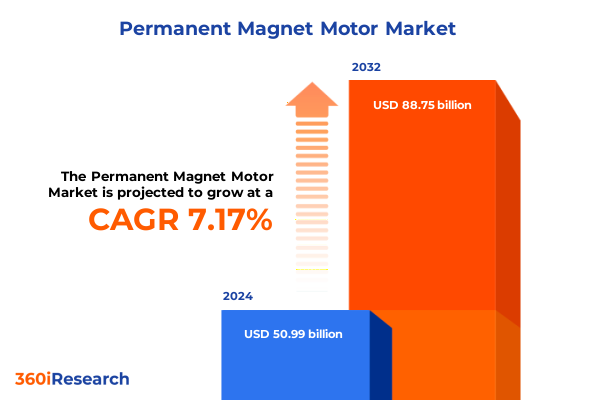

The Permanent Magnet Motor Market size was estimated at USD 54.45 billion in 2025 and expected to reach USD 58.15 billion in 2026, at a CAGR of 7.22% to reach USD 88.75 billion by 2032.

Unveiling the strategic significance and foundational principles shaping the permanent magnet motor industry’s growth trajectory across global markets

The rapid acceleration in global electrification efforts has elevated permanent magnet motors from niche components to critical enablers of next-generation industrial, automotive, and consumer technologies. Against a backdrop of tightening energy-efficiency regulations, the intrinsic high torque density, compact form factor, and superior efficiency of permanent magnet motors position them as indispensable solutions across high-performance applications. This introduction sets the stage by articulating the strategic importance of permanent magnet motors within the broader drive toward reducing carbon footprints, optimizing energy consumption, and unlocking new performance frontiers.

Moreover, increasing pressure on original equipment manufacturers (OEMs) to deliver lighter, more efficient, and cost-competitive products has intensified innovation in motor design, materials, and manufacturing techniques. From breakthroughs in rare-earth magnet formulations to advances in additive manufacturing, the permanent magnet motor sector is undergoing a fundamental transformation. By understanding key drivers such as regulatory imperatives, competitive differentiation, and evolving end-user requirements, stakeholders can anticipate forthcoming market shifts and align their R&D, production, and market strategies accordingly.

By outlining the foundational principles of permanent magnet motor technology, including the interplay of magnet materials, rotor-stator interactions, and cooling methodologies, this introduction provides a clear framework for comprehending subsequent sections. With this context in place, readers will be equipped to navigate the complex landscape of technological evolutions, policy changes, and strategic initiatives that define today’s permanent magnet motor market.

Examining the pivotal technological breakthroughs operational shifts and policy dynamics driving transformative changes within the permanent magnet motor ecosystem worldwide

Technological innovations are redefining the permanent magnet motor landscape by enabling unprecedented levels of performance, reliability, and customization. Breakthroughs in magnet composition, notably low-cobalt and cobalt-free rare-earth alloys, are reducing material dependence and price volatility while enhancing magnetic flux density. Concurrently, advances in additive manufacturing techniques are facilitating complex geometries that optimize thermal management and reduce weight, driving a new generation of high-efficiency, high-power motors.

In parallel, the integration of sophisticated power electronics and digital control systems is transforming how permanent magnet motors are operated and monitored. Real-time analytics, predictive maintenance algorithms, and IoT-enabled sensors are extending service life, minimizing downtime, and enabling adaptive torque control in critical applications. Furthermore, collaborative efforts between materials scientists, power electronics specialists, and system integrators are converging to deliver motor-inverter assemblies tailored for electric vehicles, industrial robots, and aerospace platforms.

Policy developments, including stringent efficiency mandates and decarbonization targets, have catalyzed investments in research and infrastructure. As a result, strategic alliances among academic institutions, research consortia, and leading industrial players are proliferating. These alliances aim to accelerate commercialization of next-generation permanent magnet motor architectures while addressing challenges such as supply chain sustainability and end-of-life recyclability. The combined effect of these transformative shifts is a rapidly evolving ecosystem that demands agile strategy and continuous innovation.

Assessing the cascading effects of recent United States tariff measures on the permanent magnet motor supply chain production costs and international competitive landscape

The imposition of new tariffs by the United States in early 2025 has introduced significant headwinds to the permanent magnet motor supply chain and cost structure. By targeting imported rare-earth elements, steel laminations, and critical electronic components, these duties have elevated input costs by an estimated 7 to 12 percent, prompting upstream suppliers and OEMs to reassess sourcing strategies. Furthermore, the uncertainty around potential expansion of tariff scopes has intensified supply chain risk management efforts and encouraged the exploration of domestic manufacturing incentives.

As a ripple effect, manufacturers have accelerated the qualification of alternative suppliers in allied regions, forging partnerships with producers in Asia-Pacific markets outside China and in Europe. These collaborations seek to mitigate dependency on a single source and to leverage regional capabilities in magnet recycling, precision stamping, and advanced coating applications. However, supply diversification initiatives can introduce quality variation and logistical complexity, underscoring the need for rigorous vendor assessment and contingency planning.

Looking beyond immediate cost implications, the tariffs have stimulated dialogue on regional onshoring and vertical integration, with leading OEMs investigating joint ventures and greenfield facilities to secure critical materials and components. In addition, concurrent policy incentives, such as tax credits for domestic rare-earth processing and grants for sustainable material research, are influencing the long-term strategic calculus. The net impact is a more resilient, albeit more complex, supply chain architecture reshaped by tariff-driven imperatives and complementary industrial policies.

Deriving critical insights from comprehensive segmentation analysis encompassing motor types voltage tiers phase configurations cooling methods and application domains

A nuanced understanding of permanent magnet motor applications emerges through a multidimensional segmentation framework that examines design, performance envelope, system topology, cooling methodology, and use cases. When segmenting the market by motor type, the study examines axial flux motors known for their high power density, brushless DC motors prized for efficiency across variable loads, external rotor motors offering integrated cooling surface area, and synchronous machine designs delivering precise speed control. Voltage tier analysis further reveals distinct technical requirements and compliance considerations across high voltage systems exceeding 6000 volts, medium voltage frameworks between 1000 and 6000 volts, and low voltage architectures below 1000 volts.

Phase configuration distinctions between single-phase arrangements and three-phase systems highlight compatibility with residential and industrial power grids, respectively. In terms of thermal management, air-cooled designs dominate cost-sensitive segments, whereas liquid-cooled variants are preferred for high-power applications demanding tight temperature control. The breadth of application domains spans critical aerospace and defense platforms, automotive propulsion across electric, hybrid, and internal combustion vehicles, energy-efficient consumer electronics, industrial machinery applications such as conveyors, machine tools, pumps and compressors, and robotics, as well as precision-dependent medical equipment.

This granular lens allows stakeholders to align product portfolios, R&D investments, and go-to-market strategies with specific performance requirements and end-user expectations. By weaving together these segmentation dimensions, companies can identify underserved niches, optimize cost structures, and anticipate emerging application trends with greater clarity.

This comprehensive research report categorizes the Permanent Magnet Motor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Motor Type

- Voltage Range

- Phase

- Cooling Method

- Magnet Type

- Application

Uncovering the distinct market characteristics regional demands and growth trajectories across Americas Europe Middle East Africa and Asia-Pacific territories

Regional dynamics in the permanent magnet motor market are shaped by a confluence of regulatory environments, industrial strengths, and infrastructure maturity. The Americas region exhibits robust adoption driven by automotive electrification initiatives, renewable energy integration projects, and government incentives for domestic manufacturing. North American OEMs collaborate closely with research institutions to develop tailored motor solutions for electric vehicles and aerospace applications, while Latin American hubs focus on mining and industrial machinery deployments to improve energy efficiency.

Across Europe, Middle East, and Africa, stringent emissions regulations and sustainability goals have catalyzed demand for high-performance permanent magnet motors in both mobility and industrial segments. European countries leverage established automotive and manufacturing clusters to pilot next-generation motor architectures, whereas select Middle Eastern markets invest in megaprojects targeting smart city infrastructures. In Africa, while early-stage electrification presents challenges, partnerships with international developers are fostering opportunities for applications in off-grid power generation and water treatment systems.

The Asia-Pacific region continues to lead in production capacity, research output, and innovation velocity. Major players in East Asia dominate rare-earth refining, precision magnet manufacturing, and motor assembly, while South Asian and Southeast Asian markets experience accelerated uptake in consumer electronics and two-wheeler electric mobility. Government-driven initiatives in countries such as Japan, South Korea, and India promote domestic R&D investment and supply chain localization, reinforcing the region’s pivotal role in shaping global permanent magnet motor trends.

This comprehensive research report examines key regions that drive the evolution of the Permanent Magnet Motor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting leading industry stakeholders and their strategic initiatives technological innovations and collaborative ventures shaping the permanent magnet motor competitive arena

The competitive landscape of permanent magnet motors is characterized by a blend of established multinational conglomerates and innovative specialized suppliers. Industry pioneers invest heavily in proprietary magnet materials, precision manufacturing equipment, and digital integration capabilities, striving to deliver products that meet increasingly rigorous performance and sustainability criteria. These leading stakeholders also form strategic alliances with technology partners, universities, and government research agencies to co-develop solutions that address emergent challenges such as rare-earth scarcity and thermal management.

In addition to organic research and development, mergers, acquisitions, and joint ventures are prominent tactics deployed to enhance vertical integration. By securing upstream raw material supplies, optimizing stamping and winding operations, and consolidating power electronics expertise, companies aim to capture greater value across the motor assembly lifecycle. Strategic partnerships with automotive OEMs, renewable energy developers, and industrial automation firms further enable customized motor-drive offerings that differentiate in performance, reliability, and total cost of ownership.

Meanwhile, a growing cadre of agile, technology-focused entrants is carving out niche positions through modular product architectures and digital services. These challengers leverage software-defined control platforms, cloud-based analytics, and flexible manufacturing processes to accelerate time-to-market and deliver bespoke solutions at scale. The interplay between incumbent scale advantages and startup agility is driving a dynamic competitive equilibrium, compelling all players to refine value propositions and invest in continuous innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Permanent Magnet Motor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Allied Motion Technologies Inc.

- AMETEK, Inc.

- Arnold Magnetic Technologies Corporation

- Bonfiglioli Riduttori S.p.A.

- Comer S.r.l.

- Franklin Electric Co., Inc.

- Hitachi Industrial Products, Ltd.

- Jeumont Electric

- Johnson Electric Holdings Limited

- Maxon Motor AG

- Meidensha Corporation

- Mitsubishi Electric Corporation

- Nidec Corporation

- NMB Technologies Corporation

- Oriental Motor Co., Ltd.

- Parker-Hannifin Corporation

- Regal Rexnord Corporation

- Robert Bosch GmbH

- Schneider Electric SE

- Siemens AG

- Sumitomo Electric Industries, Ltd.

- TDK Corporation

- TECO Electric & Machinery Co., Ltd.

- Toshiba Corporation

- TOYO DENKI SEIZO K.K.

- WEG SA

- Yaskawa Electric Corporation

Proposing actionable strategies and practical roadmaps for industry leaders to navigate evolving market dynamics regulatory shifts and technological disruptions effectively

Industry leaders seeking to capitalize on the evolving permanent magnet motor market should prioritize strategic diversification of supply chains to mitigate recent tariff-induced disruptions and raw material volatility. By establishing qualifying processes for alternate magnet producers and forging collaborative agreements with recycling partners, companies can secure more resilient input streams while advancing circular economy objectives. In parallel, investing in next-generation magnet materials research and co-development programs will strengthen product roadmaps and foster differentiation in performance metrics.

Additionally, organizations should expand capabilities in power electronics integration and digital control systems to deliver holistic motor-drive solutions. This entails partnering with semiconductor suppliers and software developers to embed real-time monitoring, predictive maintenance, and adaptive torque control functionalities. Strengthening cross-disciplinary teams that bridge materials science, electronics engineering, and data analytics will enable faster development cycles and more robust intellectual property portfolios.

Finally, proactive engagement with regulatory bodies and industry consortia is essential to shape emerging standards and secure early access to incentive programs. Executives must cultivate talent networks specialized in sustainable manufacturing, magnet recycling, and advanced thermal management to support long-term innovation. By adopting a holistic approach that combines supply chain resilience, technological leadership, and regulatory foresight, industry leaders will be well-positioned to navigate disruption and capture growth opportunities.

Outlining the rigorous research design methodologies data collection approaches and analytical frameworks underpinning the permanent magnet motor study’s credibility and depth

The research underpinning this permanent magnet motor analysis integrates primary and secondary methodologies to ensure rigor, credibility, and comprehensive coverage. Primary data was collected through structured interviews with motor OEM executives, materials suppliers, power electronics manufacturers, and end-user engineers, providing direct insight into emerging needs, technology roadmaps, and procurement challenges. These interviews were complemented by targeted surveys capturing quantitative feedback on design preferences, cost drivers, and performance benchmarks across key application sectors.

Secondary research drew upon an extensive review of patent filings, academic journals, industry white papers, regulatory filings, and trade publications. Emphasis was placed on sourcing information from leading technical conferences, standards bodies, and government reports to validate technological trends and policy impacts. A multi-stage data triangulation process reconciled primary inputs with published market intelligence and case studies, enhancing the depth and reliability of conclusions.

Analytical frameworks employed include SWOT assessments, competitive benchmarking, and scenario analyses to model potential pathways for supply chain evolution and technology adoption. Quality control measures, such as data validation workshops with subject matter experts and peer review of key findings, ensured methodological integrity. This robust research design delivers a balanced and actionable perspective that informs strategic decisions at every level of the permanent magnet motor value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Permanent Magnet Motor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Permanent Magnet Motor Market, by Motor Type

- Permanent Magnet Motor Market, by Voltage Range

- Permanent Magnet Motor Market, by Phase

- Permanent Magnet Motor Market, by Cooling Method

- Permanent Magnet Motor Market, by Magnet Type

- Permanent Magnet Motor Market, by Application

- Permanent Magnet Motor Market, by Region

- Permanent Magnet Motor Market, by Group

- Permanent Magnet Motor Market, by Country

- United States Permanent Magnet Motor Market

- China Permanent Magnet Motor Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding reflections on critical industry trends emerging challenges and long term strategic imperatives poised to influence the structural evolution of permanent magnet motor markets

As the permanent magnet motor industry accelerates toward widespread electrification, critical trends are converging to reshape competitive dynamics and innovation agendas. Decarbonization mandates and consumer demand for cleaner mobility continue to drive sustained investment in high-efficiency motor architectures, while advancements in magnet material sciences and additive manufacturing unlock performance ceilings once thought unattainable. Moreover, digitalization of motor control and condition monitoring is becoming a table-stakes capability, enabling predictive maintenance and operational flexibility across diverse applications.

Emerging challenges, including raw material supply constraints, tariff-induced cost pressures, and the need for end-of-life magnet recycling, underscore the importance of strategic agility. Organizations that proactively diversify sourcing, invest in sustainable materials, and engage in cross-industry partnerships will be best positioned to thrive. Meanwhile, the growing prominence of modular, software-defined motor platforms suggests a shift toward ecosystems where hardware commoditization and value-added services coexist symbiotically.

In summary, the path forward for permanent magnet motor stakeholders involves harmonizing technology leadership with supply chain resilience and regulatory engagement. Firms that align their innovation pipelines, talent strategies, and alliance networks to these imperatives stand to unlock considerable competitive advantages while contributing to broader energy efficiency and sustainability goals.

Connect directly with Ketan Rohom Associate Director Sales Marketing to secure the full permanent magnet motor market research report and tailored insights today

To gain a comprehensive understanding of the competitive dynamics, technological innovations, and strategic imperatives shaping the permanent magnet motor landscape, you are invited to contact Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. By engaging directly with Ketan Rohom, you will receive personalized guidance on how this in-depth research can inform your strategic planning, product development, and investment decisions.

Our permanent magnet motor market research report delivers actionable intelligence on emerging applications, regulatory shifts, and supply chain strategies to drive growth and sustain competitive advantage. Reach out today to secure your copy, explore customized data packages, and discuss tailored consulting services. Don’t miss the opportunity to leverage expert insights and detailed analysis that will empower your organization to navigate the evolving energy-efficient motor ecosystem with confidence.

- How big is the Permanent Magnet Motor Market?

- What is the Permanent Magnet Motor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?