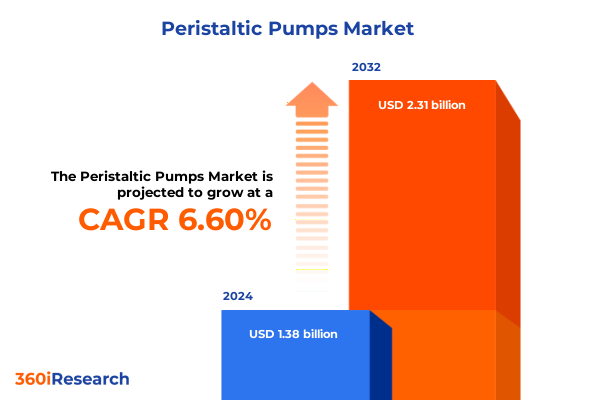

The Peristaltic Pumps Market size was estimated at USD 1.86 billion in 2025 and expected to reach USD 1.96 billion in 2026, at a CAGR of 5.22% to reach USD 2.66 billion by 2032.

Unveiling the Evolution and Strategic Imperatives of the Global Peristaltic Pump Market Amidst Disruptive Technological and Trade Dynamics

Peristaltic pumps have evolved from niche laboratory accessories into cornerstones of fluid handling across diverse industries, marrying precision with hygiene in applications ranging from chemical dosing to biopharmaceutical production. Over the past decade, advances in pumping materials, motor controls, and tubing formulations have elevated performance metrics while safeguarding against cross-contamination. As end users demand greater reliability, lower maintenance burdens, and streamlined regulatory compliance, the role of peristaltic pumps has shifted from cost-effective backups to mission-critical assets.

The introduction of smart monitoring capabilities has further reshaped expectations. Real-time diagnostics, predictive maintenance alerts, and remote performance adjustments now allow operators to anticipate issues, reduce downtime, and optimize process yields. These digital overlays complement ongoing material innovations, where food-grade silicones and chemically resistant polymers coalesce with lightweight aluminum and stainless steel housings to meet stringent purity and durability standards.

Looking ahead, the intersection of sustainability mandates and process automation will drive continued refinement of peristaltic pumping solutions. Market players are prioritizing energy-efficient motor designs and recyclable tubing compounds, reflecting a broader industrial pivot toward eco-responsible operations. With these transformative currents converging, a nuanced understanding of market dynamics and strategic planning is essential for organizations seeking to capitalize on the expanding scope of peristaltic pump applications.

Mapping the Pivotal Transformations Reshaping Peristaltic Pump Technologies and Market Structure in Response to Digitalization and Sustainability Pressures

The peristaltic pump landscape is undergoing a profound metamorphosis as digitalization, modular design philosophies, and stringent sustainability standards converge to redefine competitive advantage. Digital integration has unlocked granular control over flow rates and pressure profiles, empowering engineers to tailor pump behavior to complex fluid chemistries without manual recalibration. Concurrently, modular architectures permit rapid reconfiguration of pump components, reducing downtime and facilitating swift transitions between production processes.

Material science breakthroughs have catalyzed another pivotal shift. Next-generation tubing blends and composite casings now combine enhanced chemical resistance with extended service life, enabling operators to minimize unscheduled replacements. These material advances align with circular economy objectives, as leading suppliers explore recyclable or biodegradable tubing options that reduce waste streams and bolster corporate social responsibility credentials.

In parallel, the drive toward operational flexibility has elevated variable-speed drives from optional extras to standard features. By optimizing energy consumption across varying discharge capacities and application scenarios, variable-speed configurations yield tangible cost savings and support grid resilience initiatives. Taken together, these transformative shifts underscore a new era of peristaltic pump innovation-one in which digital, material, and sustainability imperatives coalesce to reshape market boundaries and performance benchmarks.

Assessing the Comprehensive Ripple Effects of New United States Tariffs on Peristaltic Pump Supply Chains Operations and Cost Structures in 2025

The implementation of broadened United States tariffs in early 2025 has introduced significant complexity into peristaltic pump supply chains and cost structures. Components such as precision motors and stainless steel housings now incur additional duties, elevating overall production costs and pressuring manufacturers to reassess global sourcing strategies. Imported tubing compounds, particularly specialized silicone and rubber blends, also face higher entry barriers, prompting a reevaluation of dependency on offshore suppliers.

In response, many original equipment manufacturers are accelerating domestic partnerships and nearshoring initiatives to mitigate tariff impacts. By qualifying local material producers and establishing assembly operations closer to end-markets, companies can buffer against unpredictable duty fluctuations while shortening lead times. However, this strategic pivot demands rigorous supplier audits, new quality certifications, and initial capital outlays that may strain balance sheets in the short term.

These adjustments are already reshaping competitive dynamics. Organizations that proactively redesign procurement frameworks and invest in regional production capabilities will gain resilience against future tariff escalations. Conversely, firms that maintain the status quo risk margin erosion and inventory bottlenecks. Ultimately, a deep understanding of tariff provisions and agile supply chain models will be indispensable for sustaining profitability in the evolving regulatory environment.

Unraveling Critical Peristaltic Pump Market Segmentation Dimensions from Pump Types to Application Verticals to Inform Strategic Positioning and Growth

The peristaltic pump industry exhibits multifaceted segmentation, each dimension offering strategic avenues for tailored growth. Within pump types, hose pumps deliver robustness suited for abrasive slurries, while tube pumps excel in sterile environments where hygiene is paramount. Component segmentation highlights the critical role of casings in structural integrity, hoses and tubes in fluid compatibility, motors in drive efficiency, and shoe or roller assemblies in operational smoothness.

Material distinctions further refine market positioning. Metal interfaces, such as aluminum and stainless steel, confer desirable strength and corrosion resistance, whereas non-metal options including plastic, rubber, and silicone address lightweight requirements and chemical inertness. Operation types bifurcate into fixed-speed units for simple, continuous processes and variable-speed configurations for nuanced flow control, underpinning both energy management and process flexibility aspirations.

Discharge capacity segmentation addresses diverse pressure demands: below 30 psi for gentle handling of sensitive cells, 30-100 psi for standard fluid transfer, and above 100 psi for high-pressure dosing applications. Distribution channels encompass traditional offline networks for capital-heavy industrial systems and burgeoning online platforms that streamline procurement for smaller end-users. At the application layer, chemical processing spans acid transfer and corrosive liquid pumping, food and beverage includes beverage dispensing and dairy processing among others, medical and pharmaceutical covers bioprocessing and IV fluid delivery, mining and oil and gas focuses on flotation and slurry handling, and water and wastewater treatment addresses chemical dosing and sludge management. This granular segmentation framework empowers stakeholders to align product innovation and marketing strategies with the unique requirements of each niche.

This comprehensive research report categorizes the Peristaltic Pumps market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Pump Type

- Flow Rate

- Pressure Rating

- Operation Type

- Application

- End-User

- Sales Channel

Elucidating Regional Dynamics and Growth Catalysts Influencing Peristaltic Pump Adoption Across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics exert profound influence on peristaltic pump demand patterns and technological adoption. In the Americas, infrastructure renewal projects and stringent environmental regulations are driving demand for reliable sludge processing and chemical dosing solutions. Commercial laboratories across North America are also embracing digitalized pump offerings to support biopharmaceutical pipelines, while Latin American industrial sectors seek cost-effective corrosion-resistant materials to mitigate volatile operating conditions.

In EMEA, regulatory frameworks around hygiene and contamination control sharpen the focus on tube pump deployments in food, pharmaceutical, and life sciences applications. Research-intensive clusters in Western Europe are advancing micro-dosing and lab-scale bioprocessing, fueling demand for precision variable-speed units. Meanwhile, Middle Eastern petrochemical expansions are stimulating appetite for high-pressure hose pumps capable of handling abrasive and viscous slurries under extreme climates.

Asia-Pacific’s growth trajectory is underpinned by rapid urbanization and water-treatment capacity expansions in China and India, which elevate requirements for robust chemical dosing and sludge management equipment. Simultaneously, the region’s manufacturing renaissance, centered in Southeast Asia, catalyzes demand for modular, energy-efficient pump systems that align with renewable energy integration and smart factory initiatives. Collectively, these regional insights enable market participants to prioritize investments and tailor solutions to localized requirements and growth vectors.

This comprehensive research report examines key regions that drive the evolution of the Peristaltic Pumps market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Movements Competitive Positioning and Innovation Investments of Leading Global Players Driving the Peristaltic Pump Industry Forward

Leading companies in the peristaltic pump arena are forging competitive differentiation through targeted innovation, strategic partnerships, and acquisitions. Established specialists have expanded digital offerings by integrating IoT analytics and cloud-based monitoring into their product portfolios, empowering customers with predictive maintenance and remote performance optimization. Others are securing cross-industry alliances to co-develop advanced tubing materials that resist aggressive chemistries and extend service intervals under high-stress conditions.

Several global players have also broadened their geographic footprints through joint ventures and localized manufacturing investments, aligning production capacities with regional demand clusters. This approach not only mitigates tariff exposure but also enables faster delivery and customization for key end-markets. Furthermore, leadership in regulatory compliance has become a badge of credibility-firms that proactively obtain certifications for biopharmaceutical, food-grade, and hazardous fluid handling gain early access to high-value project pipelines.

Innovation trajectories are equally shaped by acquisitions of niche technology startups, particularly those specializing in micro-peristaltic systems for lab automation or novel pump head designs for enhanced flow linearity. By blending established manufacturing scale with cutting-edge capabilities, these combined entities are poised to capture a broader range of applications and accelerate time-to-market for next-generation pumping solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Peristaltic Pumps market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Watson-Marlow Fluid Technology Group by Spirax Group plc.

- Verder International B.V.

- GE HealthCare Technologies Inc.

- Valmet Oyj

- Ingersoll Rand Inc.

- Merck KGaA

- Thermo Fisher Scientific Inc.

- IDEX Corporation

- Antylia Scientific

- Halma PLC

- Erich NETZSCH GmbH & Co. Holding KG

- Gilson, Inc.

- AxFlow Holding AB

- INTEGRA Biosciences AG

- Aalborg Instruments & Controls, Inc.

- Agilent Technologies

- Binaca Pumps

- Biobase Group

- Blue-White Industries, Ltd.

- Changzhou PreFluid Technology Co., Ltd.

- Chongqing Jieheng Peristaltic Pumps Co., Ltd.

- Etatron D.S. S.p.A.

- Fluid-o-Tech S.r.l.

- Graco Inc.

- Heidolph Instruments GmbH & CO. KG

- Kamoer Fluid Tech (Shanghai) Co., Ltd.

- Leefu Industrial Co., Ltd.

- Nanjing Runze Fluid Control Equipment Co., Ltd.

- PCM Group

- ProMinent GmbH

- RAGAZZINI s.r.l

- Randolph Austin Company

- Ravel Hiteks Pvt Ltd.

- Rola-Chem Corporation

- Seko S.p.A.

- Siemens AG

- Takasago Electric, Inc.

- Tapflo AB

- Vector Pump by Wanner Engineering, Inc.

- Welco Co., Ltd.

Proactive Strategies to Bolster Supply Chain Resilience Drive Sustainable Innovation and Capture Emerging Opportunities in the Peristaltic Pump Market

To navigate the evolving peristaltic pump landscape, industry leaders should prioritize supply chain diversification by qualifying alternative domestic and nearshore suppliers for critical components. Such proactive supplier development not only cushions against tariff fluctuations but also shortens lead times, enabling more agile responses to demand shifts. Parallel investments in digital supply chain visibility-leveraging advanced analytics and blockchain validation-will further strengthen procurement resilience and cost control.

Innovation roadmaps should target the development of energy-efficient drives and next-generation tubing compounds that balance chemical resistance with environmental sustainability. Collaborations with material science partners can unlock recyclable or biodegradable formulations, reinforcing corporate sustainability commitments while addressing tightening regulatory requirements. Additionally, embedding smart sensors for real-time flow and wear monitoring can transform service offerings into value-added subscription models, enhancing customer loyalty and recurring revenue streams.

Finally, regional market entry strategies must reflect localized end-user priorities. Organizations should invest in application-specific pilot projects, demonstrating pump performance in targeted sectors such as acid transfer in chemical plants or bioprocessing in contract development manufacturing. By coupling technical validation with consultative sales approaches, leaders can accelerate adoption curves and fortify their positions against emerging disruptors.

Detailing a Robust Research Methodology Integrating Primary Interviews Secondary Data Analysis and Quantitative Modeling to Deliver Credible Industry Insights

This research integrates a robust methodology combining qualitative insights from in-depth interviews with pump manufacturers, material suppliers, and end-user engineering teams, alongside comprehensive secondary data analysis of industry publications, patent filings, and regulatory filings. Primary interviews provided granular perspectives on emerging technological requirements, tariff mitigation tactics, and regional deployment challenges, while secondary sources offered context on global trade policies and materials advancements.

Quantitative modeling underpins the analysis of cost impacts and adoption scenarios across diverse segmentation dimensions. Data triangulation techniques ensure consistency between interview findings and documented trends, enhancing the credibility of thematic conclusions. Statistical validation of survey responses and empirical case studies further reinforce the reliability of key insights, mitigating bias and enabling nuanced understanding of market drivers.

By blending these methodological pillars, the study delivers an authoritative foundation for strategic decision-making, equipping stakeholders with clear line-of-sight into technological trajectories, supply chain strategies, and regional demand dynamics shaping the peristaltic pump industry.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Peristaltic Pumps market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Peristaltic Pumps Market, by Pump Type

- Peristaltic Pumps Market, by Flow Rate

- Peristaltic Pumps Market, by Pressure Rating

- Peristaltic Pumps Market, by Operation Type

- Peristaltic Pumps Market, by Application

- Peristaltic Pumps Market, by End-User

- Peristaltic Pumps Market, by Sales Channel

- Peristaltic Pumps Market, by Region

- Peristaltic Pumps Market, by Group

- Peristaltic Pumps Market, by Country

- United States Peristaltic Pumps Market

- China Peristaltic Pumps Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1431 ]

Concluding Insights Reinforcing Strategic Imperatives and Highlighting Critical Opportunities Shaping the Future Trajectory of the Peristaltic Pump Industry

The peristaltic pump market stands at the intersection of technological innovation, regulatory shifts, and geopolitical complexity. Digital advancements and novel materials are broadening application horizons, while tariff realignments and regional investment patterns are recalibrating supply chain strategies. In this dynamic environment, companies that embrace agility-through diversified sourcing, modular product designs, and smart offering frameworks-will unlock competitive advantage.

Equally, success hinges on an intimate understanding of segmentation nuances, from the distinctions between hose and tube pump performance to the specialized demands of corrosive chemical handling or sterile pharmaceutical processes. Targeted innovations that address specific pressure ranges or deployment channels will resonate more deeply with end users and drive sustainable growth.

As market boundaries continue to expand, industry participants must maintain a forward-looking posture, aligning research and development investments with evolving customer expectations and regulatory mandates. By leveraging the insights herein, executives can refine their strategic roadmaps and capture the most compelling opportunities that lie ahead.

Access Exclusive Peristaltic Pump Market Research and Engage with Ketan Rohom Associate Director Sales Marketing to Propel Your Strategy Today

Unlock unparalleled insights into the peristaltic pump sector and propel your strategic initiatives forward by partnering with Ketan Rohom, Associate Director of Sales & Marketing. Gain access to in-depth analysis of technological innovations, supply chain resilience strategies, and regional growth drivers that will empower you to outmaneuver competitors. By leveraging this comprehensive research, you will be equipped to make data-backed investment decisions, prioritize product development initiatives, and optimize market entry tactics tailored to the nuanced demands of end users.

Engage directly with Ketan Rohom to personalize the report’s findings for your organization’s goals, ensuring that you capture the most critical opportunities in an evolving trade and regulatory environment. Seize the moment to translate high-level intelligence into actionable plans that secure your leadership position in this dynamic marketplace.

- How big is the Peristaltic Pumps Market?

- What is the Peristaltic Pumps Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?