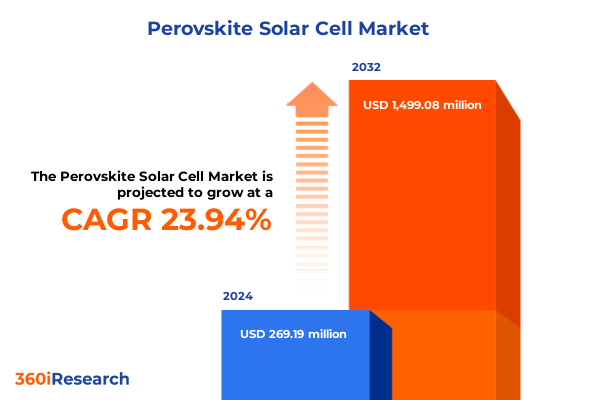

The Perovskite Solar Cell Market size was estimated at USD 325.97 million in 2025 and expected to reach USD 398.63 million in 2026, at a CAGR of 24.35% to reach USD 1,499.08 million by 2032.

A comprehensive introduction to perovskite solar cell fundamentals, recent material and process breakthroughs, and the pragmatic pathway toward industrial adoption

Perovskite solar cells represent a transformative class of photovoltaic technologies characterized by their unique crystalline absorbers, tunable optoelectronic properties, and compatibility with low-temperature fabrication. Over the past decade, material science breakthroughs have improved stability, reduced defect densities, and expanded device architectures, enabling perovskites to move from laboratory curiosities toward prototypes suitable for real-world trials. This transition reflects a convergence of advances in absorber chemistry, interface engineering, and encapsulation strategies that collectively address historical constraints such as moisture sensitivity and ion migration.

Transitioning from proof-of-concept to scalable production requires aligned progress across materials, equipment, and manufacturing ecosystems. Researchers and early-stage manufacturers have prioritized scalable deposition techniques, supplier engagement for high-purity precursor materials, and robust testing protocols to validate long-term performance. Concurrently, regulatory and standards development bodies have begun to define accelerated test regimes and reliability metrics tailored to perovskite-specific failure modes. As a result, stakeholders are increasingly able to evaluate trade-offs between device efficiency, longevity, and cost per watt equivalent in the context of specific applications from building-integrated systems to consumer electronics.

Looking ahead, the interplay between technological maturation and commercial strategies will dictate the pace at which perovskite technologies transition into broader adoption. Strategic partnerships across materials suppliers, equipment vendors, and manufacturing partners will prove essential, while targeted pilot deployments will provide the operational data necessary to refine product specifications and commercialization roadmaps.

Transformative technological, manufacturing, and ecosystem shifts that are accelerating perovskite photovoltaic adoption and redefining industry value chains

The landscape for perovskite photovoltaics is shifting in ways that redefine both near-term opportunities and long-term competitive dynamics. Innovations in tandem architectures have unlocked pathways to higher conversion efficiencies by combining perovskite absorbers with complementary photovoltaic technologies, while advances in compositional engineering have produced formulations with improved thermal and photo-stability. These technical gains are accompanied by manufacturing innovations that emphasize roll-to-roll compatibility and scalable solution processing, catalyzing new business models focused on high-volume, low-cost output.

Equally important, the ecosystem supporting perovskite deployment is evolving. Supply chain actors are beginning to invest in precursor materials production at scale, and equipment suppliers are adapting coating, drying, and encapsulation tools to meet commercial throughput requirements. Policy frameworks and standards are starting to catch up with the technology, introducing clearer pathways for certification and pilot permitting. In parallel, capital is flowing into vertically integrated pilots that test the full value chain from precursor production to end-of-life recycling and remediation.

These transformative shifts are not uniform across geographies or applications. Different end-use segments - from building-integrated photovoltaics to wearable devices - demand distinct form factors, mechanical flexibility, and aesthetic considerations. As a consequence, market entrants and incumbents alike will need to align product architectures and go-to-market strategies with differentiated customer needs while maintaining disciplined focus on reliability and lifecycle performance.

How recent United States tariff developments are reshaping sourcing, localization strategies, and supply chain resilience for perovskite photovoltaic stakeholders

Tariff policy in the United States has introduced a significant variable into supply chain planning, investment timing, and competitive positioning for developers of perovskite solar technologies. New import duties and classification reviews for certain photovoltaic components have prompted stakeholders to reassess sourcing strategies and localization opportunities. In response, manufacturers and integrators are exploring alternative supplier relationships, diversifying procurement footprints, and accelerating domestic pilot production to mitigate tariff exposure and protect margins.

Beyond immediate cost implications, tariffs influence strategic decisions such as where to site pilot lines, how to structure joint ventures, and which technologies to prioritize for scale-up. For example, tariffs that affect module components increase the value proposition for locally manufactured thin-film laminates and building-integrated products that can bypass certain trade classifications. Moreover, policy-driven incentives at the state and federal level can counterbalance tariff effects, encouraging investment in domestic capacity expansion and workforce development.

Importantly, tariffs catalyze a broader reassessment of supply chain resilience. Companies are conducting scenario planning that incorporates potential future policy shifts, investing in dual-sourcing arrangements for critical precursors, and evaluating onshore manufacturing as a hedge against geopolitical risks. These actions will shape capital allocation and partnership strategies over the medium term, influencing which firms emerge as competitive leaders in the evolving perovskite ecosystem.

Deep segmentation insights across device types, product forms, architectures, and applications that reveal differentiated development and commercialization pathways

Comprehensive segmentation analysis reveals nuanced pathways for product development, manufacturing, and go-to-market strategies driven by device type, product form, category, architecture, structure, manufacturing technology, absorber composition, manufacturing platform, application, and end-user. When considering device type, single-junction perovskite solar cells offer simpler fabrication and targeted applications, whereas multi-junction perovskite solar cells enable higher efficiencies through stacked absorber strategies that suit high-value segments. Product form considerations span discrete cells, integrated modules, thin-film laminates designed for flexible or conformal installations, and building-integrated products that encompass glazing and façade panels engineered for architectural integration.

Category distinctions between flexible perovskite solar panels and rigid perovskite solar panels determine mechanical requirements, encapsulation approaches, and installation workflows. Architecture choices, whether inverted p-i-n or regular n-i-p structures, affect interface engineering, contact materials, and processing windows. Structural variations between mesoscopic and planar devices influence charge transport and defect tolerance, informing optimization priorities for stability and scale-up. Manufacturing technology bifurcates into solution processing and vapor deposition; solution processing includes methods such as dip coating and spin coating that suit laboratory-to-pilot transitions, while vapor deposition encompasses chemical vapor deposition and thermal evaporation techniques that support uniform thin films and potential compatibility with high-throughput lines.

Absorber composition choices between lead-based and lead-free formulations carry implications for performance, regulatory compliance, and end-of-life handling. Manufacturing platform selection between sheet-to-sheet and roll-to-roll affects unit economics, throughput, and substrate selection, driving different capital expenditure and equipment footprints. Application-driven segmentation spans automotive, building-integrated photovoltaics, consumer electronics with subsegments such as smartphones and wearable electronics, and utility-scale power generation, each with unique performance, form factor, and certification demands. Finally, end-user distinctions across commercial, industrial, and residential segments determine procurement cycles, financing models, and installation ecosystems, shaping product specifications and after-sales services required for successful adoption.

This comprehensive research report categorizes the Perovskite Solar Cell market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Product Form

- Category

- Architechture

- Structure

- Manufacturing Technology

- Absorber Composition

- Manufacturing Platform

- Application

- End-User

Regional intelligence that connects deployment drivers, regulatory frameworks, and supply chain readiness across the Americas, Europe, Middle East & Africa, and Asia-Pacific

Regional dynamics exert profound influence over technology adoption curves, regulatory environments, and supply chain strategies across the perovskite landscape. In the Americas, a combination of policy incentives, state-level deployment programs, and corporate sustainability initiatives drives interest in domestic manufacturing capacity and pilot deployments. The Americas region exhibits strong momentum for building-integrated solutions in urban retrofit projects and for consumer electronics OEMs seeking thin, lightweight power sources for portable devices.

Europe, Middle East & Africa presents a complex mosaic of regulatory frameworks, climate imperatives, and architectural heritage that together create distinct opportunities for perovskite integration. In this region, stringent energy performance standards, historical building conservation concerns, and urban design priorities favor facade-integrated and glazing solutions that blend aesthetics with energy generation. Investors and developers here place heightened emphasis on circularity, end-of-life protocols, and compliance with evolving chemical safety regulations.

Asia-Pacific remains at the forefront of large-scale manufacturing and rapid deployment, owing to established photovoltaic supply chains, strong domestic equipment capabilities, and diversified end-user demand. The region prioritizes high-throughput manufacturing platforms, aggressive cost reduction strategies, and rapid iteration between pilot lines and commercial operations. Across all regions, regional policy nuances, utility frameworks, and local supply chain maturity will determine which applications and business models achieve early commercial traction.

This comprehensive research report examines key regions that drive the evolution of the Perovskite Solar Cell market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key corporate strategies and partnership models that underscore intellectual property protection, vertical integration, and pilot-driven commercialization in perovskite photovoltaics

Company strategies in the perovskite sector coalesce around several core themes: IP consolidation, vertical integration, strategic partnerships, and targeted commercialization pilots. Leading developers and supply chain participants are investing heavily in protectable intellectual property that covers absorber formulations, interface passivation chemistries, encapsulation techniques, and roll-to-roll compatible processes. This defensive posture aims to secure licensing opportunities and to create barriers to entry as technologies move from lab-scale demonstrations to pilot manufacturing.

Vertical integration strategies are emerging as a way to control quality, reduce input volatility, and shorten product development timelines. Firms pursuing integrated models often combine precursor synthesis, coating equipment development, and module assembly within coordinated pilots to validate production workflows. Strategic partnerships between materials suppliers, equipment manufacturers, and systems integrators facilitate rapid problem solving and shared capital commitments that reduce individual risk.

At the commercialization front, companies are deploying focused pilot projects to validate long-term performance in target environments such as façades, mobile electronics, and automotive applications. These pilots provide essential field data for durability, energy yield, and aesthetic considerations, while informing certification and insurance pathways. Across all company types-innovators, equipment vendors, and integrators-the emphasis remains on building repeatable manufacturing recipes, robust supply chains for critical precursors, and scalable quality assurance protocols.

This comprehensive research report delivers an in-depth overview of the principal market players in the Perovskite Solar Cell market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Chemistry

- CubicPV Technologies Inc.

- EneCoat Technologies Co., Ltd.

- Energy Materials Corp.

- G24 Power Limited

- GCL-SI

- Hangzhou Microquanta Co. Ltd.

- Hanwha Group

- Hunt Perovskite Technologies

- JinkoSolar Holding Co., Ltd

- LONGi Green Energy Technology Co. Ltd.

- Oxford Photovoltaics Ltd.

- P3C Technology and Solutions Pvt. Ltd.

- Panasonic Holdings Corporation

- Peccell Technologies, Inc.

- Perovskia Solar AG

- QD Solar Inc. by SunDensity Inc.

- Rayleigh Solar Tech Inc.

- Rayzon Solar Limited

- Saule Technologies

- SEKISUI CHEMICAL CO., LTD.

- Solaires Entreprises Inc.

- Solar-Tectic LLC

- Solaronix SA

- Swift Solar Inc.

- Tandem PV

- Toshiba Corporation

- UniTest Inc.

Actionable strategic recommendations for industry leaders to accelerate perovskite commercialization through stability, supply chain alignment, and targeted pilot deployments

Industry leaders seeking to accelerate commercialization and secure competitive advantage should pursue a set of pragmatic, high-impact actions that align R&D priorities with scalable manufacturing imperatives. First, prioritize stability-focused material strategies and encapsulation solutions that directly address field failure modes; this effort will shorten certification timelines and reduce warranty liabilities. Second, invest in pilot production that mirrors intended commercial manufacturing platforms, whether sheet-to-sheet or roll-to-roll, to de-risk scale-related process variables and to create reproducible quality metrics.

Third, cultivate upstream supplier relationships for precursor materials and collaborate on co-development of formulations that meet cost, purity, and sustainability requirements. Fourth, deploy staged deployment strategies that match product forms to early-adopter applications, focusing on high-value niches such as building-integrated photovoltaics and portable electronics where form factor and aesthetics command premium pricing. Fifth, embed circularity planning early by designing for recyclability, establishing end-of-life pathways, and engaging with regulators to shape pragmatic chemical management frameworks.

Finally, pursue strategic alliances that combine materials expertise, equipment capability, and systems integration to accelerate time to market. By coordinating investments across the value chain, organizations can capture learning curves more rapidly, reduce unit costs, and create vertically differentiated offerings that customers value.

Transparent and rigorous research methodology combining expert interviews, technical literature synthesis, patent analysis, and scenario-based supply chain evaluation

This research synthesizes multiple methodological approaches to provide a rigorous, evidence-based perspective on perovskite solar cell development and commercialization. The analysis integrates primary research through expert interviews with materials scientists, equipment engineers, and commercialization executives, complemented by secondary research encompassing peer-reviewed literature, patent landscapes, standards documentation, and regulatory guidance relevant to perovskite technologies. Triangulation across these inputs ensures that technical claims align with practical engineering constraints and policy realities.

Quantitative assessments derive from laboratory performance reports, reliability studies, and production-scale demonstrations where available, while qualitative insights emerge from structured interviews that probe commercialization barriers, supply chain dependencies, and customer adoption criteria. The methodology also employs scenario analysis to evaluate how shifts in policy, tariff regimes, and supplier concentration could influence strategic outcomes. Lifecycle considerations, including raw material sourcing and end-of-life handling, inform the environmental and regulatory analysis.

Throughout, the approach emphasizes transparency in data sources, explicit statement of assumptions, and sensitivity testing for key drivers. This methodological rigor supports actionable conclusions and ensures that recommendations reflect a balanced understanding of both current capabilities and near-term development pathways.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Perovskite Solar Cell market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Perovskite Solar Cell Market, by Type

- Perovskite Solar Cell Market, by Product Form

- Perovskite Solar Cell Market, by Category

- Perovskite Solar Cell Market, by Architechture

- Perovskite Solar Cell Market, by Structure

- Perovskite Solar Cell Market, by Manufacturing Technology

- Perovskite Solar Cell Market, by Absorber Composition

- Perovskite Solar Cell Market, by Manufacturing Platform

- Perovskite Solar Cell Market, by Application

- Perovskite Solar Cell Market, by End-User

- Perovskite Solar Cell Market, by Region

- Perovskite Solar Cell Market, by Group

- Perovskite Solar Cell Market, by Country

- United States Perovskite Solar Cell Market

- China Perovskite Solar Cell Market

- Competitive Landscape

- List of Figures [Total: 22]

- List of Tables [Total: 2385 ]

Concluding synthesis of technical readiness, commercialization levers, and strategic imperatives that will determine perovskite photovoltaic adoption pathways

Perovskite solar cells are poised to influence the future of photovoltaics by offering unique combinations of lightweight form factors, manufacturability, and potential efficiency gains through tandem architectures. The technology’s evolution depends on coordinated advances in materials stability, scalable deposition techniques, and robust encapsulation strategies that collectively address historical durability challenges. As stakeholders refine supply chains and invest in targeted pilots, commercial pathways will likely emerge first in applications where form factor, weight, and aesthetic integration justify premium positioning.

Policy and trade dynamics will play a defining role in shaping strategic choices, with tariffs, incentives, and regulatory frameworks influencing where manufacturing capacity is sited and how supply chains develop. Companies that proactively invest in IP protection, vertical integration, and strategic partnerships will be better positioned to capture early value and to navigate the complexity of certification and market entry. Ultimately, the most successful ventures will combine rigorous technical validation with disciplined commercialization strategies that match product attributes to the right application segments and regional needs.

Engage with the Associate Director for a tailored purchase consultation and expedited access to actionable perovskite solar cell research and deployment support

The report acquisition process invites senior decision-makers to engage directly with Ketan Rohom, Associate Director, Sales & Marketing, to secure detailed access to this comprehensive perovskite solar cell research and to tailor delivery options that align with strategic priorities and procurement cycles.

Prospective purchasers can request a bespoke briefing that aligns the report’s insights with their investment horizon, technology roadmap, or commercial deployment plans. Through a structured consultation, stakeholders will clarify which chapters, datasets, and appendices best support their immediate requirements and obtain guidance on licensing terms and enterprise distribution models. The engagement will also enable scheduling of a guided walkthrough, during which key findings, regional nuances, and actionable recommendations can be contextualized against the stakeholder’s specific objectives.

For organizations pursuing partnerships, manufacturing scale-up, or capital allocation, the direct dialogue will surface opportunities for deeper collaboration such as custom scenario analysis, technology validation studies, and bespoke competitor landscaping. This call-to-action emphasizes expedited access to evidence-based intelligence and a consultative buying experience designed to accelerate commercialization and reduce time to value.

- How big is the Perovskite Solar Cell Market?

- What is the Perovskite Solar Cell Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?