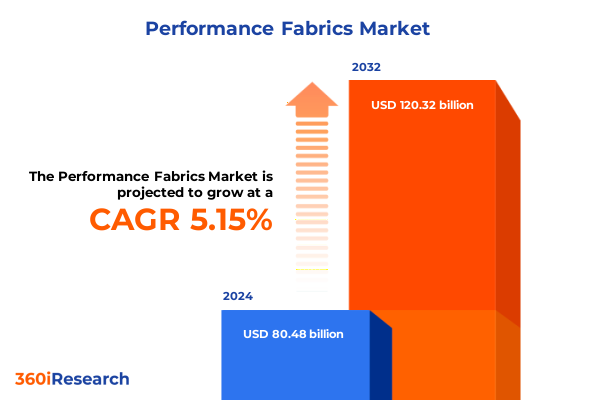

The Performance Fabrics Market size was estimated at USD 84.60 billion in 2025 and expected to reach USD 88.93 billion in 2026, at a CAGR of 5.16% to reach USD 120.32 billion by 2032.

Unveiling the Dynamic Evolution of the Performance Fabrics Market Driven by Technological Innovations, Consumer Shifts, and Environmental Imperatives

The performance fabrics industry has undergone a remarkable metamorphosis, propelled by a fusion of technological advancements, shifting consumer behaviors, and mounting environmental expectations. Over the past decade, breakthroughs in fiber engineering have enabled manufacturers to imbue textiles with properties once considered futuristic: moisture management, temperature regulation, and even embedded electronic functionality. Concurrently, the rise of active lifestyles and athleisure trends has ushered in a new era of consumer demand, one characterized by a desire for high-performance garments that seamlessly integrate comfort and style. As a result, companies across the value chain are investing heavily in R&D to stay ahead of the curve and ensure they can offer fabrics that deliver on the promise of performance without compromising on aesthetics.

Moreover, environmental imperatives have become a driving force in shaping the market’s trajectory. Sustainability credentials now serve as a critical differentiator, with end users and brand owners alike seeking materials that have minimal ecological impact. This has led to the proliferation of recycled and bio-based fibers, as well as the adoption of closed-loop production systems that aim to reduce waste and conserve resources. In addition, regulatory frameworks across key regions are increasingly aligning with sustainability objectives, reinforcing the need for manufacturers to adopt greener practices. As industry stakeholders navigate this dynamic landscape, the convergence of innovation, consumer expectations, and ecological responsibility continues to redefine what it means to excel in performance fabrics.

Decoding Accelerated Transformative Shifts Reshaping Performance Fabrics from Sustainability Demands to Smart Textile Integrations

The performance fabrics sector is witnessing an unprecedented wave of transformative shifts that extend far beyond incremental improvements. At the technological forefront, smart textiles are rapidly transitioning from laboratory prototypes to commercial reality. Through the integration of conductive fibers, sensors, and microelectronics, modern fabrics can now monitor physiological metrics, adjust thermal properties in real time, and even deliver on-demand antimicrobial protection. This leap forward is fostering new collaborations between textile manufacturers, electronics suppliers, and software developers, creating a multidisciplinary ecosystem that fuels accelerated innovation.

In tandem with these technological breakthroughs, consumer expectations are evolving in profound ways. The modern consumer demands personalization, and performance fabrics are no exception. From customizable color-changing garments that respond to environmental cues to fabrics engineered for specific athletic disciplines or medical applications, personalization is emerging as a critical competitive advantage. Furthermore, digitalization along the supply chain-from 3D knitting to on-demand manufacturing platforms-enables brands to reduce lead times, minimize inventory risk, and offer bespoke solutions at scale. As a consequence, agility and adaptability have become paramount, compelling companies to rethink traditional production models and embrace flexible manufacturing paradigms.

Examining the Pervasive Cumulative Impact of 2025 United States Tariffs on the Performance Fabrics Supply Chain and Cost Dynamics

In 2025, the United States government’s tariff regime has introduced a new layer of complexity to the performance fabrics ecosystem, reshaping cost structures and supply chain dynamics. Elevated duties on select textile imports have increased landed costs for manufacturers relying on offshore production, prompting a reevaluation of sourcing strategies. Many companies are responding by diversifying their supplier base, onshoring portions of production, or forging strategic partnerships with regional mills capable of offering tariff-exempt materials. These adaptations, while necessary, have also introduced margin pressures that demand careful mitigation through operational efficiencies and product premiumization.

At the same time, the tariff landscape has catalyzed investment in domestic manufacturing capabilities. High-tech fiber producers are expanding capacity within the United States, supported by government incentives aimed at reducing dependency on foreign supply. As a result, a localized value chain is beginning to emerge, offering both resilience and reduced exposure to trade volatility. Although the transition entails capital-intensive upgrades and workforce development initiatives, it positions forward-looking companies to capitalize on nearshore advantages and to better serve North American customers with shorter lead times. Consequently, the combined effects of import duties and proactive domestic investment are redefining the competitive parameters of the performance fabrics marketplace.

Illuminating Key Segmentation Insights Across Material Types, Weaving Techniques, Knitting Variations, and Non Woven Innovations

A nuanced understanding of the performance fabrics landscape requires an exploration of its key segmentation dimensions, each revealing distinct consumer preferences and production techniques. When considering material types, the market encompasses blended fibers that merge nylon and polyester to achieve balanced durability and comfort, alongside natural options such as cotton and wool that offer breathability and heritage appeal. Additionally, fully synthetic fibers including acrylic, nylon, and polyester have gained prominence for their engineered performance properties, with polyester further differentiated into filament and microfiber variants that cater to specific weight and texture requirements.

Beyond material composition, the way fabrics are constructed plays an equally pivotal role. In the woven domain, plain weaves provide simplicity and cost-effectiveness; satin weaves deliver enhanced drape and luster favored by high-end athletic wear, while twill weaves offer superior abrasion resistance suited to more rugged applications. Similarly, knitted constructions split into warp and weft techniques, where warp knits grant stability and resilience, and weft knits afford greater stretch and conformability, appealing to performance and comfort-centric end uses. Finally, the non woven segment, marked by meltblown and spunbond processes, addresses critical needs in filtration, medical textiles, and industrial applications, underscoring the breadth of performance fabric innovation.

This comprehensive research report categorizes the Performance Fabrics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Woven

- Knitted

- Non Woven

- End Use

Highlighting Strategic Regional Insights Spanning the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional market dynamics exhibit pronounced variation, driven by differing consumer priorities, regulatory environments, and industrial infrastructures. In the Americas, end users demonstrate a strong appetite for athleisure and performance wear fueled by health and wellness trends, encouraging brands to blend technical capabilities with fashionable aesthetics. North American manufacturers, in turn, are leveraging advanced production technologies to shorten time to market and cater to environmentally conscious consumers who prioritize transparency in supply chains.

Across Europe, Middle East & Africa, sustainability mandates and stringent environmental standards have accelerated the adoption of recycled and bio-based fibers. European mills are pioneering circularity initiatives, collaborating with luxury brands to develop high-performance textiles that uphold both eco-credentials and premium quality expectations. In parallel, the Middle East is investing heavily in synthetic fiber production, capitalizing on petrochemical resources to supply regional and global demand.

The Asia-Pacific region remains a critical production hub, buoyed by robust manufacturing capacity in countries such as China, India, and Vietnam. Yet, the steepening tariff environment and rising labor costs have spurred a gradual shift toward automation and nearshoring strategies. At the same time, burgeoning domestic consumption markets in Southeast Asia are creating new opportunities for local and international performance fabrics suppliers to innovate in fast-growing consumer segments.

This comprehensive research report examines key regions that drive the evolution of the Performance Fabrics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unpacking Key Company Strategies Driving Innovation, Collaboration, and Competitive Positioning in the Performance Fabrics Industry

Within this diverse competitive landscape, a cadre of leading companies is defining new benchmarks for performance, sustainability, and technological differentiation. Technology-driven fiber innovators are integrating nanostructured coatings to impart water repellency and UV protection, while traditional textile manufacturers are raising the bar through strategic acquisitions that expand their fiber portfolios and geographic reach. Collaborative ventures between chemical companies and athletic brands are advancing functional finishes that address niche performance requirements, such as rapid moisture-wicking for endurance sports or thermal regulation for outdoor applications.

Moreover, agile start-ups have disrupted conventional models by introducing direct-to-consumer channels that bypass traditional distribution, enabling rapid feedback loops and iterative product refinement. Meanwhile, established players are investing in digital twins and predictive analytics to optimize supply chain operations and tailor production volumes to real-time demand signals. As strategic alliances proliferate across the value chain, the most successful companies will be those that can leverage integrated capabilities-from raw material innovation through to consumer-focused product development-to secure sustainable competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Performance Fabrics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Brentano, Inc

- Colmant coated fabrics

- DuPont de Nemours, Inc

- Freudenberg SE

- Glen Raven Material Solutions, LLC

- Haren Textiles Pvt Ltd

- Hyosung Corporation

- Innovasia Inc.

- INVISTA Holdings, LLC

- Kolon Industries, Inc

- Kureha Corporation

- LEEJO TEXTILE CO., LTD.

- Milliken & Company

- Miroglio Group S.p.A.

- Mitsubishi Rayon Co., Ltd.,

- OMNOVA Solutions Inc.

- Owens Corning Industries Pvt Ltd

- Pindler & Pindler, Inc.

- Schoeller Textil AG

- Schott Performance Fabrics, Inc.

- Sigmatex (UK) Limited.

- Snyder Manufacturing Inc

- Spradling International Inc.

- Teijin Limited

- TenCate Protective Fabrics

- TORAY INDUSTRIES, INC.

- Unifi, Inc.

Outlining Actionable Recommendations for Industry Leaders to Navigate Complex Market Dynamics and Sustain Growth Trajectories

To thrive amid evolving complexities, industry leaders must adopt a multifaceted approach that balances innovation with operational rigor. First, enhancing supply chain resilience through geographic diversification and strategic partnerships will mitigate the impact of tariff volatility and geopolitical risks. Concurrently, investing in advanced manufacturing technologies-such as automated looms, digital printing, and AI-driven quality control-can drive productivity improvements and reduce waste.

Equally important is the deepening of sustainability commitments. Companies should prioritize closed-loop recycling programs and the development of next-generation bio-based fibers, while forging transparent traceability frameworks that resonate with environmentally conscious consumers. Furthermore, embracing digital ecosystems will unlock new revenue streams; integrating e-commerce platforms, virtual prototyping, and personalized product configurators can elevate engagement and accelerate time to market. By aligning these strategic imperatives with clear performance metrics, industry leaders will be well-positioned to convert market challenges into enduring growth opportunities.

Detailing Rigorous Research Methodology Employed to Deliver Accurate, Impartial, and Comprehensive Industry Insights

This research undertook a comprehensive, mixed-methods approach to ensure the integrity and depth of insights presented. Primary data collection involved in-depth interviews with a broad spectrum of stakeholders, including fiber manufacturers, textile mills, brand owners, and industry analysts, to capture firsthand perspectives on market drivers and challenges. Secondary research encompassed a rigorous review of technical journals, patent filings, trade publications, and regulatory frameworks to triangulate findings and validate emerging trends.

Quantitative analysis was conducted through the examination of production capacity data, import-export statistics, and trade flow information, enabling a detailed understanding of supply chain dynamics. Qualitative assessment was reinforced by scenario planning workshops, in which cross-functional experts evaluated potential market trajectories under varying tariff and sustainability scenarios. Throughout the process, data integrity protocols and cross-validation techniques were applied to maintain objectivity and ensure that conclusions are both reliable and actionable for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Performance Fabrics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Performance Fabrics Market, by Material Type

- Performance Fabrics Market, by Woven

- Performance Fabrics Market, by Knitted

- Performance Fabrics Market, by Non Woven

- Performance Fabrics Market, by End Use

- Performance Fabrics Market, by Region

- Performance Fabrics Market, by Group

- Performance Fabrics Market, by Country

- United States Performance Fabrics Market

- China Performance Fabrics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Reflections on the Future of Performance Fabrics with an Emphasis on Resilience, Innovation, and Sustainable Growth

As the performance fabrics market continues its rapid evolution, the interplay of innovation, regulation, and consumer demand will shape its future contours. Companies that succeed will be those that marry cutting-edge technology with a steadfast commitment to sustainability, while maintaining the agility to adapt to shifting trade policies and consumer behaviors. The emergence of smart textiles, the expansion of onshore manufacturing, and the acceleration of circularity initiatives all point toward an industry defined by resilience and transformation.

Looking ahead, collaboration across the value chain will be paramount. Shared investments in R&D, open innovation partnerships, and collective action on environmental goals will accelerate progress and amplify impact. For decision-makers, the path to sustainable growth lies in the ability to anticipate market inflection points, align corporate strategy with evolving stakeholder expectations, and leverage data-driven insights to inform every stage of product development and market engagement. By embracing these imperatives, organizations can position themselves as leaders in a market that promises both complexity and unprecedented opportunity.

Discover the Transformative Potential of Comprehensive Performance Fabrics Research and Partner with Our Associate Director to Secure Your Competitive Edge

If you’re ready to gain a decisive advantage in the rapidly evolving performance fabrics market, contact Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report and drive strategic growth with unparalleled insights

- How big is the Performance Fabrics Market?

- What is the Performance Fabrics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?