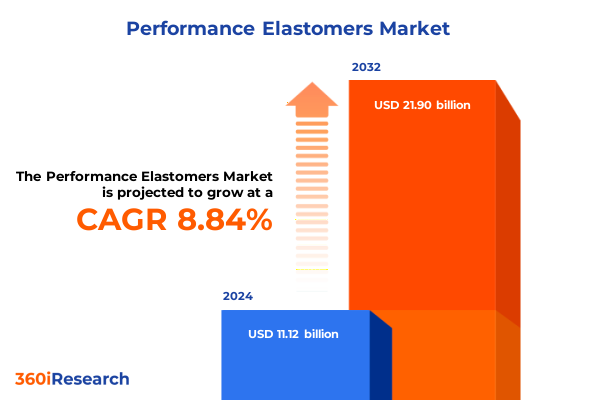

The Performance Elastomers Market size was estimated at USD 12.03 billion in 2025 and expected to reach USD 13.01 billion in 2026, at a CAGR of 8.93% to reach USD 21.90 billion by 2032.

Opening the Discussion on Performance Elastomers by Outlining Market Dynamics, Emerging Drivers, Regulatory Frameworks, and Study Objectives

Performance elastomers have emerged as indispensable materials within modern industrial applications, offering a unique combination of mechanical resilience, chemical stability, and temperature tolerance. These advanced polymers bridge the gap between conventional elastomeric solutions and the increasingly demanding requirements of sectors such as automotive engineering, energy infrastructure, and medical device manufacturing. As end users strive for improved operational efficiency, longer service lifetimes, and reduced environmental footprints, the role of high-performance rubber compounds has never been more consequential. Against this backdrop, stakeholders across the value chain-from raw material suppliers to component fabricators and original equipment manufacturers-are seeking clarity on the forces shaping demand, the barriers to adoption, and the strategic imperatives that will dictate future growth.

This study delivers a comprehensive exploration of performance elastomers by examining the interplay of technological breakthroughs, regulatory landscapes, and shifting supply chain paradigms. It delves into key material families and their respective functional advantages, evaluates critical application vectors, and identifies emerging trends that are redefining market dynamics. Through a blend of qualitative insights and rigorous validation, this analysis aims to equip decision-makers with the contextual understanding and actionable intelligence needed to navigate market complexities. The investigation’s objectives include elucidating core drivers, mapping competitive contours, and highlighting innovation levers, thereby setting the stage for well-informed investment, development, and procurement strategies.

Exploring the Technological, Environmental, and Supply Chain Disruptions Reshaping the Landscape of Performance Elastomer Development and Application

The performance elastomers landscape is undergoing a profound transformation driven by an alignment of technological, environmental, and economic shifts. Innovations in polymer chemistry are enabling the development of bio-derived and high-molecular-weight formulations that deliver exceptional thermal stability and resistance to aggressive media. Simultaneously, advancements in additive manufacturing and digital process control are reshaping production workflows, fostering leaner operations and higher consistency. Environmental considerations have become an equally potent catalyst: more stringent emissions regulations and circular economy mandates are prompting manufacturers to explore sustainable feedstocks, closed-loop recycling models, and eco-friendly crosslinking agents. These twin imperatives-innovation and sustainability-are converging to redefine the boundaries of performance, prompting new product roadmaps and collaborative ecosystems.

At the same time, the broader macro environment is buffeted by supply chain realignments that favor geographic diversification and regional self-reliance. The pursuit of resilience has spurred investment in nearshore production hubs and strategic stockpiling of critical elastomeric intermediates. Rising digitalization across logistics networks is enhancing visibility, reducing lead times, and mitigating disruptions. As a result, value chain participants are compelled to establish robust partnerships, integrate data-driven decision-making, and adopt scenario-based planning. This era of disruption demands agility, and organizations that embrace these paradigm shifts will be best positioned to capture emerging market segments and sustain competitive advantage.

Analyzing the Multifaceted Effects of United States Tariff Measures Introduced in 2025 on Sourcing, Cost Structures, and Global Supply Relationships in the Elastomer Sector

The introduction and continuation of United States tariff measures in 2025 have created a complex environment for sourcing and cost management within the performance elastomer sector. Tariffs originally imposed under Section 301 and Section 232 on specific chemical inputs and finished elastomeric components remain firmly in place, while adjustments announced earlier this year have targeted specialty rubbers used across strategic industries. These levies have elevated landed costs for affected grades, leading many buyers to reconsider traditional procurement channels. In response, some end users have accelerated efforts to qualify alternative suppliers in regions not subject to punitive duties, while others are investing in backward integration to secure feedstock availability locally.

Beyond direct cost implications, the policy landscape has reshaped global supplier relationships. Tier-one elastomer producers have intensified engagement with government bodies to navigate evolving compliance requirements, and several have expanded domestic production footprints to enhance tariff exposure management. The net effect is a recalibration of supply chains, where trade policy considerations now rank alongside quality, lead time, and technical performance as core selection criteria. Firms that successfully align sourcing strategies with the current tariff regime will maintain smoother operations and better cost control, whereas those slow to adapt risk margin erosion and project delays.

Unveiling Deep Segmentation Perspectives Across Product Types, Applications, End Use Industries, Polymerization Processes, and Forms in the Elastomer Domain

A nuanced understanding of market segmentation reveals the diverse material and application requirements that underpin performance elastomer demand. Based on product type, the landscape encompasses butyl rubber, which excels in gas retention applications; chloroprene rubber, prized for its weather and ozone resistance; ethylene propylene diene monomer blends offering broad temperature tolerance; isoprene rubber, known for its mechanical elasticity; nitrile butadiene formulations valued for fuel and oil resistance; silicone rubbers suited to extreme heat and electrical insulation tasks; and styrene butadiene compounds that serve as the backbone of high-load tire and conveyor applications. Application segmentation further underscores how automotive gaskets, seals, hoses, and tire components draw upon specific elastomer properties, while construction projects demand materials for insulation, roofing membranes, and sealing solutions. In the consumer goods arena, performance elastomers enable electronic housing seals, footwear resilient outsoles, and sporting goods components with tailored flexibility. Healthcare applications extend from catheters and medical gloves to specialized seals used in life-saving equipment. Industrial goods such as conveyor belts, fenders, and precision seals rely on compounds engineered for mechanical abrasion and chemical exposure, and the oil and gas segment requires gaskets, tubing, and sealing systems that safeguard extreme pressure operations.

When examined by end use industry, it becomes clear that aerospace and defense sectors leverage high-performance rubbers for vibration dampening and environmental sealing in critical systems, while the automotive industry applies elastomers across powertrain, chassis, and interior assemblies. Construction utilizes these materials for structural sealing and protective coverings, and electrical and electronics manufacturing integrates elastomeric connectors and insulators to ensure circuit integrity. Energy industry players spanning both hydrocarbons and renewables depend on advanced rubber compounds to maintain safety and efficiency in demanding environments. Healthcare demands a dual focus on biocompatibility and sterility, extending elastomeric materials into medical device housings and personal protective equipment. Distinct polymerization methods-cold polymerization for precise chain architecture, hot polymerization for enhanced crosslink density, and ionic polymerization for tailored molecular configurations-drive material property customization. Additionally, the form in which these compounds are delivered, whether as latex colloids suitable for dip molding, solid precursors for extruded profiles, or solution-phase formulations for coatings and adhesives, directly influences processing routes and final product performance.

This comprehensive research report categorizes the Performance Elastomers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Polymerization Process

- Form

- Application

Highlighting Regional Nuances and Growth Drivers Across the Americas, Europe Middle East and Africa, and Asia Pacific for Performance Elastomer Markets

Regional considerations play a pivotal role in shaping performance elastomer trends and opportunities. In the Americas, mature automotive and industrial manufacturing hubs are complemented by robust infrastructure modernization programs, driving consistent demand for gaskets, seals, and hoses. Sustainability mandates at the federal and state levels are catalyzing the adoption of recycled and bio-derived elastomer grades, while nearshoring initiatives have strengthened supply continuity and reduced lead times for North American buyers. Latin American markets are presenting new growth corridors, as expanding energy and construction sectors seek resilient sealing and insulation solutions.

Across Europe, the Middle East, and Africa, stringent environmental regulations in Western Europe foster a strong market for low-emission production technologies and closed-loop recycling schemes. Advanced manufacturing centers in Germany and Italy are pioneering specialty compound formulations, while the Middle East’s oil and gas infrastructure continues to drive demand for high-performance gaskets and tubing under extreme conditions. In Africa, nascent industrialization projects in key economies such as South Africa and Egypt are beginning to incorporate modern elastomeric systems into construction, energy, and transportation initiatives.

In Asia Pacific, the region serves as the manufacturing heartland for performance elastomers, with China, India, Japan, and Southeast Asian nations at the forefront of production and consumption. Electrification trends in automotive and renewable energy projects are intensifying the need for thermally stable and electrically insulative materials. Infrastructure investments in India and ASEAN countries are fueling growth in construction sealants and roofing membranes, while the presence of global chemical producers in the region ensures ongoing innovation in specialty polymers.

This comprehensive research report examines key regions that drive the evolution of the Performance Elastomers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Companies Driving Innovation, Strategic Collaborations, and Competitive Differentiation throughout the Performance Elastomer Industry Ecosystem

The competitive landscape of performance elastomers is marked by a blend of industry conglomerates and agile specialists, all striving to differentiate through innovation, capacity expansion, and strategic alliances. Major chemical enterprises have bolstered their high-performance rubber portfolios by acquiring niche producers and establishing joint ventures that leverage complementary expertise in polymer science and compounding technologies. These moves have accelerated the development of next-generation elastomers designed for extreme service environments and stringent regulatory requirements.

Concurrently, pure-play elastomer manufacturers and materials technology firms are carving out value by integrating digital process controls, advanced analytics, and tailored customer service models. The deployment of real-time monitoring and predictive maintenance solutions has enhanced production consistency and reduced downtime, translating into competitive advantage. Partnerships between polymer producers and downstream automotive or aerospace OEMs have fostered co-development frameworks, ensuring that material formulations align with evolving performance specifications and product lifecycles.

Supply-side dynamics are further influenced by firms that have diversified geographically to address regional trade policy shifts and local content regulations. By operating production sites in key markets, these companies minimize tariff exposure and respond more effectively to localized demand fluctuations. The ongoing convergence of sustainability goals, technological progress, and supply chain resilience continues to reshape the competitive equation, rewarding those organizations that marry innovation agility with operational excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Performance Elastomers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arlanxeo NV

- Avient Corporation

- BASF SE

- Biesterfeld AG

- Celanese Corporation

- Covestro AG

- DuPont de Nemours, Inc.

- Exxon Mobil Corporation

- LANXESS AG

- Momentive Performance Materials Inc.

- Shin-Etsu Chemical Co., Ltd.

- Solvay S.A.

- The Dow Chemical Company

- Wacker Chemie AG

- Zeon Corporation

Recommending Strategic, Operational, and Technological Actions that Industry Leaders Can Pursue to Enhance Resilience and Capitalize on Emerging Opportunities

To navigate the evolving performance elastomer landscape, industry leaders should pursue a multifaceted strategy that balances technological advancement with supply chain resilience. Embracing bio-based and recycled feedstocks will not only align with tightening environmental regulations but also differentiate offerings in markets where sustainability credentials are increasingly valued. Parallel to this, investment in digital quality control systems and advanced analytics can unlock process efficiencies, reduce scrap rates, and accelerate time to market.

On the sourcing front, expanding qualification programs for non-traditional suppliers and exploring nearshore manufacturing options can mitigate the impact of trade policy volatility and logistics disruptions. Collaborations with strategic partners, ranging from raw material innovators to end user OEMs, will be essential for co-creating next-generation elastomer formulations that meet specialized performance criteria. Additionally, establishing circular economy initiatives-such as take-back programs and material reprocessing networks-will safeguard long-term feedstock security and resonate with eco-conscious customers.

Finally, fostering cross-functional R&D teams that integrate market intelligence, regulatory insight, and polymer science expertise will streamline product development pipelines and ensure that material roadmaps stay ahead of application demands. Complementing these efforts with robust scenario planning and risk management frameworks will empower organizations to anticipate policy shifts, supply shocks, and technological disruptions, solidifying their competitive positioning in a rapidly evolving sector.

Detailing a Rigorous Multi-Phase Research Methodology Incorporating Quantitative, Qualitative, and Validation Techniques for Comprehensive Elastomer Market Analysis

This analysis leverages a rigorous, multi-phase research methodology designed to ensure comprehensive market coverage and robust validation. The investigative framework commenced with an extensive secondary research phase, encompassing proprietary databases, technical journals, industry association publications, and regulatory filings. This foundational layer provided a macro-level perspective on material classifications, application use cases, and policy developments.

Building on these insights, a series of in-depth primary interviews were conducted with an array of stakeholders, including elastomer compounders, automotive and aerospace OEM engineers, procurement leaders, and regulatory experts. These conversations were structured to elicit nuanced perspectives on material performance priorities, sourcing challenges, and technology roadmaps. Data triangulation techniques were then applied, aligning quantitative observations from shipment and import-export statistics with qualitative insights from expert dialogues.

To ensure analytical rigor, the research incorporated validation workshops where draft findings were reviewed by key industry participants. Feedback loops facilitated iterative refinement of segmentation frameworks and thematic interpretations. Supporting the overall framework, a suite of analytical tools-ranging from SWOT analysis and value chain mapping to scenario forecasting and sensitivity testing-was employed to stress-test assumptions and confirm strategic implications. This structured approach underpins the credibility and depth of the resulting market intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Performance Elastomers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Performance Elastomers Market, by Product Type

- Performance Elastomers Market, by Polymerization Process

- Performance Elastomers Market, by Form

- Performance Elastomers Market, by Application

- Performance Elastomers Market, by Region

- Performance Elastomers Market, by Group

- Performance Elastomers Market, by Country

- United States Performance Elastomers Market

- China Performance Elastomers Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Summarizing Key Findings, Insights, and Strategic Implications to Reinforce Decision Making and Guide Future Initiatives in the Elastomer Industry

The insights presented in this executive summary underscore the critical interplay between material innovation, regulatory evolution, and supply chain dynamics within the performance elastomer industry. Technological advancements are unlocking new performance thresholds, while environmental mandates and trade policies continue to influence sourcing and cost structures. Segmentation analysis reveals the diverse requirements across product types, application domains, and end use industries, further complicated by regional nuances in regulatory regimes and infrastructure investments.

Leading companies are distinguishing themselves through strategic collaborations, agile production footprints, and integrated digital capabilities, and those that align their strategies with sustainability and resilience imperatives are poised for long-term success. The recommended actions-ranging from sustainable feedstock adoption and digital quality assurance to nearshoring and circular economy initiatives-provide a clear roadmap for navigating complexity and capturing emerging opportunities. By synthesizing these findings, this report equips decision-makers with the clarity needed to optimize product portfolios, streamline operations, and pursue growth avenues with confidence.

Looking ahead, the continued convergence of high-performance material demands and global policy shifts will define the contours of the elastomer market. Organizations that proactively adapt to these forces by balancing innovation, sustainability, and strategic foresight will secure their competitive edge and create lasting value across the value chain.

Empowering Stakeholder Engagement with an Inviting Call to Action Featuring a Direct Pathway to Secure the Full Performance Elastomers Market Research Report Today

To access the comprehensive findings and tap into these insights, please contact Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy of the performance elastomers market research report and ensure your organization remains at the forefront of material innovation. This report offers unparalleled depth and rigor, empowering you to make informed strategic decisions, identify emerging opportunities, and mitigate risks with confidence. Reach out today to unlock the full spectrum of analysis, expert commentary, and actionable data that will drive your competitive advantage in the dynamic performance elastomers landscape.

- How big is the Performance Elastomers Market?

- What is the Performance Elastomers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?