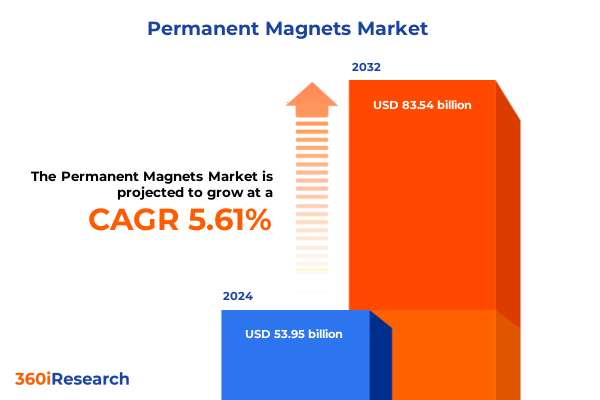

The Permanent Magnets Market size was estimated at USD 56.76 billion in 2025 and expected to reach USD 59.79 billion in 2026, at a CAGR of 5.67% to reach USD 83.54 billion by 2032.

Comprehensive Overview of Global Permanent Magnet Dynamics Highlighting Core Drivers Market Evolution and Strategic Imperatives for Stakeholders

In recent years, the global permanent magnet sector has become a cornerstone of advanced industries, from electric vehicles and renewable energy systems to consumer electronics and defense applications. Electrification initiatives and clean energy mandates across major economies have accelerated demand for high-performance magnetic materials, while geopolitical tensions and supply chain vulnerabilities have prompted a strategic reevaluation of sourcing strategies. As a result, stakeholders are now prioritizing supply security, technological innovation, and sustainable practices to maintain competitive positioning and address critical material dependencies.

Alongside these drivers, the miniaturization trend in electronics and the proliferation of the Internet of Things have heightened the need for specialized, high-flux magnet solutions, challenging manufacturers to push the boundaries of material science. Artificial intelligence and machine learning are increasingly integrated into production processes, enabling real-time optimization of raw material blends and predictive maintenance protocols-factors that collectively enhance yield and quality control.

Looking forward, the interplay of government incentives, technological breakthroughs, and demand from emerging applications will shape the permanent magnet narrative through 2025 and beyond. Understanding these multidimensional forces is essential for decision-makers seeking to capitalize on growth levers, mitigate risks, and align investment strategies with industry evolution.

Exploring the Transformative Technological Innovations Supply Chain Realignments and Sustainable Practices Reshaping the Permanent Magnet Landscape

Over the past 24 months, the permanent magnet landscape has undergone profound transformation driven by supply chain realignments, material science advancements, and sustainability mandates. Western governments have actively funded domestic rare earth processing facilities to reduce dependence on China, reshaping global value chains; for instance, Australia-based Lynas Rare Earths and industrial magnets specialist Vacuumschmelze are establishing production sites in North America and Europe under public-private partnerships.

Simultaneously, research institutions and manufacturers are pioneering novel composite magnets and coatings that enhance thermal stability and coercivity, while reducing reliance on critical heavy rare earth elements. High-flux soft magnetic composites now rival traditional neodymium-iron-boron grades in select high-frequency applications, illustrating a shift toward hybrid solutions that balance performance, cost, and supply security.

Environmental and circular economy considerations have also taken center stage: recycling of end-of-life magnets is gaining momentum to reclaim neodymium, praseodymium, and dysprosium, thereby alleviating material shortages and curbing ecological impacts. These collective shifts not only underscore the sector’s rapid pace of innovation but also highlight the strategic imperative to adopt integrated, resilient approaches across the magnet lifecycle.

Analyzing the Cumulative Consequences of United States Tariff Measures on Permanent Magnets Supply Chains Manufacturing Costs and Strategic Sourcing

The United States’ evolving tariff regime in 2025 has significantly impacted permanent magnet sourcing costs and strategic manufacturing decisions. Following a 90-day trade truce with China, U.S. tariffs on imported magnets now comprise a 20% fentanyl-related levy, a 10% universal surcharge, and the base Harmonized Tariff Schedule duty of 2.1%, resulting in an aggregate rate of approximately 32.1%. This temporary reduction has provided short-term relief yet underscored volatility in duty structures that complicate long-term planning.

Moreover, China’s export restrictions on rare earth alloys in April 2025 precipitated an 18.9% year-on-year decline in rare earth magnet shipments during the first half of the year, before a 660% rebound in June, illustrating the unpredictable interplay of export controls and U.S. tariff adjustments. Such fluctuations have driven non-Chinese automakers and wind turbine OEMs to seek diversified suppliers and local production partners to mitigate supply disruptions.

Concurrently, anti-dumping and countervailing duty orders on raw flexible magnets from China and Taiwan were upheld in a five-year USITC sunset review, reinforcing existing trade remedies and signaling continued enforcement of trade-defense measures. Collectively, these tariff and trade policy developments have prompted companies to reassess global sourcing strategies, invest in domestic capacity, and incorporate duty forecasting into supply chain optimization.

Unveiling Key Segment Dynamics Across Material Types Manufacturing Processes Application Verticals and Operating Temperatures to Unlock Sector Potential

The permanent magnet market can be dissected through multiple dimensions to uncover nuanced opportunities and challenges. Material type segmentation reveals a spectrum ranging from legacy Alnico alloys to ubiquitous ferrite grades-categorized into hard and soft variants for cost-sensitive applications-to advanced neodymium-iron-boron compounds available in bonded and sintered forms that deliver superior energy density. High-performance samarium-cobalt magnets, differentiated as SmCo 32 and SmCo 33, offer exceptional thermal stability, while flexible magnets provide bespoke form factors for niche use cases.

Distinguishing manufacturing processes underscores the trade-offs between bonded techniques, which support intricate geometries and reduced material waste, and sintered approaches that yield the highest magnetic flux for critical applications. Application-centric analysis further illustrates the diversity of end-use sectors-from guidance systems and satellites in aerospace and defense to electric vehicle traction motors, infotainment screens, and safety sensors in automotive; from consumer electronics devices such as smartphones, televisions, and wearables to healthcare instruments-including diagnostic imagery and implantable devices; as well as robotic actuators, electric motors, and sensors within industrial equipment and solar tracking assemblies and wind turbines in the renewable energy domain.

Finally, operating temperature classification-standard, high, and ultra-high-directs material selection based on service conditions, guiding product designers as they navigate performance thresholds across diverse environments. This elaborate segmentation framework equips stakeholders with an analytical lens to target investments, tailor product portfolios, and align R&D priorities with shifting demand profiles.

This comprehensive research report categorizes the Permanent Magnets market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Manufacturing Process

- Product Form

- End Use Application

- Distribution Channel

Gaining Strategic Advantage by Understanding Regional Dynamics Across the Americas Europe Middle East Africa and Asia Pacific Permanent Magnet Ecosystems

Regional market dynamics have evolved into critical determinants of competitive advantage. In the Americas, government funding and tax incentives underpin the emergence of a nascent domestic supply chain, with companies like MP Materials spearheading integrated rare earth magnet production in Texas and California, bolstered by a Department of Defense price-floor guarantee for neodymium-praseodymium.

Across Europe, the Middle East, and Africa, the European Union’s Critical Raw Materials Act and national circular economy directives are catalyzing recycling initiatives and strategic stockpiling of magnet compounds, while Middle Eastern and African nations explore rare earth mining projects to join the value chain.

In Asia-Pacific, China’s historical dominance-illustrated by its rapid export recovery after April restrictions-continues to shape global pricing and availability, even as Japan, South Korea, and Australia invest in refining capacities and collaborative R&D consortia. This regional mosaic underscores the importance of aligning sourcing strategies and partnership models with localized policy incentives and infrastructure developments.

This comprehensive research report examines key regions that drive the evolution of the Permanent Magnets market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Influential Industry Players Advancements and Strategies Driving Competitive Differentiation in the Global Permanent Magnet Sector

Key market participants are driving the evolution of the permanent magnet ecosystem through diverse strategic approaches. Global incumbents such as Lynas Rare Earths, Solvay, Vacuumschmelze, Less Common Metals, REEtec, Iluka Resources, Posco International, Shin-Etsu Chemical, TDK, and Neo Performance Materials are investing in capacity expansions, new processing plants, and vertical integration to secure feedstock and magnet assembly operations across multiple regions.

Meanwhile, U.S.-based pioneer MP Materials has transitioned from mine operator to fully integrated producer, commencing commercial NdPr metal output and trial sintered NdFeB magnet production at its Independence facility in Fort Worth, with first deliveries scheduled for late 2025. This milestone marks the first large-scale domestic magnet manufacturing capability in decades, positioning MP as a linchpin of national security and electrification supply chains.

In parallel, innovators are leveraging AI-driven process controls and advanced material design collaborations to optimize magnetic properties while reducing rare earth content, thus differentiating product portfolios and fortifying competitive positioning in high-growth application segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Permanent Magnets market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adams Magnetic Products, LLC

- Advanced Technology & Materials Co., Ltd.

- AIC Magnetics Ltd.

- Allstar Magnetics, LLC

- Arnold Magnetic Technologies Corporation

- BGRIMM Magnetic Materials and Technology Co. Limited

- Bunting Magnetics Co.

- Chengudu Galaxy Magnets Co. Ltd.

- CJ-Magnet

- Daido Steel Co., Ltd.

- Dexter Magnetic Technologies

- Earth Panda Advance Magnetic Material Co. Ltd

- Eclipse Magnetics

- Electron Energy Corporation

- GKN Powder Metallurgy Engineering GMBH

- Goudsmit Magnetics

- Hangzhou Permanent Magnet Group

- Hitachi Metals, Ltd.

- Integrated Magnetics

- JFE Steel Corporation

- JPMF Guangdong Co., Ltd.

- Lynas Corporation Ltd.

- Magnequench

- Master Magnetics, Inc.

- Ningbo Jintian Copper Group

- Ningbo Ketian Magnet Co., Ltd.

- Ningbo Yunsheng Co. Ltd.

- Ningbo Yunsheng Co., Ltd.

- Proterial, Ltd.

- SDM Magnetics Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Showa Denko Materials Co., Ltd.

- Stanford Magnets

- TDK Corporation

- Thomas & Skinner, Inc.

- Toshiba Materials Co. Ltd.

- Vacuumschmelze GmbH & Co. KG

- VACUUMSCHMELZE GmbH & Co. KG

- Yantai Dongxing Magnetic Materials Inc.

- Yantai Shougang Magnetic Materials Inc.

- ZheJiang Stilwell Electronics Co.,LTD

Actionable Insights and Strategic Recommendations to Navigate Supply Chain Challenges Technological Shifts Regulatory Impacts and Market Opportunities

Industry leaders should prioritize diversified sourcing by establishing multi-geographic procurement channels and forging alliances with alternative rare earth suppliers, thereby mitigating exposure to unilateral export restrictions. Investing in domestic production capacity and recycling infrastructure will not only insulate against tariff fluctuations but also align with emerging sustainability regulations.

In parallel, allocating R&D resources toward alternative magnetic materials, hybrid composite formulations, and AI-enabled manufacturing processes can unlock cost efficiencies and performance gains. Engaging proactively with policy makers to shape balanced trade and environmental frameworks-while leveraging government incentives such as tax credits and defense-backed price floors-will enable firms to secure strategic advantages in a dynamic regulatory environment.

Finally, integrating full-lifecycle assessments and predictive analytics into product development cycles will enhance agility, inform risk mitigation strategies, and empower decision-makers to capitalize on nascent applications in sectors ranging from robotics to grid-scale energy solutions.

Detailed Research Methodology Emphasizing Robust Data Sources Analytical Approaches Validation Techniques and Quality Assurance Protocols

This study employs a rigorous mixed-methodology framework, combining primary interviews with C-suite executives, procurement managers, and technical specialists across the magnet supply chain with secondary research drawn from reputable news agencies, government publications, industry white papers, and peer-reviewed journals. Data points were cross-validated through triangulation to ensure consistency and reliability.

Quantitative analyses leveraged both top-down and bottom-up modeling techniques, dissecting material flows, cost components, and tariff impacts, while qualitative assessments focused on strategic behaviors, technology roadmaps, and regulatory developments. The research team adhered to stringent quality assurance protocols, including iterative review cycles and methodological audits, to guarantee the accuracy and integrity of all findings and insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Permanent Magnets market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Permanent Magnets Market, by Material Type

- Permanent Magnets Market, by Manufacturing Process

- Permanent Magnets Market, by Product Form

- Permanent Magnets Market, by End Use Application

- Permanent Magnets Market, by Distribution Channel

- Permanent Magnets Market, by Region

- Permanent Magnets Market, by Group

- Permanent Magnets Market, by Country

- United States Permanent Magnets Market

- China Permanent Magnets Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Conclusive Perspectives on Industry Evolution Emerging Trends and Strategic Imperatives Guiding Stakeholder Decisions in the Permanent Magnet Domain

Throughout this executive summary, we have traced the intricate interplay of technological innovation, geopolitical dynamics, and regulatory frameworks shaping the permanent magnet industry. From supply chain realignment and recycled material integration to tariff volatility and regional policy incentives, stakeholders must navigate a landscape defined by both disruptive challenges and catalytic opportunities.

The imperative for resilient, sustainable, and forward-looking strategies has never been greater, as market participants contend with competing forces-from the burgeoning electrification wave to circular economy mandates and material security considerations. By harnessing the segmentation insights, regional analyses, and company benchmarks presented here, decision-makers can chart a course toward enhanced competitiveness and long-term value creation.

In conclusion, the permanent magnet sector stands at a pivotal juncture, where targeted investments in technology, diversification of supply, and proactive engagement with policy architects will distinguish industry leaders from followers.

Take Definitive Action to Secure Your Competitive Edge and Engage with Ketan Rohom for the Comprehensive Permanent Magnet Market Research Report

To secure your strategic roadmap and gain a competitive edge in the evolving permanent magnet landscape, reach out to Ketan Rohom, Associate Director, Sales & Marketing, who can provide immediate access to the full market research report. Leveraging in-depth analysis, data-driven insights, and expert recommendations, this comprehensive study equips stakeholders with the intelligence required to navigate supply chain complexities, master technological shifts, and capitalize on emerging opportunities. Engage with Ketan Rohom today to discuss bespoke licensing options, customized data packages, and hands-on support tailored to your organizational objectives, ensuring you stay ahead in the dynamic permanent magnet domain.

- How big is the Permanent Magnets Market?

- What is the Permanent Magnets Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?