and three-layer configurations to sophisticated multilayer stacks-permit integration of dedicated barrier, sealant, and structural layers. Lastly, technology and thickness criteria underscore the versatility of laser perforation, macroperforation, microperforation, and water jet perforation across thicknesses from 10 to 35 microns, 36 to 70 microns, and above 70 microns to meet diverse functional and mechanical requirements.

This comprehensive research report categorizes the Perforated Packaging Film market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- End Use

- Material

- Film Type

- Technology

- Thickness

Analyzing regional variations in regulatory frameworks production capacities and consumer demands shaping the perforated film landscape

Regional dynamics play a pivotal role in shaping demand and innovation trajectories for perforated packaging films. In the Americas, a mature retail infrastructure and stringent food safety regulations have spurred adoption of advanced perforation techniques, including microperforation for fresh produce and water jet perforation for high-barrier multilayer wraps. Market participants in North and South America increasingly emphasize localized production footprints to mitigate the impact of the 2025 tariffs and to ensure rapid response to fluctuating crop cycles and consumer trends.

Europe, the Middle East, and Africa exhibit diverse regulatory frameworks that drive investment in sustainable mono-material film solutions and bio-based polymers. Stringent waste reduction targets under various EU directives and growing eco-label certifications across EMEA have created a fertile environment for laser perforation and fully recyclable cast films tailored for bakery, meat, and dairy applications. Additionally, geopolitical considerations in the Middle East and Africa underscore the need for flexible supply networks and resilient partnerships to navigate import dependencies.

Asia-Pacific remains the fastest-growing region, fueled by expanding modern retail chains, rising per capita consumption, and a surge in food delivery services requiring innovative packaging. In China, Japan, and Southeast Asia, manufacturers are piloting high-speed blown film lines with inline laser perforation modules to cater to local fruit and vegetable markets, while India’s growing dairy sector is exploring multilayer BOPP films for lassi and yogurt packaging. Across Asia-Pacific, a renewed focus on affordability and performance is driving the convergence of cost-effective materials with next-generation perforation technologies.

This comprehensive research report examines key regions that drive the evolution of the Perforated Packaging Film market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Discovering how industry leaders leverage innovation partnerships acquisitions and proprietary technologies to develop differentiated perforated film solutions

Leading companies in the perforated packaging film arena are charting distinct strategic paths to fortify their market positions and address evolving customer expectations. One global packaging specialist has prioritized investment in research hubs dedicated to developing biodegradable perforated films and advanced analytics for pore pattern optimization. Another industry frontrunner has expanded its product portfolio through acquisitions of precision perforation technology providers, enabling seamless integration of laser and water jet capabilities into existing film production lines.

Meanwhile, a North American converter has entered into strategic alliances with agritech firms to co-develop tailored fresh produce packaging solutions, incorporating real-time respiration monitoring sensors and perforation arrays calibrated for specific fruit and vegetable varieties. A leading cast film manufacturer has ramped up digital printing offerings, providing brand owners with high-resolution graphics combined with microperforated breathable zones for bakery and confectionery items. These initiatives underscore how top players leverage partnerships, M&A, and innovation ecosystems to deliver differentiated, value-added solutions that respond to regulatory shifts, sustainability imperatives, and cost pressures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Perforated Packaging Film market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor plc

- Berry Global Group, Inc.

- Bolloré SE

- Clifton Packaging Group Limited

- Constantia Flexibles Group GmbH

- Cosmo Films Limited

- Coveris Holdings S.A.

- Flex Films

- Jindal Poly Films Limited

- Mondi plc

- Novolex Holdings, LLC

- Polyplex Corporation Limited

- Printpack, Inc.

- Sealed Air Corporation

- Taghleef Industries LLC

- TCL Packaging Limited

- Toray Industries, Inc.

- Uflex Limited

- Vibac Group S.p.A.

- Winpak Ltd.

Implementing integrated sustainability digitization and collaboration frameworks to strengthen supply chain resilience and accelerate product differentiation

Industry leaders should adopt a multi-pronged strategy to navigate the complexities of the perforated film market. First, embedding sustainability at the core of product development by prioritizing mono-material constructions and bio-based resins will ensure compliance with tightening environmental regulations and meet retailer eco-certification requirements. Second, optimizing film lines for digital printing and inline perforation capabilities can enhance customization, reduce lead times, and create new revenue streams through premium, differentiated packaging offerings.

Furthermore, cultivating strategic partnerships with domestic resin suppliers and technology vendors can help mitigate tariff risks and secure flexible supply chains. Leaders should also invest in advanced process analytics and IoT-enabled monitoring to improve yield, minimize waste, and accelerate time-to-market for new film grades. Finally, expanding application development services to support end users in selecting the optimal combination of material, film architecture, perforation technology, and thickness can deepen customer engagement and foster long-term loyalty in competitive end-use segments.

Detailing the comprehensive primary interviews secondary research data triangulation and advanced analytics techniques driving robust insights

This report’s findings are underpinned by a rigorous research methodology combining quantitative and qualitative techniques. Primary insights were garnered through in-depth interviews with key stakeholders across the perforated film value chain, including film converters, polymer suppliers, packaging equipment integrators, and end-use customers in food and beverage sectors. These discussions were complemented by site visits and technology demonstrations to evaluate the practical performance of various perforation methods and film constructions.

Secondary research leveraged a wide array of reputable sources, including industry journals, regulatory publications, patent filings, and corporate sustainability reports. Data triangulation was employed to validate market trends, tariff impacts, and segmentation breakdowns, ensuring that projections align with both historical patterns and emerging inflections. Proprietary databases provided granular production capacity and shipment statistics, while advanced analytics tools enabled cross-sectional analysis of regional dynamics and end-use behaviors. Collectively, this methodology ensures that the insights presented are robust, impartial, and actionable for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Perforated Packaging Film market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Perforated Packaging Film Market, by End Use

- Perforated Packaging Film Market, by Material

- Perforated Packaging Film Market, by Film Type

- Perforated Packaging Film Market, by Technology

- Perforated Packaging Film Market, by Thickness

- Perforated Packaging Film Market, by Region

- Perforated Packaging Film Market, by Group

- Perforated Packaging Film Market, by Country

- United States Perforated Packaging Film Market

- China Perforated Packaging Film Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing key drivers competitive imperatives and strategic themes defining the future of perforated packaging films in a dynamic market

In summary, the perforated packaging film market is undergoing a period of accelerated transformation driven by sustainability mandates, technological innovation, and evolving trade dynamics. Businesses that proactively realign their strategies to embrace mono-material solutions, digital customization, and resilient supply chain partnerships will be best positioned to capture value across end uses from bakery and fresh produce to meat, dairy, and processed foods. The ripple effects of the 2025 US tariffs underscore the importance of flexible sourcing strategies and domestic production expansion, while regional nuances demand localized approaches to regulation, consumer preferences, and performance requirements.

As the market matures, leading companies will differentiate themselves through continuous R&D investments, strategic alliances, and customer-centric application development services. By leveraging advanced perforation technologies-ranging from laser microperforation to water jet methods-and harnessing data-driven process optimization, stakeholders can deliver packaging solutions that extend shelf life, reduce waste, and contribute to circular economy objectives. Ultimately, a strategic, integrated perspective will be essential for navigating complexity, mitigating risks, and unlocking new growth opportunities in the dynamic perforated packaging film landscape.

Unlock unparalleled strategic intelligence on perforated packaging films by engaging with the Associate Director of Sales & Marketing

To delve deeper into the intricacies of perforated packaging film dynamics and secure comprehensive insights that can drive your strategic decisions, connect with Ketan Rohom, Associate Director of Sales & Marketing at our firm. Ketan can guide you through tailored solutions, answer any queries related to the report’s findings, and facilitate the procurement process so that you gain instant access to proprietary data, detailed analyses, and expert recommendations across end uses, materials, film types, technologies, thickness ranges, and regional dynamics. Reach out today to empower your business with the clarity and foresight needed to outpace competitors, optimize supply chains, and capitalize on emerging trends. Your next strategic advantage is just a conversation away

- How big is the Perforated Packaging Film Market?

- What is the Perforated Packaging Film Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?