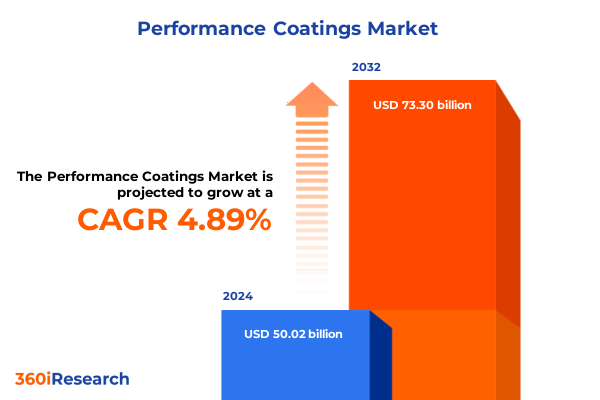

The Performance Coatings Market size was estimated at USD 134.47 billion in 2025 and expected to reach USD 148.20 billion in 2026, at a CAGR of 11.89% to reach USD 295.30 billion by 2032.

Unveiling the Dynamic World of Performance Coatings Market Driving Innovation Sustainability and Competitive Advantage Across Industries

The performance coatings sector stands at the forefront of material innovation, playing a pivotal role in enhancing durability, aesthetics, and functionality across a spectrum of industries. As global infrastructure, transportation, and consumer goods sectors evolve, the demand for advanced coatings has intensified, driven by stringent environmental regulations and the pursuit of long-lasting surface protection. Emerging end-use applications now require formulations that balance performance with sustainability, prompting manufacturers to invest heavily in research and development.

In recent years, the convergence of technological breakthroughs-such as low-VOC waterborne systems, high-solid formulations, and UV-curable chemistries-has reshaped market dynamics. These innovations offer superior resistance to abrasion, corrosion, and chemical exposure while addressing environmental and safety concerns. Meanwhile, increasing consumer expectations for premium finishes have elevated the aesthetic dimension of coatings, requiring a fusion of science and design expertise. Consequently, manufacturers are challenged to strike the optimal balance between cost efficiency, regulatory compliance, and high performance.

Against this backdrop, understanding the intricate interplay of regulatory shifts, raw material constraints, and end-user requirements has become essential for stakeholders aiming to capture emerging opportunities. This executive summary presents a concise yet comprehensive view of key trends, market drivers, segmentation insights, regional dynamics, and actionable strategies to navigate the evolving landscape of performance coatings.

Exploring Key Technological Regulatory and Demand Side Transformations Reshaping the Performance Coatings Landscape for Future Growth

Over the past decade, the performance coatings landscape has experienced transformative shifts underpinned by technological advancements, evolving regulatory frameworks, and changing consumer expectations. Central to this evolution is the rapid adoption of sustainable chemistries. Waterborne coatings, which once occupied a niche position, now command significant R&D investment as formulators strive to reduce volatile organic compounds without compromising protective qualities. Similarly, high-solid and powder coatings have gained traction for their efficiency and lower environmental footprint, prompting a wave of comparative studies and pilot programs across multiple industries.

Regulatory pressure has further accelerated these shifts, with global bodies imposing stricter emission limits and disposal requirements. Manufacturers are responding by reformulating legacy solventborne systems and seeking novel crosslinking mechanisms that deliver exceptional performance under new guidelines. Digitalization, too, has played a vital role by enabling advanced process monitoring, precision application, and enhanced quality control. Real-time data analytics now inform production parameters, reduce waste, and optimize throughput, reinforcing the strategic importance of Industry 4.0 initiatives.

Meanwhile, end-use demand profiles are diverging. The automotive sector increasingly prioritizes lightweighting and corrosion resistance in electric vehicle coatings, while construction coatings must balance rapid curing with long-term durability under harsh environmental conditions. In industrial applications, machinery and equipment coatings are tailored to withstand extreme temperatures, pressures, and chemical exposures. As these diverse requirements converge, stakeholder collaboration across supply chains has become critical, spurring joint ventures between resin producers, pigment manufacturers, and specialty chemical companies. This collaborative ethos is shaping a more resilient and adaptive market infrastructure poised to address both current needs and future challenges.

Assessing the Combined Effects of 2025 United States Tariffs on Raw Material Costs Supply Chain Resilience and Industry Competitiveness

The introduction of new United States tariffs in early 2025 has exerted a multifaceted impact on the performance coatings sector, influencing raw material procurement, cost structures, and supply chain resilience. Most notably, tariffs on critical pigment inputs and specialty resins sourced from major overseas suppliers have driven a recalibration of sourcing strategies. Manufacturers have scrambled to identify alternative feedstock from domestic producers or tariff-unaffected markets, yet these substitutes often carry higher base prices or require additional qualifying tests to ensure performance parity.

Simultaneously, logistical challenges have emerged as firms reroute shipments to mitigate tariff liabilities. Increased transit times and elevated freight expenses have eroded margins, particularly for companies with complex just-in-time manufacturing processes. Some organizations have responded by revising quantification thresholds, consolidating order volumes, or renegotiating supplier contracts to include tariff pass-through clauses. While these tactics have provided partial relief, smaller players with limited purchasing power face a disproportionate burden, potentially leading to market consolidation over time.

On a strategic level, the tariff landscape has accelerated investments in vertical integration and backward compatibility. Coating producers are exploring joint ventures with resin manufacturers and pigment synthesizers to secure supply at stable cost points. In parallel, R&D teams are prioritizing low-cost raw material substitutions, such as bio-based polyols, that bypass tariff classifications. These shifts underscore a broader industry trend: companies that proactively adapt procurement models and invest in supply chain agility are better positioned to maintain competitive pricing and meet evolving regulatory requirements under ongoing geopolitical uncertainty.

Deriving Strategic Insights from End Use Industry Technology Resin Type and Application Segmentation to Navigate Market Complexity with Precision

An intricate segmentation framework provides deep insights into how different market segments drive demand and influence product development strategies. Within the end use industry sphere, the automotive sector bifurcates into OEM lines, focusing on factory-finished coatings that emphasize uniformity and high throughput, and refinish applications where quick cure times, corrosion resistance, and aesthetic match are paramount. Construction coatings split between commercial projects, which demand high-performance products capable of enduring heavy foot traffic and exposure, and residential spaces that place greater emphasis on low odor, easy application, and eco-friendly credentials. In the general industrial domain, equipment coatings require robust chemical resistance and thermal stability, whereas machinery coatings must balance process efficiency with protective efficacy. Marine coatings are engineered for extreme saltwater environments, demanding anti-fouling and anti-erosion properties, while protective coatings employ anticorrosion technologies to safeguard critical infrastructure alongside intumescent systems that provide fire-resistant barriers. Flooring and furniture segments within the wood category necessitate durable, scratch-resistant, and visually appealing finishes that cater to evolving design trends.

Exploring technology segmentation reveals that high solid formulations strike a balance between performance and environmental compliance by significantly reducing VOC emissions. Powder coatings, divided into thermoplastic and thermoset families, offer advantages in thickness control and chemical resistance, with thermosets delivering permanent crosslinked networks and thermoplastics providing repairable surfaces. Solventborne systems retain relevance in applications where high film build and extended pot life are essential. UV cure technologies, differentiated by LED and mercury arc sources, enable rapid crosslinking under low-heat conditions, making them indispensable for high-speed manufacturing lines. Waterborne chemistries continue to expand as regulatory scrutiny intensifies, offering an ever-wider array of polymer backbones and performance attributes.

Resin type analysis underscores the distinct roles of acrylics, prized for weatherability and clarity; alkyds, known for cost-effective gloss and hardness; epoxies, valued for chemical resistance; polyesters, which deliver strength and flexibility; and polyurethanes, renowned for abrasion resistance and durability. Application methodologies further refine market segmentation: brush, dip, and roll techniques cater to specialized repair and coating operations, while spray applications-encompassing air spray, airless, and electrostatic methods-enable high productivity and uniform coverage across diverse substrates. By understanding how these segmentation layers intersect and interact, stakeholders can tailor product portfolios, prioritize R&D investments, and align go-to-market strategies that resonate with specific customer requirements.

This comprehensive research report categorizes the Performance Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Resin Type

- End Use Industry

- Application

Analyzing Regional Dynamics in Americas Europe Middle East Africa and Asia Pacific to Illuminate Growth Drivers and Strategic Opportunities Worldwide

Regional market dynamics display distinct characteristics shaped by economic trends, regulatory environments, and end-use priorities. In the Americas region, robust infrastructure spending and a mature automotive industry drive demand for high-performance coatings, particularly in the United States and Canada where environmental regulations incentivize low-VOC and waterborne solutions. Latin America, while price-sensitive, presents growth avenues in protective coatings for expanding industrial and energy sectors.

Within the Europe Middle East and Africa region, European Union directives on emissions and sustainability have catalyzed widespread adoption of eco-friendly formulations, while Middle Eastern markets prioritize thermal stability and chemical resistance due to harsh climates. Africa’s nascent industrial expansion offers promising opportunities for corrosion-resistant and long-lifespan protective systems, albeit tempered by price constraints and infrastructure variability.

The Asia Pacific region exhibits a dual narrative: advanced economies like Japan and South Korea lead in cutting-edge UV and powder coating technologies, driven by electronics and automotive export markets. In China and India, rapid urbanization and infrastructure projects fuel growth in construction and industrial coatings, although raw material supply bottlenecks and currency fluctuations create periodic volatility. Southeast Asian nations are gradually transitioning toward greener chemistries, influenced by multinational company standards and consumer awareness. Across all regions, localized regulatory landscapes and customer preferences underscore the importance of agile portfolio adaptation and region-specific go-to-market frameworks.

This comprehensive research report examines key regions that drive the evolution of the Performance Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players Driving Innovation Collaboration and Market Leadership to Furnish a Comprehensive View of the Competitive Performance Coatings Arena

The competitive landscape is characterized by a blend of multinational corporations with expansive R&D capabilities and specialized regional players focusing on niche segments. Industry leaders consistently allocate substantial budgets to innovation pipelines, yielding advanced chemistries that address evolving environmental and performance demands. Alliances between specialty pigment manufacturers, resin producers, and formulators have led to co-developed solutions offering enhanced adhesion, durability, and aesthetic versatility.

Strategic collaborations extend beyond product development, encompassing joint ventures for manufacturing scale-up and shared distribution networks. These partnerships optimize capital expenditures and accelerate market entry into underserved regions. Meanwhile, agile mid-tier companies leverage flexibility to tailor offerings rapidly, adapting formulations to local raw material availability and customer specifications. They often capitalize on under-penetrated segments where large players maintain limited focus.

Mergers and acquisitions remain a key strategic tool, enabling companies to expand technological portfolios, secure proprietary supply chains, and strengthen geographic presence. Recent transactions have underscored the value of integrated solutions, particularly in high-growth end-use markets such as electric vehicle coatings and renewable energy infrastructure. Across the board, firms demonstrating a balanced approach to innovation, supply chain integration, and customer engagement are setting new benchmarks for value creation in the performance coatings arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Performance Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Axalta Coating Systems Ltd.

- BASF SE

- Hempel A/S

- Jotun A/S

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- The Sherwin-Williams Company

Strategic Action Plan Enabling Industry Leaders to Capitalize on Emerging Trends Optimize Operations and Drive Sustainable Growth in Performance Coatings

Industry leaders should prioritize a multifaceted strategy to navigate evolving market dynamics and capitalize on emerging trends. First, accelerating the transition toward sustainable chemistries will be critical; investing in next-generation waterborne, high-solid, and UV-cure technologies can secure regulatory compliance and meet end-user sustainability targets. Concurrently, expanding backward integration through strategic partnerships or acquisitions of resin and pigment producers will enhance supply chain stability and offer greater control over raw material costs under fluctuating tariff regimes.

Second, embracing digital transformation across production and quality control processes can yield significant efficiency gains. Real-time monitoring, predictive maintenance, and advanced analytics will reduce downtime and improve batch consistency, thereby driving operational excellence. Third, cultivating bespoke customer collaboration programs will differentiate offerings; co-development initiatives with original equipment manufacturers, construction firms, and industrial end users can tailor formulations to specific performance requirements, strengthening long-term client relationships.

Lastly, a regionalized go-to-market approach-incorporating market-specific regulatory expertise, distribution partnerships, and localized R&D centers-will enable faster responsiveness to customer needs and evolving standards. By executing these actions in concert, companies can build resilient business models, unlock new revenue streams, and fortify their competitive positioning amid ongoing industry transformation.

Detailing Rigorous Methodological Framework Incorporating Primary Secondary Research Data Validation and Analytical Techniques Ensuring Reliability of Findings

This study deploys a comprehensive research framework integrating primary interviews with industry executives, technical experts, and supply chain stakeholders, complemented by extensive secondary data collection. Authoritative regulatory publications, patent filings, and technical journals were systematically reviewed to capture the latest technological developments and compliance requirements. Quantitative data on production volumes, raw material pricing, and trade flows were sourced from global customs databases and specialized analytics platforms.

Triangulation techniques ensured data reliability, combining cross-validation across multiple sources to identify and rectify discrepancies. Market structure analysis utilized Porter’s Five Forces and PESTEL evaluations to contextualize competitive intensity and macroeconomic influences. Scenario modeling and sensitivity analysis were applied to assess the potential impact of policy shifts and tariff changes on cost structures and market access. Throughout the process, rigorous quality checks and expert reviews upheld methodological integrity, delivering robust insights to inform strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Performance Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Performance Coatings Market, by Technology

- Performance Coatings Market, by Resin Type

- Performance Coatings Market, by End Use Industry

- Performance Coatings Market, by Application

- Performance Coatings Market, by Region

- Performance Coatings Market, by Group

- Performance Coatings Market, by Country

- United States Performance Coatings Market

- China Performance Coatings Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Critical Findings and Future Outlook to Empower Stakeholders with a Clear Vision of Opportunities Challenges and Strategic Imperatives in Performance Coatings

The performance coatings market is at an inflection point, where innovation, sustainability, and strategic supply chain management converge to define competitive success. Throughout this analysis, it is evident that regulatory pressures and geopolitical shifts have elevated the importance of agile procurement and localized solution deployment. Segment-specific demands-from high-durability automotive finishes to low-emission architectural coatings-underscore the necessity for precision in product development and go-to-market execution.

Looking ahead, companies that leverage integrated R&D strategies, digital operational frameworks, and collaborative partnerships will emerge as industry frontrunners. The balance between environmental responsibility and performance excellence will continue to drive formulation innovation, while tariff mitigation and vertical integration will shape cost and supply chain resilience. As end-use sectors evolve in response to global megatrends such as electric mobility and infrastructure renewal, the ability to anticipate and address nuanced performance requirements will be paramount.

In sum, the insights presented here provide a strategic roadmap for stakeholders seeking to navigate complexity, unlock new growth opportunities, and build sustainable competitive advantage within the dynamic performance coatings landscape.

Connect Directly with Ketan Rohom Associate Director of Sales and Marketing to Unlock Comprehensive Performance Coatings Market Research Insights and Propel Strategic Decision Making

To gain an in-depth understanding of the performance coatings market and to secure access to the full spectrum of strategic insights, readers are encouraged to reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expertise will guide prospective clients through tailored report packages that address specific industry challenges and growth objectives. By engaging with Ketan, stakeholders can customize data deliverables, explore value-add research modules, and benefit from exclusive advisory support shaped by rigorous analysis. Take the next step toward data-driven decision making and competitive advantage by contacting Ketan Rohom today to acquire the definitive performance coatings market research report.

- How big is the Performance Coatings Market?

- What is the Performance Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?