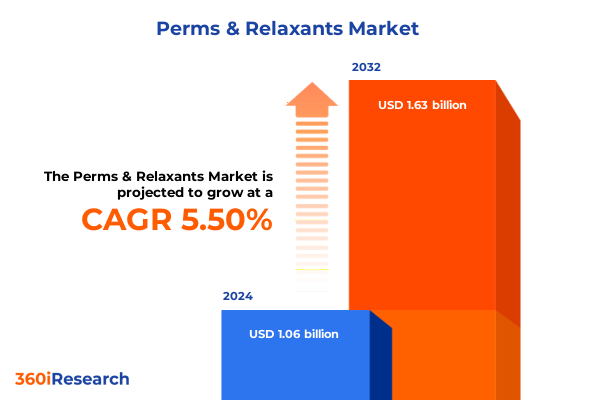

The Perms & Relaxants Market size was estimated at USD 1.12 billion in 2025 and expected to reach USD 1.18 billion in 2026, at a CAGR of 5.50% to reach USD 1.63 billion by 2032.

Introduction to the rapidly evolving global perms and relaxants sector shaped by shifting consumer preferences for personalized hair texture, technological advances, and regulatory landscapes

The evolving haircare industry continues to elevate perms and relaxants from mere styling utilities to powerful tools of self-expression and identity. Once regarded as niche salon services, these chemical treatments have now become pivotal offerings in both professional and at-home settings, reflecting broader shifts in consumer attitudes toward personalization and hair health. As individuals prioritize texture diversity-from defined curls to uniform straightening-perms and relaxants have become central to daily styling routines and salon service menus.

Against this backdrop, this research initiative seeks to uncover the forces shaping the perms and relaxants landscape, examining currents of innovation, regulatory developments, and evolving consumer demands. By delving into product portfolios, go-to-market strategies, and formulation advancements, the study provides an integrated view of how market participants are navigating complexity while delivering superior experiences and results.

Insights drawn from extensive primary and secondary research will equip stakeholders with a nuanced understanding of emerging opportunities and potential blind spots. Whether planning new product launches, refining distribution tactics, or calibrating ingredient sourcing, decision-makers will find actionable intelligence to inform strategic roadmaps and ensure enduring relevance in a rapidly shifting marketplace.

Uncovering transformative shifts redefining the perms and relaxants market as consumer values, digital innovation, sustainability priorities, and salon experiences converge

Recent years have witnessed transformative shifts across the perms and relaxants market, driven by converging consumer, technological, and environmental imperatives. Consumers are increasingly drawn to gentle, ammonia-free formulations and clean-beauty ingredients, prompting manufacturers to revisit core chemistries and invest heavily in research of botanical derivatives. Consequently, product pipelines now feature hybrid systems that promise enhanced curl retention or smoothing performance without compromising hair integrity.

Parallel to these formulation breakthroughs, digital transformation has redefined how brands engage with end users and professionals alike. Online tutorials and social media platforms have propelled DIY treatments into mainstream culture, even as professional salons adopt augmented reality tools to visualize potential outcomes. This seamless blending of digital and physical experiences has heightened consumer expectations for personalization and educational support at every stage of the purchase journey.

Sustainability has emerged as a third pivotal force, with growing scrutiny on packaging waste, water usage, and carbon footprints. Companies are responding by piloting refill stations and recyclable packaging, reengineering supply chains, and embracing renewable energy in manufacturing facilities. As these three forces-ingredient innovation, omnichannel engagement, and sustainability priorities-continue to converge, they will fundamentally redefine competitive dynamics and accelerate the emergence of next-generation perms and relaxants offerings.

Assessing the cumulative impact of the United States’ 2025 tariff measures on chemical inputs and finished formulations within the perms and relaxants market

In January 2025, new U.S. tariff measures targeting a broad array of chemical inputs and finished cosmetic formulations were implemented, marking a significant inflection point for the perms and relaxants sector. These duties, levied primarily on certain imported thioglycolates, stabilizers, and processing additives, introduced heightened cost pressures across global supply chains. Ingredient costs rose sharply, compelling manufacturers to evaluate alternative sourcing strategies and accelerate in-house production capabilities.

In response, many brands initiated formulation reviews to identify domestically available substitutes without sacrificing performance or compliance. This shift drove closer collaboration between R&D teams and raw material suppliers, as companies sought to secure multi-tiered sourcing agreements that would insulate operations from further tariff volatility. Despite these efforts, certain niche ingredients remained constrained, leading to temporary production bottlenecks and backlogs in professional salon channels.

Over the longer term, the tariff landscape has spurred innovation in both product design and procurement practices. Forward-thinking organizations are investing in vertically integrated facilities to bring production onshore, while others have formed strategic partnerships with regional chemical manufacturers in Europe and Asia to diversify risk. As the industry adapts to this new economic reality, cost efficiency, supply chain resilience, and agile formulation capabilities will become indispensable competitive differentiators.

Unveiling critical segmentation insights illuminating market dynamics across product types, distribution channels, end users, formats, applications, and price tiers

Examining product-type segmentation reveals that the market bifurcates into perms and relaxants, each with distinct formulation matrices. Within perms, the rise of acid-based systems has catered to fine or damaged hair types, while alkaline variants continue to dominate traditional salon offerings. The emergence of ammonia-free alternatives has captured growing attention, striking a balance between effective curl creation and minimal odor or irritation. Relaxants likewise encompass diverse chemistries, with ammonium thioglycolate solutions favored for predictable straightening outcomes, guanidine hydroxide approaches appealing to formulations seeking pH control, and sodium hydroxide systems delivering rapid, robust results for coarse hair textures.

Distribution channels further shape market dynamics, evolving from traditional professional salons and retail outlets into an omnichannel ecosystem. E-commerce platforms have boomed, enabling direct-to-consumer sales of DIY perm and relaxant kits, whereas professional salons maintain their appeal through expert services and personalized consultations. Within retail, consumers encounter options ranging from value-driven drugstore brands to premium specialty store assortments and expansive supermarket selections, each catering to different purchase motivations and price sensitivities.

End-user segmentation underscores divergent requirements between haircare professionals seeking concentrated, salon-grade systems and consumers gravitating toward user-friendly at-home treatments. Varied format preferences-from cream-based formulations that facilitate controlled application to lightweight lotions and fast-penetrating sprays-reflect both functional and experiential considerations. Application zones, including targeted work at roots, mid lengths, and ends, have given rise to specialized two-step processes in professional settings, while price-range tiers span accessible value offerings to premium lines promising advanced benefits and bundling with post-treatment care rituals.

Through this multifaceted segmentation lens, stakeholders can align product innovation, marketing messaging, and channel investments with the nuanced expectations of each consumer cohort and professional user base.

This comprehensive research report categorizes the Perms & Relaxants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- End User

- Form

- Application

Key regional insights highlighting how prevailing economic, regulatory, and consumer trends shape the perms and relaxants market across Americas, EMEA, and Asia-Pacific

A regional analysis of the perms and relaxants landscape highlights the Americas as a mature market characterized by high consumer awareness of hair health and beauty trends. Here, premium services in upscale salons coexist with expansive at-home treatment options, supported by stringent regulatory frameworks that prioritize ingredient transparency and consumer safety. Innovations in natural and low-toxicity chemistries often emerge from North American R&D hubs before diffusing globally.

In Europe, the Middle East, and Africa region, diverse hair textures and cultural preferences drive demand for both curling and straightening solutions. Professional salons in Western Europe emphasize cutting-edge formulas that promise reduced processing times and enhanced conditioning, while emerging markets in the Middle East and Africa show robust uptake of DIY treatments tailored to local climate and hair types. Regulatory harmonization initiatives across the European Union foster easier cross-border product launches but also require careful compliance with updated safety standards.

Asia-Pacific stands out as the fastest-growing region, fueled by rising disposable incomes, beauty influencer culture, and an entrenched salon-going tradition. In markets such as South Korea and Japan, innovative product formats and multifunctional systems have gained rapid traction, while large populations in China and Southeast Asia are embracing both professional services and scalable at-home solutions. Regional manufacturing hubs provide cost advantages, even as rising labor and raw material expenses prompt manufacturers to enhance production efficiencies.

This comprehensive research report examines key regions that drive the evolution of the Perms & Relaxants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the strategic maneuvers and portfolio expansions of leading companies driving innovation and competitive advantage in the global perms and relaxants landscape

Leading multinational corporations continue to consolidate market share through strategic portfolio expansions and technological advancements. A prominent beauty conglomerate recently introduced a next-generation ammonia-free perm line featuring encapsulated conditioning agents, underscoring its commitment to innovation while addressing consumer health concerns. Another global player focused on professional salon partnerships has invested heavily in digital education platforms, equipping stylists with virtual training modules and augmented reality demonstrations that elevate service quality and foster brand loyalty.

Regional specialists and boutique brands are carving out niche positions by harnessing natural and plant-derived chemistries. For example, an emerging company based in Europe launched a bio-sourced relaxant system formulated with amino-acid derivatives, targeting eco-conscious consumers and premium salon networks. Meanwhile, an Asian enterprise has scaled its direct-to-consumer model through live-streamed tutorials and influencer collaborations, driving rapid adoption of its color-conditioning perm offerings.

Strategic collaborations between raw material suppliers and end-product manufacturers are also reshaping the competitive landscape. Joint ventures to develop patented polymer stabilizers and time-release infusion technologies have yielded formulations that maintain hair structure integrity throughout the perm or relaxant process. These partnerships illustrate a broader industry trend toward co-innovation, where shared expertise accelerates time to market and yields differentiated value propositions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Perms & Relaxants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Cadiveu Professional USA LLC

- Combe Incorporated

- Coty Inc.

- Dariyé Beauty (Jiangsu) Co., Ltd.

- Dr. Wolff Group

- Godrej Consumer Products Limited

- Henkel AG & Co. KGaA

- Kao Corporation

- L'Oréal SA

- Lion Corporation

- Namaste Laboratories LLC

- Procter & Gamble Co.

- Revlon, Inc.

- Shiseido Company, Limited

- Streax Industries Pvt. Ltd.

- Unilever PLC

- World Hair Cosmetics (Japan) Co., Ltd.

- Zotos International, Inc.

Actionable recommendations for industry leaders to optimize growth through ingredient innovation, supply chain diversification, digital engagement, and sustainable practices

To navigate the complexities of this dynamic market environment, industry leaders should prioritize investment in advanced bio-based chemistries that balance performance with reduced environmental impact. By partnering with specialty ingredient suppliers, organizations can co-develop novel formulations that meet emerging regulatory requirements and resonate with health-conscious consumers.

Supply chain diversification must be pursued alongside cost management strategies. Establishing regional manufacturing nodes and multi-tiered sourcing agreements will enhance resilience against trade disruptions and tariff fluctuations. Concurrently, deploying digital sales channels and virtual consultation tools can broaden consumer reach while delivering personalized guidance for at-home treatments.

Marketing investments should emphasize storytelling around ingredient provenance, sustainability credentials, and professional endorsements. Collaborations with salon educators to offer accredited training programs will deepen adoption of premium systems and reinforce brand credibility. Additionally, exploring circular packaging solutions and refill models can further align brand values with evolving consumer expectations around waste reduction and resource efficiency.

Finally, organizations must maintain proactive regulatory monitoring and agile formulation processes. Embedding cross-functional teams that seamlessly integrate regulatory intelligence, R&D insights, and market feedback will accelerate innovation cycles and support timely product launches tailored to regional preferences.

In-depth research methodology outlining the comprehensive approaches and analytical techniques underpinning the perms and relaxants market study

This analysis draws upon a robust mixed-method research framework designed to capture both quantitative market metrics and qualitative industry perspectives. Primary research included in-depth interviews with C-suite executives, R&D directors, salon professionals, and key distribution partners across major global regions. These firsthand insights provided clarity on strategic priorities, product performance perceptions, and channel evolution.

Secondary research involved the systematic review of scientific publications, patent filings, regulatory submissions, and corporate financial reports, ensuring that emerging technologies and legislative developments were fully accounted for. Data triangulation techniques were employed to validate findings, reconciling disparate data points and reducing potential bias.

To enhance analytical rigor, the study incorporated advanced statistical modeling and scenario analysis, mapping out potential trajectories for demand shifts under varying economic, regulatory, and consumer preference conditions. A dedicated expert advisory panel convened at multiple project milestones to review interim findings and ensure methodological integrity.

The resulting market intelligence reflects a synthesis of empirical data, expert opinion, and macroenvironmental factors, offering a comprehensive foundation for strategic decision-making in the perms and relaxants sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Perms & Relaxants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Perms & Relaxants Market, by Product Type

- Perms & Relaxants Market, by Distribution Channel

- Perms & Relaxants Market, by End User

- Perms & Relaxants Market, by Form

- Perms & Relaxants Market, by Application

- Perms & Relaxants Market, by Region

- Perms & Relaxants Market, by Group

- Perms & Relaxants Market, by Country

- United States Perms & Relaxants Market

- China Perms & Relaxants Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Conclusion synthesizing pivotal market insights, strategic imperatives, and the importance of agility in navigating evolving consumer demands and regulatory shifts

The perms and relaxants market resides at the nexus of tradition and innovation, shaped by evolving consumer desires, technological breakthroughs, and a complex regulatory fabric. As the industry adapts to tariff recalibrations, sustainability imperatives, and digital disruption, companies that adopt a holistic perspective will be best positioned to capture emerging opportunities.

Key insights underscore the importance of segmentation-understanding how product type, channel, end user, format, application, and price tiers intersect to inform tailored strategies. Regional nuances further demand that organizations localize their offerings and partnerships to align with distinct market dynamics.

Ultimately, success in this domain will hinge on agility: the capacity to reformulate in response to supply chain shifts, integrate sustainability throughout the product lifecycle, and to leverage digital tools that enhance consumer and professional engagement. This report offers the strategic foundation for navigating a landscape defined by continual transformation and underscores the imperative of data-driven decision-making.

Seize exclusive insights and drive strategic growth by contacting Ketan Rohom to secure the full perms and relaxants market research report and support informed decision-making

To gain a competitive edge and unlock the full value of the comprehensive market intelligence presented in this executive summary, readers are invited to connect with Ketan Rohom, whose expertise in sales and marketing will ensure a seamless acquisition process. His guidance will facilitate access to tailored data sets, in-depth slide decks, and customizable reports designed to meet the unique needs of your organization. By initiating a conversation with this Associate Director of Sales & Marketing, stakeholders can explore flexible licensing options, enterprise-wide user access, and ongoing support services that translate critical market insights into actionable strategies. Reach out today to secure the complete perms and relaxants market research report and empower your team with the knowledge required to drive innovation, bolster market positioning, and achieve sustainable growth.

- How big is the Perms & Relaxants Market?

- What is the Perms & Relaxants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?